Overnight Summary: The SP 500 closed Wednesday lower by -0.95% at 5160.64 from Tuesday higher by 0.14% at 5209.91. The overnight high was hit at 5,209.75 at 2:25 a.m. while the overnight low was hit at 5187 at 7:15 a.m. EDT. The range overnight is 22 points as of 5:40 a.m. EDT. Currently, the S&P 500 is lower by -19 points at 7:20 a.m. EDT.

Breaking News: ECB keeps rates unchanged.

Executive Summary: The rate of the 10-year blew through 4.50% yesterday on the higher than expected CPI number. Today we get PPI at 8:30 a.m. EDT and the $64,000 question is “Et Tu PPI?”

- March PPI is due out at 8:30 a.m. EDT and is expected to fall to 0.20% from 0.30%.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

Earnings Out After The Close:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs Priced or News:None of note.

- New SPACs launched/News: None of note.

- Secondaries Priced: None of note.

- Notes Priced of note:

- Common Stock filings/Notes:

- CERO files up to 26,619,050 shares of common stock.

- FCEL files up to $300 million of common stock.

- GREE files up to 2,521,000 of common stock.

- MDAI files up to 6,369,937 shares of common stock.

- UMAC file up 940.719 shares of common stock.

- Direct Offering: None of note.

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Private Placement of Public Entity (PIPE): None of note.

- Mixed Shelf Offerings:

- VTVT files $250 million mixed-self offering.

- Debt/Credit Filing and Notes: None of note.

- Tender Offer: None of note.

- Convertible Offering & Notes Filed: None of note.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- ALPN +36.6%, ARTNA +2%,

- RCEL -3%, REGN -2.6%,

- News Items After the Close:

- Costco (COST) March Sales Growth was +7.5%, e-commerce up +28%.

- Vertex Pharmaceutical (VRTX) to buy Alpine Immune Sciences (ALPN) for $65 a share. (see M&A)

- Sunstone Hotel (SHO) to buy 630-room Hyatt (H) Regency San Antonio Riverwalk for $230 million.

- U.S. files False Claims Act against Regeneron (REGN) for fraudulent pricing reporting. (Press Release)

- BAE Systems (BAESY) awarded $460 million U.S. Army order dependent contract.

- Exchange/Listing/Company Reorg and Personnel News:

- Bio-Rad Labs (BIO) Executive VP and COO Dr. Andrew Last to retire September, 2024.

- Crown Castle (CCI) names Steven Moskowitz as CEO.

- Buyback Announcements or News: None of note.

- Stock Splits or News:

- Barrett Business (BBSI) to split 4:1 but needs shareholder approval on June, 3rd.

- Dividends Announcements or News:

- Costco (COST) raises dividend by +13.70% to $1.16 a share.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 -23, Dow Jones -159, NASDAQ -60 , Russell -17. (as of 7:56 a.m. EST). Asia lower ex the Kospi and Europe is lower this morning. VIX Futures are at 16 from 15.01. Gold and Silver are higher with Copper lower this morning. WTI Crude Oil and Brent Crude Oil are lower with Natural Gas lower as well. US 10-year Treasury sees its yield at 4.554% from 4.36%. The U.S. Dollar is higher versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $70.430 from $69,124 higher by +1.01% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Energy of note.

- Daily Negative Sectors: All others of note led by Real Estate, Utilities and Materials.

- One Month Winners: Energy, Communication Services, Basic Materials and Industrials of note.

- Three Month Winners: Technology, Communication Services, Industrials, Energy and Financials of note.

- Six Month Winners: Technology, Financials, Industrials of note.

- Twelve Month Winners: Technology, Communication Services, and Financial of note.

- Year to Date Winners: Energy, Communication Services, Technology and Financials of note.

Upcoming Earnings Of Note:

- Thursday After the Close: AGX of note.

- Friday Before the Open:

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: KMX -0.16, LOVE -0.06, FAST -0.01.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: ALPN +36.2%, ARTNA +2%, CWT +2% of note.

- Gap Down: RCEL -6.6%, SGHT -4%, RSKD -2.5%, REGN -2.3%, STC -2.2% of note.

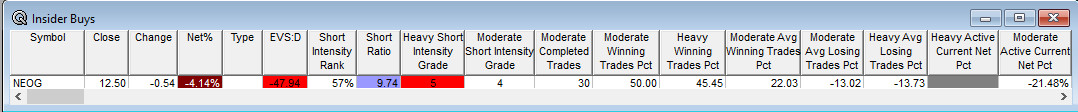

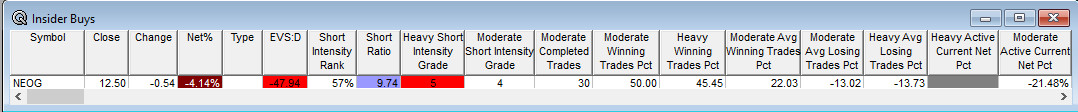

Insider Action: No stock see Insider buying with dumb short selling. NEOG sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Bond Traders are Preparing For a 5% Yield, No-Rate Cut World. (Bloomberg)

- U.S. futures, bonds slip on fading rate cut hopes: Markets Wrap. (Bloomberg)

- Interview with Amazon CEO Andy Jassey this morning on CNBC. (CNBC)

- “Supercore” is the new word in the inflation debate. (CNBC)

- Microsoft (MSFT) will unveil new Windows and AI features in May. (CNBC)

- Bloomberg: Daybreak Podcast: Traders pare ECB, BOE bets after U.S. CPI. (Podcast)

- Bloomberg The Big Take: Why filing taxes could get easier. (Podcast)

- NYT The Daily: The staggering success of Trump’s trial delay tactics. (Podcast)

- Marketplace: The race to resurrect the Dodo. (Podcast)

Moving Average Update: Score bombs to 34% from 82%.

Geopolitical:

- President’s Public Schedule:

- President Biden receives the Daily Briefing at 10:00 a.m. EDT.

- Press Briefing at 1:30 p.m. EDT by Press Secretary Karine Jean-Pierre,

- President Biden meets with Philippines President Ferdinand Marcos at 3:15. Then at 4:15 p.m. EDT the Prime Minister of Japan and Vice President join the conversation.

Economic:

- March PPI is due out at 8:30 a.m. EDT and is expected to fall to 0.20% from 0.30%.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve New York President John Williams speaks at 8:45 a.m. EDT.

- Federal Reserve Richmond President Thomas Barkin speaks at 10:00 a.m. EDT

- Federal Reserve Boston President Susan Collins speaks at 12:00 p.m. EDT

- Federal Reserve Atlanta President Raphael Bostic speaks at 1:30 p.m. EDT

M&A Activity and News:

- Vertex Pharmaceutical (VRTX) to buy Alpine Immune Sciences (ALPN) for $65 a share.

Meeting & Conferences of Note:

- Sellside Conferences:

- Needham Healthcare Conference

- Wells Fargo Software Symposium

- Top Shareholder Meetings: None of note.

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ELVN FAST GSL HLIT MRVL SAIC

- Update: None of note.

- R&D Day: None of note.

- Company Event:

- Industry Meetings:

- Space Symposium

- Google Cloud Next

- Spinal Cord Injury Investor Symposium

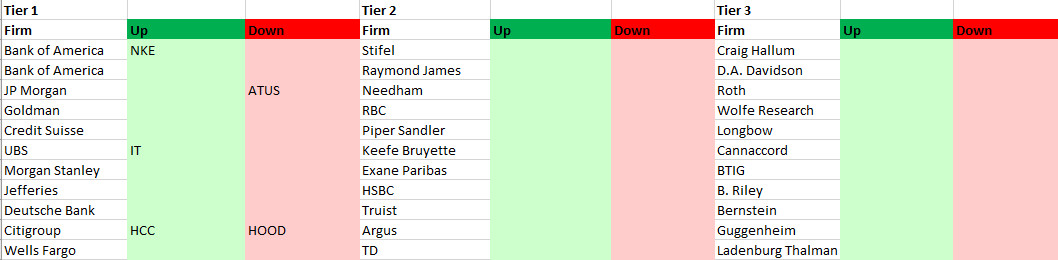

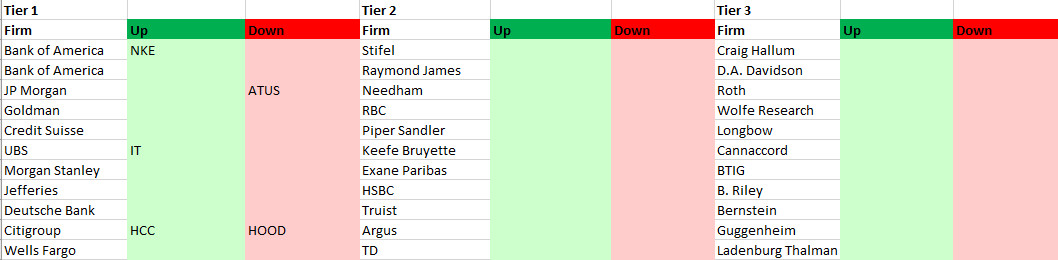

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: