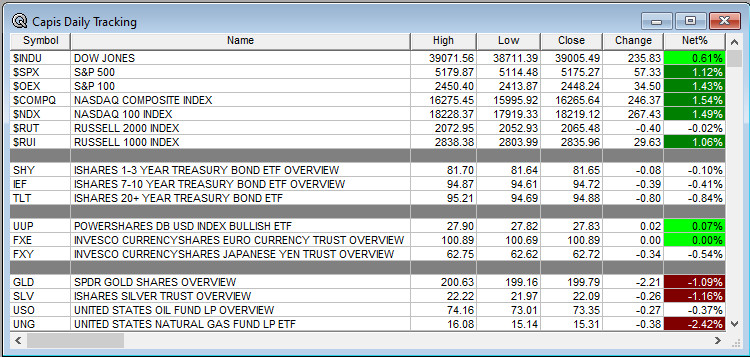

Overnight Summary: The S&P 500 closed Tuesday higher by 1.12% at 5175.27 from Monday lower by -0.11% at 5117.94. The overnight high was hit at 5247.50 at 3:25 a.m. EST while the overnight low was hit at 5235 at 11:20 p.m. EST. The range overnight is 12points as of 7:00 a.m. EST. The 10-day average of the overnight range is at 21.74 from 23.45. The average for May-January average was 20.88 from 20.87 during May-December. Currently, the S&P 500 is higher by +2.75 points at 7:00 a.m. EST.

Executive Summary: Key today will be the 1:00 p.m. EDT 30-Year Auction. The 10-Year Auction grade did not go off great and CNBC graded it a C-.

- Quiet morning with no major economic releases other than weekly mortgage applications and crude oil inventories.

Earnings Out After The Close:

- Beats: RXT +.01 of note.

- Flat: SKIN of note.

- Misses: CYRX -0.98, WEST -0.23 of note.

- IPOs Priced or News:

- New SPACs launched/News:

- Altitude Acquisition Corp. (ALTU) announces liquidation of trust account.

- Secondaries Priced:

- GEHC priced 14 million shares of common stock.

- Notes Priced of note:

- Common Stock filings/Notes:

- ICHR: Files public offering of ordinary shares.

- LEXX: Files 1,162,989 shares of common stock.

- Direct Offering: None of note.

- Selling Shareholders of note:

- GEHC: Files for 13,000,000 shares of its common stock by selling shareholder.

- ODD: Files for 4,000,000 shares of Class A common stock by selling shareholder.

- BHVN: Files for 45,883 common shares by selling shareholders.

- Private Placement of Public Entity (PIPE):

- Mixed Shelf Offerings:

- LBPH: Files mixed shelf securities offering.

- PHX: Files $100 million mixed shelf securities offering.

- AIRT: Files $25,000,000 mixed shelf offering.

- Debt/Credit Filing and Notes: None of note.

- Tender Offer: None of note.

- Convertible Offering & Notes Filed:

- COIN: To offer $1.0 billion convertible senior notes due 2030.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- SKIN: up +22.6%

- MXCT: up +13.1% on earnings

- SIGA: up +8.3%

- LUNA: down -19.3% delays 10-K and Q-4 as well as FY23 results

- SWIM: down -11.6%

- CYRX: down -11%

- RXT: down -6.8% on refinancing

- News Items After the Close:

- Stocks making the biggest moves after hours: (CNBC)

- Alaska Air (ALK) flight involving the door plug blowing off was scheduled for safety check that day. (NYT)

- Intel (INTC) down over -1.0% after Pentagon abandons its plan to spend $2.5 billion on Intel grant. (Bloomberg)

- Textron (TXT) awarded $455 million U.S. Navy contract.

- BAE Systems (BAESY) awarded $318 million U.S. Army contract

- Assets Under Management (MofM):

- Exchange/Listing/Company Reorg and Personnel News:

- Equinix (EQIX) CEO Charles Meyers to transition to the role of Executive Chairman; Google Cloud go-to-market President Adaire Fox-Martin to serve as CEO; current Chairman to step away.

- Phillips 66 (PSX) appoints CEO Mark E. Lashier to the additional position of Chairman of the Board.

- The Beauty Health Company (SKIN) announces that it has appointed Marla Beck as its permanent President and Chief Executive Officer.

- Delayed 10-Q Filings:

- Avid Bioservices (CDMO) to delay 10-Q filing.

- Comtech Telecom (CMTL) to delay 10-Q filing.

- Luna Innovations (LUNA) to delay 10-K filing.

- P3 Health Partners (PIII) to delay 10-K filing.

- Buyback Announcements or News:

- Appian (APPN) authorizes up to $50 million for repurchases.

- Stock Splits or News:

- Dividends Announcements or News:

- International General Insurance (IGIC) declares extraordinary cash dividend of $0.50 per share.

- InvenTrust Properties (IVT) increases quarterly dividend by 5% to $0.226 per share.

- Toll Brothers (TOL) announces 10% increase in quarterly cash dividend to $0.23 per share; equates to a new annualized yield of 0.75%.

What’s Happening This Morning: Futures value reflects the change with fair value.

S&P 500 +1.23, Dow Jones +32, NASDAQ -19.21, and Russell 2000 -2.08. (as of 7:50 a.m. EST). Asia is mixed while Europe is higher this morning. VIX Futures are at 14.90 from 15.10 yesterday morning. Gold, Silver and Copper higher this morning. WTI Crude Oil and Brent Crude Oil are higher with Natural Gas lower. US 10-year Treasury sees its yield at 4.168% from 4.089% yesterday morning. The U.S. Dollar is lower versus the Euro, flat versus the Pound and higher against the Yen. Bitcoin is at $73,436 from $71,838 higher by 2.66% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Technology, Consumer Cyclical, Communication Services and Consumer Defensive of note.

- Daily Negative Sectors: Utilities, Real Estate, Materials, of note.

- One Month Winners: Utilities, Basic Materials, Real Estate of note.

- Three Month Winners: Technology, Financial, Healthcare of note.

- Six Month Winners: Technology, Financial, and Industrials of note.

- Twelve Month Winners: Technology, Communication Services, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Healthcare, Financial of note.

The latest reading of U.S. inflation was hotter than economists expected but cooler than many investors feared. That lifted stocks Tuesday.

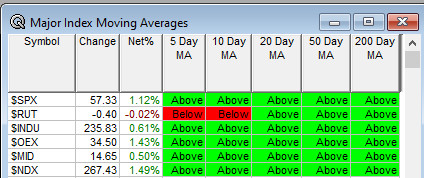

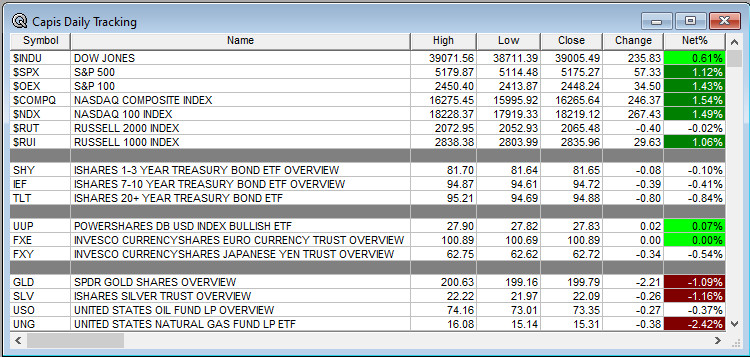

Companies from chip makers and software providers to big-box retailers and pharmaceutical giants helped pull all three major indexes higher. The Dow Jones Industrial Average climbed 0.6%, or about 236 points, while the tech-heavy Nasdaq Composite rose by 1.5%. The S&P 500 added 1.1%, marking its 17th record high of 2024.

The gains came despite a Labor Department report showing consumer prices rose 3.2% in February from a year earlier, another installment in a string of recent data suggesting inflation remains stubbornly high. Even so, many investors continue to believe the Federal Reserve remains on track to cut interest rates later this year, reducing borrowing costs for businesses and, potentially, boosting stocks.

Traders are now assigning a roughly 60% chance that the central bank begins cutting rates in June, according to futures markets.

“The Fed has already quashed the market’s expectation of a March rate cut anyway,” said Charlie Ashley, a portfolio manager at Catalyst Funds, referencing next week’s policy meeting. “The only way this [reading] was going to be important is if it was scorching hot.”

Treasury yields rose, erasing last week’s declines, after the government’s latest issuance of debt inspired lackluster interest from investors. The benchmark 10-year Treasury note yield, which rises when prices fall, edged higher to 4.154%.

(WSJ – edited by QPI)

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close: LEN, S, PATH

- Thursday Before the Open: DG, BEKE, DKS, GIII, MOMO

Earnings of Note This Morning:

- Beats: TH +0.04 of note.

- Flat: None of note.

- Misses: DLTR -0.12 of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: ALK of note.

- Negative Guidance: KSS of note.

Erlanger Research Advance/Decline Chart: Will return tomorrow!

Gap Ups & Down In Early Pre-Market:

- Gap Up: SKIN +22.6%, TH +11.2%, SIGA +10.30%, WOOF 4.30%, MXCT +2.3% of note.

- Gap Down: LUNA -21.70%, SWIM -20.7%, WOW -11.3%, CYRX -8.7%, ACDC -8.3%, DLTR -7.1%, WEST -4.7%, ZIM -4.7%, RXT -4.1% of note.

Insider Action: No stock sees Insider buying with dumb short selling. No stock sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- Stocks Making The Biggest Moves. DLTR, DG, TSLA, TXRH, GEHC. (CNBC)

- Morning Briefing for Bloomberg subscribers. (Bloomberg)

- Bloomberg Lead Story: Trump Wins Republican Nomination Setting Rematch With Biden. (Bloomberg)

- European Parliament approves world’s first major bill to regulate AI. (CNBC)

- Stocks lose momentum after Wall Street Rally: Markets Wrap. (Bloomberg)

- Eli Lilly (LLY) to use Amazon (AMZN) Pharmaceutical to help deliver Zepbound. (CNBC)

- Bloomberg Daybreak: Trump/Biden Rematch. TikTokBill. (Podcast)

- NYT The Daily: Alarming find inside shooter’s mind. (Podcast)

- Marketplace: Why has the Biden Administration had a CTO? (Podcast)

- Wealthion: Investor panic sparks market chaos. (Podcast)

- Adam Taggart Thoughtful Money: Easy gains are over, Michael Howell. (Podcast)

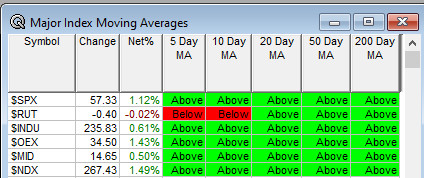

Moving Averages Update: 93% from 71%, nice improvement.

Geopolitical:

- President’s Public Schedule:

- President receives the Presidential Daily Briefing at 10:00 a.m. EDT.

- President heads to Milwaukee at 1:35 p.m. EDT.

- President delivers remarks on his investments are rebuilding communities at 5:00 p.m. EDT.

- President participates in a campaign event at 5:50 a.m. EDT.

Economic:

- No monthly events of note for today.

- MBA Mortgage Application Index out at 7:00 a.m. EDT and rose week over week by 7.1% after last week’s rise by 9.7%.

- EIA Weekly Crude Oil Inventories due at 10:30 a.m. EDT.

- 30-Year Bond Auction at 1:00 p.m. EDT.

Federal Reserve / Treasury Speakers: None of note.

M&A Activity and News:

- inTEST Corp (INTT) acquires Alfamation S.p.A.

- Teledyne Tech (TDY) enters into agreement to acquire Valeport Holdings.

Meeting & Conferences of Note:

- Sellside Conferences:

-

- Previously posted and ongoing conferences:

- Bank of America Consumer & Retail Conference

- Barclays Global Healthcare Conference

- BTG – Latam Opportunity Conference

- Citi India Conference

- Citigroup TMT Conference

- Deutsche Bank Media Internet & Telecom Conference

- Guggenheim 5th Annual Healthy Altitudes Summit

- Jefferies Biotech on the Bay Summit

- J.P. Morgan Industrials Conference

- Leerink Global Biopharma Conference

- Oppenheimer Healthcare MedTech & Services Conference

- Top Shareholder Meetings:

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: SUM, MDU, BV, JAMF, JNPR, WKC

- PDUFA Update: MIRM PDUFA date for Maralixibat.

- R&D Day: None of note.

- Company Event: None of note.

- Industry Meetings:

-

- Previously posted and ongoing conferences:

- Acute Kidney Injury and Continuous Renal Replacement Therapy Conf

- HIMSS Global Health Conference and Exhibition

- iAccess Alpha Best Ideas Spring Virtual Conference

- International Battery Seminar & Exhibit

- International Conference on Advances in Critical Care Nephrology (AKI & CRRT 2024)

- NYSE Materials Day

- Partner Marketing Visionaries Summit

- Society of Neuroimmune Pharmacology Conference

- Society of Toxicology conference

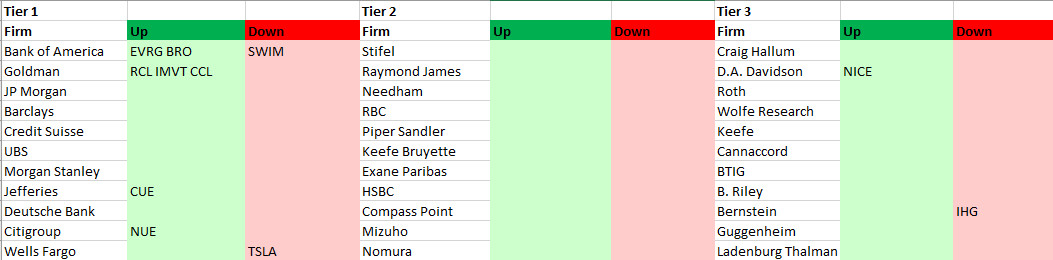

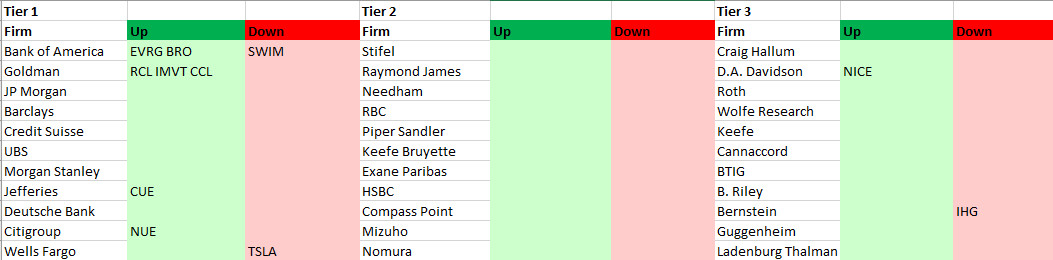

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

Previous Day’s Upgrades and Downgrades: