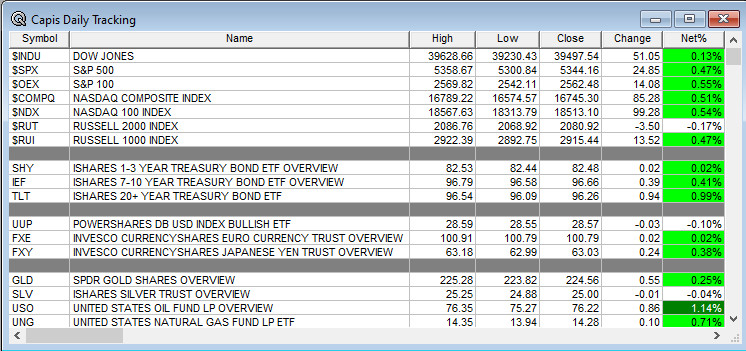

Overnight Summary: The S&P 500 closed Friday higher by 0.47% at 5344.16 from Thursday higher by 2.30% at 5319.31. The overnight high was hit at 5,384 at 4:00 a.m. EDT and the low was hit at 5350.25 at 6:15 p.m. EDT. The overnight range is 34 points. The current price is 5380.25 at 7:10 a.m. EDT higher by +10 points.

- This week is all about CPI and PPI and where inflation is going. Also, retail sales are out this week.

- 3 and 6-month Bill Auction at 11:30 a.m. EDT.

- NYSE Short Interest fell -2.30% and NASDAQ Short Interest fell -2.00%.

Earnings Out After The Close:

- Beats: RNA +0.18, CDRE +0.04,

- Flat:

- Misses: CLSK -1.08, PWSC -0.01

Capital Raises:

- IPOs For The Week: IBG, PMAX, SKK, TDTH, YXT

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ASST: Form S-1.. 467,489 Shares of Class B Common Stock

- CXAI: Form S-1.. RESALE OF UP TO 10,026,776 SHARES OF COMMON STOCK

- OPHC: Form S-3.. $25,000,000 Common Stock

- PRCH: Form S-3.. 18,312,208 Shares Common Stock

- PRZO: Form F-3.. $50,000,000 Ordinary Shares, Units

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- PRCH files for 18,312,208 shares of common stock by selling shareholder.

- NUZE: Form S-1.. Up to 2,617,736 Shares of Common Stock by Selling Stockholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- CMCL files $150 mln mixed shelf securities offering

- SMLR files $150 mln mixed shelf securities offering

- GPMT files $500 mln mixed shelf securities offering

- XENE files mixed securities shelf offering

- RIOT files mixed securities shelf offering

- AMTX files for $234 mln mixed securities shelf offering

- BCDA: Form S-1.. Mixed Shelf

- CTMX: Form S-3.. $250,000,000 Mixed Shelf

- NWN: Form S-3ASR Mixed Shelf

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Last Week:

- Movers Up: GTHX (7.09 +78.02%), PETQ (30.47 +45.1%), INGN (12.2 +42.86%), VCYT (29.38 +36%), AXGN (10.9 +34.57%), INSP (195.65 +30.75%), MD (10.08 +26.1%), IOVA (9.76 +25.23%), ICUI (151.97 +20.71%), RYAM (7.13 +19.63%), UA (7.69 +21.79%), SHOP (68.91 +26.59%), COMM (2.83 +23.58%), FTNT (69.62 +23.2%), GGAL (33.93 +27.32%), SUPV (6.84 +21.93%), TGS (19.28 +20.05%).

- Movers Down: PCRX (11.7 -44.97%), NVRO (5.9 -34.86%), EBS (7.06 -30.17%), ARRY (7.17 -23.86%), TBI (7.73 -31.52%), ODP (25.25 -36.38%), IRBT (7.63 -25.1%), MITK (8.31 -33.56%), RAMP (21.7 -24.55%), GPRE (13 -23.69%).

News After The Close :

-

- Stocks make a comeback at the end of a dizzying week. (Bloomberg)

- Short bets rise on 5-Year and 10-Year Treasuries. (Reuters)

- Hedge Funds most bearish on Commodities since 2011. (Bloomberg)

- Hawaiian Electric (HE) says the loss from the Maui fire is $1.7 billion. (Bloomberg)

- China’s WeRide seeks $440 million in U.S. IPO. (Bloomberg)

- McDonald’s (MCD) will have to stretch $5 meal deal to remain value victor. (Yahoo)

- CPNG disclosed in SEC filing that Korea Fair Trade Commission (KFTC) issued a formal written order regarding their June 2024 decision – fine was $121 mln and KFTC directed the company to take certain remedial measures

- APAM reports that its preliminary assets under management as of July 31, 2024 totaled $162.7 billion

- CLSK enters into a partnership with Coinbase (COIN) to acquire a $50 million revolving line of credit collateralized by a portion of its Bitcoin holdings

- BORR projects Q2 operating revs ahead of consensus, $272 million versus $242 million

- Starbucks (SBUX) +2.7% after hours on report that activist investor Starboard Value has a stake. (WSJ)

- Delay 10-Q filings CMP, USPH, SKLZ, SRG, AIOT, SHIM, DDD

- BA awarded a $2.56 bln modification to previously awarded US Air Force contract action

- LMT awarded a $611 mln modification to a previously awarded US Navy contract

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

Exchange/Listing/Company Reorg and Personnel News:

- PINS says its Chief Product Officer Sabrina Ellis would, effective immediately, transition to an advisory role and then transition from the company, effective Sep 21.

Dividends Announcements or News:

- Stocks Ex Div Today: AAPL COP KKR CEG COF GWW EXC ROK PPG ROL CAN FIX X AA

- Stocks Ex Div Monday: AWK ETR RYAN DCI IGT HTGC KMT

- BMI increases quarterly cash dividend 26% to $0.34/share from $0.27/share.

- B.Riley (RILY) suspends dividend.

What’s Happening This Morning: Futures S&P 500 + NASDAQ 100 + Dow Jones + Russell 2000 -7.02. Asia is higher and Europe is higher this morning ex France. VIX Futures are at 19.25 from 21.95 yesterday while Bonds are at 3.959% from 3.949% on the 10-Year. Crude Oil and Brent higher with Natural Gas higher as well for a second trading day. Gold, Silver and Copper higher for a third trading day in a row. The U.S. Dollar is lower versus the Euro, flat versus the Pound and higher against the Yen. Bitcoin is at $59,513 from $60,662 lower by -0.60% this morning.

- Daily Positive Sectors: Communication Services, Healthcare, Technology, Financials, Real Estate and Utilities of note.

- Daily Negative Sectors: Industrials of note.

- One Month Winners: Real Estate, Utilities, Healthcare and Consumer Defensive of note.

- Three Month Winners: Technology, Real Estate, Healthcare, Consumer Defensive and Utilities of note.

- Six Month Winners: Utilities,

Technology, Communication Services, Financials, Real Estate and Consumer Defensive of note. - Twelve Month Winners: Technology, Communication Services, Financials, Utilities, Industrials and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials,

Industrials,Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

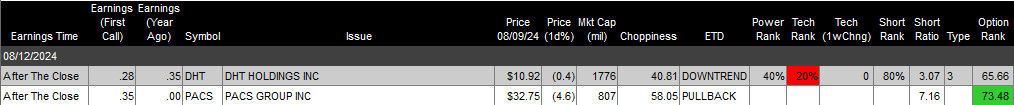

- Monday After the Close:

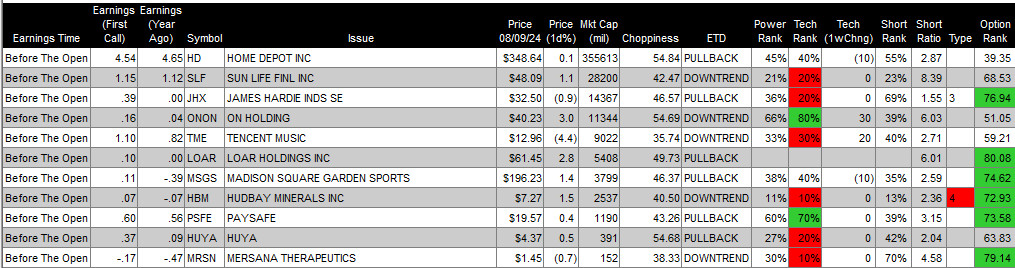

- Tuesday Before The Open:

Earnings of Note This Morning:

- Beats: BEKE +0.70, MNDY +0.38, GOLD +0.05,

- Flat:

- Misses: FTRE -0.10

- Still to Report: BLDP

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: of note.

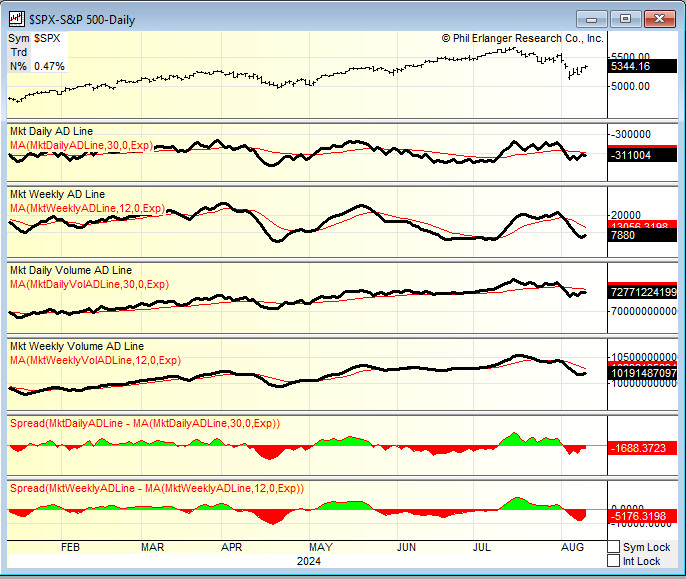

Erlanger Research Advance/Decline Chart: A/D lines were stronger on Friday BUT off recent lows.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: KEY +8.5%, NIU +5.5%, TBRG +4.9%, BORR +4.6%, APGE +3.7%, CDRE +3.5%, BEKE +3.3%, GPMT +3.1%, RKLB +3%, SBUX +2.8%, DDD +2.4%, AIOT +2.3%, SMLR +2.1%, GOLD +2.1%

- Gap Down: RNA -14.8%, HUMA -13.3%, SCPH -8.5%, HE -6.9%, SKLZ -3.6%, SSL -2.4%, SHIM -2.1%

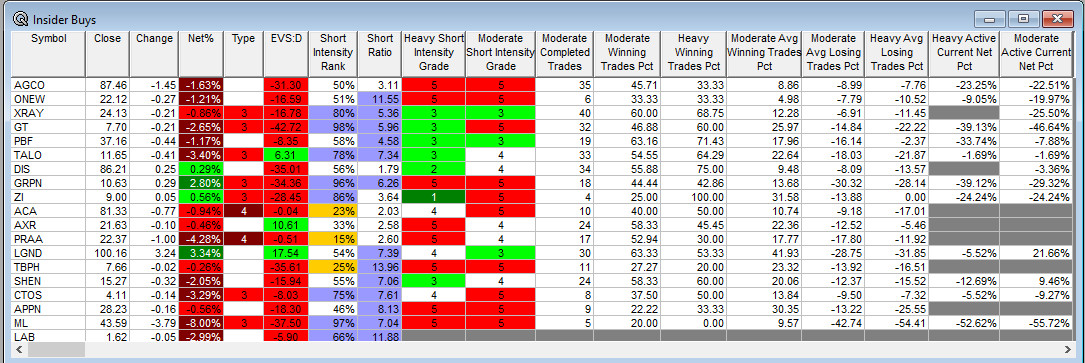

Insider Action: XRAY GT TALO ZI CTOS see Insider buying with dumb short selling. GRPN ML see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Bloomberg Lead Story: Carry Trade Blowup Haunts Markets Rattled By Rapid Unwind. (Bloomberg)

- Pre-Market Movers KEY SBUX JBLU LLY. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Markets Wrap: US Futures head higher at start of a big week. (Bloomberg)

- Scotiabank to buy 15% of KeyCorp (KEY). (Bloomberg)

- Bloomberg’s The Big Take: Hedge Funds smell blood as lenders turn on each other. (Bloomberg)

- Bloomberg’s Odd Lots: How Treasury will fund $20 Trillion in Debt. (Podcast)

- Marketplace: Can AI solve fans’ concert ticket woes. (Podcast)

- NYT: The Daily: Inside the worst three weeks of Trump’s campaign. (Podcast)

- Wealthion: Global Market Shock – What you need to know. (Podcast)

Economic:

- July Treasury Budget will be released at 2:00 p.m. EDT and last month came in at $-66 billion.

Geopolitical:

- President Biden receives the Daily Briefing today at 10:00 a.m. EDT.

- The President and First Lady leave Rehoboth Beach, Delaware and return to the White House at 8:55 a.m. EDT.

- Press Briefing by Press Secretary Karine Jean-Pierre at 2:00 p.m. EDT.

Federal Reserve Speakers

- None of note for today.

M&A Activity and News:

- None of note.

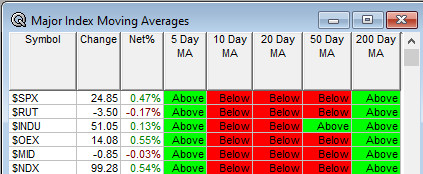

Moving Averages On Major Indexes: Moves from 24% to 43% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Needham Virtual MedTech &Diagnostics 1×1 Conference

- Oppenheimer Technology Internet & Communications Conference

- Stifel Biotech Summer Summit

- TD Cowen Communications Infrastructure Summit

- Wedbush PacGrow Healthcare Conference

- Fireside Chat: None of note.

- Top Shareholder Meetings: AGFY, AVGR, OTLK, VINC

- Investor/Analyst Day/Calls: LUCD, PGNY

- Sellside Conferences:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- Worldwide MASTERs Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: PFLT COHR PGR TTWO PAR MAA LLY CPT CHDN BLND

Downgrades: SATS PCRX BOH BHF