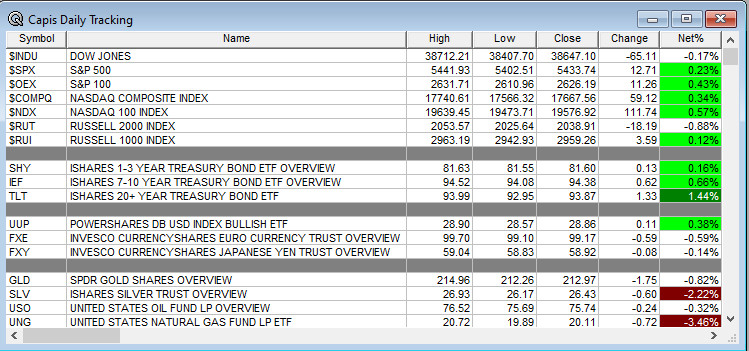

Overnight Summary: The S&P 500 closed Thursday higher by 0.23% at 5433.74 from Wednesday higher by 0.85%. The overnight high was hit at 5,507.75 at 2:30 a.m. EDT and the low was hit at 5462.50 at 7:10 p.m. EDT. The overnight range is 44 points. The current price is 5476 at 7:35 a.m. EDT lower by -27.50.

- Latest Michigan Sentiment is due out at 10:00 a.m. EDT.

- Beats: ADBE +0.09 of note.

- Flat: None of note.

- Misses: RH -0.27 of note.

Capital Raises:

- IPOs For The Week: EHGO KAPA OSTX QMMM TEM TLX WOK

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- TEM priced 11.1M shares at $37.00.

- SPMC priced 4M shares at $20.00.

- Secondaries Filed or Priced:

- RARE: Pricing of Public Offering of Common Stock and Pre-Funded Warrants.. Priced @$39.

- RZLT: Pricing of Public Offering of $60 Million of Common Stock and Pre-Funded Warrants @$4

- Common Stock filings/Notes:

- ABL announces proposed public offering of 10 mln shares of common stock.

- TUSK files $500 mln common stock offering.

- BACK filed common stock and warrants.

- FEAM Up to 41,935,491 Shares of Common Stock.

- Notes Priced of note:

- PDM priced senior notes.

- WSC pricing of $500 Million Senior Secured Notes Offering

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- STOK files for 10,843,681 shares of common stock by selling shareholders.

- TUSK files for 23,527,161 shares of common stock by selling shareholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- NB: files a $200 million mixed shelf offering.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers:

- ADBE +17%, ZKH +6.5%, CIM +3.1%, LNW +2.8%, MITT +2%

- RZLT -13%, RH -10%, MSM -6%, POWW -3.2%, FAST -2.1%

- MSM issues downside guidance.

- On Semiconductor (ON) to cut workforce by 1,000.

- CABO to reduce total headcount by approximately 4%.

- TSLA shareholders approve move to Texas and Musk’s compensation package.

- Jim Cramer interviewed on Mad Money during Wednesday’s show. (CNBC).

Stock Splits or News:

Buybacks or Repurchases:

- ZKH announces $50 million share repurchase program.

- LNW announces authorization of new $1 billion share repurchase program

Exchange/Listing/Company Reorg and Personnel News:

- SEE names Patrick Kivits as its new CEO, effective July 1; promotes Dustin Semach to CFO.

Dividends Announcements or News:

- Stocks Ex Div Today:

- MITT increases quarterly cash dividend 5.6% to $0.19/share from $0.18/share.

- CIM increases quarterly cash dividend to $0.35/share from $0.33/share on a reverse-stock-split adjusted basis.

- TPL approves $10.00 per share special dividend; payable on July 15, 2024 to stockholders of record at the close of business on July 1, 2024.

What’s Happening This Morning: Futures S&P 500 -28, NASDAQ 100 -63, Dow Jones -296, Russell 2000 -28. Asia is higher ex the ASX 200 while Europe is lower this morning. VIX Futures are at 14.34 from 14.05 yesterday while Bonds at 4.20% from 4.312% yesterday on the 10-Year. Crude Oil and Brent are higher while Natural Gas is lower. Gold, Silver and Copper are higher today. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $67,143 higher by 0.75% this morning.

- Daily Positive Sectors: Technology, Real Estate and Utilities of note.

- Daily Negative Sectors: Energy, Communication Services and Financials of note.

- One Month Winners: Technology, Healthcare, Communication Services and Real Estate of note.

- Three Month Winners: All led by Communication Services, Utilities, Technology, Consumer Defensive and Energy of note.

- Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Healthcare of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare, Industrials and Consumer Defensive of note.

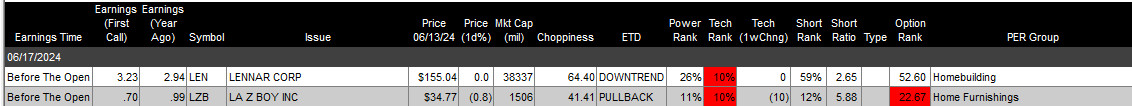

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open:

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: ADBE +14.3%, MOLN +13.4%, BITF +10.7%, ZKH +10.5%, STTK +9.8%, ZURA +4.6%, MITT +2.1%, LNW +2.1% of note.

- Gap Down: RZLT -18.8%, RH -11.9%, MSM -11.7%, QXO -10.9%, POWW -6.4%, ISSC -5.9%, LOGI -3.4%, DYN -3%, FAST -2.8%, GME -2.7%, RARE -2.6%, GWW -2.3%, TUSK -2% of note.

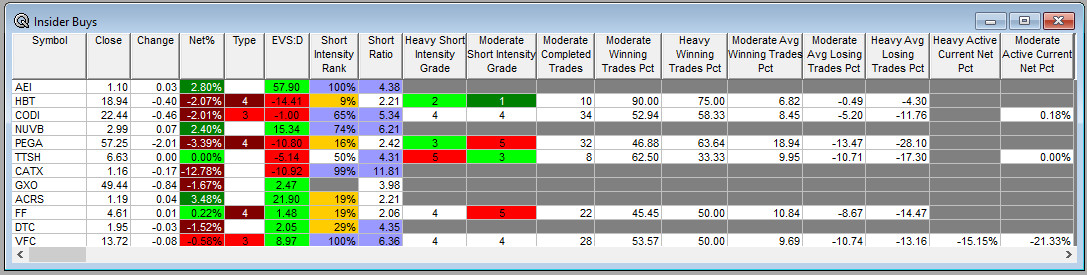

Insider Action: CODI and VFC see Insider buying with dumb short selling. No stocks see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Friday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making The Biggest Moves in Pre-Market: (CNBC)

- Market Wrap: Anxiety over France deepens European stock rout. (Bloomberg)

- Bloomberg Lead Story: Bank of Japan Lack of Details on Bond Buying Leaves Yen Vulnerable. (Bloomberg)

- Russian President Putin outlines conditions for peace talks with Ukraine. (CNBC)

- Trump met with CEOs in private and what he told them. (CNBC)

- Adobe (ADBE) set for biggest gain since 2020. (Yahoo)

- Bloomberg: Odd Lots: What a “DeGen” Crypto Trader does all day. (Podcast)

- Bloomberg: Big Take: Is the Fed thinking about inflation all wrong? (Podcast)

- NY Times Daily: How to retire as early as possible. (Podcast)

- Marketplace: Bytes: Week in Review – Apple’s AI Flex, Uber’s legal loss and X’s hidden likes. (Podcast)

- Wealthion: Inflation crash or job’s crisis. (Podcast)

- Taggart: Will rising unemployment trigger a recession? (Podcast)

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 2:00 a.m. EDT today as in Italy.

- President Biden is attending the G-7 meeting in Italy today.

- Later in the day, President Biden meets with Pope Francis at 12:15 p.m. EDT.

- President Biden returns to the U.S. at 5:40 p.m. EDT.

Economic:

- June University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT and is expected to rise to 73 from 69.10.

- Import and Export Prices for May are due out at 8:30 a.m. EDT and last month rose 0.9% and 0.5%.

- Baker Hughes Weekly Rig Count is due out at 1:00 p.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve Chicago President Austan Goolsbee speaks at 2:00 p.m. EDT.

- Federal Reserve Governor Lisa Cooke speaks at 7:00 p.m. EDT.

M&A Activity and News:

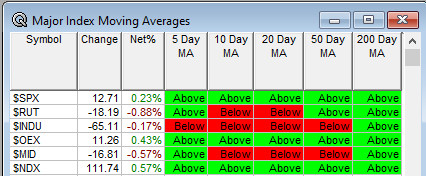

Moving Averages On Major Indexes: 70% from 84% of the moving averages are positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- RBC Global Mining & Materials Conference

- Top Shareholder Meetings: COIN, JOBY, OPEN, RUM, TGTX, WYY

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AFRM, BMY, IRON, STTK

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- Apple WWD Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: