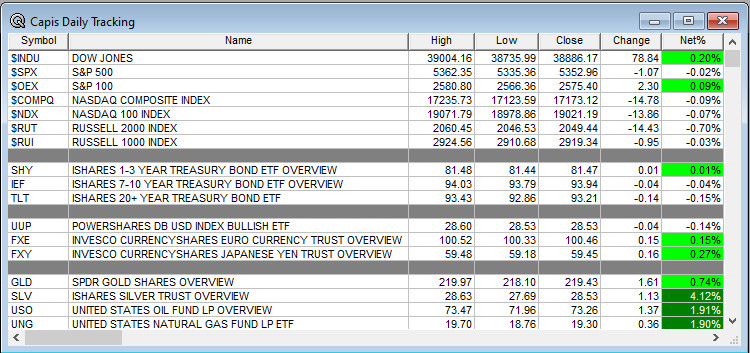

Overnight Summary: The S&P 500 closed Friday lower by -011% from Thursday lower by -0.02% at 5352.96. The overnight high was hit at 5,358.75 at 6:20 p.m. EDT and the low was hit at 5359.50 at 4:05 p.m. EDT. The overnight range is 13 points. The current price is 5354 at 8:30 a.m. EDT down by -1.75.

- 3 and 6 Month Treasury Bill Auction at 11:30 a.m. EDT. 3-Year Auction at 1:00 p.m. EDT.

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: EHGO KAPA OSTX QMMM TEM TLX WOK

- New IPOs/SPACs launched/News:

- .

- IPOs Filed:

- Secondaries Files or Priced:

- Common Stock filings/Notes: GOVX NMHI PSTV SATL SPEC

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- BTDR files for 23,587,360 Class A ordinary shares offering by selling shareholder.

- SOPH files for 200,000 ordinary shares offering by selling shareholder.

- SERV files for 4,813,041 shares common stock offering by selling shareholders.

- DOGZ files for 2,000,000 shares common stock offering by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- DKNG: files a mixed shelf offering

- ITRM: files a mixed shelf offering.

- POCI: files a $75 million mixed shelf offering.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers For The Week:

- Healthcare: AGIO (47.9 +31.81%), ESPR (2.82 +30.32%), NEOG (16.2 +23.19%), NVAX (18.17 +20.86%), CDNA (15.22 +16.99%), HALO (50.93 +14.99%), OMER (3.86 +14.73%), STIM (2.19 +13.8%) Industrials: FWRD (20.73 +23.36%), TTC (96.03 +19.75%), SRCL (59 +14.46%) Consumer Discretionary: SFIX (3.71 +50.2%), GME (28.12 +21.52%), HZO (33.54 +17.77%) Software: SMAR (44.52 +20.32%), DDD (4.11 +16.76%), COHR (66.08 +15.81%), GWRE (130.33 +14.4%)

- Healthcare: CGC (6.98 -18.23%), BEAT (2.36 -15.11%) Materials: FSM (4.97 -20.35%), TSE (3.09 -19.45%), CENX (15.63 -14.73%) Industrials: SITE (128.26 -17.16%), EAF (1.38 -16.36%) Consumer Discretionary: BIG (2.66 -23.71%), PLCE (10.12 -17.39%) Software: SMTC (30.86 -20.65%), LSCC (60.66 -18.29%), INSG (7.92 -18.01%), JKS (25.27 -15.05%) Financials: AMBC (12.94 -26.98%), SUPV (6.21 -14.3%) Consumer Staples: MED (21.48 -16.57%)

- S&P 500 quarterly changes. KKR CRWD and GDDY go into the S&P 500. ILMN into S&P 400 from S&P 500. RHI and CMA into the S&P 600 from S&P 500. TPL BMRN WMG NXT ALTR and RBA move into S&P 400. LEG HTZ GO PENN IART and WERN move into the S&P 600 from the S&P 400. KRYS VIRT STEP WHD and TDW move into the S&P 600. The following are dropped from the S&P 600 OSUR MCS TTEC MED and CRNC.

- RTX wins a $677.7 million modification to a previously awarded Navy contract.

- Mattel (MAT) to bring Matchbox driving adventures to consoles and PC this September.

- Jim Cramer interviewed the CEO of MDT on Mad Money. (CNBC).

- Barron’s: + MSGS TOKU MANU AVGO +/- AAPL and – on GME.

Stock Splits or News: Splits effective today NVDA (normal split) and NAAS ICU TNXP (reverse splits)

Buybacks or Repurchases:

- VRRM repurchases 2 mln shares from selling shareholder.

Exchange/Listing/Company Reorg and Personnel News:

- CMP appoints Jeffrey Cathey as CFO.

- CSV CFO to resign on July 1st.

Dividends Announcements or News:

- Stocks Ex Div Today: GOOGL BDX OXY TRV FIS PPL KNX VFC

What’s Happening This Morning: Futures S&P 500 -4.49, NASDAQ 100 -15.95, Dow Jones -35, Russell 2000 -12,45. Asia is higher ex South Korea and Europe is lower this morning. VIX Futures are at 13.35 from 13.31 yesterday. Gold is lower but Silver and Copper are higher. WTI Crude Oil and Brent Crude Oil are higher while Natural Gas is higher as well. US 10-year Treasury sees its yield at 4.461% from 4.295% on Friday. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $69,358 from $71,286 lower by -0.56% this morning.

- Daily Positive Sectors: Technology of note.

- Daily Negative Sectors: Materials, Utilities, Communication Services and Real Estate of note.

- One Month Winners:

Energy, Technology, Healthcare,Utilities,Communication Services and Real Estate of note. - Three Month Winners: All led by Communication Services, Utilities, Technology, Consumer Defensive and Energy,

Materials and Financialsof note. - Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Healthcare,

Consumer Cyclicalsof note. - Year to Date Winners: Communication Services,

Energy,Utilities, Technology, Financials, Healthcare, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close: CVGW YEXT of note.

- Tuesday Before The Open: ASO of note

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: PROK +25.7%, KKR +8.9%, DO +6.6%, CRWD +5.5%, ZYME +4.7%, SOPH +3.8%, GDDY +3.1%, HIVE +2.9% of note.

- Gap Down: SERV -3.9%, BITF -2.1% of note.

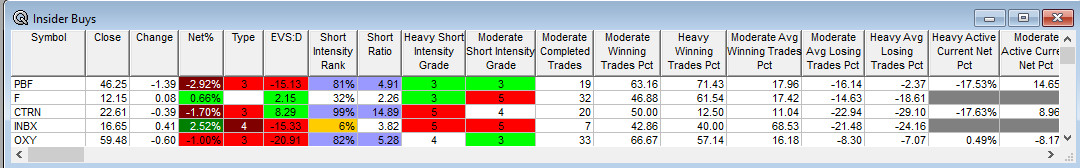

Insider Action: No stocks see Insider buying with dumb short selling. BOC and ALTI see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Monday morning. (CNBC)

- Stocks Making The Biggest Moves in Pre-Market: (CNBC)

- Market Wrap: Fallout from European Election hits Euro and Bonds. (Bloomberg)

- Bloomberg Lead Story: Macron Gambles On A Snap Election in France. (Bloomberg)

- Barron’s out positive on Nvidia (NVDA) this morning. (Barron’s)

- Apple (AAPL) World Wide Developer’s Conference is today and will show whether it ca be a force in AI. (Bloomberg)

- Bloomberg: The Big Take: New York Fed is Losing Talent and “Street Cred” Under President John Williams. (Podcast)

- Bloomberg: Odd Lots: Food makers adopt to a post Ozempic world. (Podcast)

Geopolitical:

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today in Wilmington, DE.

- President Biden returns to the White House at 6:05 p.m. EDT.

- President Biden hosts a Juneteenth Concert with the Vice President and Second Gentleman attending at 7:00 p.m. EDT.

- President Biden then delivers comment at 8:00 p.m. EDT from the conference.

Economic:

- None of note.

Federal Reserve / Treasury Speakers:

- Federal Reserve Speakers are in a blackout period through next Wednesday’s FOMC announcement.

M&A Activity and News:

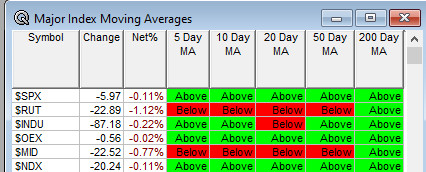

Moving Averages On Major Indexes: 70% from 73% of the moving averages are positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- BMO Software Conference

- Evercore’s Energy & Transition Technologies Summit.

- Goldman Sachs Global Healthcare Conference

- Morgan Stanley U.S. Financials Payments & Commercial Real Estate Conference

- Oppenheimer Consumer Growth & E-Commerce Conference

- Top Shareholder Meetings: CMCSA, FWONA, LSXMA, LSXMK, MNMD, MTTR

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AAPL,PEGA

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: GNFT LLY REGN

- Company Event:

- Industry Meetings:

- Apple WWD Conference

- Fulton Market Design Day

- PegaWorld iNspire

- SNMMI Meeting

- Spinal Cord Injury Investor Symposium

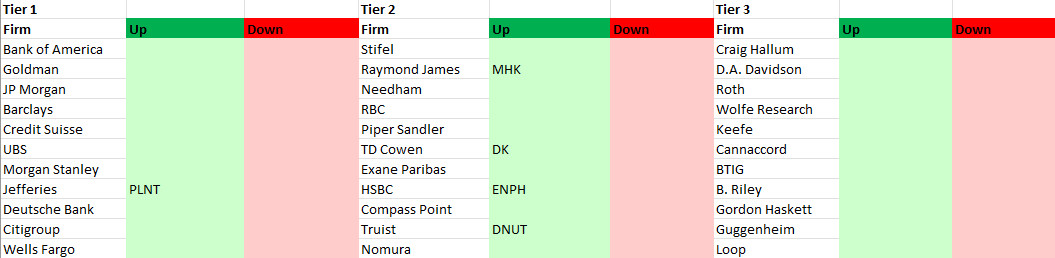

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: