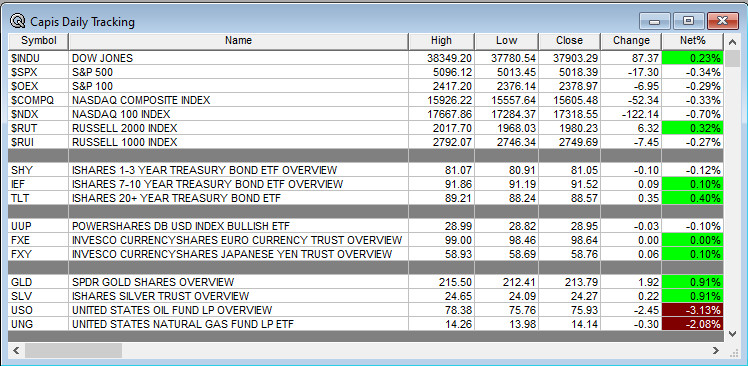

Overnight Summary: The SP 500 closed Wednesday lower by -0.34% at 5018.39 from Tuesday lower by -1.57% at 5035.69. The overnight high was hit at 5,082.50 at 4:10 a.m. while the overnight low was hit at 5045 at 4:05 p.m. EDT. The range overnight is 37 points as of 6:30 a.m. EDT. Currently, the S&P 500 is higher by +30 points at 6:30 a.m. EDT.

- Factory Orders and several weekly data points along with Challenger Gray Job Cuts data.

- Beats: MKL +57.50, ALL +1.20, VMI +1.01, CVNA +0.90, SRPT +0.72, BZH +0.35, CW +0.25, NOVA +0.25, CHRW +0.23, FSLR +0.20, MGM +0.18, QRVO +0.18, MPWR +0.15, PAYC +0.14, AIG +0.11, HLF +0.11, QCOM +0.11, SFM +0.11, AFL +0.08, PPC +0.08, CTVA +0.07, AFG +0.06, ZG +0.06, EBAY +0.05, of note. (Greater than +0.05)

- Flat: of note.

- Misses: SIGI -0.53, ANSS -0.53, QTWO -0.50, CAR -0.27, APA -0.18, AEIS -0.09, DASH -0.03, MOS -0.01, MET -0.01, FORM -0.01 of note.

Capital Raises:

- IPOs For The Week: ALEH KMCM NNE RAN ZENA

- New SPACs launched/News:

- Secondaries Priced:

- TFFP prices $4.8 million offering.

- Notes Priced of note:

- Common Stock filings/Notes:

- XXII files 1,850,000 shares of common stock with up to 7,290,012 shares of common stock issuable on the exercise of warrants.

- Direct Offering:

- files a $15M direct offering.

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes: .

- Mixed Shelf Offerings:

- BLZE files a $200 million mixed-shelf offering

- AMKR files a mixed-shelf offering

- APA files a mixed-shelf offering

- INMB files a mixed-shelf offering

- KAVL files a mixed-shelf offering.

- LSTA files a $150 million mixed-shelf offering.

- TRNR files a $25 million mixed-shelf offering.

- Tender Offer:

- Private Placement of Public Entity (PIPE)

- Rights Offering:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

- Movers of Note:

- CVNA +35.4%, ENVX +21.4%, VMI +10.2%, FORM +6.3%, UPWK +5.3%, QCOM +4.5%

- FSLY -27.4%, RELY -21.3%, FRSH -18.6%, DASH -14.4%, ETSY -12.9%, QRVO -10.6%, PAYC -10.5%, ZG -8.3%

- News Items After the Close:

- Exxon (XOM) makes deal with FTC, Pioneer deal to close. (CNBC)

- Carvana (CVNA) shares spike 30% as car retailer posts record quarter. (CNBC)

- Stocks making the biggest move in after hours: EBAY QCOM DASH FRSH CVNA ETSY QRVO. (CNBC)

- IAC to join the S&P 600 on Monday replacing AEL which is buying bought by BNRE.

- Boeing (BA) wins a $458 million contract with the Navy.

- Take Two Interactive (TTWO) to shut two studios in conjunction with mass layoff. (Bloomberg)

- Delays in 20-Fs NTCO PROC.

- Buyback Announcements or News

- POOL increases buyback by $600 M.

- Met Life (MET) announces a new $3 billion share repurchase authorization.

- Exchange/Listing/Company Reorg and Personnel News

- Kemper (KMPR) names Gerald Laderman as the Chairman of the Board.

- Freshworks (FRSH) names Dennis Woodside as CEO and President.

- Unity (U) names Matthew Bromberg as CEO and President.

- Gold Fields (GFI) CFO Paul Andy Schmidt to retire.

- Peloton (PTON) CEO McCarthy stepping down.

- Stock Splits or News:

- .

- Dividends Announcements or News:

- POOL increase their dividend from $1.10 to $1.20.

- BCO ups dividend by 10% to $0.2425 a share.

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Utilities, Communication Services, Healthcare and Financials of note.

- Daily Negative Sectors: Energy, Technology and Consumer Defensive of note.

- One Month Winners: Communication Services, Energy and Utilities of note.

- Three Month Winners: All but Real Estate led by Energy, Industrials or Communication Services of note.

- Six Month Winners: Communication Services, Technology, Industrials and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclicals of note.

- Year to Date Winners: Communication Services, Energy, Technology, Financials, Industrials, and Technology, Consumer Defensive of note.

(WSJ – Edited by QPI)

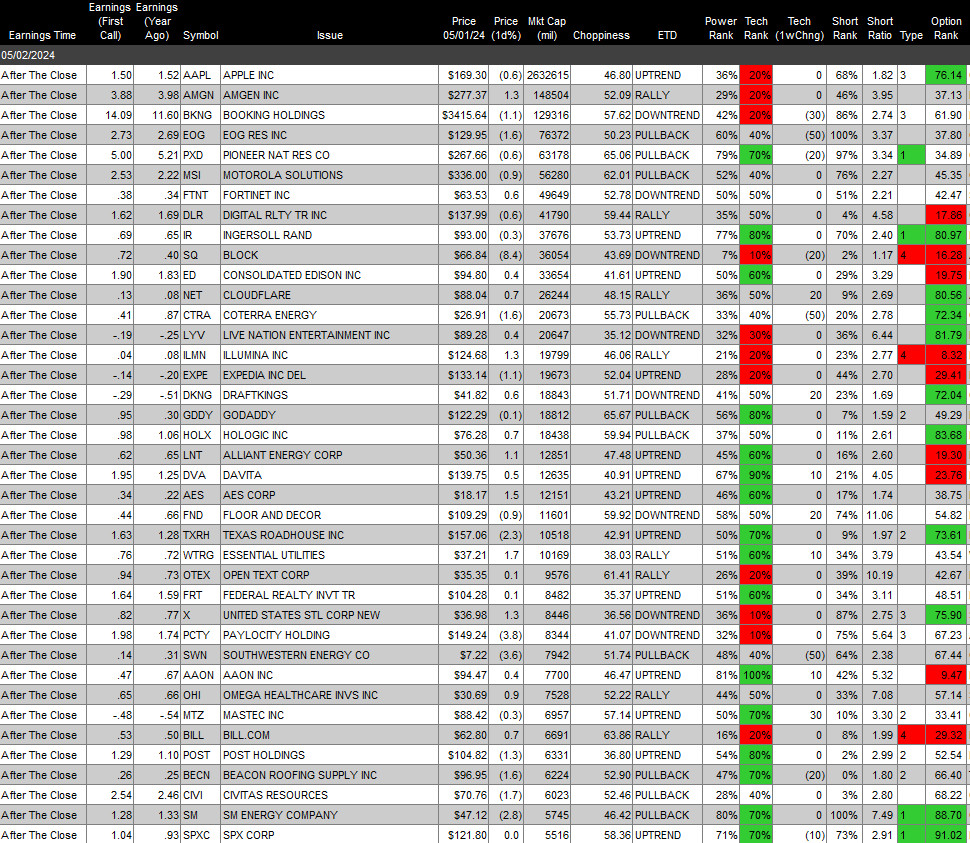

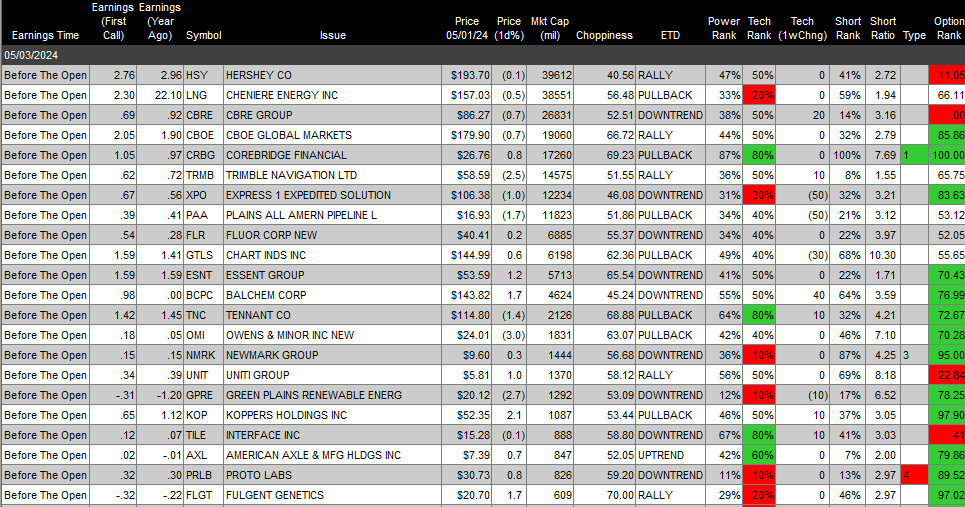

Upcoming Earnings Of Note:

- Thursday After the Close: ($6 Billion Market Cap Cut Off)

- Friday Before the Open: (No Market Cap Cut Off)

Earnings of Note This Morning:

- Beats: CMI +8.97, MRNA +0.49, CYBR +0.47, PH +0.39, MCO +0.36, HII +0.33, CI +0.25, BDX +0.20, BWA +0.16, K +0.16, CAH +0.13, SO +0.13, ULCC +0.09, LAMR +0.07, ZBH +0.07, ITT +0,06 of note. (Greater than +0.05)

- Flat: None of note.

- Misses: BHC -0.85, LNC -0.69, PENN -0.17, PTON -0.09, APPN -0.09, W -0.01, BTU -0.01 of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: CRTO HWM LNTH SSTK of note.

- Negative Guidance: CMI LAMR ARW PTON of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: of note.

- Gap Down: of note.

Insider Action: No stocks sees Insider buying with dumb short selling. No stocks see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens On Thursday. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves: (CNBC)

- Bloomberg Lead Story: Huawei Secretly Backs U.S. Research, Awarding Millions in Prizes. (Bloomberg)

- Hamas rejects latest cease fire offer. (NYT)

- The Bank of Japan executed its second intervention in the price of the Yen (Bloomberg)

- U.S. Stocks gain as rate relief sets in: Markets Wrap. (Bloomberg)

- Chubb (CB) will have to make a $350 million payout on Baltimore bridge collapse. (WSJ)

- Moderna (MRNA) beats estimates on cost cutting measures. (Bloomberg)

- Wayfair (W) losses narrow after layoffs even as sales dip. (CNBC)

- NIO shares up 20% as April EV deliveries doubled in April. (CNBC)

- Novo-Nordisk (NVO) beats profit estimates as sales of weight loss drug Wegovy double. (CNBC)

- Bloomberg: The Big Take: Record immigration meets housing shortage. (Podcast)

Moving Average Update: Score remains at 20%.

Geopolitical:

- President’s Public Schedule:

- President Biden receives the Daily Briefing at 9:00 a.m. EDT.

- President Biden heads to Charlotte, NC to meet with families of law officers killed in the line of duty at 12:50 p.m. EDT.

- President Biden then heads to Wilmington, NC to give a speech on the infrastructure rebuild at 4:30 p.m. EDT. Heads back to D.C. after the speech.

Economic:

- March Factory Orders are due out at 10:00 a.m. EDT and expected to rise to 1.60% from 1.4%.

- Challenger Gray Job Cuts out at 7:30 a.m. EDT.

- Weekly Jobless Claims out at 8:30 a.m. EDT.

- Weekly Natural Gas Inventories are out at 10:30 a.m. EDT.

Federal Reserve / Treasury Speakers:

- None of note but some may pop up today as first day out of the blackout period.

M&A Activity and News:

- None of note.

Meeting & Conferences of Note:

- Sellside Conferences:

- None of note.

- Top Shareholder Meetings: AKR BCE BSX CNQ CNX CSTM DTE ECL EHC EMN FTS GLW GOOD GTE HUN KMB LMT OXY PRGO RIO UPS WYNN

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: FLEX TEAM

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- Austin Technology Workshop

- BC Capital Markets US Banks Fixed Income Investor Symposium

- SBW Summit

- Spinal Cord Injury Investor Symposium

- THRIVELIVE 2024

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: