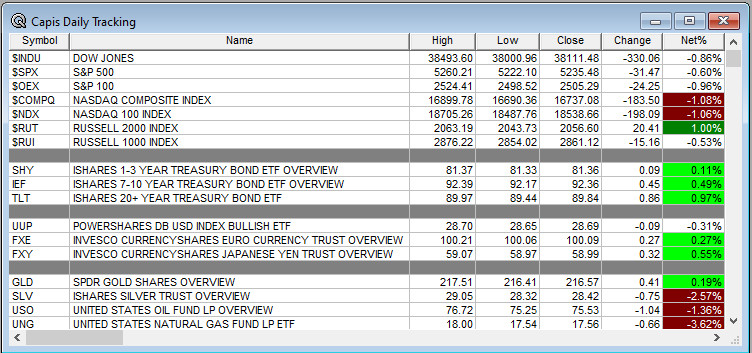

Overnight Summary: The S&P 500 closed Thursday lower by -0.60% at 5235.48 from Wednesday lower by -0.74% at 5266.95. The overnight high was hit at 5,251.75 at 4:05 p.m. EDT and the low was hit at 5234.50 at 8:55 a.m. EDT. The overnight range is 17 points. The current price is 5237.50 at 6:45 a.m. EDT down by -15.50.

- Markets are watching for PCE Core data up shortly.

- Watch yields on bonds as the 10-Year approaches 4.60%.

- Beats: GPS +0.23, ULTA +0.22, ZS +0.22, GES +0.13, MDB +0.13, PHR +0.13, VEEV+0.08, COST +0.07, HCP +0.07, AMBA +0.05, S +0.05, PD +0.04, ASAN +0.02, COO +0.02, ESTC +0.01, NTAP +0.01 of note.

- Flat: DELL and MRVL of note.

- Misses: JWN -0.17 of note.

Capital Raises:

- IPOs For The Week: KDLY

- New SPACs launched/News:

- IPOs Filed:

- Secondaries Files or Priced:

- AIG filed a 30,000,000 common stock offering of CBRG shares.

- secondary offering of 6,000,000 shares.

- filed 36,845,902 common stock.

- files a secondary offering, no specifics.

- filed up t0 13,910,991 shares of common stock.

- filed 19,265,586 shares of common stock.

- filed 133,815,727 shares of common stock.

- Common Stock filings/Notes:

- KPTI files 45,776,213 shares of common stock.

- MRAI files 3,943,334 shares of common stock.

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- GYRE files for 1,081,332 shares of common stock by selling shareholders.

- TRNS files for 292,424 shares of common stock by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- GYRE: files a mixed shelf offering

- PRLD: files a $400 mixed shelf offering.

- SHBI: files a $175 million mixed shelf offering.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers:

- GPS +20.9%, ZS +15.2%, AMBA +12.4%, ULTA +11.2%., VFC +6.2%, HTZ +4.3%,

- MDB -25.3%, DELL -18.1%, VEEV -12.5%, S -9.6%, JWN -6%, MRVL -4.2%, GES -2.4%, COST -1.7%.

- News Items After the Close:

- Jim Cramer interviewed on Mad Money. (CNBC)

- Former President Donald J. Trump was convicted of 34 counts of falsifying business records and will be sentenced on July 11th. (The Washington Post)

- Apple (AAPL) plans to overhaul Siri. (Bloomberg)

- Federal Reserve Atlanta President Raphael Bostic says no rate cut in July. (Fox)

- Senate Democrats accuse oil companies of collusion with OPEC on pricing. (Fox)

- Fed officials see inflation falling but no need to cut rates. (Reuters)

- Chinese factories slip back into contraction, hurting growth hopes. (Bloomberg)

- RTX awarded $302 mln U.S. Navy contract modification.

- Stock Splits or News:

- Dividends Announcements or News:

- Stocks Ex Div Today: TMUS UNP INFY CSX IBKR EL D ALL DOW DD GLW EBAY DOV WY TSN BAX HII HUBB LCII

- Exchange/Listing/Company Reorg and Personnel News:

- QSI appoints Former Bio-Techne (TECH) President and CEO, Chuck Kummeth, to serve as independent Chairman of the Board of Directors; effective May 27, 2024.

- LXP announces Beth Boulerice to step down as Chief Financial Officer and be succeeded by Nathan Brunner, effective September 1.

What’s Happening This Morning: Futures value reflects the change with fair value. Futures on the Dow -13, S&P 500 -2, NASDAQ -31 and Russell -5.80 at 8:10 a.m. EDT. Asia is higher and Europe is lower ex the FTSE this morning. VIX Futures are at 14.40 from 14.46 yesterday. Gold, Silver and Copper lower for a second day in a row. WTI Crude Oil is higher with Brent Crude Oil lower along with Natural Gas. US 10-year Treasury sees its yield at 4.556% from 4.596% yesterday. The U.S. Dollar is lower versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $68,271 from $67,912 lower by -0.75% this morning.

- Daily Positive Sectors: Real Estate, Utilities, Financials and Industrials of note.

- Daily Negative Sectors: Technology and Communication Services of note.

- One Month Winners: Technology, Utilities, Communication Services, Healthcare and Materials of note.

- Three Month Winners: All led by Utilities, Technology, Energy, Materials, Financials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open:

![]()

Earnings of Note This Morning:

- Beats: GCO +0.56, DOOO +0.04 of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: AMBA of note.

- Negative Guidance: GCO MDB PHR ULTA of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: GPS +23.1%, AMBA +17.8%, ZS +17.1%, ASAN +13.2%, PD +10.9%, ESTC +8.4%, ULTA +7%, HTZ +6.9%, VFC +6.7%, LRMR +4.1%, COO +3.3%, MLAB +3.2%, BPMC +3.1%, AGEN +3.1%, PHR +2% of note.

- Gap Down: MDB -25%, DELL -15.3%, S -14%, VEEV -7.8%, JWN -7.4%, DOOO -6.6%, MRVL -5%, GYRE -3.9%, PRLD -2.1%, PTON -2% of note.

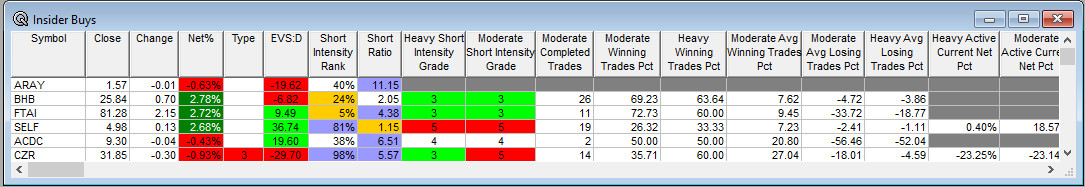

Insider Action: CZR sees Insider buying with dumb short selling. SELF sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things To Now Before The Market Opens on Friday. (CNBC)

- Bloomberg Lead Story: Billionaires are Rushing To Back Trump, Verdict be Damned. (Bloomberg)

- Stocks Making The Biggest Moves: . (CNBC)

- Market Wrap: U.S. Futures dip with a key focus on inflation data. (Bloomberg)

- Japan confirms first currency intervention since 2022 wit h$62 billion in spending. (CNBC)

- Dallas Federal Reserve President Lorrie Logan says Fed policy may not be as restrictive as people think. (Bloomberg)

- Telsa (TSLA) looks to recall 125,000 cars over seat belt issues. (CNBC)

- META now has 40 million younger users on Facebook in the U.S. and Canada with reels watch time up 80%. (CNBC)

- Barron’s out positive on ABNB. (Barron’s)

- Bank of America CEO says that consumers and businesses have turned cautious on spending. (CNBC)

- Bloomberg The Big Take: Trump Guilty On 34 Counts. (Podcast)

- The NY Times Daily: Guilty. (Podcast)

- Marketplace: Bytes: Week In Review -OpenAI’s workplace expansion, data center power woes and the 80’s on Tik Tok. (Podcast)

- Wealthion: Consumers, Inflation and the Great Wealth Divide. (Podcast)

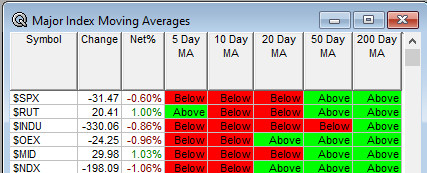

Moving Average Update: Score at 46% unchanged from yesterday.

Geopolitical:

- President’s Public Schedule:

- There is no Daily Briefing scheduled for today.

- President Biden welcomes the Kansas City Chiefs to the White House and then returns to Rehoboth Beach, Delaware.

Economic:

- April Personal Income is due out at 8:30 a.m. EDT and is expected to fall to 0.3% from 0.5%.

- April PCE Core is also due out at 8:30 a.m. EDT and is expected to remain at 0.3%.

- May Chicago PMI is due out at 9:45 a.m. EDT and is expected to rise to 41.0 from 37.90.

- Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve Atlanta President Raphael Bostic speaks at 6:15 p.m. EDT.

M&A Activity and News:

- None of note.

Meeting & Conferences of Note:

- Sellside Conferences:

- Top Shareholder Meetings: ALKS, AMGN, DOOO, ECO, GES, IOVA, LOW, LSTA

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AFMD, ERJ, IONS

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- ASCO.

- American Society of Clinical Psychopharmacology Meeting

- Consortium of Multiple Sclerosis Centers Annual Meeting

- KetoCon Conference

- National Lipid Association Scientific Sessions

- Oncology Innovation Forum

- Orthopedic Research Society Tendon Conference

- Psych Congress Elevate

- Spinal Cord Injury Investor Symposium

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

- Upgrades WYNN BILI

- Downgrades None of note.