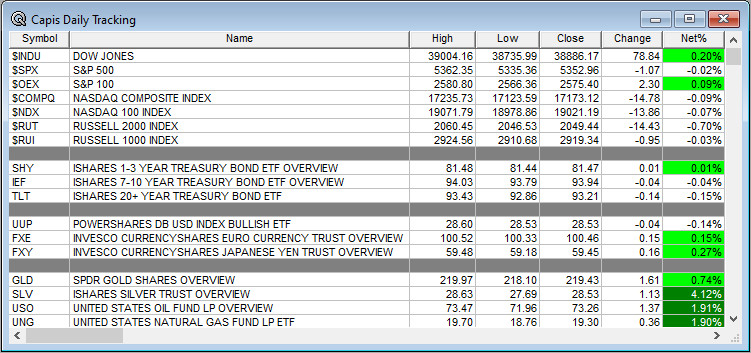

Overnight Summary: The S&P 500 closed Thursday lower by -0.02% at 5352.96 from Wednesday higher by 1.18% at 5354.03. The overnight high was hit at 5,372 at 2:55 a.m. EDT and the low was hit at 5359.50 at 4:05 p.m. EDT. The overnight range is 13 points. The current price is 5362.50 at 6:45 a.m. EDT down by -1.50.

- May Nonfarm Payrolls is due out at 8:30 a.m. EDT and is expected to rise to 185,000 from 175,000.

- Next week the FOMC meets on Tuesday and Wednesday with press release and presser on Wednesday.

- Beats: ZUMZ +0.28, AVO +0.17, AGX +0.06, BRZE +0.05, DOCU +0.03, IOT +0.02 of note.

- Flat: None of note.

- Misses: MTN -0.46, NAPA -0.03 of note.

Capital Raises:

- IPOs For The Week: FLYE GAUZ NVL WAY

- New IPOs/SPACs launched/News:

- WAY priced mid-range between $20 and $23.

- IPOs Filed:

- Secondaries Files or Priced:

- Common Stock filings/Notes:

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- JFIN: files a $250 mixed shelf offering

- ASB: files a mixed shelf offering.

- SHAK:files a mixed shelf offering.

- SMLR: files a $150 million mixed shelf offering.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close:

- BRZE +14.3%, NX +6.3%, AVO +6%, AGX +3.8%, PL +3.8%

- IOT -6.4%, DOCU -5.8%, MTN -5.7%

- Items After the Close:

- Stock Splits or News:

- Buybacks or Repurchases:

- NGL announces new $50 mln share repurchase program.

- DOCU announces $1 bln increase to share repurchase program

- Exchange/Listing/Company Reorg and Personnel News:

- CHRW names Damon Lee as its new CFO .

- Dividends Announcements or News:

- Stocks Ex Div Today: BAC PEP BKNG BLK WM CME GM WMB KMB TAP

- ESP increases quarterly cash dividend to $0.20/share from $0.19/share.

What’s Happening This Morning: Futures S&P 500 -4.50, NASDAQ 100 flat , Dow Jones -18, Russell 2000 -6.07. Asia is higher ex Japan and Europe is higher this morning. VIX Futures are at 13.35 from 13.31 yesterday. Gold, Silver and Copper are lower. WTI Crude Oil and Brent Crude Oil are higher while Natural Gas is higher as well. US 10-year Treasury sees its yield at 4.295% from 4.297% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at$71,286 from $70,994 higher by +0.85% this morning.

- Daily Positive Sectors: Materials, Consumer Cyclical, Energy and Consumer Defensive of note.

- Daily Negative Sectors: Utilities, Industrials and Technology of note.

- One Month Winners: Energy, Technology, Utilities and Communication Services of note.

- Three Month Winners: All led by Utilities, Energy, Materials, Financials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: FCEL of note

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: GERN +17%, BRZE +15.2%, AVO +9.3%, NX +6%, AGX +5.5%, SMLR +4.4%, PAX +2.5% of note.

- Gap Down:

- BMEA -60.6%, GME -16%, BCP -11.7%, MTN -8.5%, DOCU -7.9%, IOT -6.8%, NGL -4.9%, HSHP -3.5%, JFIN -3.3%, XPO -2.5%, HFFG -2.5%, ROG -2.2% of note.

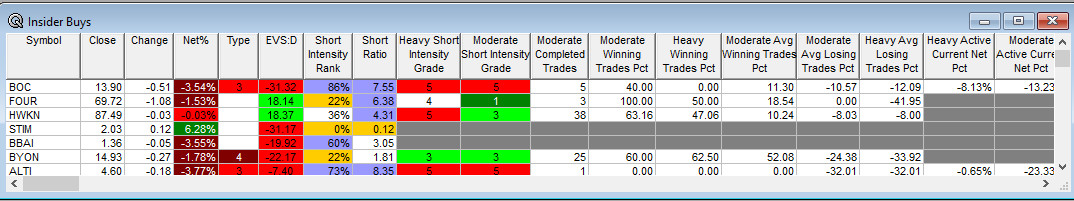

Insider Action: No stocks see Insider buying with dumb short selling. BOC and ALTI see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making The Biggest Moves in Pre-Market: (CNBC)

- Market Wrap: Global stock rally falters ahead of jobs report. (Bloomberg)

- Bloomberg Lead Story: US Jobs Report Is Set To Show A Steady Slowdown. (Bloomberg)

- Here’s what to expect from the latest jobs report. (CNBC)

- Chinese Exports up 7.6% in May. (CNBC)

- Gamestop (GME) whipsaws on secondary offering overnight. (Bloomberg)

- Bloomberg: The Big Take: Biden’s bet on Israel Hamas Ceasefire explained. (Podcast)

- Bloomberg: Odd Lots: Economic Vibes. (Podcast)

- Marketplace: Bytes: Week In Review AI whistleblowers, Facebook’s future and meme stock backlash. (Podcast)

- Wealthion: Are Central Banks pointing to a disaster. (Podcast)

Geopolitical:

- President’s Public Schedule:

- There is a Daily Briefing scheduled for 4:00 a.m. EDT today in Paris.

- President Biden hosts a bilateral meeting with Ukrainian President Zelensky at 6:15 a.m. EDT.

- President Biden heads back to Normandy at 9:10 a.m. EDT and then Pointe du Hoc at 9:40 a.m. EDT.

- President Biden arrives back in Paris at 12:25 p.m. EDT.

Economic:

- May Nonfarm Payrolls is due out at 8:30 a.m. EDT and is expected to rise to 185,000 from 175,000.

- The Unemployment Report is due out at the same time and is expected to stay at 3.90%.

- Baker Hughes Weekly Rig Count at 1:00 p.m. EDT.

- April Consumer Credit out at 3:00 p.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve Speakers are in a blackout period through next Wednesday’s FOMC announcement.

M&A Activity and News:

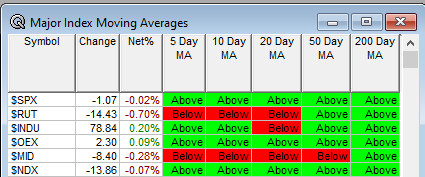

Moving Averages On Major Indexes: 73% of the moving averages are positive up from 80%.

Meeting & Conferences of Note:

- Sellside Conferences:

- TD Cowen Financial Services & Fintech Summit

- Top Shareholder Meetings: AMSF, ARI, GOOG, GOOGL, VIA, UPWK, WTM

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ALXO, ETR, OSCR

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- Computex

- EASL Congress

- Heart in Diabetes Conference

- Spinal Cord Injury Investor Symposium

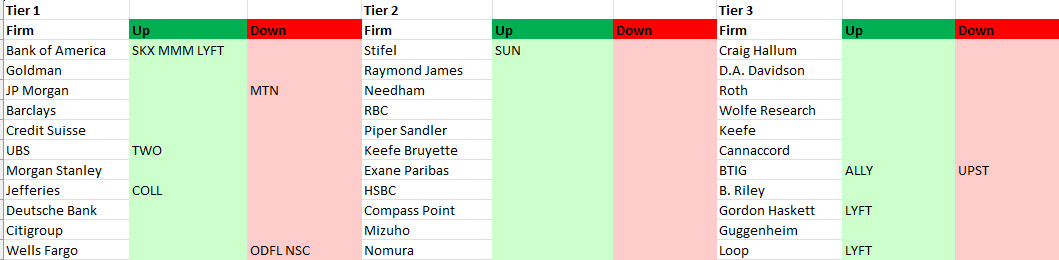

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: