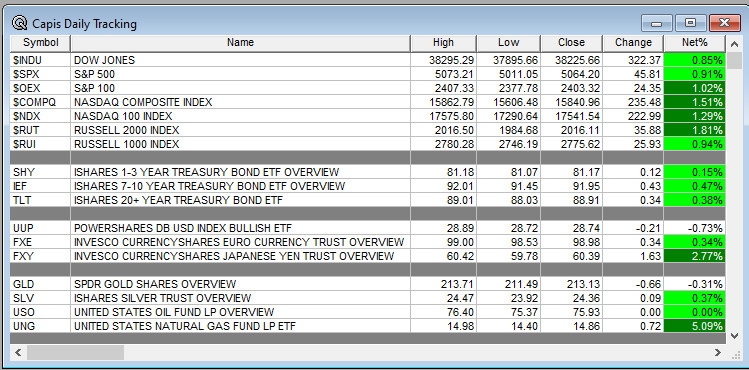

Overnight Summary: The SP 500 closed Thursday higher by 0.91% at 5064.20 from Wednesday lower by -0.34% at 5018.39. The overnight high was hit at 5,118 at 6:20 p.m. while the overnight low was hit at 5087 at 4:35 p.m. EDT. The range overnight is 31 points as of 7:15 a.m. EDT. Currently, the S&P 500 is higher by +16.50 points at 7:15 a.m. EDT.

Executive Summary: It’s Jobs Friday. Enough said as stocks are up. Could be volatile

- Jobs data and ISM Non-manufacturing PMI Index later in the morning.

Earnings Out After The Close:

- Beats: BKNG+6.41, COIN +3.25, GDDY +1.81, MELI +0.68, +0.72, DVA+0.43, EXPE +0.35, AES +0.26, POST+0.22, BJRI +0.15, EOG +0.10 of note. (Greater than +0.10)

- Flat: of note.

- Misses: CIVI -0.80, PXD -0.43, FDP -0.26, AEE -0.08, DKNG -0.01 of note.

- IPOs For The Week: ALEH KMCM NNE RAN ZENA

- SLNO prices at $16.00 a share.

- New SPACs launched/News:

- Secondaries Priced:

- prices $4.8 million offering.

- Notes Priced of note:

- Common Stock filings/Notes:

- ASPM files 21,070,518 shares of common stock .

- TARA files 21,686,760 shares of common stock.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- GDYN files 14,802,570 by the selling shareholder.

- Debt/Credit Filing and Notes: .

- Mixed Shelf Offerings:

- CDXS files mixed-shelf offering

- MBUU files a mixed-shelf offering

- OPEN files a mixed-shelf offering

- SABR files a mixed-shelf offering

- SBET files a $100 million mixed-shelf offering.

- TOVX files a $200 million mixed-shelf offering.

- ZYME files a mixed-shelf offering.

- Tender Offer:

- Private Placement of Public Entity (PIPE)

- Rights Offering:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

- Movers of Note:

- News Items After the Close:

- If you cannot create earnings off sales, then buy back stock and shrink the float. Apple to buyback $110 billion. (Reuters)

- Apple sales fall less than expected. (Reuters)

- April Job’s Preview. (Yahoo)

- Expedia lowers full year revenue forecast. (Reuters)

- Draft Kings (DKNG) raises sales forecast on customer growth. (Bloomberg)

- Amgen on earnings call announced they have a weight loss drug in trials. (Bloomberg)

- Lockheed Martin (LMT) drops bid for Terran Orbital. (MarketWatch)

- Northrop Grumman (NOC) gets B-2 Bomber contract worth $7 billion. (MarketWatch)

- Stocks making the biggest move in after hours: . (CNBC)

- Buyback Announcements or News

- Exchange/Listing/Company Reorg and Personnel News

- Stock Splits or News:

- Dividends Announcements or News:

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +18, Dow Jones +298, NASDAQ +110, Russell -2. (as of 8:15 a.m. EDT). Asia is lower ex Australia while Europe is higher this morning. VIX Futures are at +15.30 from 16.05. Gold and Silver are lower with Copper lower this morning. WTI Crude Oil and Brent Crude Oil are higher with Natural Gas higher as well for a second day in a row. US 10-year Treasury sees its yield at 4.561% from 4.616% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $59,176 from $57,667 higher by -0.02% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Consumer Cyclical, Technology, Real Estate, Communication Services and Industrials of note.

- Daily Negative Sectors: Healthcare of note.

- One Month Winners: Communication Services, Energy and Utilities of note.

- Three Month Winners: All but Real Estate led by Energy, Industrials or Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Technology, Financials, Industrials, and Technology, Consumer Defensive of note.

(WSJ – Edited by QPI)

Upcoming Earnings Of Note:

- Friday After the Close: ($6 Billion Market Cap Cut Off)

- Monday Before the Open: (No Market Cap Cut Off)

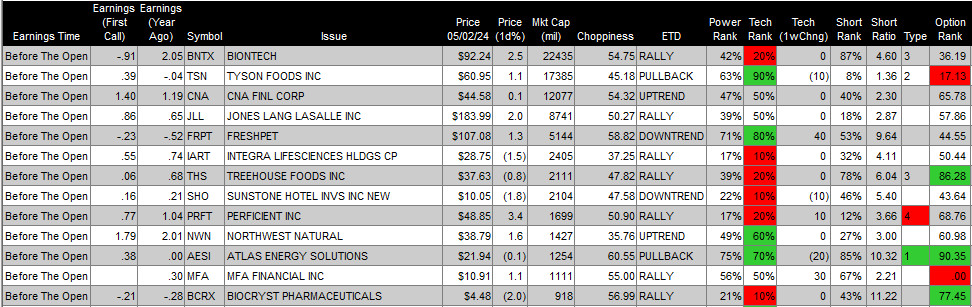

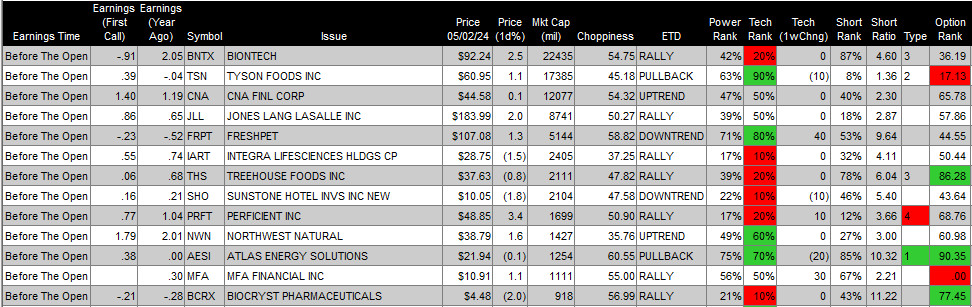

Earnings of Note This Morning:

- Beats: TRP+0.40, HSY+0.31, CQP +0.21, TDS +0.15, CBOE +0.10, TRMB +0.02, OMI +0.01of note.

- Flat: None of note.

- Misses: GPRE -0.50, MGA -0.16, LNG -0.13, FLR -0.07, USM-0.06, UNIT -0.02 of note.

- Still to Report: AXL NMRK TNC of note.

Company Earnings Guidance:

- Positive Guidance: TILE of note.

- Negative Guidance: ADNT MGA of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: ARDX +29%, OSPN +19.5%, LOCO +19.4%, TNDM +17.3%, WOW +14.8%, AMGN +14.1%, PCTY +12.4%, UDMY +11.8%, RMAX +11%, OPEN +10.8%, BJRI +10.5%, CDXS +10.2%, ALHC +10.1%, CLFD +9.7%, MODV +9.2%, TWST +9.2%, IBRX +7.2%, SIMO +7.2%, SQ +7.2%, NR +6.8%, MTZ +6.6%, AAPL +5.9%, MSI +5.6%, TDW +5.2%, FIVN +5%, OLED +4.9%, WSC +4.9%, WK +4.8%, MELI +4.7%, SPXC +4%, REG +3.3%, DBRG +3.2%, AES +3.2%, MBUU +3.1%, QGEN +3.1%, RKT +3.1%, LYV +3.1%, VIR +3.1%, CRBG +3.1%, MNST +3%, ACA +2.9%, DVA +2.9%, HOLX +2.8%, CTRA +2.7%, TILE +2.4%, LMAT +2.3%, DLR +2% of note.

- Gap Down: SPT -25.4%, LLAP -18.6%, STEM -18.3%, NET -13.8%, TRUP -13.8%, BBAI -12.1%, CTOS -11.2%, EXPE -10.8%, VREX -10.8%, ASUR -10.1%, FTNT -8.1%, KURA -7.7%, VIAV -7.2%, SLNO -6.6%, OTEX -6.3%, FDP -5.5%, AAON -5.4%, CABO -5.3%, RARE -5.1%, MGA -5%, IR -4.4%, SWN -4.3%, ILMN -4%, COIN -3.5%, ASPN -3.2%, WW -3.2%, DRH -3%, IHG -3%, COHU -2.9%, KOD -2.7%, PLMR -2.5%, CLLS -2.3%, ZYME -2.2%, ALTR -2.1%, of note.

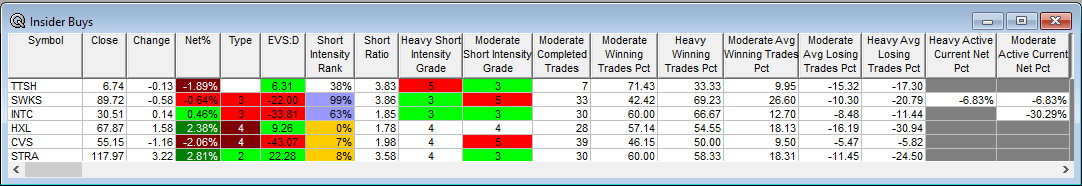

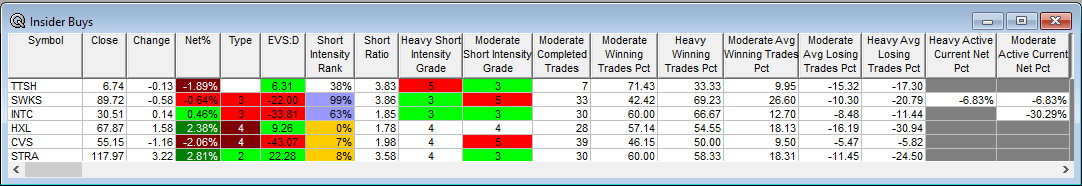

Insider Action: No stocks sees Insider buying with dumb short selling. No stocks see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens On Friday. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves: (CNBC)

- Bloomberg Lead Story: Traders Pull First Rate Cut To November. (Bloomberg)

- Stocks rally on Apple earnings before jobs report: Markets Wrap. (Bloomberg)

- Here’s what to expect from Friday Job’s Data. (CNBC)

- Bloomberg: The Big Take: World’s largest pension fund is falling short for its retirees. (Podcast)

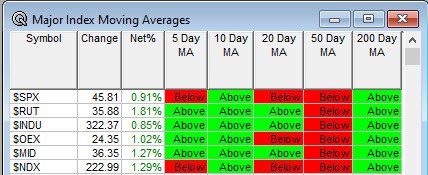

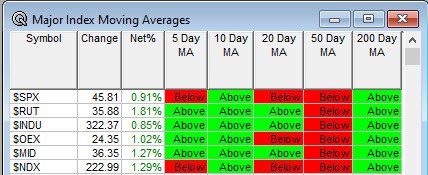

Moving Average Update: Score moves to 63% from 20%.

Geopolitical:

- President’s Public Schedule:

- President Biden receives the Daily Briefing at 12:30 p.m. EDT.

- Press Briefing by Press Secretary Karine Jean-Pierre at 1:30 p.m. EDT.

- President Biden presents Presidental Medal of Freedom at 4:30 p.m. EDT.

- President Biden head to Wilmington, DE for the weekend at 6:00 p.m. EDT.

Economic:

- April Nonfarm Payrolls are due out at 8:30 a.m. EDT and expected to fall to 250,000 from 300,000. The unemployment rate is expected to stay at 3.80%.

- April ISM Non-Manufacturing PMI is due out at 10:00 a.m. EDT and expected to rise to 51.80% from 51.40%.

- Baker Hughes Rig Count is due out at 1:00 p.m. EDT..

Federal Reserve / Treasury Speakers:

- Federal Reserve New York President John Williams speaks at 7:45 a.m. EDT.

- Federal Reserve Chicago President Austan Goolsbee speaks at 7:45 a.m. EDT as well.

M&A Activity and News:

Meeting & Conferences of Note:

- Sellside Conferences:

- Top Shareholder Meetings: ABBV CMS DOV FELE GEO ITW MAN R SATS SHO ZEUS

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: CGON SGMT OKYO

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- CGON Data presentation for Cretostimogene

- LCTX Data presentation for OpRegen

- Company Event:

- Industry Meetings:

- Austin Technology Workshop

- American Urological Association Annual Meeting

- American Association of Immunologists

- European Wound Mgmt Association

- NSBW Summit

- Pediatric Endocrine Society Annual Meeting

- Retinal Cell & Gene Therapy Innovation Summit

- Spinal Cord Injury Investor Symposium

- Uranium, Battery and Precious Metals Investor Conference

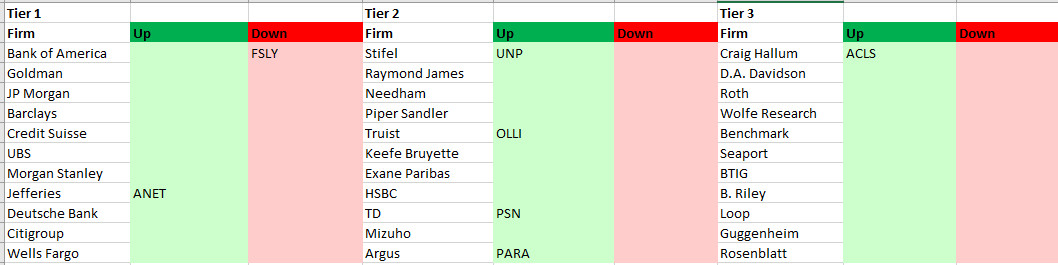

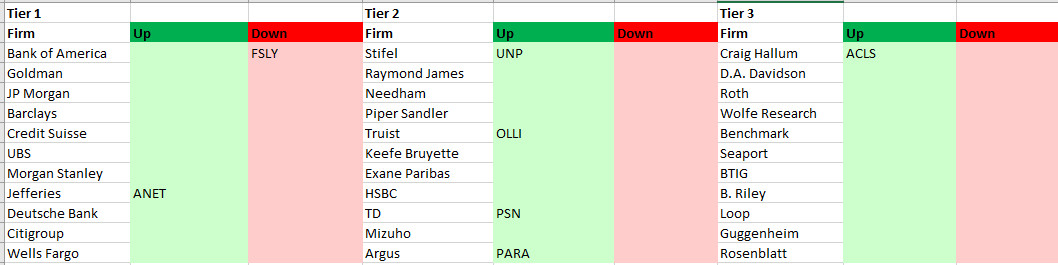

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: