Overnight Summary: The SP 500 closed Friday higher by 1.11% at 5204.34 from Thursday lower by -1.23% at 5147.21. The overnight high was hit at 5,269.25 at 6:05 p.m. while the overnight low was hit at 5236.50 at 4:30 p.m. EDT. The range overnight is 33 points as of 7:02 a.m. EDT. Currently, the S&P 500 is lower by -1.50 points at 7:20 a.m. EDT.

Executive Summary: Today is a quiet day as no economic or earnings data. Markets are preparing for inflation data this week with both CPI and PPI due out.

Earnings Out After The Close:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs Priced or News:None of note.

- New SPACs launched/News: None of note.

- Secondaries Priced:None of note.

- Notes Priced of note:

- HLF prices $800 million of Senior Secured Notes.

- Common Stock filings/Notes:

- AWH up to 1,571,000 share of common stock filed.

- Direct Offering: None of note.

- Exchangeable Subordinate Voting Shares:

- Brookfield Renewable (BEPC) files for $2.5 billion offering.

- Selling Shareholders of note:

- Selling Shareholder to sell 737,210 shares of CDE.

- EXR shareholder to sell 189,076 shares.

- GDRX shareholder to sell 99,983,317 shares.

- Private Placement of Public Entity (PIPE): None of note.

- Mixed Shelf Offerings:

- EDAP files a $125 million mixed shelf offering.

- VLY files a mixed shelf offering.

- BIP files mixed shelf offering.

- KINS files $50 million mixed shelf offering.

- Debt/Credit Filing and Notes: None of note.

- Tender Offer: None of note.

- Convertible Offering & Notes Filed: None of note.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close and Over the Weekend:

- News Items After the Close:

- Churchill Downs (CHDN) opens casino in Terre Haute, Indiana.

- Coupang (CPNG) completes 10 million share repurchase from early stage investor.

- Elon Musk tweets that Tesla (TSLA) Robotaxi to be unveiled on 8/8.

- United Airlines (UAL) delays Investor Day.

- General Dynamics (GD) awarded $519 million contract by the U.S. Army for Stryker system technical support.

- News Items Over the Weekend:

- As Congress returns, TikTok steps up fight against a possible ban. (MarketWatch)

- Boeing (BA) Engine Cover falls off Southwest (LUV) plane in Denver. (BBC)

- Doubt creeps in over a Fed rate cut. (WSJ)

- Barron’s:

- Positive View: AMAT, BEP, NEE, TRP, INTC and India of note.

- Cautious View: PFE, TSLA of note.

- Mixed View: None of note.

- Erlanger Type 1 Short Squeezes and Type 4 Long Squeezes reporting earnings this week:

- Exchange/Listing/Company Reorg and Personnel News:

- Vital Farms (VITL) COO Jason Dale to transition into non-employee advisory role.

- Bragg Gaming Group (BRAG) CFO Ronen Kannor to step down.

- Buyback Announcements or News: None of note.

- Stock Splits or News: None of note.

- Dividends Announcements or News: None of note.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +1, Dow Jones +13, NASDAQ +1, Russell +5. (as of 7:56 a.m. EST). Asia higher ex Shanghai and Europe is higher this morning. VIX Futures are at 15.70 from 15.95. Gold, Silver and Copper are higher this morning. WTI Crude Oil and Brent Crude Oil are lower with Natural Gas higher. US 10-year Treasury sees its yield at 4.445% from 4.332%. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $72,545 from $66,783 higher by 4.77% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Communication Services, Technology, Industrials and Materials of note.

- Daily Negative Sectors: Utilities of note.

- One Month Winners: Energy, Communication Services, Basic Materials and Industrials of note.

- Three Month Winners: Technology, Communication Services, Industrials, Energy and Financials of note.

- Six Month Winners: Technology, Financials, Industrials of note.

- Twelve Month Winners: Technology, Communication Services, and Financial of note.

- Year to Date Winners: Energy, Communication Services, Technology and Financials of note.

Upcoming Earnings Of Note:

- Monday After the Close: None of note.

- Tuesday Before the Open

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: DCO +13.2%, OCUL +6.6%, SSL +6.3%, ESPR +5.6%, LEGN +4.4%, TSLA +3.3%, CDE +3.3%, INZY +2.7% of note.

- Gap Down: PERI -38.4%, ITOS -7.5%, EDAP -4.4%, HOWL -3.7%, IONS -2.4% of note.

Insider Action: CRMT see Insider buying with dumb short selling. No stock see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Yellen implores China to rethink growth strategy. (Bloomberg)

- Bonds retreat as Traders trim rate cut expectations: Markets Wrap. (Bloomberg)

- Israel withdrew some troops from Southern Gaza. (NYT)

- President Biden will warn China against aggression in the South China Sea. (FT)

- Heard on the Street: Blood tests won’t replace stool samples or Colonoscopies yet. (WSJ)

- Health Insurance Companies reap hidden fees when they lower payments. (NYT)

- Apple (AAPL) seeks to overturn watch ban over patent dispute.

- Spirit Airlines (SAVE) to defer Airbus orders to 2030, furlough 260 pilots as seeks to shore up liquidity. (CNBC)

- Bloomberg: Daybreak Podcast: TSMC gets $11.6 billion of U.S. grants to build in Arizona. (Podcast)

- NYT The Daily: The Eclipse Chaser. (Podcast)

- Marketplace: Facial recognition part of Israel’s arsenal in Gaza War. (Podcast)

- Wealthion: Weekly Recap: Tax Loopholes, Crypto Boom and Gold’s Surprising Rally. (Podcast)

- Adam Taggart’s Thoughtful Money: Marc Faber Dr. Gloom. (Podcast)

Moving Average Update: Score improves to 51% to 34%.

Geopolitical:

- President’s Public Schedule:

- President Biden receives the daily briefing at 9:00 a.m. EDT.

- President Biden heads to Madison, WI leaves Philadelphia at 11:00 a.m. EDT and arrives in Madison at 12:00 p.m. CDT.

- President Biden delivers a speech on lowering costs for Americans at Madison College at 1:15 p.m. CDT.

- President Biden then heads to Chicago for a campaign reception at 5:45 p.m. CDT.

- President Biden heads back to the White House at 7:20 p.m. CDT.

- President Biden arrives back at White House at 10:20 p.m. EDT.

Economic: None of note.

Federal Reserve / Treasury Speakers:

- Federal Reserve Chicago President Austan Goolsbee to speak at 1:00 p.m. EDT.

- Federal Reserve Minneapolis President Neel Kashkari to speak at 7:00 p.m. EDT.

M&A Activity and News: None of note.

Meeting & Conferences of Note:

- Sellside Conferences:

- Needham Healthcare Conference

- Top Shareholder Meetings: None of note.

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: CUE INZY IONS VINC

- Update: None of note.

- R&D Day: None of note.

- Company Event: None of note.

- Industry Meetings:

-

- AACR

- American College of Cardiology’s Scientific Sesssion & Expo

- Electric & Autonomous Vehicles Conference

- LD Micro Invitational

- Space Symposium

- WEX SPARK 2024

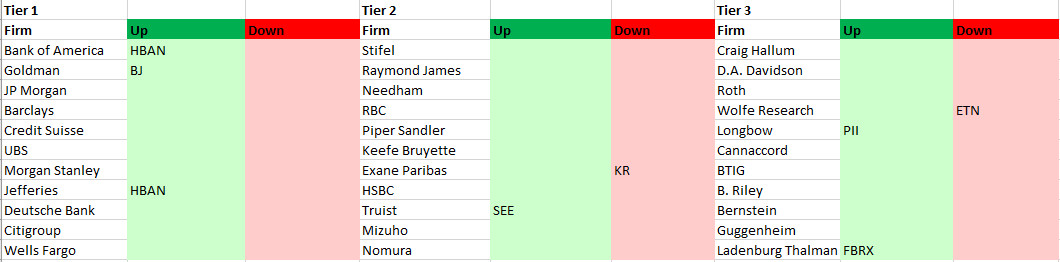

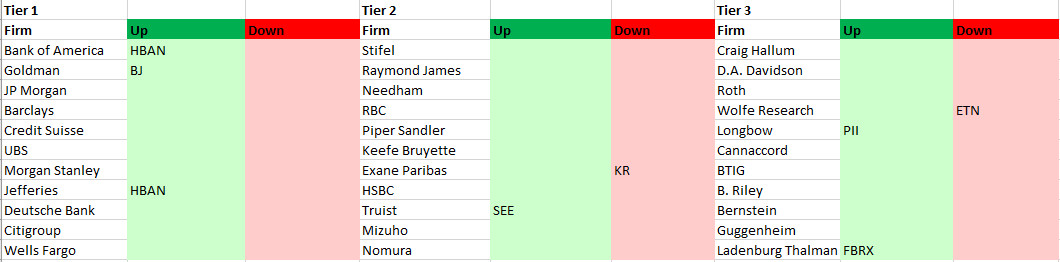

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: