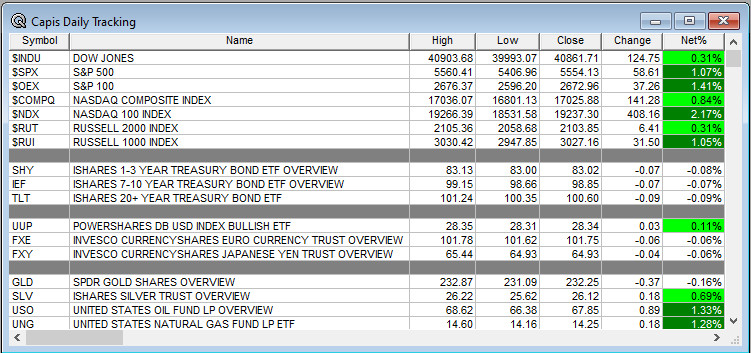

Overnight Summary: The S&P 500 closed Wednesday higher by +1.07% at 5554.13 from Tuesday higher by 0.45% at 5495.52 . The overnight high was hit at 5577.50 at 3:25 a.m. EDT and the low was hit at 5554.25 at 4:05 p.m. EDT. The overnight range is 23 points. The current price is 5567.75 at 7:10 a.m. EDT higher by +6.50 points.

Most Important Article Of the Morning: How America Became a Republic of Distrust (Bloomberg)

Executive Summary: Stocks are higher this morning as we await PPI data at 8:30 a.m. EDT. Yesterday saw stock turn higher after early weakness. We saw the same trend on Tuesday.

- 30-Year Note auction at 1:00 p.m. EDT.

- PPI is out at 8:30 a.m. EDT.

Earnings Out After The Close:

- Beats: None of note.

- Flat:

- Misses: OXM -0.23 of note.

- IPOs For The Week: BCAX, CUPR, FLAI, KAPA, TDTH, YMAT, ZBIO,

ZSPC - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CNTA announces $150,000,000 proposed public offering of American Depositary Shares

- VNOM files Class A common stock offering

- APLD: Form S-1.. 2,964,917 Shares of Common Stock Underlying the Warrant

- BIAF: Form S-1.. 1,801,944 Shares of Common Stock

- ORKT: Form F-1.. 2,940,000 Class A Ordinary Shares

- REBN: Form S-1.. 3,685,574 Shares

- SNAX: Form S-1 — Common Stocks and Warrants

- VIK – Pricing of its Secondary Offering 30,000,000 ordinary shares @$31

- UMAC: FORM S-1 – 7,080,038 Shares of Common stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- LENZ files for 1,578,947 shares of common stock offering by selling shareholder

- APLD files for 2,964,917 shares of common stock by selling shareholder; relates to warrants

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- CNTA files mixed shelf securities offering

- PED: Form S-3.. $100,000,000 Mixed Shelf

- PIPE: SMX Announces $5.35 Million Private Placement

- Convertible Offering & Notes Filed:

- MGRM Upsizes 8.00% Series D Convertible Cumulative Preferred Stock and Warrant Offering to

$12.5 Million

- MGRM Upsizes 8.00% Series D Convertible Cumulative Preferred Stock and Warrant Offering to

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: NTGR +23.4%, BEEP +5.5%

- Movers Down: OXM -9.1%, VNOM -4.4%, INSG -2.1%, AVNW -2%

News After The Close :

-

- OpenAI to raise $6.5 bln from investors at a $150 bln valuation. (Bloomberg)

- EZPW enters into definitive agreement to acquire 53 pawn stores in Mexico

- AWS (AMZN) to invest 10 bln reais, or about $1.8 bln, in Brazil through 2034 to expand data center operations (Reuters)

- SITC announces spin-off and distribution dates of its portfolio of convenience retail properties into a separate publicly traded company

- Assets Under Management (AUM) Update

- IVZ reports preliminary month-end assets under management (AUM) of $1,751.8 billion, an increase of 1.1% versus previous month-end

- APAM reports that its preliminary assets under management as of August 31, 2024 totaled $166.2 billion

- VCTR reports total Assets Under Management (AUM) of $173.8 bln for August 2024, up 1% from July 2024

- BEN reports preliminary month-end assets under management (AUM) of $1.68 trillion at August 31, 2024 compared to $1.66 trillion at July 31, 2024

- MOD provided FY27 financial targets during Investor Day earlier today, including three-year revenue CAGR of 10-13%

- PACS has finalized acquisition of operations of 53 skilled nursing, assisted and independent living facilities from Prestige Care

- NTGR enters into settlement agreement with TP-Link Systems; receives $135 mln payment; raises Q3 guidance

- ACN awarded $1.6 bln U.S. Air Force contract

- RTX awarded $1.2 bln U.S. Air Force contract modification

- 10-Q or 10-K Delays – AVNW of note.

- NASDAQ Delisting Notice – None of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- BBW authorizes new repurchase program of up to $100 million.

- NSIT authorizes new stock repurchase program of up to an aggregate of $300 mln

Exchange/Listing/Company Reorg and Personnel News:

- Solaris Oilfield Infrastructure (SOI) announces completion of acquisition of Mobile Energy Rentals. Will also begin trading under new symbol “SEI” on September 12, 2024

- MBIN announces appointment of Sean Sievers as its new CFO, effective Sept. 9

- CYH CMO Lynn Simon, MD, to retire and transition into consulting role at the end of the year; Miguel Benet, MD, appointed successor.

Dividends Announcements or News:

- Stocks Ex Div Today: TSM NXPI BR REG CIVI FFIN MDU BDC MCY AMBP NSSC

- Stocks Ex Div Tomorrow: CCI DLR NDAQ VRSK XEL GRMN GPN FTV DVN TROW LDOS TXT AMH DPZ GLPI ARCC GFI SCI OVV ALB GPK CX FHN CMA WCC BPOP PB RRC ADT NOV WH IBP CADE BYD

- RWT announces 6.25% increase in its common stock dividend to $0.17/share.

- WRB declares a special cash dividend on its common stock of $0.25/share to be paid on September 30, to stockholders of record at the close of business on September 23.

What’s Happening This Morning: Futures S&P 500 -10 NASDAQ 100 -39 Dow Jones-117 Russell 2000 -4.54. Asia is lower with Europe is higher this morning. VIX Futures are at 18.31 from 18.85 yesterday while Bonds are at 3.616% from 3.721% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $56,807 from $57,120 lower by -1.72% this morning.

- Daily Positive Sectors: Technology, Consumer Cyclicals, Communication Services,Materials and Utilities of note.

- Daily Negative Sectors: Consumer Defensive, Financials and Energy of note.

- One Month Winners: Financials, Healthcare, Consumer Defensive, Real Estate, Consumer Cyclicals and Utilities of note.

- Three Month Winners: Real Estate, Utilities, Financials, Consumer Defensive, Healthcare of note.

- Six Month Winners: Utilities, Consumer Defensive, Real Estate, Financials and Communication Services of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Utilities, Consumer Defensive and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close: ADBE RH

- Friday Before The Open: None of note

Earnings of Note This Morning:

- Beats: SIG +0.11, LOVE +0.06 of note.

- Flat:

- Misses: CAL -0.24 of note.

- Still to Report: KR

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Minimal follow through yesterday.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: NTGR +27.7%, AURA +11.9%, BEEP +6.4%, ALK +4.8%, INSG +4%, BTG +3.6%, SMMT +3.1%, ASND +2.5%, BEN +2.1%, CEVA +2%

- Gap Down: OXM -10%, AVNW -8.2%, CURV -8.1%, MRNA -7%, VNOM -4.8%, APLD -3.6%

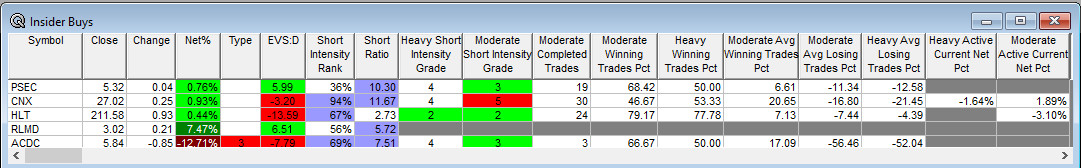

Insider Action: CNX HLT ACDC of note see Insider buying with dumb short selling. No names of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Market Opens. (CNBC)

- Pre-Market Movers: MRNA ALK OXM DEO IPG (CNBC)

- Bloomberg Lead Story: China Detains Investment Bankers, Takes Passports In Corruption Sweep. (Bloomberg)

- Markets Wrap: Stocks rally spreads as Tech Rally gains momentum. (Bloomberg)

- McDonalds (MCD) extends $5 value meal to December. (CNBC)

- Vice Presidential Candidate JD Vance being interviewed on CNBC this morning as we write out note.

- Big Take: Intel (INTC) has only tough options after fall from grace. (Podcast)

- Odd Lots: The Big Misconceptions of Chinese Economy. (Podcast)

- Wealthion: Fed Rates Cuts will trigger inflation. (Podcast)

Economic:

- August PPI is due out at 8:30 a.m. EDT and expected to remain at 0.2%.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT as well.

- Weekly Natural Gas Data is due out at 10:30 p.m. EDT.

Geopolitical:

- President Biden receives the Daily Briefing by 10:00 a.m. EDT.

Federal Reserve Speakers

- Federal Reserve speakers are in blackout period this week and through next Wednesday.

M&A Activity and News:

- VNOM announces acquisition of certain mineral and royalty interest- owning subsidiaries of Tumbleweed Royalty IV, LLC in exchange for $461.0 million of cash and approximately 10.1 million OpCo units.

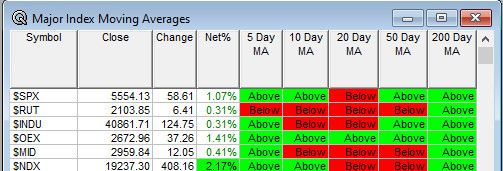

Moving Averages On Major Indexes: Moves from 36% to 60% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- B. Riley Consumer Conference

- Barrington Research Fall Investment Conference

- Bank of America Securities Global Real Estate Conference

- Goldman Sachs Communacopia + Technology Conference

- Jefferies Tech Trek

- Lake Street 8th Annual Best Ideas Growth Conference

- Morgan Stanley Laguna Conference

- Santander’s Carbon Removal Capital Summit

- Wainwright Global Investment Conference

- Wells Fargo Private Credit Unplugged Conference

- Wolfe Research TMT Conference

- Fireside Chat: None of note.

- Top Shareholder Meetings: AWH, BARK, GB, GLBS, MMYT, LVO, SB, SONN, WD, XRTX

- Investor/Analyst Day/Calls: AURA, BDC, EOLS, KIDS, MRNA, NAT, NMRA, ONDS, USB

- Update: None of note.

- R&D Day: None of note.

- Sellside Conferences:

-

- FDA Presentation: AURA: Data Presentation on Belzupacap Sarotalocan

- Company Event:

- Industry Meetings or Events:

- Annual Congress of International Drug Discovery Science & Technology

- China International Optoelectronic Exposition

- Gartner CFO and Finance Executive Conference

- Oracle CloudWorld

- RE+ Solar Industry Event

- Zelman 2024 Housing Summit

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: DEO

Downgrades: IPG