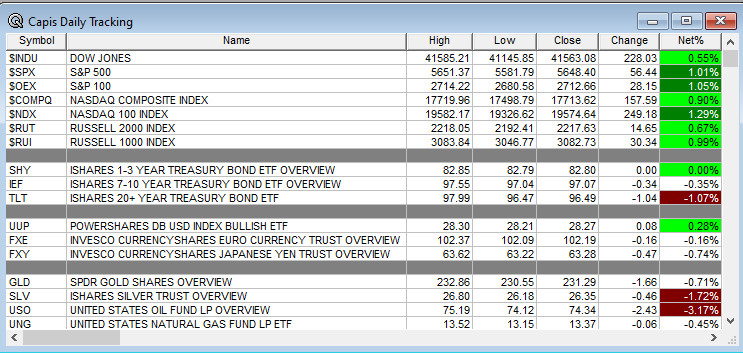

Overnight Summary: The S&P 500 closed Friday higher by 1.01% at 5648.10 from Thursday flat at 5591.96. The overnight high was hit at 5,669.75 at 6:00 p.m. EDT and the low was hit at 5626.50 at 6:00 a.m. EDT. The overnight range is 43 points. The current price is 5634.75 at 6:45 a.m. EDT lower by -26.25 points.

Sunday Night Into Monday Morning Futures Close at 8:30 a.m. CDT: Dow Jones Industrials -64, S&P 500 -6, NASDAQ 100 -9 and Russell 2000 -12.

Most Important Article Of the Morning: T.Rowe Price Who Predicted Yen Shock Sees Another One In The Offing. (Bloomberg)

Executive Summary: Over the last ten years, September has been the worst month of the year dropping seven of the years. The average return is -2.30%. The only positive years

were 2019, 2018 and 2017. The last four years have been tough for investors with drops of -4.87%, -9.34%, -4.76% and -3.92% on the S&P 500. Will the S&P 500 break that trend or add to it? This morning stocks are weak so are we back to a case of “meet the old boss same as the new boss?”

- 52 Week Bill Auction at 1:00 p.m. EDT.

- ISM Manufacturing Index and Construction Spending are out this morning at 10:00 a.m. EDT.

Earnings Out After The Close:

- Beats: None of note.

- Flat:

- Misses: None of note.

- IPOs For The Week: CUPR, GLXG, JBDI, PMAX, TDTH

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ALLR: FORM S-3 – 18,529,000 Shares of Common Stock

- APVO – Form S-1.. Up to 13,513,513 Shares of Common Stock

- GLMD: Form F-1.. Up to 416,667 Ordinary Shares

- PYPD: Form F-3.. Up to 3,912,045 Ordinary Shares

- TENX: Form S-3.. Up to 1,450,661 Shares of Common Stock Up to 31,882,671 Shares of Common

Stock Underlying Pre-Funded Warrants - VCSA: Form S-3.. UP TO 10,932,790 SHARES OF CLASS A COMMON STOCK

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- CANF files for 5,914,286 ADS offering by selling shareholders

- TXO also files for 2.5 mln common unit offering by selling unitholders

- PSNL files for 3.5 mln share offering by selling shareholders

- NMTC: Form S-3.. 5,552,784 Shares of Common Stock Offered by the Selling Stockholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- ASC files for $500 mln mixed securities shelf offering

- FNB files mixed securities shelf offering

- TXO files for $250 mln mixed securities shelf offering;

- CELC files for $400 mln mixed securities shelf offering

- CMPX files for $300 mln mixed securities shelf offering

- CCAP files for mixed securities shelf offering up to $444.4 mln

- ISPO: Form S-3.. $50,000,000 Mixed Shelf

- LOOP: Form S-3.. $175,000,000 Mixed Shelf

- RLMD: Form S-3.. $250,000,000 Mixed Shelf

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: COO (105.6 +11.6%), PCRX (15.56 +9.65%), VEEV (217.57 +9.19%), PODD (201.75 +9.03%), GLDD (9.95 +9.7%), AVAV (203.48 +9.62%), BBY (100.29 +13.77%), MXL (15.15 +18.73%), SMTC (43.78 +18.61%), NTNX (63.07 +18.22%), AMBA (58.87 +18.05%), MDB (289.89 +17.08%), BOX (32.66 +14.7%), AAOI (11.1 +14.33%), INSG (14.49 +11.25%), GGAL (38.95 +12.31%), HAIN (7.98 +23.34%), UNFI (15.03 +11.58%)

- Movers Down: NBIX (126.37 -17.31%), IEP (13.24 -16.71%), DG (83.55 -32.4%), PDD (96.06 -31.32%), SERV (8.39 -17.71%), FLWS (7.86 -17.09%), ESTC (74.97 -29.05%), OKTA (79.06 -20.15%), PSTG (51.06 -17.06%), SEDG (24.34 -15.39%)

News After Thsee Close :

-

- Brazil bans X.

- RTX confirms it entered into a Consent Agreement with the US Dept of State to resolve alleged civil violations.

- LMT awarded a $3.43 bln modification to US Army contract for Guided Multiple Launch Rocket System.

- GD awarded a $491.6 mln modification to previously awarded US Air Force contract.

- HII awarded a $228.3 mln modification to previously awarded US Navy contract.

- Barron’s + on AVGO GE NDAQ TDG ZTS C GS DOW HAS KMX ALB and – on SMCI

- 10-Q or 10-K Delays – SMCI, CTLT of note.

- NASDAQ Delisting Notice – None of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- PFBC announces approval to continue its $150 million stock repurchase plan

Exchange/Listing/Company Reorg and Personnel News:

- COHR appoints CEO James Anderson to also serve as the co’s President, effective September 1

Dividends Announcements or News:

- Stocks Ex Div Today: MCD LMT NKE ADI NOC O CTVA EFX HIG MLM MTB K RF TPL BALL SSNC SWK UHS IPG UI ITT HLI AIZ SF BERY BWA CWEN SLGN BCC PII JWN PTEN WEN

- Stocks Ex Div Tomorrow: CI SLB ODFY HKKCY HAL FOX FOXA AVY LUV TXRH ALV LEA PVH

What’s Happening This Morning: Futures S&P 500 -29 NASDAQ 100 -132 Dow Jones -203 Russell 2000 -22. Asia and Europe are lower this morning. VIX Futures are at 15.80 from 15.65 yesterday while Bonds are at 3.917% from 3.856% on the 10-Year. Crude Oil and Brent are lower with Natural Gas higher. Gold is higher with Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $59,067 from $59,567 higher by +1.04% this morning.

- Daily Positive Sectors: Consumer Cyclicals, Technology, Financials, Real Estate and Industrials of note.

- Daily Negative Sectors: Energy of note.

- One Month Winners: Financials, Technology, Real Estate, Utilities, Consumer Defensive, Industrials and Healthcare of note.

- Three Month Winners: Technology, Real Estate, Healthcare, Financials and

Utilitiesof note. - Six Month Winners: Utilities, Technology, Communication Services, Financials, Real Estate and Consumer Defensive of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Industrials, Utilities, and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

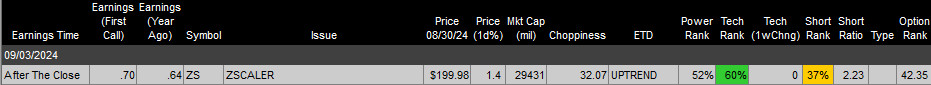

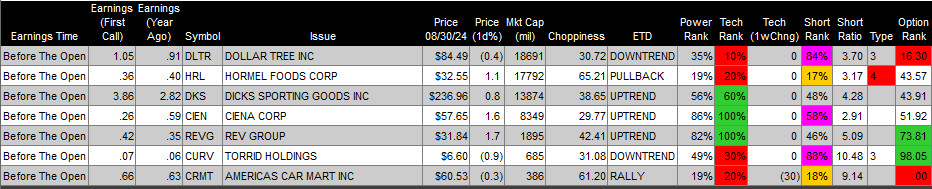

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close: None of Note

- Wednesday Before The Open:

Earnings of Note This Morning:

- Beats: MOMO +0.54 of note.

- Flat:

- Misses: None of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

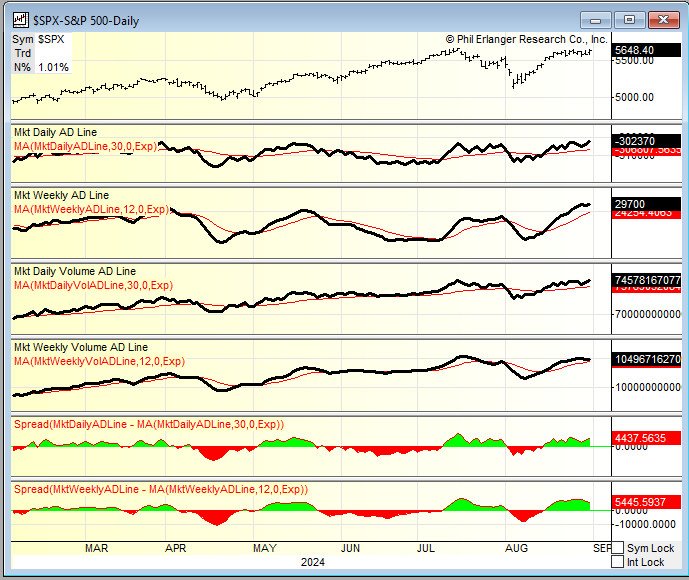

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Some improvement week over week.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up:ARWR +10.4%, PRAX +7.8%, SNY +2.6%, CANF +2.3%, TV +2%

- Gap Down: IOBT -10.7%, LI -3.8%, HII -3%, MOMO -2.9%, VALE -2.8%, NE -2%

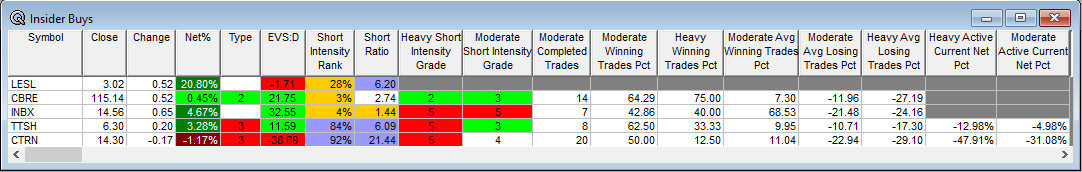

Insider Action: None see Insider buying with dumb short selling. TTSH CTRN of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Stock Market Opens Today. (CNBC)

- What You Need To Know to Start your Day. (Bloomberg)

- Bloomberg Lead Story: Citadel Securities and Jane Street on track for record revenues as they encroach on big banks’ trading revenues. (Bloomberg)

- Markets Wrap: Stocks fall before manufacturing data, Yen rallies. (Bloomberg)

- Pre-Market Movers X U BA NVS BAC. (CNBC)

- Volkswagen braces for plant shutdowns as battles with unions. (CNBC)

- Intel (INTC) CEO Pat Gelsinger will present cost cutting plan to board of directors later this month. (NY Post)

- Vice President Kamala Harris does not support Nippon Steel takeover of US Steel (X). (WSJ)

- Bloomberg Big Take: VW Turns On Germany. (Podcast)

- NYT Times Daily: The push to ban phones in school. (Podcast)

- Wealthion: Recession is Here: Why Gold and Uranium are your best bets. (Podcast)

Economic:

- August ISM Manufacturing Index is due out at 10:00 a.m. EDT and is expected to rise to 47.50% from 46.80%.

- July Construction Spending is also due out at 10:00 a.m. EDT and is expected to rise to 0.2% from -0.3%.

Geopolitical:

- President Biden receives the Daily Briefing at 11:00 a.m. EDT.

- President Biden delivers remarks at 2:00 p.m. EDT on Investing in America content series.

- Press Briefing by Press Secretary Karine Jean-Pierre and Director of the Office of Intergovernmental Affairs Tom Perez.

Federal Reserve Speakers

- None of note today.

M&A Activity and News:

- None of note.

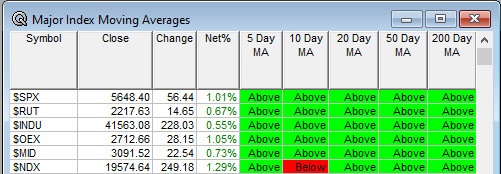

Moving Averages On Major Indexes: Moves from 100% to 97% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Barclays Global Consumer Staples Conference

- Barclays CEO Energy Power Conference

- Citi Global Technology Conference

- Goldman Sachs EMEA Credit and Levered Finance

- KeyBank Non-Deal Roadshow

- Fireside Chat: None of note.

- Top Shareholder Meetings: ECOR, NUVB

- Investor/Analyst Day/Calls: NVST

- Update: None of note.

- Sellside Conferences:

-

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- European Meeting on Complement in Human Diseases (EMCHD)

- SIEM Annual Symposium

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: NTAP LMT KOF RDFN FRGE BAC ADSK

Downgrades: SPHR CME