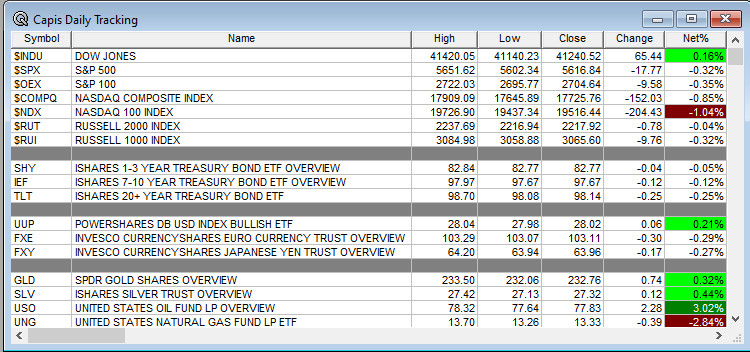

Overnight Summary: The S&P 500 closed Monday lower by -0.32% at 5616.84 from Friday higher by 1.15% at 5634.61. The overnight high was hit at 5,645.75 at 4:15 a.m. EDT and the low was hit at 5623.25 at 6:45 p.m. EDT. The overnight range is 23 points. The current price is 5633.25 at 6:40 a.m. EDT lower by -3.75 points.

Important Read of the Morning:

Executive Summary: A quiet week ahead, kind of. All eyes are focused on Nvidia’s (NVDA) earnings which are due out on Wednesday after the close. A rather distressing story on Facebook now Meta that the White House forced them to censor Covid-19 comments.

These comments come a day after Telegram CEO was arrested in France for allowing illegal acts to take place on the Telegram app. Clearly, Tech is under assault for free speech and the big question is, “Does government know what is best for us?” As The Washington Post says, “Democracy dies in darkness.”

- 2-Year Note at 1:00 a.m. EDT.

Earnings Out After The Close:

- Beats: HEI +0.05 of note.

- Flat:

- Misses: None of note.

Capital Raises:

- IPOs For The Week: CUPR, GLXG, JBDI, PMAX, TDTH

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- WDC files mixed securities shelf offering

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: TRIB +44%, MOLN +24.6%, TUYA +2.8%, LESL +2.6%, DCTH +2.3%, AURA +2.2%.

- Movers Down: KKR -5.7%, CRTO -3.3%.

News After The Close :

-

- AAPL CFO Luca Maestri to transition from CFO role; names Kevan Parekh as new CFO

- DKNG unchanged on report that it was sued by the National Football League Players Association (NFLPA) today on accusation that it refused to pay what it owes for using NFL player likenesses on NFTs (Reuters)

- LHX awarded a $587.4 mln US Navy contract

- 10-Q Delays none of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

Exchange/Listing/Company Reorg and Personnel News:

- CRTO CEO Megan Clarken to retire within the next 12 months

- AVA announces retirement of CEO Dennis Vermillion, effective in the first quarter of 2025

- LESL announces CEO transition as current CEO Michael Egeck departs the company and resigns from the Board; company also reaffirms FY24 guidance

- AAPL CFO Luca Maestri to transition from CFO role; names Kevan Parekh as new CFO

- ACHV announces that Richard Stewart, the company’s co-founder and current Executive Chairman, will reassume the role of CEO

Dividends Announcements or News:

- Stocks Ex Div Today: JNJ SPGI SBLK YUM KEY YUMC H ADEA CRS WMG SPB JFIN NDSN CABO VOYA CRI CRAI

- Stocks Ex Div Tomorrow: PH EA ACT GFF CCS PSEC SPNS HEES

What’s Happening This Morning: Futures S&P 500 -6.25 NASDAQ 100 -28 Dow Jones -52 Russell 2000 +20. Asia is lower ex Japan while Europe is higher this morning. VIX Futures are at 15.75 from 16.60 Friday while Bonds are at 3.854% from 3.807% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold and Silver are lower with Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $62,489 from $63,886 lower by -1.50% this morning.

- Daily Positive Sectors: Energy, Consumer Defensive, Utilities and Materials of note.

- Daily Negative Sectors: Consumer Cyclical, Technology, Healthcare and Industrials of note.

- One Month Winners: Real Estate, Utilities, Consumer Defensive, Technology and Healthcare of note.

- Three Month Winners: Technology, Real Estate, Healthcare, Financials and Utilities of note.

- Six Month Winners: Utilities, Technology, Communication Services, Financials, Real Estate and Consumer Defensive of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Industrials, Utilities, and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close:

- Wednesday Before The Open:\

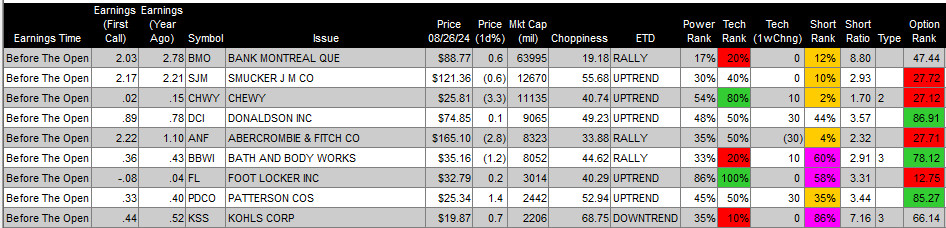

Earnings of Note This Morning:

- Beats: HAIN +0.03, BNS +0.01, of note.

- Flat:

- Misses: AMWS -0.48, BMO -0.12 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Some deterioration for a second day.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: TRIB +79.3%, ADXN +12.4%, TUYA +10.2%, TCOM +8.6%, DCTH +4.6%, JD +4.5%, LESL +3.3%, WDS +2.6%, HR +2.4%, AURA +2.3%, CHPT +2.2%

- Gap Down: CAVA -8%, AMWD -7.9%, GOTU -6.4%, PARA -4.4%

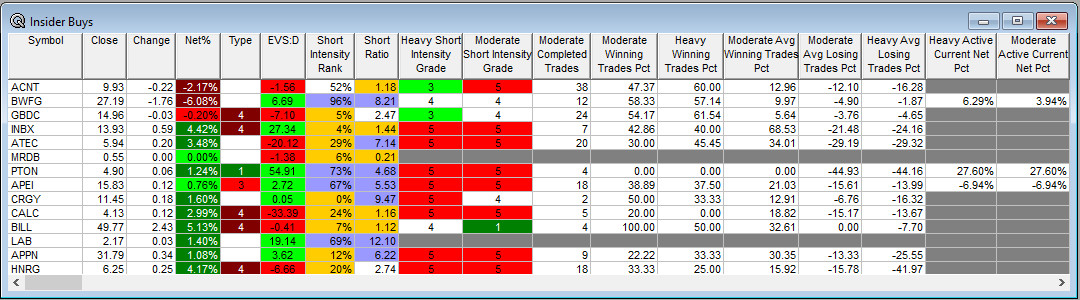

Insider Action: BWFG sees Insider buying with dumb short selling. PTON APEI see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things To Know Before The Stock Market Opens Today. (CNBC)

- Bloomberg Lead Story: Skydance Set to Seal Paramount Merger After Bronfman Exits. (Bloomberg)

- Markets Wrap: Stocks waver in thin trading in front of Nvidia earnings. (Bloomberg)

- Pre-Market Movers PARA CAVA JD HSY (CNBC)

- PDD stock crash sense warning on China’s economy. (Bloomberg)

- META CEO Founder Mark Zuckerberg says White House pressured it to censor Covid-19 comments. (CNBC)

- Eli Lilly (LLY) releases new weight loss drug at half the price. (CNBC)

- Bloomberg Odd Lots: What the rate cut cycle could look like. (Podcast)

- Marketplace: Court blocks CA law protecting kids online. (Podcast)

- NY Times Daily: Iran hacks Trump campaign. (Podcast)

- Wealthion: Is the Fed too late? (Podcast)

Economic:

- August Consumer Confidence is due out at 10:00 a.m. EDT and is expected to rise to 101.80 from 100.30.

- August Case-Schiller Home Price Index is out at 9:00 a.m. EDT.

- Richmond Federal Reserve Manufacturing Index is out at 10:00 a.m. EDT.

Geopolitical:

- President Biden is on vacation in Delaware.

- President Biden receives the Daily Briefing at 10:00 a.m. EDT.

Federal Reserve Speakers

- No Fed speakers of note today.

M&A Activity and News:

- None of note.

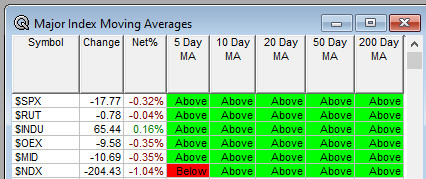

Moving Averages On Major Indexes: Moves from 100% to 80%of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Evercore ISI Semiconductor IT Hardware & Networking Conference

- Jefferies Semiconductor IT Hardware & Communications Technology Conf

- Jefferies Healthcare Services Back to School Summit

- Stifel Tech Executive Summi

- Fireside Chat: None of note.

- Top Shareholder Meetings: APPS, CRMT, FBLG, HLF, LZB

- Investor/Analyst Day/Calls: None of note

- Sellside Conferences:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- Aging Research and Drug Discovery Meeting

- e-Fuels Summit

- Military Health System Research Symposium

- o VMware Explore

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: ENR CTRA CLF

Downgrades: VSTA SITM HSY PDD