Overnight Summary: The S&P 500 closed Wednesday lower by -0.74% at 5266.95 from Tuesday higher by 0.02% at 5306.04. The overnight high was hit at 5,289.25 at 4:05 p.m. EDT and the low was hit at 5250.50 at 1:45 a.m. EDT. The overnight range is 39 points. The current price is 5264 at 6:20 a.m. EDT down by -21.

- Markets are watching for PCE Core data tomorrow.

- Watch yields on bonds as the 10-Year approaches 4.60%.

- Beats: AI +0.19, NTNX +0.11, OKTA +0.11, PSTG +0.11, CRM +0.07, AEO +0.06, NCNO +0.05, SSYS +0.05, A +0.03, CRDO +0.02, HPQ +0.01, PATH +0.01 of note.

- Flat: None of note.

- Misses: CPRI -0.25, IMVT -0.08 of note.

Capital Raises:

- IPOs For The Week: KDLY

- New SPACs launched/News:

- IPOs Filed:

- Secondaries Files or Priced:

- ATIF filed 2,290,000 ordinary shares.

- BRKR secondary offering of 6,000,000 shares.

- GNS filed 36,845,902 common stock.

- HESM files a secondary offering, no specifics.

- PAPL filed up t0 13,910,991 shares of common stock.

- SITC filed 19,265,586 shares of common stock.

- TFPM filed 133,815,727 shares of common stock.

- Common Stock filings/Notes: .

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- NVFY files for 570,000 share common stock offering by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:.

- Rights Offering:

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers:

- PSTG +6.3%, AI +5.7%, SRPT +4.9%, OKTA +3%, HPQ +2.6% .

- PATH -30%, CRM -16.4%, A -13.2%, NTNX -9.9%, AEO -7.3%.

- News Items After the Close:

- Rising bond yields weigh on stocks. (WSJ)

- Saudi Arabia to launch a $10 billion sale of Aramco stock. (Bloomberg)

- UiPath’s CEO exits abruptly, big miss on guidance causes stock to drop 30%. (MarketWatch)

- Nutantix (NTNX) offers weaker guidance and stock drops -12%. (MarketWatch)

- Nelson Peltz sells Walt Disney (DIS) stake after losing proxy fight. (Bloomberg)

- Salesforce (CRM) tumbles on earnings miss and first revenue miss since 2006. (MarketWatch)

- Jim Cramer interviewed Chipotle (CMG) CEO Brian Niccol on Mad Money. (CNBC)

- LDOS, PLTR RTX all pick up new military contracts.

- Stock Splits or News:

- HONE approves a share repurchase program for up to 2.22 mln shares of common stock.

- CMPR announces in SEC filing that it has authorized a share repurchase program for up to $200 mln

- Dividends Announcements or News:

- initiates a quarterly dividend of $0.075.

- Stocks Ex Div Today: HD QCOM GS VLO XYL CHE SSTK

- Exchange/Listing/Company Reorg and Personnel News:

- FF CEO Tom McKinlay to retire, effective September 30.

- AVD COO Bob Trogele to retire, effective May 31.

What’s Happening This Morning: Futures value reflects the change with fair value. Futures on the Dow -330, S&P 500 -21, NASDAQ -60 and Russell +2.71. Asia is lower and Europe are higher this morning. VIX Futures are at 14.46 from 13.84 from a day ago. Gold, Silver and Copper lower. WTI Crude Oil and Brent Crude Oil lower with Natural Gas higher. US 10-year Treasury sees its yield at 4.596% from 4.5639% yesterday. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $67,912 from $67,875 lower by +0.80% this morning.

- Daily Positive Sectors: None of note.

- Daily Negative Sectors: Materials, Energy, Industrials and Utilities of note.

- One Month Winners: Technology, Utilities, Communication Services, Healthcare and Materials of note.

- Three Month Winners: All led by Utilities, Technology, Energy, Materials, Financials and Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Utilities, Technology, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

- Friday Before The Open:

![]()

Earnings of Note This Morning:

- Beats: RY +0.90, BURK +0.37, BBY +0.12, FL +0.10, DG +0,07, ROIV +0.07, BIRK +0.03, CAL +0.02, HRL +0.02 of note.

- Flat: None of note.

- Misses: FRO -0.24, SPTN -0.01 of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: AI +13.4%, PSTG +11.1%, BIRK +10.8%, RRGB +10.7%, AMSC +8.9%, CM +7.1%, RY +6%, OKTA +5.9%, HPQ +5.8%, SRPT +4.9%, ISSC +3%, PLTR +2.8%, SSYS +2.2%, NOAH +2.1% of note.

- Gap Down: PATH -30%, CRM -15.7%, A -13%, NTNX -11.3%, AEO -8.5%, BRKR -5.3%, IMVT -5.3%, DOMO -4.7%, CNC -3.5%, HESM -3.1%, CPRI -2.5%, SITC -2.2% of note.

Insider Action: COR EVBN TMCI see Insider buying with dumb short selling. GHC sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things To Now Before The Market Opens on Thursday. (CNBC)

- Bloomberg Lead Story: UBS Has Management Shakeup. (Bloomberg)

- Stocks Making The Biggest Moves: . (CNBC)

- Market Wrap: U.S. stocks drop as high yields sour mood. (Bloomberg)

- Foot Locker (FL) shows signs of life. (CNBC)

- Best Buy (BBY) sees sluggish consumer electronics demand. (CNBC)

- Kohl’s (KSS) drops 20% on huge earnings miss. (CNBC)

- Bloomberg The Big Take: Scarlet Johansson and opting out of AI. (Podcast)

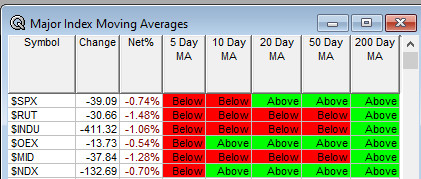

Moving Average Update: Score at 46% from 66%.

Geopolitical:

- President’s Public Schedule:

- There is a Daily Briefing scheduled today for 8:30 a.m. EDT.

- President Biden heads to the beach today as he enjoys a little vacation time at Rehoboth Beach, Delaware.

Economic:

- Q1 GDP (Second Estimate) are due out at 8:30 a.m. EDT and expected to fall to 1.50% from 1.60%.

- April Pending Home Sales are then due out at 10:00 a.m. EDT and expected to drop to 1.0% from 3.4%.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

- Weekly Crude Oil Inventories are due out at 11:00 a.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve New York President John Williams speaks at 12:05 p.m. EDT.

- Federal Reserve Dallas President Lorrie Logan speaks at 5:00 p.m. EDT.

M&A Activity and News:

- .

Meeting & Conferences of Note:

- Sellside Conferences:

- Bank of America Emerging Markets Debt & Equity Conference

- Bernstein Strategic Decisions Conference

- Cowen Technology Conference

- Deutsche Bank Financial Services Conference

- Goldman Sachs Global Semiconductor Conference

- Jefferies Software Conference

- Key Bank Industrials & Basic Materials Conference

- Raymond James Chicago Bus Tour

- TD Cowen Oncology Innovation Summit

- Wells Fargo West Coast MedTech Tour

- Top Shareholder Meetings: ABVX, ANTE, CAKE, COLM, CONN, CRSP, IRM, KOP, LI, LODE, LU, MDXH, RBLX,

SSNT, STRW, VOXR, WNS, WULF, WWR, XFLT - Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AXS, ICLR, JBLU, LTH, LVO, NET, XYL

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: BHVN ARWR

- Company Event:

- Industry Meetings:

- International Society for Cell & Gene Therapy Meeting.

- Leerink Partners Healthcare Crossroads Conference

- The Mining Investment Event

- Spinal Cord Injury Investor Symposium

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

- Upgrades FWONA PYPL IGT DDOG ALHC

- Downgrades GNRC FDS EC