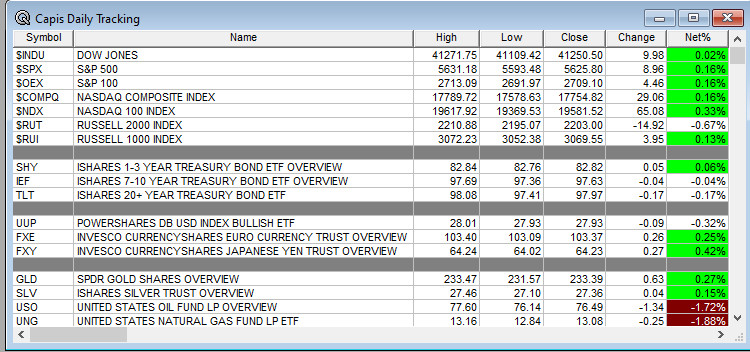

Overnight Summary: The S&P 500 closed Tuesday higher by 0.16% at 5625.80 from Monday lower by -0.32% at 5616.84. The overnight high was hit at 5,645.75 at 4:15 a.m. EDT and the low was hit at 5623.25 at 6:45 p.m. EDT. The overnight range is 23 points. The current price is 5633.25 at 6:40 a.m. EDT lower by -3.75 points.

Important Read of the Morning:

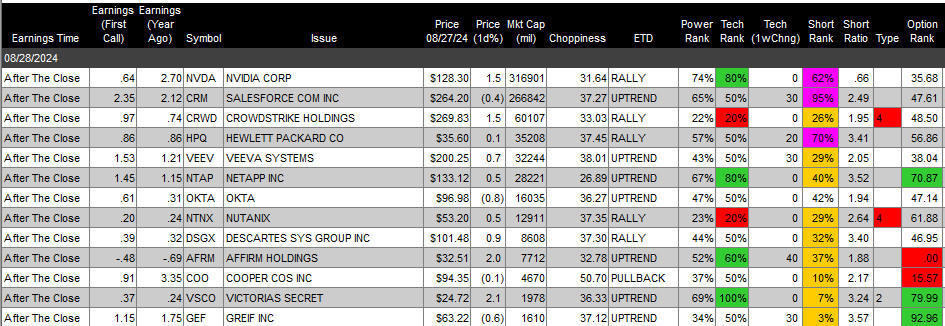

Executive Summary: All eyes are focused on Nvidia’s (NVDA) earnings which are due out after the close. We will have a video out on Nvidia this morning so check our Twitter Feed at Bullet86.

- 5-Year Note at 1:00 p.m. EDT.

Earnings Out After The Close:

- Beats: PVH +0.72, JWN +0.25, AMBA +0.06, BOX +0.04, SMTC +0.02, NCNO +0.01, S +0.01 of note.

- Flat:

- Misses: None of note.

Capital Raises:

- IPOs For The Week: CUPR, GLXG, JBDI, PMAX, TDTH

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- NLSP: FORM F-1 – Up to 3,277,750 Common Shares Issuable Upon Exercise of Warrants

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- OCS files for 361,011 shares of common stock offering by selling shareholder

- Debt/Credit Filing and Notes:

- HD: FORM S-3ASR – Debt Securities

- Mixed Shelf Offerings:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: AMBA +18%, OCS +7.60%, JWN +7.2%, SMTC +6.2%, DRS +5.5%, BOX +5.1%, HLX +4%, AVPT +3.9%, ELF +2.8%, SPIR +2.6%, AVAV +2.3%, CIFR +2.1%.

- Movers Down: NCNO -10.2%, PVH -7.1%, LAMR -2%

News After Thsee Close :

-

- COST sees over 150 fleet drivers vote to authorize a strike. (Teamster.org)

- GVA awarded a $45 mln contract to reconstruct and modernize the John Wilkie Safety Roadside Rest Area along the Interstate 40 (I-40) corridor by the California Department of Transportation

- HLX announces new three-year charter and service contracts with PBR, aggregate estimated value of $786 mln

- SHAK to close nine company-owned stores in CA, OH, and TX; reiterates Q3 and FY24 guidance

- META to shut down Meta Spark’s platform of third party tools, effective January 14, 2025

- AVAV awarded $990 mln U.S. Army contract to provide an organic, stand-off capability to dismounted infantry formations

- President Biden issues statement on prices for anti-obesity medications. (White House Statement)

- 10-Q Delays SPIR of note.

- NASDAQ Delisting Notice EGRX

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- ELF announces $500 million share repurchase program

Exchange/Listing/Company Reorg and Personnel News:

- NSP announces that its CFO has elected to retire on November 15, 2024; James Allison appointed successor

- UFPI CEO Matthew Missad to move to Executive Chairman; William Schwartz named CEO; CFO Mike Cole to add new role

- NKLA appoints Thomas Schmitt as Chief Commercial Officer

Dividends Announcements or News:

- Stocks Ex Div Today: PH EA ACT GFF CCS PSEC SPNS HEES

- Stocks Ex Div Tomorrow: HD XYL LH KNSL PIPR FBP CATY ZIM KLG FLNG SSTK GPRK DHIL

- LAMR increases quarterly cash dividend to $1.40/share from $1.30/share

What’s Happening This Morning: Futures S&P 500 -1.25 NASDAQ 100 -9.50 Dow Jones -3 Russell 2000 -4.40. Asia is higher while Europe is higher ex the FTSE this morning. VIX Futures are at 15.60 from 15.75 yesterday while Bonds are at 3.81% from 3.854% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well for a second day. Gold, Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $60,024 from $62,489 lower by -3.26% this morning.

- Daily Positive Sectors: Technology, Financial, Consumer Defensive and Healthcare of note.

- Daily Negative Sectors: Energy, Utilities, Communication Services and Consumer Cyclicals of note.

- One Month Winners: Real Estate, Utilities, Consumer Defensive, Technology and Healthcare of note.

- Three Month Winners: Technology, Real Estate, Healthcare, Financials and Utilities of note.

- Six Month Winners: Utilities, Technology, Communication Services, Financials, Real Estate and Consumer Defensive of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Industrials, Utilities, and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

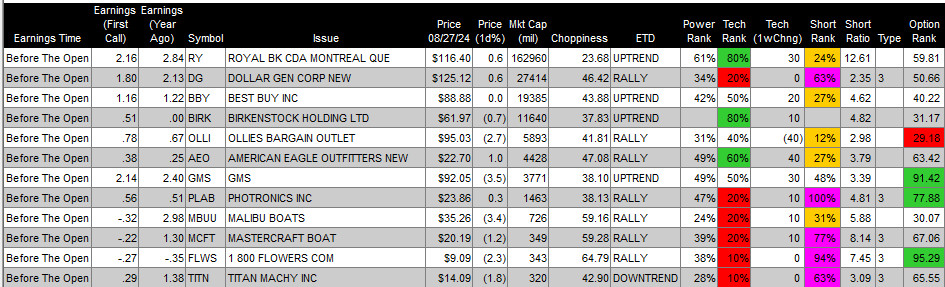

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: RY +1.09, LI +0.08, DCI +0.05, FL +0.02, BBWI +0,01 of note.

- Flat:

- Misses: AMWS -0.48, BMO -0.12 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Some deterioration for a third day and failed at the July high.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: AMBA +23.5%, WALD +14.1%, AVAV +8.5%, JWN +7.9%, BOX +7.6%, OOMA +7.5%, SWTX +6.9%, VNET +6%, SMTC +5.9%, YY +4.2%, AVPT +2.6%, ELF +2.5%, ICL +2.2%, OCS +2.2%, TWFG +2%

- Gap Down: NCNO -13.6%, PVH -8.3%, SPIR -1.8%

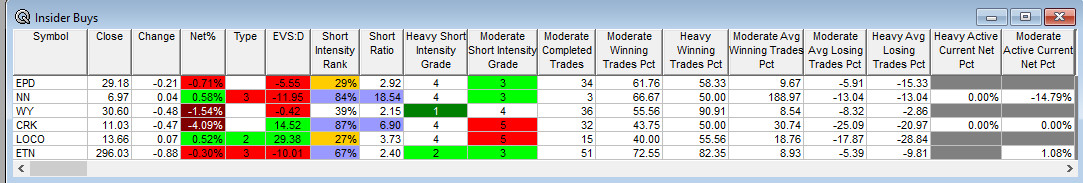

Insider Action: NN ETN CRK see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Stock Market Opens Today. (CNBC)

- Bloomberg Lead Story: Nvidia Earnings To Test August Rebound. (Bloomberg)

- Markets Wrap: Global stocks are on edge as Nvidia earnings out later today. (Bloomberg)

- Pre-Market Movers (CNBC)

- Bloomberg Odd Lots: A new way for the Fed to fight market crises. (Podcast)

- Marketplace: AI in the election. (Podcast)

- NY Times Daily: The war that won’t end. (Podcast)

- Wealthion: Inflation is higher and the economy is weaker than you think. (Podcast)

Economic:

- Weekly Mortgage Applications were out at 7:00 a.m. EDT and rose 0.5% after dropping -10.1% last week.

- Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

Geopolitical:

- President Biden is on vacation in Delaware.

- President Biden receives the Daily Briefing at 10:00 a.m. EDT.

Federal Reserve Speakers

- Federal Reserve Governor Christopher Waller speaks at 1:15 p.m. EDT.

- Federal Reserve Atlanta President Raphael Bostic speaks at 6:00 p.m. EDT.

M&A Activity and News:

- None of note.

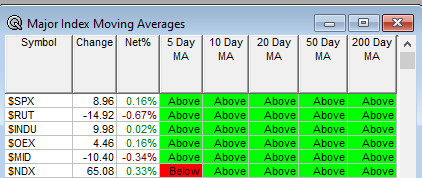

Moving Averages On Major Indexes: Stays at 97% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Deutsche Bank Technology Conference

- Evercore ISI Semiconductor IT Hardware & Networking Conference

- Fireside Chat Hosted by Goldman Sachs

- Jefferies Semiconductor IT Hardware & Communications Technology Conf

- Jefferies Healthcare Services Back to School Summit

- Fireside Chat: None of note.

- Top Shareholder Meetings: CASY, MIST, NKGN, RVSB

- Investor/Analyst Day/Calls: APLT, HCM, INCY, VRAR

- Sellside Conferences:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- Flexible and Printed Electronics

- Semiconductor IT Hardware & Networking Conference

- VMware Explore

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: MT ILMN DKL

Downgrades: GCI