- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: ALEH, CUPR, DMAA, HUHU, LBGJ, LUD, NAMI, PTLE, SAG, SFHG, SNYR, SUNH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- BA filed at $25 billion mixed shelf offering.

- PIPE:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: PHX +6.1%, BTBT +3.3%, MPW +3.3%, CVAC +2.8%, JYNT +2.8% of note.

- Movers Down: COTY -6.2% of note.

News After The Close:

-

- California investigates five possible human cases of bird flu. (Reuters)

- COTY announces prelim Q1 results; reiterates FY25 adjusted EBITDA outlook of +9-11%

- Israel to strike Iranian military sites not oil or nuclear. (The Washington Post)

- Boeing (BA) to issue layoff notices to workers next month. (Reuters)

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

- JYNT names Sanjiv Razdan as its President and CEO, effective today; former CEO Peter D. Holt announced resignation

- MSFT VP of GenAI Research Sebastien Bubeck, to leave the company and join OpenAI

- STT CFO Eric Abouf to leave. (Bloomberg)

Dividends Announcements or News:

- Stocks Ex Div Today: ABBV ABT FCX EME MAA HRL AFG PECO ACA TRN ALG CHCO BFS ARR

- Stocks Ex Div Tomorrow: PNC FMX WSO PFLT

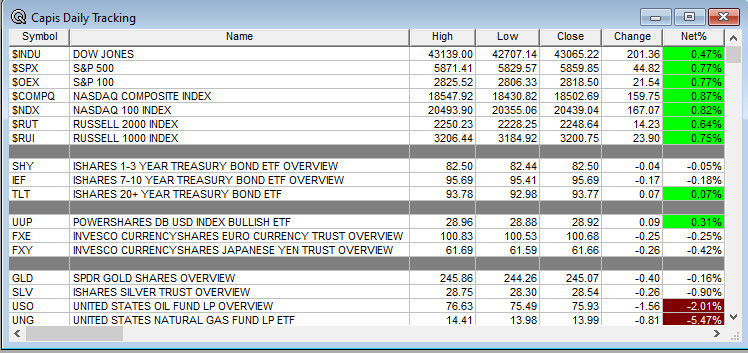

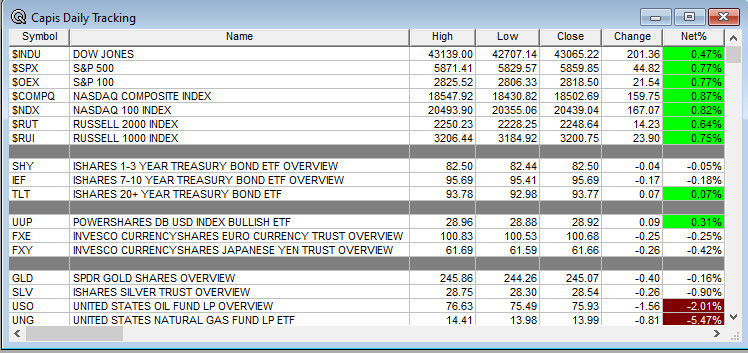

What’s Happening This Morning: Futures S&P 500 +2 NASDAQ 100 +4 Dow Jones +8 Russell 2000 +7.56 (at 8:20 a.m. EDT). Asia is higher ex China while Europe is lower ex the DAX. VIX Futures are at 18.05 from 18.75 yesterday while Bonds are at 4.071% from 4.096% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold and Silver higher with Copper lower. The U.S. Dollar is higher versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $65,549 from $64,825 lower by -406 at -0.61% this morning.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Technology, Utilities, Real Estate, Communication Services and Industrials of note.

- Daily Negative Sectors: Consumer Cyclicals and Energy of note.

- One Month Winners: Energy, Materials, Communication Services and Technology of note.

- Three Month Winners: Utilities, Real Estate, Industrials, Financials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Communication Services, Financials, Industrials and Consumer Defensive of note.

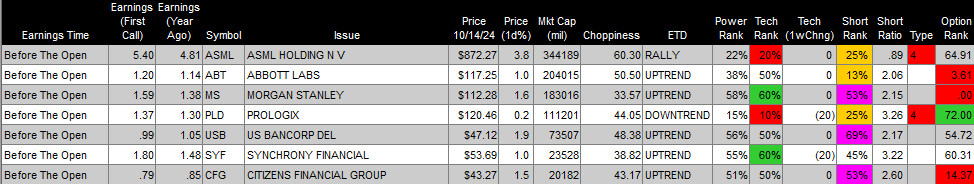

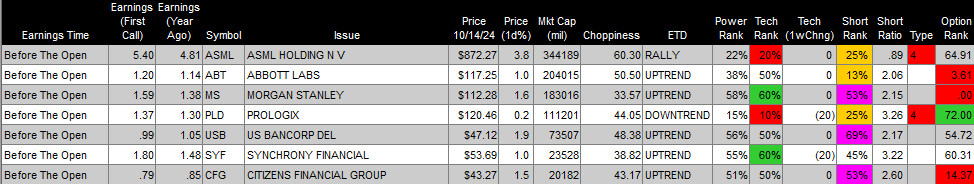

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday Before The Open:

Earnings of Note This Morning:

- Beats: GS +1.51, JNJ +0.21, C +0.20, PNC +0.19, UNH +0.15, STT +0.14, FBK +0.06, BAC +0.05, WBA +0.03, SCHW +0.02 of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line sees improvement.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: WOLF +24.3%, IMRN +16.2%, ERIC +9.5%, PHX +8.3%, NIPG +5.6%, CDNA +5.4%, KEN +3.6%, JYNT +2.8%, BTBT +2.1%

- Gap Down: TVGN -8.3%, COTY -4.9%, UNH -3.7%, FBK -3%

Insider Action: None of note see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: Check back not out yet. (CNBC)

- Bloomberg Lead Story: Goldman Sachs Traders Head To Record Year, Fuel 45% Profit Surge. (Bloomberg)

- Markets Wrap: US Futures steady as robust bank earnings reassure. (Bloomberg)

- Walgreens (WBA) to shutter 14% of all stores in next three years. (Bloomberg)

- JNJ beats on sales and guidance. (MarketWatch)

- UNH shares drop as medical costs rise and profit outlook lowered. (MarketWatch)

- Bloomberg: The Big Take – Insurers struggle with stronger storms. (Podcast)

- Wealthion: Prepare for market turmoil. (Podcast)

- NY Times Daily: Two Blue States to drive control of the House. (Podcast)

Economic:

- October New York Fed Manufacturing Index is due out at 8:30 a.m. EDT and last month came in at 11.50 with estimates at 2.0 for this month.

Geopolitical:

- President Biden receives the President’s Daily Brief at 2:30 p.m. EDT.

- A quiet day ahead as the president heads to Philadelphia to speak to the Sheet Metal Workers Local 19 at 6:45 p.m. EDT.

Federal Reserve Speakers:

- Federal Reserve San Francisco President Mary Daly will speak at 11:30 a.m. EDT.

- Federal Reserve Governor Adriana Kugler will speak at 1:00 p.m. EDT.

M&A Activity and News:

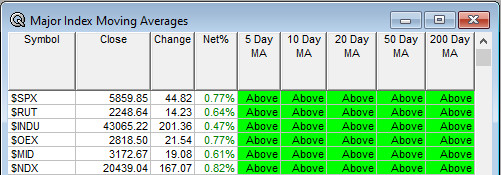

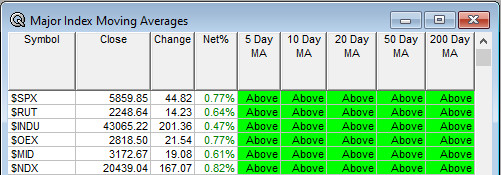

Moving Averages On Major Equity Indexes: Remains at 100% positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- UBS Organ Restoration and Cell Therapy Day

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: PORT, PRPL

- Top Analyst, Investor Meetings: AENT, BTTR, CASY, CDNA, CLYM, SCHW, TGS, UBX

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- AASLD The Liver Meeting

- ABVX: Data Presentation for obefazimod

- BCLI: provide an update on the planned Phase 3b clinical trial for NurOwn

- Company Event: None of note.

- Industry Meetings or Events:

- Adobe MAX The Creativity Conference

- Capital Link’s New

- York Maritime Forum

- Colloquium on Lung and Airway Fibrosis

- Diabetes Technology Meeting

- Maxim Group’s Healthcare Virtual Summit

- MedTech Conference

- OCP Global Summit

- OneCon Conference

- Sohn San Francisco Investment Conference

- USC Marshall Energy Business Summit

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: SM ED BOKF ASX

Downgrades: ETSY CRK APPF