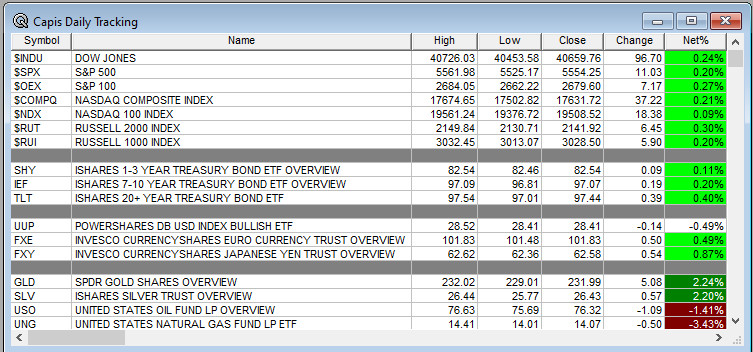

Overnight Summary: The S&P 500 closed Friday higher by 0.20% at 5554.25 from Thursday higher by 1.61% at 5543.22. The overnight high was hit at 5,593.75 at 6:00 a.m. EDT and the low was hit at 5565.25 at 4:05 a.m. EDT. The overnight range is 28 points. The current price is 5576 at 7:05 a.m. EDT lower by -2.25 points.

Important Read of the Morning:

Executive Summary: Amazingly since two week’s ago Monday low the S&P 500 has been higher every day except Wednesday 8/7. Now eight up days to one down day. Clearly, this move is impressive.

- Leading Indicators are out at 10:00 a.m. and are expected to remain below -0%.

- President Biden gives the keynote address at the DNC at 9:50 p.m. CDT. Will he be awake?

Earnings Out After The Close:

- Beats: None of note.

- Flat:

- Misses: None of note.

Capital Raises:

- IPOs For The Week: IBG, PMAX, SKK, TDTH, YXT

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CASI: FORM F-3 – 3,000,000 Ordinary Shares

- MGRX: FORM S-1 – 16,166,667 Shares of Common Stock

- OGEN: FORM S-1 – Up to 2,403,846 Shares of Common Stock – Pre-Funded Warrants to Purchase

up to 2,403,846 Shares of Common Stock – Up to 2,403,846 Shares of Common Stock underlying

such Pre-Funded Warrants - SEEL: FORM S-3 – Up to 1,945,260 Shares of Common Stock Issuable Upon Exercise of Warrants

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- SPSC files for 404,587 shares of common stock by selling shareholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- RCKT files mixed shelf securities offering

- VCEL files mixed shelf securities offering

- EVRG files mixed shelf securities offering

- SMTK: FORM S-3 – $100,000,000 Mixed Shelf Offering

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: RVNC (6.59 +86.69%), EBS (8.66 +22.14%), SLDB (8.93 +21%), TNDM (43.82 +16.85%), HA (16.46 +20.32%), GRPN (13.72 +29.07%), SBUX (94.88 +26.36%), SBH (12.65 +24.26%), UIS (5.03 +34.85%), LITE (52.26 +20.83%), DELL (110.21 +19.08%), SMTC (35.96 +18.88%), CEVA (24.05 +17.66%), NVDA (122.86 +17.29%), CLS (56.00 +17.2%)

- Movers Down: AMN (51.86 -10.8%), MERC (6.24 -9.96%), JBLU (4.68 -22.64%), SERV (11.44 -17.04%), DDS (348.89 -10.29%), PLCE (6.57 -9%), RILY (5.04 -70.27%), HE (13.51 -12.84%)

News After The Close :

-

- H updates its FY24 outlook following completion of the sale of the Hyatt Regency Orlando

- FUBO announced it has been successful in stopping the launch of The Walt Disney Company, FOX Corp. and Warner Bros. Discovery’s Venu Sports joint venture (JV) after its request for a preliminary injunction was approved by the U.S. District Court, Southern District of New York today.

- XPER subsidiary Perceive Corporation to be sold to Amazon (AMZN) for $80 mln in cash

- GD and several other companies, including BAH, LDOS, and LUMN awarded a combined $12.5 bln U.S. Air Force contract

- 10-Q Delays

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- CBOE increases share repurchase authorization by $500 million

Exchange/Listing/Company Reorg and Personnel News:

- TRUE announces that Jill Angel, formerly company’s Chief People Officer & Operations, has been appointed as Chief Operating Officer

- EL CEO Fabrizio Freda to retire. (CNBC)

Dividends Announcements or News:

- Stocks Ex Div Today: CVX UPS SO EQNR SNA BG JEF WYNN ALSN

- Stocks Ex Div Monday: PSX PRU CTSH WLK SWKS ECRG LSTR LPX

- CBOE increases quarterly cash dividend to $0.63/share from $0.55/share

What’s Happening This Morning: Futures S&P 500+2 NASDAQ 100 +2 Dow Jones -3 Russell 2000 -2.32. Asia is lower ex Australia while Europe is higher ex the FTSE this morning. VIX Futures are at 15.85 from 16.05 yesterday while Bonds are at 3.869% from 3.871% on the 10-Year. Crude Oil and Brent lower with Natural Gas higher. Gold is lower with Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $58,512 from $58,378 lower by -1.97% this morning.

- Daily Positive Sectors: Financials, Communications Services, Consumer Cyclicals and Technology of note.

- Daily Negative Sectors: Industrials, Healthcare and Real Estate of note.

- One Month Winners: Real Estate, Utilities, Healthcare and Consumer Defensive of note.

- Three Month Winners: Technology, Real Estate, Healthcare, Consumer Defensive, Financials and Utilities of note.

- Six Month Winners: Utilities, Technology, Communication Services, Financials, Real Estate and Consumer Defensive of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Utilities,

Industrialsand Healthcare note. - Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close:

- Tuesday Before The Open:

Earnings of Note This Morning:

- Beats: EL +0.38.

- Flat:

- Misses:

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: of note.

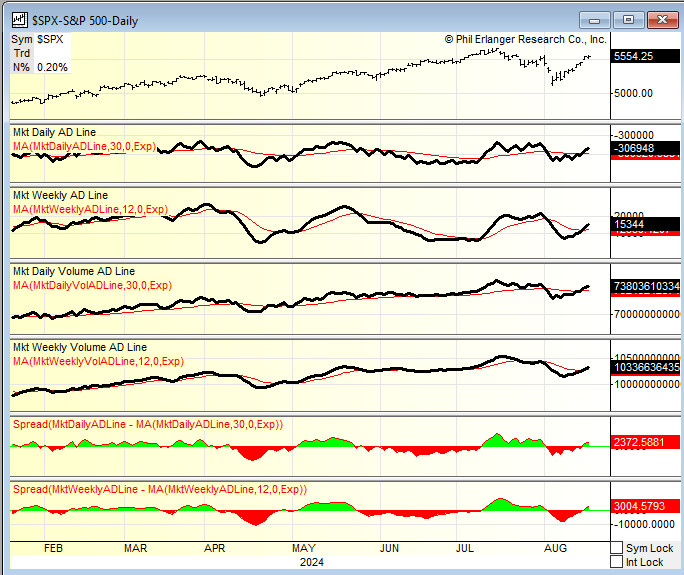

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Nice Improvement week over week.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: XPER +18.1%, FUBO +11.1%, BNR +8.4%, CVII +6.3%, AMD +2.9%, PL +2%

- Gap Down: LQDA -32.7%, RILY -8.5%, EL -8.4%, SOND -4.6%

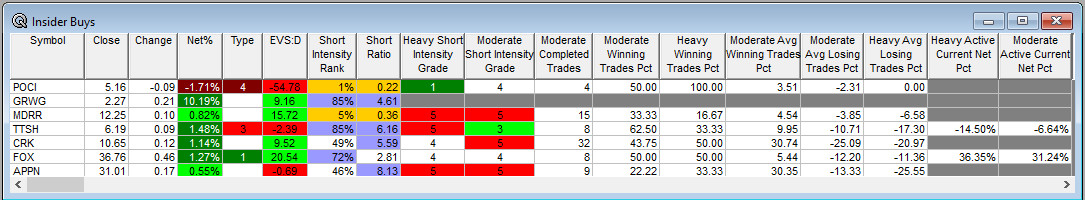

Insider Action: FOX sees Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Bloomberg Lead Story: Traders Need Fed Rate Cut Signal to Keep Stocks Rallying. (Bloomberg)

- Pre-Market Movers AMD EL BROS HPQ TMHC (CNBC)

- 5 Things to Know Before The Market Opens. (CNBC)

- Markets Wrap: Stocks drift as caution reigns ahead of Jackson Hole. (Bloomberg)

- AMD to buy ZT Systems for $4.9 billion. (Bloomberg)

- Barron’s + on RTX GD LMT BAESY LHX PAMW NET FTNT ZS TSLA as well as gold, oil and copper. (Barron’s)

Economic:

- July Leading Indicators will be released at 10:00 a.m. EDT and last month came in at -0.3% and is expected to come in at -02.%.

Geopolitical:

- President Biden receives the Daily Briefing today at 10:00 a.m. EDT.

- President Biden leaves California and heads to Chicago for the Democratic National Convention.

- President Biden gives the keynote address at the DNC at 9:50 p.m. CDT.

Federal Reserve Speakers

- Federal Reserve Governor Christopher Waller will speak at 9:15 a.m. EDT.

M&A Activity and News:

- RILY receives unsolicited preliminary proposal to be taken private at $7.00/share from management.

- AMD to buy ZT Systems for $4.9 billion. (Bloomberg)

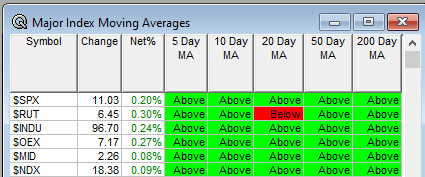

Moving Averages On Major Indexes: Remain at 97% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Needham & Co. Industrial Tech Robotics & Clean Tech

- Rosenblatt 4th Annual Technology Summit

- Truist Energy Event

- Fireside Chat: None of note.

- Top Shareholder Meetings: NXT

- Investor/Analyst Day/Calls: NONE

- Sellside Conferences:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- EnerCom Denver – The Energy Investment Conference

- RE/MAX Broker Owner Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: TMHC BURL BBD

Downgrades: