Overnight Summary: The S&P 500 closed Tuesday from Monday higher by 1.08% at 5564.41. The overnight high was hit at 5,608.75 at 4:05 p.m. EDT and the low was hit at 55517.75 at 4:30 a.m. EDT. The overnight range is 57 points. The current price is 5560.50 at 7:25 a.m. EDT lower by -38.50 points.

- There is a 5-Year Note Treasury auction at 1:00 p.m. EDT.

- Beats: MTDR +0.29, STX +0.29, CB +0.24, MANH +0.22, AGR +0.15, RRR +0.15, ENVA +0.14, EQT +0.11, EWBC +0.10, HIW +0.08, PKG +0.08, CSGP+0.06, GOOGL +0.05, RRC +0.05, RNST +0.03, TRMK +0.03, ADC +0.02, FCF +0.02, MAT +0.02, TXN +0.01 of note.

- Flat: NXPI of note.

- Misses: PFSI -0.71, COF -0.25, VICR -0.12, TSLA -0.09, CNI -0.09, CALM -0.09, WFRD -0.08, NBHC -0.06, ENPH -0.06, VBTX -0.03, APAM -0.02 of note.

- Yet to Report:

Capital Raises:

- IPOs For The Week: ACTU AZI BLMZ FLAI NIPG PMAX ORKT PGHL OS CON LINE

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ALGM launches Primary Offering of Common Stock

- VSTM Proposed Public Offering of Common Stock, Warrants and Pre-Funded Warrants

- Notes Priced:

- KRO: PRICES PRIVATE OFFERING OF AN ADDITIONAL €75 MILLION OF 9.50% SENIOR SECURED NOTES DUE 2029

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- GOEV files mixed shelf securities offering

- ALGM FORM S-3ASR – Mixed Shelf Offering

- V – Filed Form S-3ASR – Mixed Shelf

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: MANH +8%, SNDR +6.7%, AVTR +5.6%, STX +5.5%, ENPH +3.6%, TXN +3%

- Movers Down: GERN -12.3%, ALGM -6.7%, AKTR -5.3%, TSLA -4.3%, CSGP -3.8%, CNI -3.7%, V -2.9%, VBTX -2.3

News After The Close :

- SNDR added to S&P 600.

- AVTR to join the S&P 400

- ERJ published a 20-year outlook for commercial aircraft deliveries. (Press Release)

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- CTAS approves an additional share buyback program under which the Company may buy up to $1.0 bln of common stock at market prices.

Exchange/Listing/Company Reorg and Personnel News:

- KO announced today that three longtime board members — Barry Diller, Alexis Herman and Marc Bolland — are retiring from their duties as directors effective Aug. 1.

- LYFT announced that Kristin Sverchek, the company’s President, and the Company agreed to terms to depart as an employee effective August 20, 2024

- EL appoints Akhil Shrivastava as CFO, effective November 1

Dividends Announcements or News:

- Stocks Ex Div Today: LOW AM DNUT

- Stocks Ex Div Tomorrow: MMC BSBR ATR KALU

- FCBC increases quarterly cash dividend to $0.31/share from $0.29/share

- CTAS increases quarterly cash dividend 15.6% to $1.56/share from $1.35/share

- CTBI increases quarterly cash dividend 2.2% to $0.47/share from $0.46/share

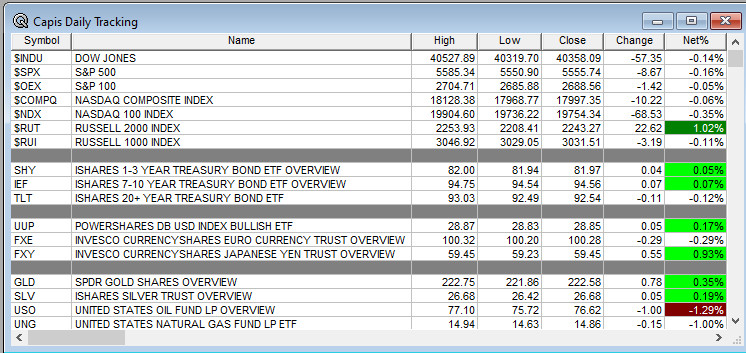

What’s Happening This Morning: Futures S&P 500 -39.50, NASDAQ 100 -218.25, Dow Jones -150, Russell 2000 -2.97. Asia and Europe are lower this morning. VIX Futures are at 15.13 from 15.65 yesterday while Bonds are at 4.23% unchanged on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold and Silver are higher with Copper are lower. The U.S. Dollar is higher versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $66,412 from $66,550 higher by +0.04% this morning.

- Daily Positive Sectors: Materials, Financials, Healthcare and Technology of note.

- Daily Negative Sectors: Energy, Utilities, Consumer Defensive and Industrials of note.

- One Month Winners: Real Estate, Financials, Energy, Utilities and Consumer Cyclical of note.

- Three Month Winners: Technology, Real Estate, Financials, Utilities and Communication Services of note.

- Six Month Winners: Technology, Communication Services, Financials, Utilities and Energy of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Industrials, and Energy of note.

- Year to Date Winners: Technology, Communication Services, Financials, Industrials, Utilities and Consumer Defensive of note.

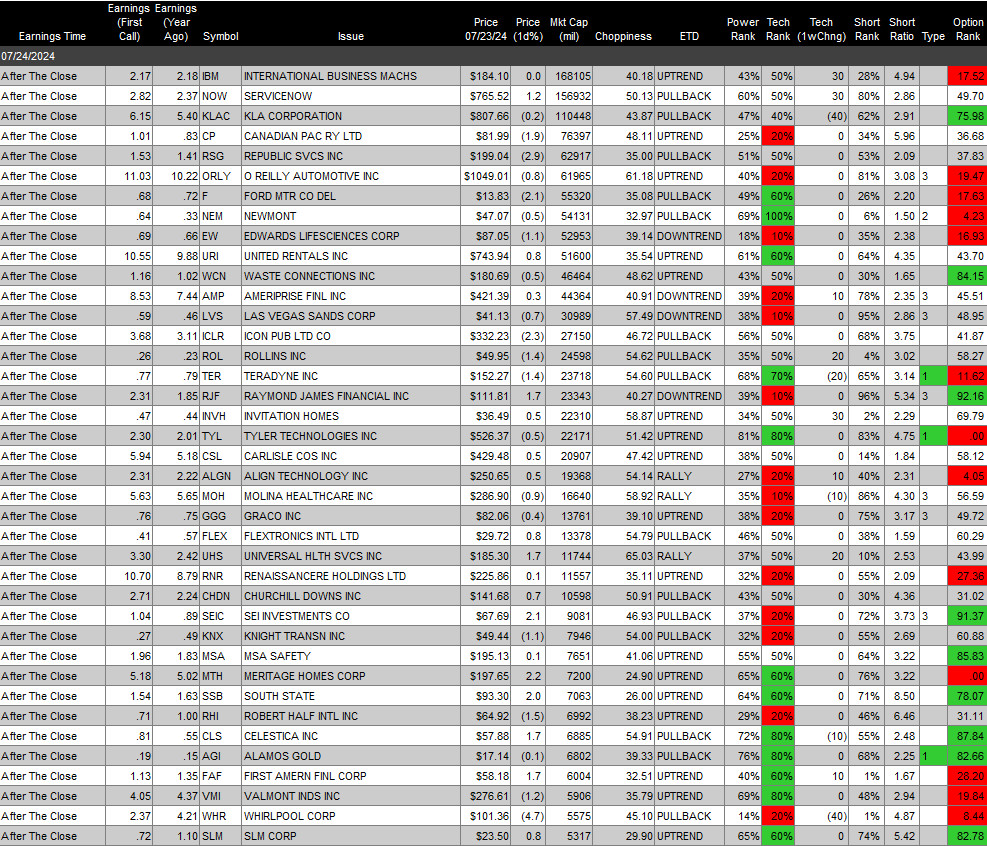

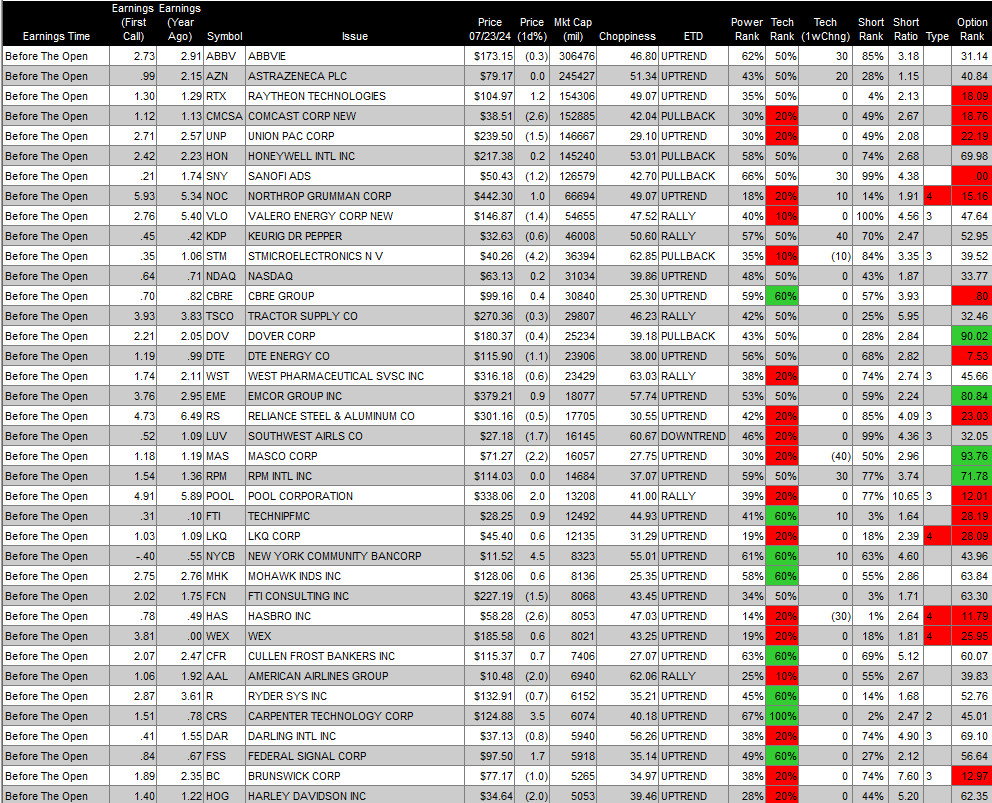

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: GEV +3.92, ALKS +0.49, GPI +0.46, THC +0.41, BPOP +0.39, LII +0.25, TMO +0.25, IP +0.14, TSEM +0.09, SLAB +0.08 of note.(GREATER THAN -0.08)

- Flat: T of note.

- Misses: NAVI -0.14, NEP -0.09, TMHC -0.03, GD -0.02, RCI -0.o1 of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: THC PRG of note.

- Negative Guidance: WNC of note.

Erlanger Research Advance/Decline Chart: A/D lines improved on Monday.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: GEV +6.7%, ENPH +6.1%, SNDR +5.1%, STX +5.1%, VRT +4.5%, NAVI +4.2%, BLX +4.1%, AVTR +3.9%, NUVB +3.7%, VLN +3.6%, MTDR +2.9%, ENVA +2.9%, FTAI +2.9%, TXN +2.8%, PKG +2.1% of note.

- Gap Down: VSTM -26.5%, TSLA -7.6%, GERN -6.9%, ALGM -6%, DB -6%, EWBC -5%, FCF -4.9%, CNI -4.1%, V -3.2%, GOOG -3%, RIVN -2.9%, RRR -2.7%, TECK -2.6%, LCID -2.4%, VBTX -2.3%, CSGP -2.2%, TMO -2.2%, META -2%, SNAP -2% of note.

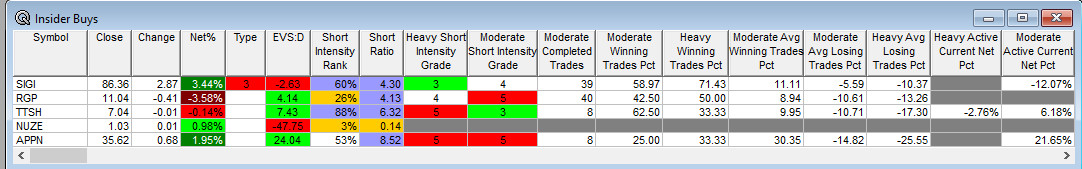

Insider Action: SIGI see Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Bloomberg Lead Story: Harris to Put Her Record Against Trump in First Rally Yesterday. (Bloomberg)

- 5 Things You Need To Know To Start Your Day. (CNBC)

- Markets Wrap: Stocks slump on earnings from Tesla and LVMH. (Bloomberg)

- Google (GOOGL) beats on estimates but misses on You Tube ad revenues. (CNBC)

- Tesla earnings slump as Musk ties future to robotaxis. (Bloomberg)

- Barron’s – Rates cuts are on the way. (Barron’s)

- Bloomberg: The Big Take: FDA loophole fueling Ozem[ic knockoffs. (Podcast)

Economic:

- June New Home Sales are due out at 10:00 a.m. EDT and are expected to rise to 640,000 from 619,00.

- Weekly Crude Inventories are due out at 10:30 a.m. EDT.

- Weekly Mortgage Applications fell -2.2% this morning from an increase of 3.9% last week.

Geopolitical:

- President Biden leaves lockdown in Delaware a day later than expected.

- The President receives the Daily Briefing today at 10:00 p.m. EDT.

- President Biden will address the nation at 8:00 p.m. EDT.

- President Biden meeting with Israel President Netanyahu at the White House yesterday was postponed to probably to Wednesday. Netanyahu will address Congress today.

Federal Reserve Speakers

- Federal Reserve speakers are now in blackout mode as next week the FOMC meets on Tuesday and Wednesday.

M&A Activity and News:

- None of note.

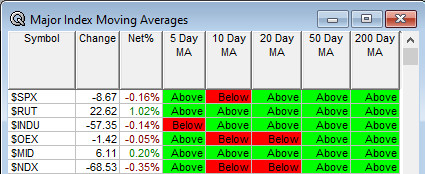

Moving Averages On Major Indexes: Moves from 60% to 63% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: BAH, LSB, MYMD, NCPL

- Investor/Analyst Day/Calls: CLRB, CLSD, DAKT, SKYE

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- AIDS Conference

- Farnborough Air Show

- National Homeland Security Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

- Upgrade: INVH SPOT MSGE LMT AOS

- Downgrade: