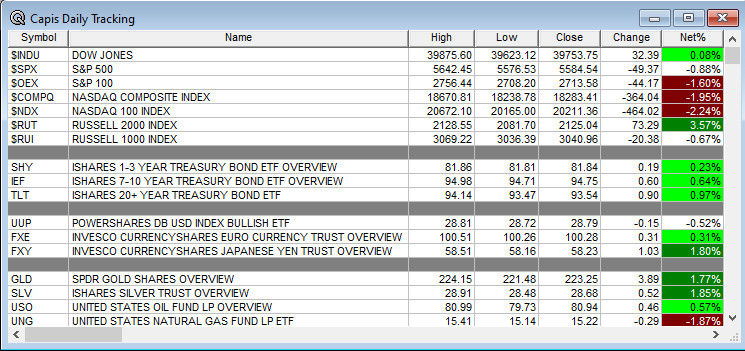

Overnight Summary: The S&P 500 closed Thursday lower by -0.88% at 5584.54 from Wednesday higher by 1.02% at 5633.91. The overnight high was hit at 5,646 at 5:15 a.m. EDT and the low was hit at 5632.75 at 4:05 p.m. EDT. The overnight range is 14 points. The current price is 5640.25 at 7:02 a.m. EDT higher by +0.75 points.

- June PPI is due out at 8:30 a.m. EDT and is expected to rise to 0.1% from 0.0%. U Mich Survey out at 10:00 a.m. EDT.

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Yet to Report:

Capital Raises:

- IPOs For The Week: ACTU, AZI, MJID, MSW, ORKT, OSTX, PGHL, QMMM, WOK

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ASPI announces proposed public offering of common stock.

- AIM: Form S-1.. 11,281,916 Shares Common Stock.

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- KARO files for 6,000,000 shares of ordinary shares by selling shareholder

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- KALV files $300 mln mixed-shelf securities offering.

- CAG files a mixed-shelf securities offering.

- ADTX files a mixed-shelf securities offering.

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: None of note.

- Movers Down: ASPI -17.4%, NRIX -4.6%.

News After The Close :

-

- LMT awarded $251 mln U.S. Army contract modification.

- President Biden held a press conference after the NATO meeting and passed the smell test. Was it enough? (Politico)

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- CCNE promotes Michael Noah to COO.

Dividends Announcements or News:

- Stocks Ex Div Today: MRVL AMX IEX MORN AEO AAP BKE TEN

- Stocks Ex Div Monday: ABBV ABT FCX PNC MAA HRL OC

- ATR increases quarterly cash dividend ~10% to $0.45/share from $0.41/share.

What’s Happening This Morning: Futures S&P 500+4, NASDAQ 100 -4, Dow Jones +73, Russell 2000 +33. Asia is lower ex Australia and Europe is higher this morning. VIX Futures are at 14.06 from 13.00 yesterday while Bonds at 4.221% from 4.201% yesterday on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold and Silver are lower with Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $5,711 from $58.875 lower by -0.69% this morning.

- Daily Positive Sectors: Real Estate, Utilities, Materials and Industrials of note.

- Daily Negative Sectors: Communication Services, Technology and Consumer Cyclical were negative of note.

- One Month Winners: Technology, Communication Services, Consumer Cyclical and Energy of note.

- Three Month Winners: Technology, Communication Services, Utilities, Consumer Cyclical and Consumer Defensive of note.

- Six Month Winners: Technology, Communication Services, Financials and Consumer Cyclicals of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Energy, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Communication Services, Financials, Consumer Defensive, Energy and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: JPM WFC C FAST ERIC of note.

Earnings of Note This Morning:

- Beats: JPM +0.24, C +0.13, BK +0.09, WFC +0.04 of note.

- Flat: None of note.

- Misses: DAL -0.01 of note.

- Still to Report: ERIC FAST of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: CAG DAL PEP of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: IMMP +26.9%, DDD +3.4% of note.

- Gap Down: ASPI -21.3%, HL -2.4% of note.

Insider Action: None of note see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What Your Need to Know to Start Your Day. (Bloomberg)

- 5 Things To Know Before The Stock Market Opens On Friday. (CNBC)

- Market Wrap: Stocks stable as bank stocks steal the limelight. (Bloomberg)

- Bloomberg Lead Story: JP Morgan Notches Record Profit. (Bloomberg)

- JP Morgan President Jamie Dimon warns inflation and rates may stay higher for longer. (CNBC)

- Wells Fargo (WFC) cost cutting progress stalls and stock falls. (Bloomberg)

- Barron’s out positive on DVN. (Barron’s)

- Rio Tinto (RIO) in discussions to acquire Teck Resources (TECK). (Sky News)

- AT&T (T) Hack was bigger than the company acknowledged earlier. (Bloomberg)

- Bloomberg: The Big Take: A Cable Under Norway’s Seas Disappeared. Russia To Blame? (Podcast)

- Marketplace: Bytes Week In Review- FTC Crackdown, Trump’s Pro Crypto Campaign and Threads a year old. (Podcast)

- Wealthion: Investing in AI and Energy with Dr. J (Jon Najarian). (Podcast)

Economic:

- June PPI is due out at 8:30 a.m. EDT and expected to rise to 0.1% from -0.2%.

- July University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT and expected to fall to 67.50 from 68.20.

- Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Geopolitical:

- President Biden receives the President’s Daily Briefing at 10:00 a.m. EDT.

- President Biden heads to Michigan for a campaign event at 6:00 p.m. EDT.

Federal Reserve Speakers

- None of note.

M&A Activity and News:

- Rio Tinto (RIO) is in discussions to acquire Teck Resources (TECK). (Sky News)

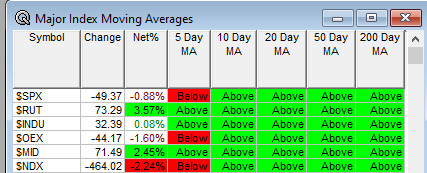

Moving Averages On Major Indexes: Moves from 97% to 90% of the moving averages are now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: BTCY, FEMY, WPC

- Investor/Analyst Day/Calls:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- International Society for Stem Cell Research (ISSCR)

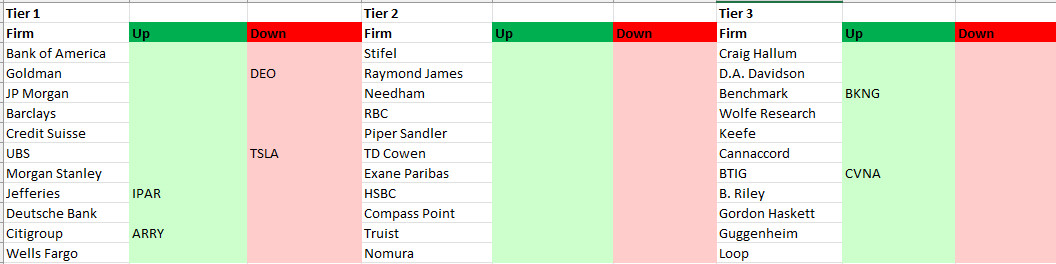

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.