Overnight Summary: The S&P 500 closed Wednesday lower by -0.001% at 5187.67 from Tuesday higher by 0.13% at 5187.70. The overnight high was hit at 5,213 at 6:35 p.m. while the overnight low was hit at 5195 at 5:20 a.m. EDT. The range overnight is 18 points as of 6:25 a.m. EDT. Currently, the S&P 500 is lower by -10.50 points at 6:25 a.m. EDT.

Executive Summary: We get a fresh look on Short Interest. Shorts continue to add this year to their positions. Will this continue?

- The latest NYSE And NASDAQ Short Interest for the period of April 11th through April 26th. During this period, the S&P 500 fell -1.91%

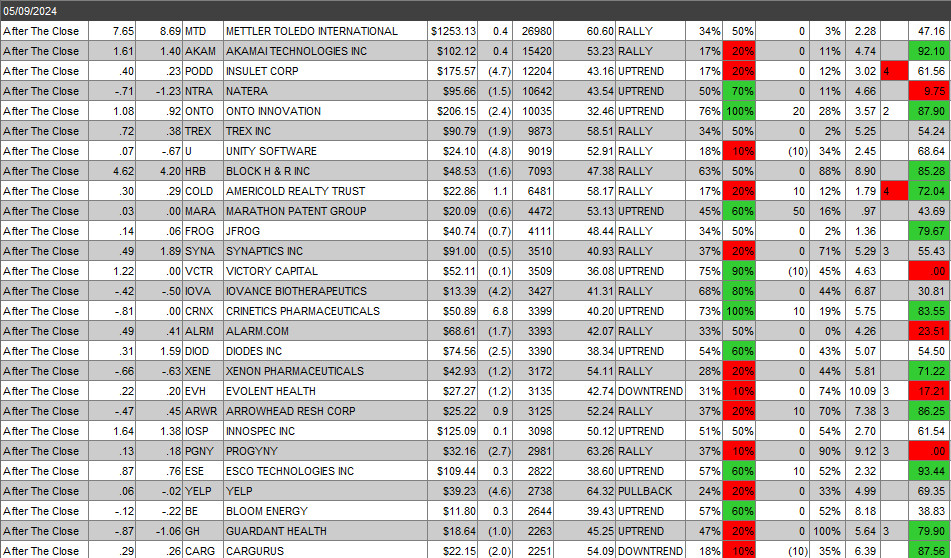

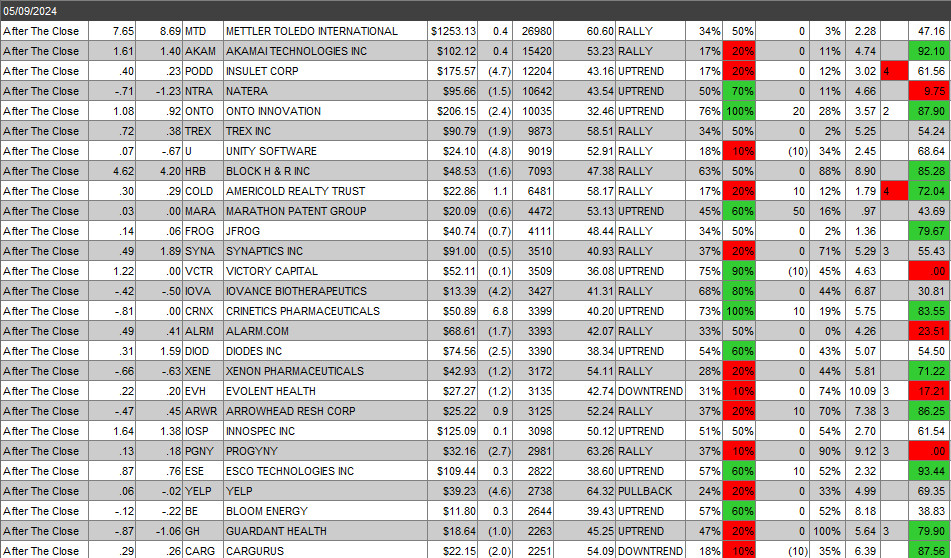

Earnings Out After The Close:

- Beats: RCUS +0.96, KW +0.91, WES +0.70, SBGI +0.59, JXN +0.48, CART +0.45, MKSI +0.43, CDLX +0.34, ATO +0.32, DUOL +0.30, PCVX +0.28, MMS +0.27, PRIM +0.27, MFC +0.27, EQIX +0.26, LNW +0.23, WTS +0.23, STE +0.23, ABNB +0.18, HUBS +0.18, BKH +0.17, CE +0.17, PETQ +0.15, AMC +0.13, IIPR +0.13, HOOD +0.12, BMBL +0.12, CXW +0.12, APP +0.10, CAKE +0.10, ESTA +0.09, HLIO +0.09, VSTO +0.08, NTR +0.08, MODG +0.08, INST +0.08, FNF +0.07, ASLE +0.07, MRC +0.07, SITM +0.07, PAAS +0.07, IONQ +0.06, ARM +0.06, RVMD +0.05, MGNI +0.05, ACAD +0.05, QDEL +0.05, HLI +0.04, TTD +0.04, NUS +0.04, ORA +0.03, AZTA +0.03, JAMF +0.02, HPK +0.02, KGS +0.02, MNKD +0.02, RDNT +0.02, KVYO +0.02, SBRA +0.02, CPK +0.01, GNK +0.01, CXT +0.01, ECPG +0.01, COOK +0.01, EGHT +0.01, LESL +0.01, PYCR +0.01, CPAY +0.01 of note.

- Flat: FLNC +0.00, HL +0.00, QNST +0.00, NWSA +0.00 of note.

- Misses: TKO (1.68), SEDG (0.35), KNTK (0.31), CTLT (0.28), SUPN (0.26), CYTK (0.19), SANA (0.19), PRTA (0.18), BYND (0.17), HMN (0.16), ACVA (0.14), EXAS (0.13), RGNX (0.12), NVEE (0.11), METC (0.10), FSK (0.09), CRSP (0.08), VTLE (0.07), MRVI (0.06), VZIO (0.06), STR (0.06), ET (0.05), JRVR (0.04), RUN (0.03), BGS (0.03), TTEC (0.03), OSUR (0.02), RGLD (0.01), DOX (0.01), STKL (0.01) of note.

- IPOs For The Week: .

- New SPACs launched/News:

- Secondaries Priced:

- Notes Priced of note:

- HAS: Pricing of Public Offering of Notes.

- MITT: Pricing of Public Offering of Senior Notes.

- PECO: Pricing of Offering of $350 Million Aggregate Principal Amount of 5.750% Senior Unsecured Notes Due 2034.

- Common Stock filings/Notes:

- ALLR: Filed a Form RW.

- ECC: Offering of 7.00% Convertible and Perpetual Preferred Stock.

- PALI: Filed Form S-3.. 1,575,019 shares of Common Stock.

- RVMD: Filed Form S-3ASR — Up to 2,194,341 shares of commons stock issuable upon exercise of warrants.

- RXST: Proposed Public Offering of Common Stock $100 million of shares. (BAC Bookmanager)

- ZOOZ: Form F-1 .. 2,240,000 Ordinary Shares.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- CMPO: Secondary Offering of Shares of Class A Common Stock by Selling Shareholders. (JPM, BAC and TD Bookmanager)

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- BTCY: Filed Form S-3. $50,000,000 Mixed Shelf Offering.

- CHR: Form F-3 Filed – $200,000,000 Mixed Shelf.

- CUZ: FORM S-3ASR – Mixed Shelf Offering.

- FPI: FORM S-3 – $300,000,000 Mixed Shelf Offering.

- PBPB: Filed Form S-3.. $75,000,000 Mixed Shelf.

- RJF: FORM S-3ASR – Mixed Shelf Offering.

- WAL: FORM S-3ASR – Mixed Shelf Offering.

- Tender Offer:

- Private Placement of Public Entity (PIPE):

- GIL: C$200 Million Private Placement Financing with CDPQ.

- Rights Offering:

- Convertible Offering & Notes Filed:

- PCRX: Proposed Offering of $250.0 Million Aggregate Principal Amount of Convertible Senior Notes.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Movers of Note:

- CTMX: +36% Positive Initial Phase 1a Dose Escalation Data for Monotherapy CX-904

- ZIMV: +18% Earnings

- BLBD: +14.5% Earnings

- MGNI: +12% Earnings

- EQIX: +11.5% Earnings

- APP: +11.5% Earnings

- TARS: +11% Earnings

- ASLE: +9% Earnings

- BMBL: +9% Earnings

- CDLX: -25% Earnings

- EXAS: -17% Earnings

- DUOL: -12.5% Earnings

- BYND: -12% Earnings

- LFMD: -11.5% Earnings

- EHAB: -10% Earnings

- BLZE: -9% Earnings

- BGS: -9% Earnings

- SEDG: -8% Earnings

- ABNB: -8% Earnings

- News Items After the Close:

- Stocks making the biggest moves after hours: ABNB, HOOD, ARM, EQIX, APP, SEDG (CNBC)

- Arm (ARM) Shares Fall After Company Gives Tepid Annual Forecast. (Bloomberg)

- ARM CEO: “Our growth has been accelerating. It took ARM 20 years to reach $1B in revenue. It took us 10 years to reach $2B. This year, we passed $3B just 2 years after our first $2B year, and we expect to be near $4B this year. The future is very bright and will run on ARM”

- Airbnb (ABNB) beats earnings expectations for first quarter but offers weaker-than-expected guidance. (CNBC)

- Robinhood’s (HOOD) stock rallies as company swings to profit, drums up more business. (MarketWatch)

- House votes overwhelmingly to save Speaker Johnson from Marjorie Taylor Greene’s push to oust him. (NBCNews)

- Apple’s (AAPL) Unionized Maryland Store to Vote on Possible Strike. (Bloomberg)

- Lockheed Martin (LMT) awarded $861 million U.S. Army contract.

- Exchange/Listing/Company Reorg and Personnel News:

- Anika Therapeutics (ANIK) has appointed Steve Griffin as the Company’s Executive Vice President, Chief Financial Officer and Treasurer.

- AZEK files to delay its 10-Q.

- Azenta (AZTA) announces retirement of Stephen Schwartz from his position as CEO.

- Trimble (TRMB) files to delay its 10-Q.

- Buyback Announcements or News:

- Stock Splits or News:

- Dividends Announcements or News:

- Atmos Energy (ATO) Board of Directors has declared a quarterly dividend of $0.805 per common share.

- Houlihan Lokey (HLI) announces an increase in the quarterly dividend to $0.57 share from $0.55 per share.

- Kennedy Wilson (KW) lowers quarterly dividend to $0.12 per share from $0.24 per share.

- Osisko Gold Royalties (OR) increases quarterly cash dividend 8% C$0.066 per share from $0.06 per share.

- Rand Capital Corp. (RAND) increases quarterly cash dividend 16% to $0.29 per share from $0.25 per share.

- Watts Water Tech. (WTS) increased dividend by 19%.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -10, Dow Jones -53, NASDAQ -35, Russell -6.94. (as of 8:15 a.m. EDT). Asia is lower and Europe higher ex CAC this morning. VIX Futures are at 14 from 14.09. Gold is lower, Silver higher and Copper lower this morning. WTI Crude Oil and Brent Crude Oil are higher with Natural Gas lower. US 10-year Treasury sees its yield at 4.506% from 4.481% yesterday. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $61,079 from $62,455 by -1.85% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Utilities, Industrials, Financial of note.

- Daily Negative Sectors: Real Estate, Basic Materials, Communication Services, Healthcare, Consumer Cyclical of note.

- One Month Winners: Consumer Defensive, Communication Services, and Utilities of note.

- Three Month Winners: All but Real Estate led by Energy, Materials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Technology, Financials, Industrials, and Technology, Consumer Defensive of note.

The Dow Jones Industrial Average rose Wednesday, extending its longest winning streak of the year. The blue-chip index gained 0.4%, or 172 points, logging a sixth straight day of gains. The tech-heavy Nasdaq fell 0.2%. The S&P 500 fell by just three-hundredths of a point, its smallest move since 2018. All three indexes remain higher to start May after dropping in April. The slight decline for the benchmark S&P 500 broke a four-day winning streak. Stocks had edged higher in recent days, helped by a batch of solid corporate earnings reports and hopes that the Federal Reserve may cut interest rates. (WSJ – edited by QPI)

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

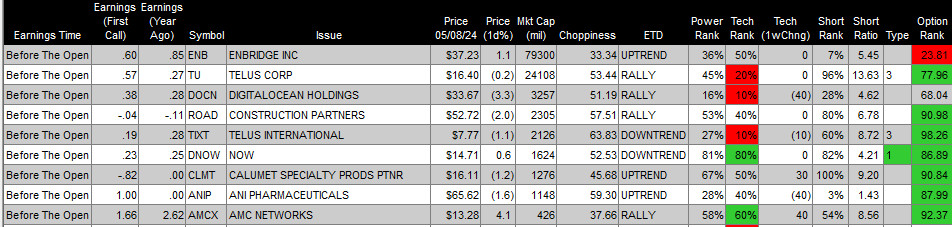

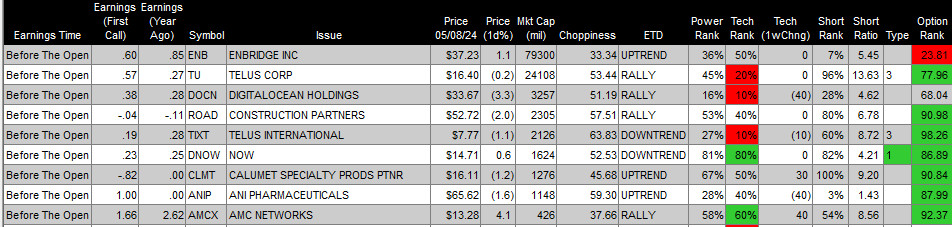

Earnings of Note This Morning:

- Beats: NXST +1.19, SPB +0.94, CEG +0.52, CSIQ +0.20, COMM +0.14, TPR +0.13, PZZA +0.10, SN +0.09, CAMT +0.06, HBI +0.04, PLNT +0.03, HIMX +0.02, HAE +0.01, DNUT +0.01, USFD +0.01 of note.

- Flat: of note.

- Misses: IRWD -0.22, WBD -0.20, WRBY -0.09, EQX -0.08, CEVA -0.08, SIX -0.06, H -0.06, SBH -0.05, TGLS -0.04, STVN -0.03, PLTK -0.02 of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: SPB, SN, CAMT, HIMX, SBH, DIBS, GENI, AFRM, PAYO, GFF, TTD, APP, INST, KVYO, ARM, JAMF, AZEK, CXW, PRIM, ATO, BLBD, NVEE, STKL of note.

- Negative Guidance: CSIQ, ALGM,FOLD, XMTR, STVN, IRWD, PFGC, KRNT, HLLY, MCFT, INTC, SEDG, QNST, CDLX, PETQ, BMBL, RDNT, EGHT, MODG, CPAY, PYCR, EQIX, STE, BYND of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: APP +14.9%, BMBL +11.5%, BLBD +10.8%, MGNI +10.6%, EQIX +10.6%, KVYO +10.5%, ASLE +9.3%, YETI +9.2%, STKL +9%, PRIM +8.5%, HPK +8.1%, SBGI +7.7%, HG +7.3%, ESTA +7.2%, HIMX +6.9%, EGHT +6.8%, BLND +6.8%, JXN +6.4%, PETQ +6.2%, STN +6%, RCUS +5.8%, STE +5.7%, MKSI +5.4%, COOK +5.3%, CRSR +5.2%, HOOD +5.2%, INST +4.8%, FVRR +4.8%, ORA +4.2%, CAKE +4.2%, MRVI +3.6%, LNW +3.6%, MNKD +3.4%, HLIO +3.3%, FLNC +3%, ACDC +3%, CART +2.7%, CCO +2.6%, PBPB +2.5%, MMS +2.5%, AHH +2.4%, RUN +2.2%, SITM +2.1%, KNTK +2%, ZD +2% of note.

- Gap Down: CTMX -36.3%, CDLX -28.9%, FWRD -25.5%, EXAS -16.9%, GDRX -14.3%, BYND -13.5%, DUOL -12.9%, EHAB -9.9%, SEDG -9.8%, CPAY -9.7%, ABNB -8.5%, ARM -8.3%, CMPO -7.1%, ARGX -7%, PRTA -6.8%, BBVA -6.2%, OSUR -5.8%, BGS -5.6%, PCRX -5.5%, AZEK -5.4%, METC -4.8%, HUBS -4.5%, EPAM -4.5%, QNST -4.3%, LESL -4.1%, ARQ -4%, AZTA -3.8%, CYTK -3.2%, AMC -2.8%, HMN -2.7%, VSTO -2.7%, IIPR -2.5%, CRSP -2.4%, KW -2.2%, RXST -2%, CSIQ -2% of note.

Insider Action: No stock sees Insider buying with dumb short selling. sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens On Wednesday. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves: (CNBC)

- Bloomberg Lead Story: BOE Edges Closer To Rate Cut. (Bloomberg)

- Country Garden misses bond payment in China, says Guarantor would step in. (Bloomberg)

- President Biden warns he will delay more weapons to Israel. (Bloomberg)

- Stocks and Bonds slip as traders seek fresh impetus: Market Wrap. (CNBC)

- Bloomberg Big Take Podcast: Tim Cook Can’t Run Apple Forever, Who’s Next? (Podcast)

- Bloomberg Daybreak: (Podcast)

- NYT The Daily: (Podcast)

- Marketplace: (Podcast)

- Wealthion: (Podcast)

Moving Average Update: Score at 100%, day 3.

Geopolitical:

- President’s Public Schedule:

- President Biden meets with the WNBA Champions Las Vegas Aces at 4:15 p.m. EDT.

- President Biden heads to San Francisco and lands there at 11:15 p.m. EDT.

Economic:

- 8:30a.m. Jobless Claims

- 10:30 a.m. EDT EIA Natural Gas Report

- 11:00 a.m. EDT 3- and 6-month Bill Announcement

- 11:00 a.m. EDT 52-Week Bill Announcement

- 11:30 a.m. EDT 4-Week Bill Auction

- 1:00 p.m. EDT 30-Yr Bond Auction

- 4:30 p.m. EDT Fed Balance Sheet

- The latest NYSE And NASDAQ Short Interest for the period of April 11th through April 26th. During this period, the S&P 500 fell -1.91%

Federal Reserve / Treasury Speakers:

- Federal Reserve San Francisco President Mary Daly 2:00 p.m. EDT

M&A Activity and News:

- Corsair Gaming (CRSR) enters into exclusive negotiations to acquire Fanatec brand.

Meeting & Conferences of Note:

- Sellside Conferences:

- Top Shareholder Meetings: SYK, PLD, DUK, CME, NSC, F, SLF, TU, CCJ, KEY, STN, BL, CNO, MTRN, ESRT, EAF, GUTS, MGX, TG, THTX, SGMO, BYD

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ATH, GNTA, MOB, OII, NRGV, RICK, SYM, WW

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- American Society of Cell & Gene Therapy Meeting

- Aegis Conference

- Association for Research in Vision and Opthamology

- Barclays Americas Select Franchise Conference

- Battery and EV Congress

- BMO Real Estate Conference

- BTIG Obesity Forum

- Canaccord Global Metals & Mining Conference

- D.A. Davidson Financial Institutions Conference

- Jamaica Mining Conference

- Milken Institute Global Conference

- Offshore Technology Conference

- Oppenheimer Industrial Growth Conference

- Sidoti Micro Cap Virtual Conference

- Spinal Cord Injury Investor Symposium

- Waste Expo

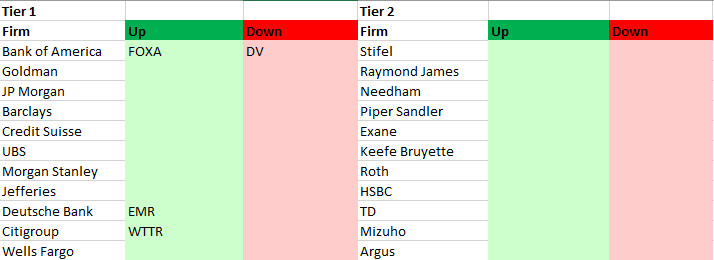

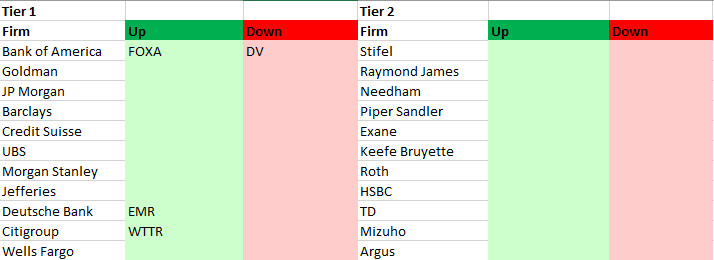

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: