Overnight Summary: The S&P 500 closed Monday at 5221.42 lower by -0.02% from Friday at 5222.68 higher by 0.16%. The overnight high was hit at 5,247.75 at 4:05 p.m. while the overnight low was hit at 5240.75 at 11:45 p.m. EDT. The range overnight is 7 points as of 7:00 a.m. EDT. Currently, the S&P 500 is higher by +1.75 points at 6:10 a.m. EDT.

Executive Summary: All eyes are focused on PPI this morning.

- Treasury 52-Week Bill Auction at 11:30 a.m. EDT.

Earnings Out After The Close:

- Beats: AGYS +0.04, ALLO +0.03, PSFE +0.02 of note.

- Flat: None of note.

- Misses: STNE -0.02 of note.

- IPOs For The Week: .

- New SPACs launched/News:

- IPOs Filed:

- Sprott (SII) Physical Copper Trust files IPO at $10 a share.

- Secondaries Priced:

- ALLO prices its $110 million common stock offering.

- Common Stock filings/Notes:

- MBIN files a 2,400,000 common share offering.

- Notes Priced of note:

- : Pricing of Public Offering of Notes.:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- JAMF files a 8,956,522 share common stock offering by selling shareholders.

- files a 5,064,570 share common stock offering by selling shareholders.

- Debt/Credit Filing and Notes:

- BKH files a $450 million 6.00% note due January 15th.

- Mixed Shelf Offerings:

- ATOS: Filed a $100 million Mixed Shelf Offering.

- NGD: Filed a Mixed Shelf Offering.

- : Filed a Mixed Shelf Offering.

- : Filed a $750 million Mixed Shelf Offering.

- : Filed a Mixed Shelf Offering.

- Private Placement of Public Entity (PIPE):

- Rights Offering:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Winners & Losers After The Close:

- AMC +16.80%, HROW +14.9%, VYGR +7.9%, PSFE +7.2%, STXS +6.1%, ALLO +5.2%, IFIN +5.2%

- NOTV -12.50%, MBIN -9.2%, STNE -7%, NGD -5.7%

- News Items After the Close:

- Copper hits a two year high. (Marketwatch)

- Dow Jones Industrials winning streak ends. (WSJ)

- Is Open AI and its ChatGPT a Siri killer? (MarketWatch)

- Goldman Sachs (GS) raises a $3.6 billion new Real Estate Credit Fund. (Bloomberg)

- Infinera (IFIN) now expects to file its 10-K by Friday.

- DDD, NOTV, MAPS, FRST, RXT, RILY and SPWR delay their 10-Qs.

- Exchange/Listing/Company Reorg and Personnel News:

- Unity Software (U) Chief Product and Technology Officer Marc Whitten to resign, effective June 1 .

- Horizon Bancorp (HBNC) names John R. Stewart as CFO, effective May 20

- MPC announces that Maryann Mannen will succeed Michael J. Hennigan as CEO on Aug 1; Mr. Hennigan will transition from CEO to Executive Chairman

- MPLX elects Maryann Mannen as CEO, effective August 1; former CEO Michael J. Hennigan to transition to Executive Chairman

- Buyback Announcements or News:

- MHO announces a $250 million repurchase agreement.

- RNR renews its buyback program up to $500 million.

- Stock Splits or News:

- Dividends Announcements or News:

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +2, Dow Jones +33, NASDAQ +5.75, Russell +10.62. (as of 8:15 a.m. EDT). Asia is higher ex Australia and Europe is lower this morning ex the FTSE. VIX Futures are at 14.52 from 13.49. Gold, Silver and Copper are higher this morning. WTI Crude Oil and Brent Crude Oil are lower with Natural Gas lower as well. US 10-year Treasury sees its yield at 4.477% from 4.488% yesterday. The U.S. Dollar is lower versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $61,686.34 from $62,645 lower by -2.15% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Technology, Consumer Cyclical, Real Estate and Healthcare of note.

- Daily Negative Sectors: Industrials, Financials, Utilities and Energy of note.

- One Month Winners: Utilities, Consumer Defensive, Financials,

Communication Services, and Healthcare of note.

- Three Month Winners: All but Real Estate led by Utilities, Energy, Materials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday Before the Open:

Earnings of Note This Morning:

- Beats: NMM +0.31,ONON +0.19, IGT +0.15, SFL +0.09, HD +0.03 of note.

- Flat: of note.

- Misses: IHS -4.64, SE -0.26, BABA -0.13of note.

- Still to Report: JACK SDHC of note.

Company Earnings Guidance:

- Positive Guidance: ONON of note.

- Negative Guidance: of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: AMC +58%, SPWR +15.3%, HROW +14.3%, PSFE +11.6%, ONON +11.4%, ALLO +5.5%, INFN +5%, LLAP +4.8%, VYGR +4.7%, DDD +4.6%, LBAI +3.8%, VOD +3.4%, PACS +2.9%, STLA +2.4%, STXS +2.3%of note.

- Gap Down: NOTV -33.8%, JAMF -11.5%, MBIN -9.7%, STNE -6.9%, NGD -3.2%, RILY -2.8%, PBR -2%of note.

Insider Action: No stock sees Insider buying with dumb short selling. No stocks see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: . (Bloomberg)

- Bloomberg Talks: Janet Yellen. (Bloomberg)

- Stocks, Dollar wait on fresh U.S. data: Market Wrap. (CNBC)

- U.S. Trade Representative Tai says that China will take note of U.S. tariff action while on CNBC.

- Meme stocks “el fuego” this morning with GME +130%, AMC +118%, SPWR +65%, KOSS +44%, HOLO +36%, BB +30%. (Trade Exchange)

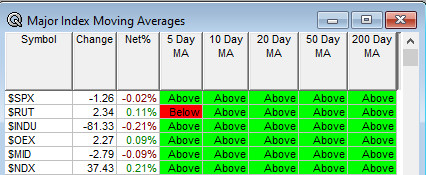

Moving Average Update: Score at 97% from 97%.

Geopolitical:

- President’s Public Schedule:

- There is no Daily Briefing today.

- President Biden delivers remarks from the Rose Garden at 12:15 p.m. EDT to promote American investment and jobs.

- Press Briefing at 12:45 p.m. EDT with Press Secretary Karine Jean-Pierre.

- President Biden delivers remarks at the Asian Pacific American Institute for Congressional Studies Annual Gala at 7:35 p.m. EDT in Washington D.C.

Economic:

- April PPI is due out at 8:30 a.m. EDT and is expected to remain at 0.2%.

- April NFIB Small Business Optimism is due out at 6:00 a.m. EDT and is expected to rise to 88.9 from 88.50.

Federal Reserve / Treasury Speakers:

- Federal Reserve Chairman Jerome Powell speaks at 10:00 a.m. EDT

- Federal Reserve Governor Lisa speaks at 9:1a.m. EDT.

- Federal Reserve Kansas City President Jeffrey Schmid speaks at 8:15 a.m. EDT.

M&A Activity and News:

Meeting & Conferences of Note:

- Sellside Conferences:

- Top Shareholder Meetings: ABG ADAP AHT ALL ARE BFH BHC BROS CMI COP ESS EQNR LH MMM MSI PRU QDEL SWKS TDC THG W WKHS

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: CR CRIS DIS PAVM SCHW TTEK ZBRA

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- Bank of America Healthcare Conference, Global Metals & Mining Conference and Transportation and Industrials Conference

- Capital One Biotech/Biopharma Disruptors Conference

- Goldman Sachs Structured Leverage and Credit Conference

- JPM Homebuilding Conference and Gaming, Lodging and Leisure Conference

- JPM Life Sciences

- Morgan Stanley EEMEA Conference

- Needham Technology Conference

- RBC Global Healthcare Conference

- Wells Fargo Financial Services Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

Upgrades: FOLD (Guggenheim)

Downgrades: