Overnight Summary: The S&P 500 closed Tuesday higher by 0.15% at 5291.34 from Monday higher by 0.11% at 5283.40. The overnight high was hit at 5,317.25 at 6:20 a.m. EDT and the low was hit at 5300.50 at 4:05 p.m. EDT. The overnight range is 17 points. The current price is 5313.50 at 7:15 a.m. EDT up by +9.50.

- Non-ISM Manufacturing is due out at 10:00 a.m. EDT.

- Beats: PVH +0.28, GWRE +0.13, SFIX +0.06, VRNT +0.05, CRWD +0.04, HPE +0.03 of note.

- Flat: None of note.

- Misses: SPWH -0.10 of note.

Capital Raises:

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- AppsFlyer considers going public. (Bloomberg)

- IPOs Filed:

- Secondaries Files or Priced:

- ANNX files $125 millionof common shares of stock.

- Common Stock filings/Notes:

- Notes Priced of note:

- HRI priced $800 million of senior unsecured notes.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- SU: files a mixed shelf offering

- ZVRA: files a $350 million mixed shelf offering.

- GDHG: files a $100 million mixed shelf offering.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close:

- SFIX +22%, DDD +16.5%, HPE +18%, CRWD +7.4%, GWRE +7.3%, VRNT +6.1%,

- SPWH -11.5%, ZVRA -4.3%, ANNX -2%.

- Items After the Close:

- ASCO Presentations after the close .

- NDAQ reports monthly volumes for May; equity derivatives down 3.7% yr/yr and 3.0% sequentially. (Press Release)

- YEXT to cut the size of its workforce by approximately 12%.

- Greif (GEF) announces a $50 to $70 per short ton price increase for all grades of Uncoated Recycled Paperboard..

- Jim Cramer interviewed AZN CEO Pascal Soriot on Mad Money. (CNBC).

- Stock Splits or News:

- Buybacks or Repurchases:

- AAON authorizes up to $50 mln for share repurchases

- Exchange/Listing/Company Reorg and Personnel News:

- ALSN appoints Frederick Bohley as COO, effective immediately.

- Dividends Announcements or News:

- Stocks Ex Div Today: SLB HAL HRB PVH HOG

What’s Happening This Morning: Futures S&P 500 +16 , NASDAQ 100 +106 , Dow Jones +74 , Russell 2000 +3.16. Asia is higher ex the Nikkei and Europe is higher this morning on India’s drop of -5%. VIX Futures are at 13.60 from 14.10 yesterday. Gold and Silver are higher with Copper lower. WTI Crude Oil and Brent Crude Oil are higher while Natural Gas is higher as well. US 10-year Treasury sees its yield at 4.338% from 4.383% yesterday. The U.S. Dollar is higher versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $70,877 from $68,880 higher by +0.68% this morning.

- Daily Positive Sectors: Consumer Defensive, Real Estate, Healthcare, Communication Services of note.

- Daily Negative Sectors: Materials, Energy, Financials and Industrials of note.

- One Month Winners: Energy, Technology, Utilities and Communication Services of note.

- Three Month Winners: All led by Utilities, Energy, Materials, Financials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: THO +0.33, BFB +0.15, REVG +0.13, HIBB +0.09, OLLI +0.08, UNFI +0.08, CPB +0.05 of note.

- Flat: DLTR of note.

- Misses: DBI -0.05 of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: CPB SFIX of note.

- Negative Guidance: THO of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: WKME +42.6%, CLLS +19.5%, SFIX +17.2%, HPE +12.8%, DDD +12.4%, CRWD +9.1%, VRNT +8.6%, VIR +8.5%, GWRE +7.8%, ABUS +6.6%, APO +3%, DENN +3% of note.

- Gap Down: MNMD -12%, SPWH -11%, ANNX -10.2%, ZVRA -3.2% of note.

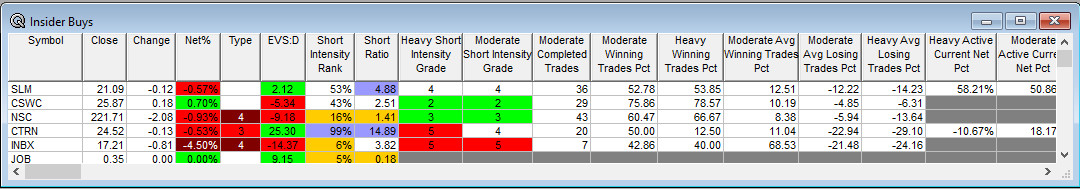

Insider Action: No stocks see Insider buying with dumb short selling. CTRN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Wednesday. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making The Biggest Moves in Pre-Market: HPE CRWD DLTR PVH TSM AMAT KLAC AMC (CNBC)

- Market Wrap: Stocks gain as data reignites dovish rate bets. (Bloomberg)

- MBA Mortgage Applications were out at 7:00 a.m. EDT and fell -5.2% and ReFis -6.8%.

- Intel (INTC) CEO confident in the company’s ability to compete in AI space. (Bloomberg)

- Nike (NKE) cuts jobs at European headquarters. (Bloomberg)

- Citadel and Blackrock forming competing stock exchange to NYSE in Texas. (WSJ)

- Tesla (TSLA) Chinese sales up 15% in May. (WSJ)

- Elliott pushes Softbank to buy back shares. (Bloomberg)

- CNBC had a long interview with Ron Baron of The Baron Funds on TSLA. (CNBC)

- Bloomberg: The Big Take: Stunning Blow For Modi. (Podcast)

- Bloomberg: Odd Lots: How Companies Got Smarter About Price Hikes. (Podcast)

- Marketplace: The universe is expanding faster than we thought. (Podcast)

Geopolitical:

- President’s Public Schedule:

- There is a Daily Briefing scheduled for 4:30 a.m. today in Paris.

- President Biden has nothing on the agenda as he needs a day to adjust to the time difference.

Economic:

- The ADP Unemployment Report is due out at 8:15 a.m. EDT and is expected to fall to 175,000 from 192,000.

- May Non-ISM Manufacturing Index is due out at 10:00 a.m. EDT and is expected to rise to 50.3% from 49.4%.

- Weekly Crude Oil Inventory Report is due out at 10:30 a.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve Speakers are in a blackout period through next Wednesday’s FOMC announcement.

M&A Activity and News:

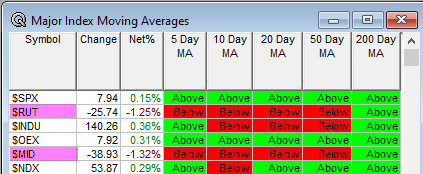

Moving Averages On Major Indexes:60% of the moving averages are positive down from 70%.

Meeting & Conferences of Note:

- Sellside Conferences:

- Baird Global Consumer Tech & Services Conference

- Bank of America Global Technology Conference

- Bank of America Housing Symposium

- William Blair Growth Stock Conference

- Deutsche Bank Global Consumer Conference

- Jefferies Global Healthcare Conference

- Piper Jaffray Sandler Global Exchange and Trading Conference

- Stifel Cross Sector Insight Conference

- TD Cowen Future of the Consumer Conference as well as the Financial Services & Fintech Summit

- UBS Global Industrials and Transportation Conference

- UBS Healthcare Conference as well as the Global Industrials and Transportation Conference

- Wolfe Research SMID Conference

- Vertical Research SMID Innovators Conference

- Top Shareholder Meetings: AAL, ABNB, AFYA, AMBC, AMC, APP, BMBL, DVN. FIS, HLNE, INDO, MVIS, NYCB,

PLTR, U, URBN, WMT - Fireside Chat: None of note.

- Investor/Analyst Day/Calls: HLNE, IFRX, LVO, PCAR, USFD

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- Associated Professional Sleep Societies

- BASF Sustainability Matters

- Nareit’s REITweekInvestor Conference

- World Nuclear Fuel Market

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

- Upgrades ABBV SNN CART of note.

- Downgrades RLMD MED of note.