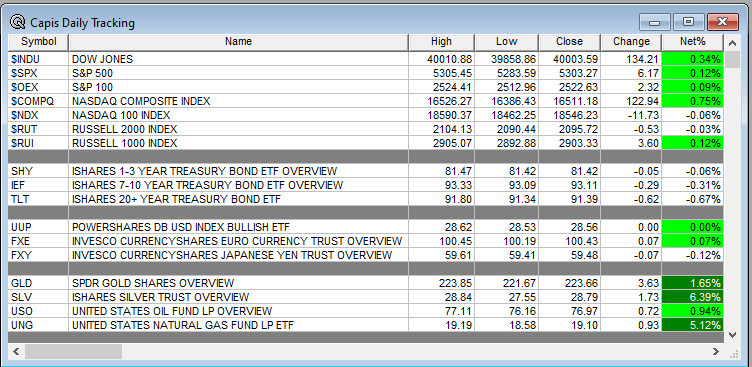

Overnight Summary: The S&P 500 closed Friday at 5303.27 up by 0.12% from Thursday at 5297.10 lower by -0.21%. The overnight high was hit at 5,336.50 at 7:50 p.m. while the overnight low was hit at 5324 at 4:05 p.m. EDT. The range overnight is 12 points as of 7:00 a.m. EDT. Currently, the S&P 500 is higher by +7 points at 7:00 a.m. EDT.

Executive Summary: Stocks are higher to start the week with the catalyst of the week being Nvidia’s earnings due on Wednesday after the close.

- 3 & 6 month Treasury Bill Auction at 11:30 a.m. EDT.

- Lots of Fedspeak continues.

Earnings Out After The Close:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week:

- New SPACs launched/News:

- IPOs Filed:

- Secondaries Files or Priced:

- Common Stock filings/Notes:

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- files to sell 14.421,070 shares by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- SFNC: Filed a Mixed Shelf Offering.

- AMCR: Filed a Mixed Shelf Offering.

- LH: Filed a Mixed Shelf Offering.

- CHD: Filed a Mixed Shelf Offering.

- Private Placement of Public Entity (PIPE):

- Rights Offering:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Winners & Losers For The Week:

- NVAX +62%, NVCR +34%, PACB +24%, BCRX +22%, CGC +22%, GME +27%, GRPN +26%, SPWR +24%, TRUP +27%

- ARRY -11%, AZUL -7%, FL -9%, RRGB -7%, STNE -11%, RILY -11%, PBR -11%.

- News Items After the Close:

- Lockheed Martin (LMT) awarded $757 mln U.S. Army contract modification.

- Barron’s + on AES, VST, CEG, BE, RUN, FSLR, SEDG, DAR, APA, KOS, SHEL, ARM, QCOM, SSNLF, UBER, GOOGL.

- Exchange/Listing/Company Reorg and Personnel News:

- Stride Board (LRN) Chair Dr. Craig R. Barrett to retire, effective at the conclusion of the Annual Meeting

- Xponential Fitness(XPOF) CEO Anthony Geisler resigns; Brenda Morris will continue to serve as Interim CEO

- Buyback Announcements or News:

- Stock Splits or News:

- Dividends Announcements or News:.

- SLVM ups dividend to $0.45 from $0.30.

What’s Happening This Morning: Futures value reflects the change with fair value. Futures on the Dow +26, S&P 500 +9.48, NASDAQ +46.02, and Russell +6.28. Asia and Europe are higher this morning. VIX Futures are at 13.51 from 13.76. Gold, Silver and Copper higher this morning. WTI Crude Oil flat with Brent Crude Oil lower are lower with Natural Gas higher. US 10-year Treasury sees its yield at 4.414% from 4.398% Friday. The U.S. Dollar is higher versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $67,215 from $66,306 higher by 1.56% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Materials, Energy and Financials of note.

- Daily Negative Sectors: Technology, Utilities, Consumer Defensive and Healthcare of note.

- One Month Winners: Utilities, Real Estate, Technology, Consumer Defensive, Financials, and

Healthcare of note.

- Three Month Winners: All but

Real Estate led by Utilities, Energy, Materials, Financials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday Before the Open: None of note

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative Guidance: of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: WIX +7.6%, DYN +7.4%, ESPR +2.5%, MIRM +2.4%, XPOF +2.2% of note.

- Gap Down: LI -4.4% of note.

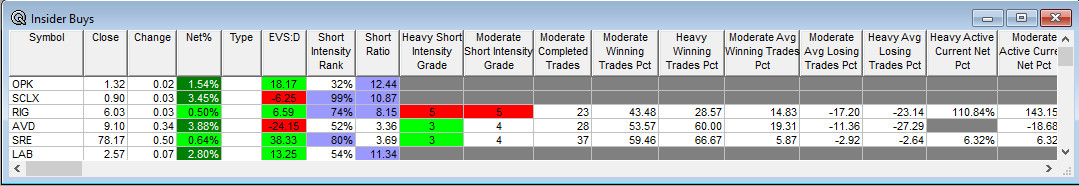

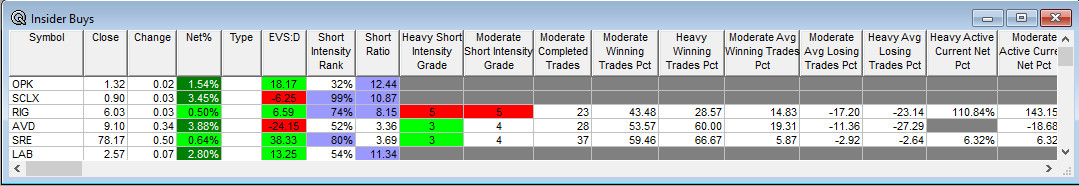

Insider Action: SRE sees Insider buying with dumb short selling. RIG see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things to Know Before The Stock Market Open Today. (CNBC)

- Stocks Making The Biggest Move: AAPL NVDA LI (CNBC)

- Bloomberg Lead Story: Iran Set for Election After President Raisi Dies in Helicopter Crash. (Bloomberg)

- Asia stocks rise after U.S. gains, China support: Markets Wrap. (Bloomberg)

- Barron’s is out with a cautious view on markets. (Barron’s)

- Red Lobster files for bankruptcy. (CNBC)

- Are Consumers pulling back on spending? Depends which CEO you speak to. (CNBC)

- Bloomberg’s The Big Take: Trump’s 2024 Campaign. (Podcast)

- NY Times Daily: Was the 401(k) a mistake? (Podcast)

- Marketplace: “Right To Mine” crypto laws making way across U.S.. (Podcast)

- Wealthion: Massive sell-off ahead? (Podcast)

- Adam Taggart: Millions give up on working. (Podcast)

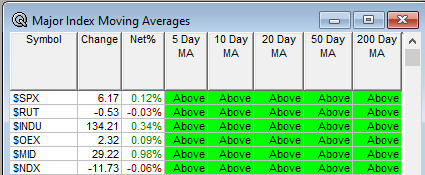

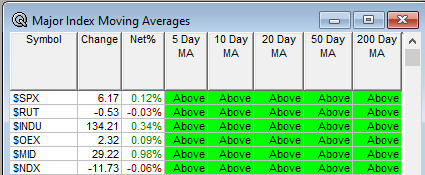

Moving Average Update: Score at 100% from 100%.

Geopolitical:

- President’s Public Schedule:

- There is a Daily Briefing today at 10:00 a.m. EDT.

- President Biden arrives at the White House from Delaware 1:50 p.m. EDT.

- The President and Second Gentleman deliver remarks at a celebration for Jewish American Heritage Month at the White House at 5:15 p.m. EDT.

Economic:

Federal Reserve / Treasury Speakers:

- Federal Reserve Atlanta President Raphael Bostic speaks at 8:45 a.m. EDT and then again at 3:00 p.m. EDT.

- Federal Reserve Governor Christopher Waller speaks at 9:00 a.m. EDT.

- Federal Reserve Governor Michael Barr speaks at 9:00 a.m. EDT.

- Federal Reserve Vice Chairman Phillip Jefferson speaks at 10:30 a.m. EDT.

M&A Activity and News:

Meeting & Conferences of Note:

- Sellside Conferences:

- Top Shareholder Meetings: AJX, CECO, ED, FROG, FULT, RXO, YS

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AMGN, ATNM, JPM, JSPR, KFS, MSFT, MTH, NCLH, OGEN, STNG, TRVI

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: AMGN UTHR

- Company Event:

- Industry Meetings:

- Bank of America Healthcare Conference

- American Gas Association Financial Forum

- American Thoracic Society International

- Cantor’s Frontiers in Radiopharma Virtual Summit

- Digestive Disease

- Gartner CFO & Finance Executive Conference

- JP Morgan TMT Conference

- Mizuho Neuroscience Summit

- SME Current Trends in Mining Finance Conference

- Spinal Cord Injury Investor Symposium

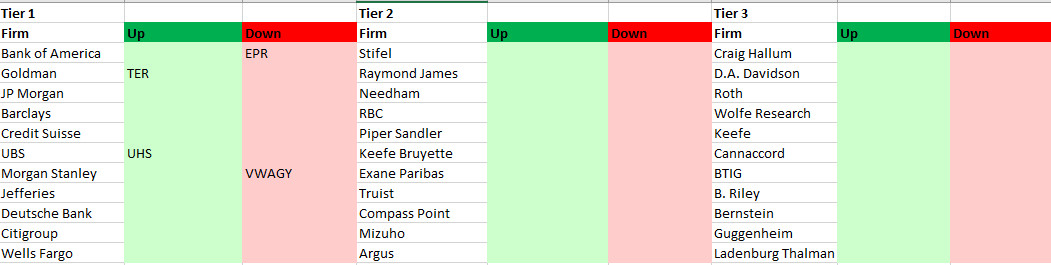

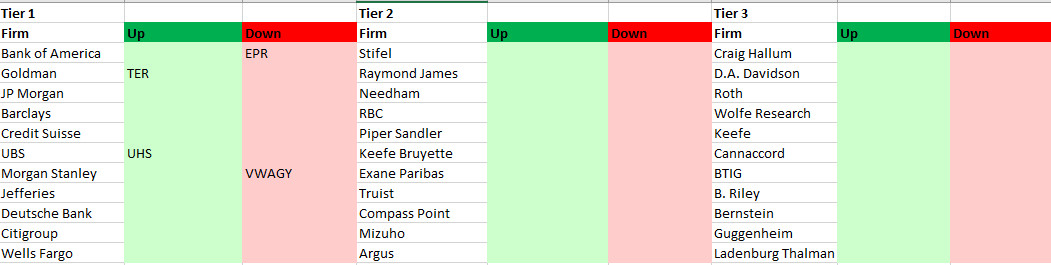

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: