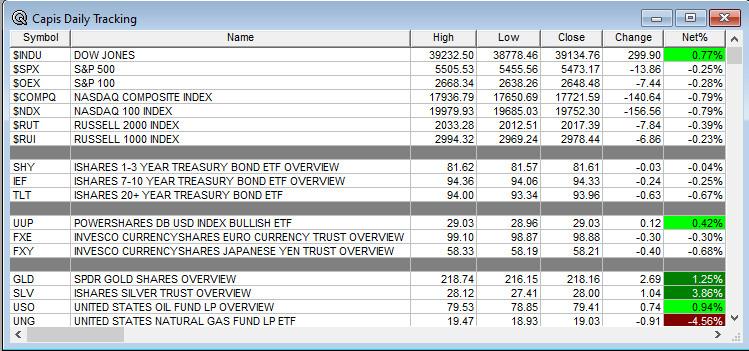

Overnight Summary: The S&P 500 closed Thursday lower by -0.25% at 5473.17 from Tuesday higher by 0.25% at 5487.03. The overnight high was hit at 5,550.75 at 2:15 a.m. EDT and the low was hit at 5526.50 at 4:45 a.m. EDT. The overnight range is 24 points. The current price is 5537 at 6:50 a.m. EDT lower by -5.67.

- Existing Home Sales and Leading Indicators are due out at 10:00 a.m. EDT.

- Today is Triple Witching as we have options expiration today along with stock futures and index futures. Could be a wild one or not. We favor or not.

- SPY holders received $1.7590 per share SPY looks down overnight compared to Futures or where SPX opens. SPY goes ex-dividend date today.

- JP Morgan Trading Desk notes: “We are now less than 1 month away from the 2Q24 earnings season kicking off. FactSet expects 24Q2 earnings to grow 9.0% YoY, the highest since 22Q1, and revenue to grow 4.6% YoY which is the 15th consecutive quarter of revenue growth for the index.” Carl Quintanilla of CNBC

- Beats: SWBI +0.10 of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: EHGO KAPA MJID NVA OSTX QMMM

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:.

- Secondaries Filed or Priced:

- .

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- OKLO files for 62,440,080 shares of common stock by selling shareholders.

- .

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- DHC files $1.5 bln mixed-shelf securities offering.

- DFS filed a mixed-shelf offering.

- KOS filed a mixed-shelf offering.

- IPSC

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close:

- SRPT +40%, CLOV +9.7%, RYAN +6.7%, ASAN +3.2%, NG +2.7%.

- SWBI -4.7%.

- U.S. adds Japan to currency watch list due to strong Dollar. (Bloomberg)

- “Mania” could drive S&P 500 to 6,000 before plunge says Stifel. (Yahoo Finance)

- Boyd Gaming (BYD) approached Penn Gaming (PENN) for a deal. (MarketWatch)

- Nvidia (NVDA) sees put volume increase on reversal. (MarketWatch)

- American Airlines (AAL) flight attendants prepare to strike. (Yahoo Finance)

- Preview of June Options Expiration. (Bloomberg)

- LMT awarded $283 mln U.S. Missile Defense Agency contract

- BAESY, RTX and Data Link Solutions LLC awarded $999 mln U.S. Navy contract

- OII picks up a large contract with domestic independent energy company; expects approximately $50 mln in revenue from the contract.

- JNJ submits applications to FDA seeking approval of TREMFYA (guselkumab) for the treatment of active Crohn’s disease.

- Sarepta Therapeutics (SRPT) announces expanded FDA approval of ELEVIDYS to Duchenne Muscular Dystrophy patients

Buybacks or Repurchases:

- ASAN approves up to $150 mln for stock repurchases.

- BTMD announces $60 million agreement to repurchase 8.3 million shares and cancel approximately 4.0 million earnout shares.

Exchange/Listing/Company Reorg and Personnel News:

- PLMR appoints Rodolphe Herve to COO role, effective July 1.

- IRWD appoints CFO Sravan K. Emany to additional role of COO, effective immediately.

- RYAN to join the S&P 400 Mid Cap replacing AIRC that is being bought.

Dividends Announcements or News:

- Stocks Ex Div Today: PM CARR IFF GGAL MAIN AVNT.

- Delta Airlines (DAL) raised its dividend to $0.15 cents from $0.075. (MarketWatch)

What’s Happening This Morning: Futures S&P 500 -11, NASDAQ 100 -45, Dow Jones -37, Russell 2000 -0.19. Asia is lower ex Australia while Europe is lower this morning. VIX Futures are at 14.93 from 14.16 yesterday while Bonds at 4.228% from 4.254% yesterday on the 10-Year. Crude Oil and Brent are lower along with Natural Gas. Gold is higher with Silver and Copper lower today. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $63.910 from $65,718 lower by -1.58% this morning.

- Daily Positive Sectors: Energy, Financials, Utilities, Communication Services and Materials of note.

- Daily Negative Sectors: Technology, Real Estate and Industrials of note.

- One Month Winners: Technology, Healthcare, Communication Services, Consumer Defensive and Real Estate of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and Healthcare of note.

- Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Healthcare of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare and Utilities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: None of note.

Earnings of Note This Morning:

- Beats: of note.

- Flat: None of note.

- Misses: of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: SRPT +34%, RYAN +7%, CLOV +6.8%, ASAN +4.6%, DHC +4.2%, ASTL +3.8%, RERE +3.3%, CLW +2.9%, TREE +2.9%, GENI +2.5% of note.

- Gap Down: ABL -18%, SWBI -8.5%, BTMD -3% of note.

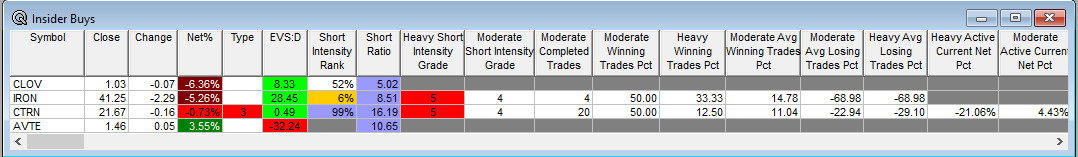

Insider Action: No stocks see Insider buying with dumb short selling. AVTE see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Friday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Market Wrap: Risk-Off Mode Puts Bonds In Favor After Weak PMIs. (Bloomberg)

- Bloomberg Lead Story: Wall Street’s $5.5 Trillion Triple Witching To Test Market Calm. (Bloomberg)

- China asked Mastercard (MA) and Visa (V) to cut transaction fees. (Bloomberg)

- Barron’s is + on NVDA this morning. (Barron’s)

- Bloomberg: The Big Take: Blackstone’s $339 Billion Property Arm’s Honeymoon is almost over. (Podcast)

- Bloomberg: CoreWeave (private) CSO on Building AI Datacenters. (Podcast)

- Marketplace: Bytes: Week In Review – Social Media warning labels, Adobe hidden fees and less open Open AI. (Podcast)

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today.

- President Biden is at Camp David.

Economic:

- May Existing Home Sales are due out at 10:00 a.m. EDT and are expected to fall to 4.10 million from 4.14 million.

- May Leading Indicators are due out at the same time and are expected to improve to -0.30% from -0.60%.

- S&P Flash PMIs at 9:45 p.m. but they do not move market like the traditional PMIs do.

- Baker Hughes Rig Count is out at 1:00 p.m. EDT.

Federal Reserve Speakers

- No Federal Speakers planned today but they can just appear when media calls them. Check out The Trade Exchange as they catch such events.

M&A Activity and News:

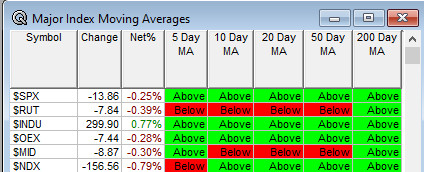

Moving Averages On Major Indexes: 73% from 77% of the moving averages are positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Stifel Inaugural ADA Diabetes Tech Summit

- TD Cowen Genetic Medicines & RNA Summit

- Top Shareholder Meetings: AON, ARLO, ATHM, JD, MLR, MTCH, PRPO

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: SRPT

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- AOA Optometry Meeting

- IMS 2024

- Intersolar Europe

- Next-Gen-Immuno-Oncology Conference

- Scientific Sessions of the American Diabetes Tech Summit.

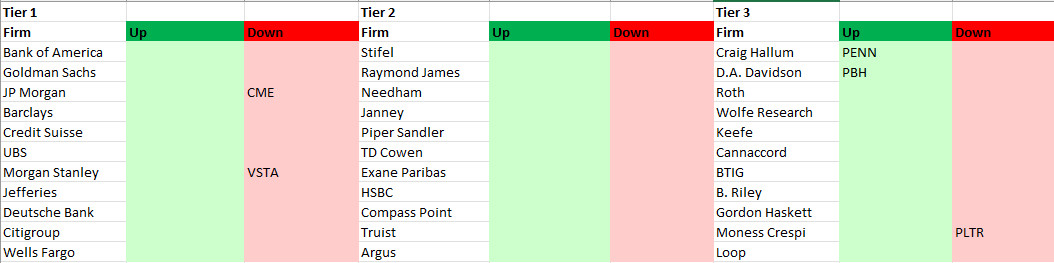

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: