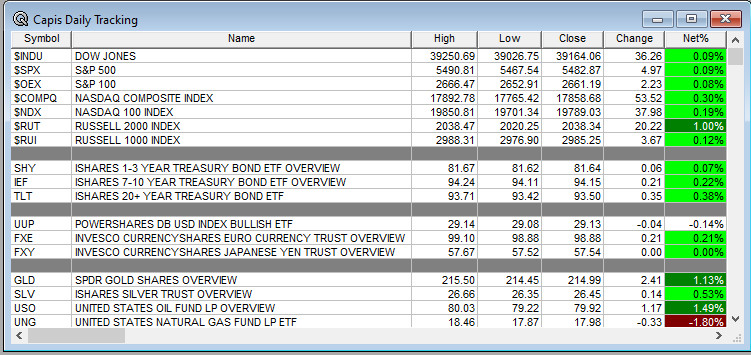

Overnight Summary: The S&P 500 closed Thursday higher by +0.09% at 5490.81 from Wednesday higher by 0.16% at 5477.90 from Tuesday higher by +0.39% at 5469.30. The overnight high was hit at 5,567.25 at 5:50 a.m. EDT and the low was hit at 5546.75 at 4:05 p.m. EDT. The overnight range is 21 points. The current price is 5565.50 at 6:45 a.m. EDT higher by +19.50.

- Today is a big day as the latest PCE Core is due out at 8:30 a.m. EDT and will alert us to current inflation levels.

- President Biden and Former President Trump debated last night and many Democrats are calling for the removal of Biden as the Democratic candidate.

- Short Sellers continue to add to positions.

- Beats: NKE +0.15, ACCD +0.13 of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: ACTU, GLE, LB, MJID, NVA, OSTX, QMMM, ALMS

TBN, WBTN, WOK. - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- ALMS priced at $16, low end of range.

- LB priced at $17, low end of range.

- Secondaries Filed or Priced:

- CCCS announces proposed secondary offering of 30 million shares of common stock and was priced this morning.

- ELTX proposed stock offering.

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- LQDA files for 7,322,197 shares of common stock by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- AOMR filed a $750 million mixed-shelf offering.

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close Of Note:

- IFIN +21.7%, PTGX +9.1%, ELYM +6.9% .

- ACCD -27.70%, KRUS -15%, NKE -10,3%, FL -5.1%, ONON -2.6%, SKX -2%.

- Fluor (FLR) awarded an engineering, procurement and construction management services contract for Northvolt’s large-scale lithium-ion battery factory.

- Kura Sushi (KRUS) guides May Quarter sales below consensus; lowers FY24 revenue guidance.

- Nike (NKE) beat on estimates but guided lower and is down -14%.

- NFL to pay $4.7 bln in damages over anticompetitive features of its Sunday Ticket broadcast package.

- LDOS awarded $477 mln NASA contract for cargo mission support.

- LMT awarded $1.56 bln U.S. Navy contract and $520 mln U.S. Air Force contract modification.

- GD awarded $323 mln U.S. Army contract modification.

- CDC recommends pneumonia shot for adults 65 years or older which should benefit for Merck (MRK).

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- NGVC announces retirement of CFO Todd Dissinger, effective Dec 31.

- SMMT names Jeff Huber, Transformational Google and GRAIL Executive, to its Board of Directors.

- JJSF CFO Ken Plunk to retire, effective December 31.

- SPGI CEO Douglas Peterson to retire; names Martina Cheung as new CEO, effective November 1.

- PTGX to replace WIRE as they are being bought in the S&P 600.

Dividends Announcements or News:

- Stocks Ex Div Today: DHR SYK MDT DE MDLZ ITW USB KDP HUM NUE WTW STLD RL DDS FLS SLG.

What’s Happening This Morning: Futures S&P 500 +20, NASDAQ 100 +86, Dow Jones +36, Russell 2000 +16. Asia is higher while Europe is higher this morning ex France. VIX Futures are at +13.85 from 13.95 yesterday while Bonds at 4.308% from 4.327% yesterday on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well for a second day. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $61,482 from $61,169 higher by 0.04% this morning.

- Daily Positive Sectors: Real Estate, Communication Services and Energy of note.

- Daily Negative Sectors: Consumer Defensive, Materials, Healthcare and Financials of note.

- One Month Winners: Technology, Healthcare and Communication Services of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and Healthcare of note.

- Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: None of note.

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: ACCD NKE of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: INFN +17.1%, PTGX +10.6%, LWAY +5%, ELYM +4.6%, TIGO +4.4%, EBR +3.7% of note.

- Gap Down: ACCD -25.2%, NKE -14.6%, KRUS -7.8%, PTCT -6.1%, FL -5%, DVAX -3.3%, UAA -3.1%, ONON -2.7%, SKX -2.7%, LDOS -2% of note.

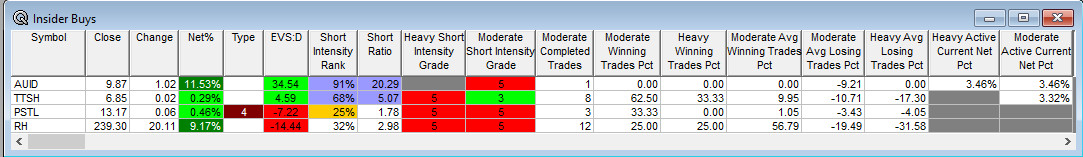

Insider Action: None of note saw Insider buying with dumb short selling. AUID TTSH see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Friday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves Pre-Market: NKE DJT IFIN DLR SAP. (CNBC)

- Market Wrap: U.S. Futures gain as focus shifts from debate to data. (Bloomberg)

- Bloomberg Lead Story: Biden’s Disastrous Debate Accelerates Doubts Over Candidacy. (Bloomberg)

- Key takeaways from the Presidential Debate. (CNBC)

- Democrats are seriously considering replacing Joe Biden. (Politico)

- 2/3 of last night’s viewers felt Trump did a better job than Biden. (CNN)

- Apple (AAPL) iPhone sales in China were up 40% in May. (Bloomberg)

- Morgan Stanley Strategist Andrew Sheets say the Fed and ECB could cut rates in September. (CNBC)

- Barron’s is out positive on SMCI this morning. (Barron’s)

- Barron’s writes on PCE and notes Fed may get its wish as inflation slows. (Barron’s)

- Bloomberg: Odd Lots: Neil Dutta on potential Fed Policy Error. (Podcast)

- Marketplace: Bytes: Week In Review. (Podcast)

- NY Times Daily: A brutal debate for Biden. (Podcast)

- Wealthion: Recession risks and Fed policies. (Podcast)

- Adam Taggart: John Hussman rings the bell. (Podcast)

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today.

- President Biden is in North Carolina this morning for a campaign event and then heads to New York City.

Economic:

- May Personal Income is due out at 8:30 a.m. EDT and are expected to improve to 0.4% from 0.3%.

- May PCE Core is due out at the same time and are expected to drop to 0.1% from 0.2%.

- June Chicago PMI is due out at 9:45 a.m. EDT and came in at 35.4%.

- Baker Hughes Rig Count due out at 1:00 p.m. EDT.

Federal Reserve Speakers

- Federal Reserve Richmond President Thomas Barkin spoke at 6:40 a.m. EDT.

- Federal Reserve Governor Michelle Bowman will speak at 12:00 p.m. EDT.

M&A Activity and News:

- Nokia (NOK) makes a bid for Infinera (IFIN). (Bloomberg)

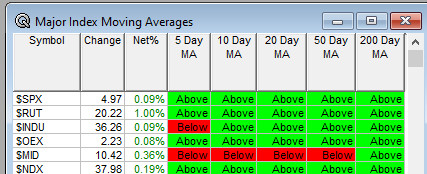

Moving Averages On Major Indexes: Moves from 80% to 67% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Bank of America Internet Tour.

- Oppenheimer Montauk Life Sciences Summit

- Fireside Chat: None of note.

- Top Shareholder Meetings: ADXN, BILI, BUJA, BZ, CLLS, PHVS, TRVG, VFF

- Investor/Analyst Day/Calls: None of note.

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: GMAB

- Company Event:

- Industry Meetings:

- RNA Therapeutics Conference

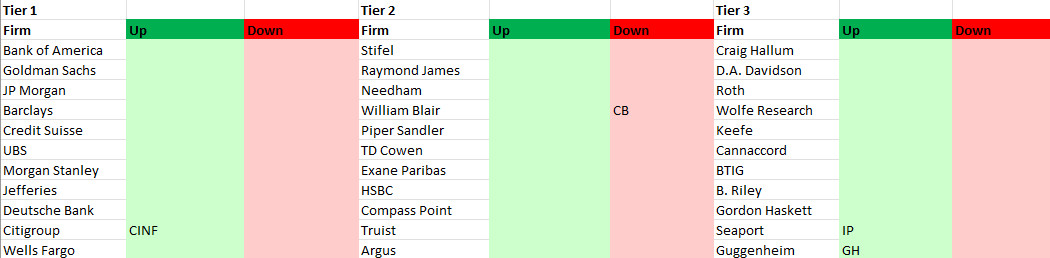

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: