Overnight Summary & Early Morning Trading: The S&P 500 closed Wednesday higher by 0.61% at 6086.49 from Tuesday higher by 0.05% at 6049.88. The overnight high was hit at 6097.75 at 4:05 p.m. EDT and the low was hit at 6091 at 8:00 p.m. EDT. The overnight range is 6 points. The current price is 6096 at 6:55 a.m.

Executive Summary: Fed Chairman Powell spoke yesterday at 1:45 p.m. and any time he talks of late stocks drop so expect a drop later afternoon.

Key Events of Note Today:

- Economic releases of note include Factory Orders and Weekly Jobless Claims and Natural Gas Inventories.

- 4-Week Bill Auction at 11:30 a.m. EDT.

Daily Chart Request: Want to see an Erlanger Chart? Simply email us at [email protected].

Next up is News Corp (NWS). The stock is mixed technically with a rank of 40% but has been strong technically recently. Short Intensity is high at 64% with the Short Ratio at 4.90. This morning the stock is at $32.48. What to Do: We would nibble on the stock as a potential Short Squeeze. To Short or Not To Short: We are not okay with being short or shorting this name it could become a short squeeze.

Notable Earnings Out After The Close

- Beats: PVH +0.44, FIVE +0.25, VRNT +0.11, SNPS +0.10, NCNO +0.05, AEO +0.02, CXM +0.02 of note.

- Flat: None of note.

- Misses: AVAV -0.29, GEF -0.25, S -0.01, CHPT -0.01 of note.

- IPOs For The Week: ALEH, CJMB, DGX, FCHL, FTRK, HIT, JUNS,

LSE, NAMI, NTCL, YSXT, ZSPC - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- MYO announces proposed public offering of common stock

- SMTC announces proposed public offering of $400 mln of common stock

- Notes Priced:

- AES Pricing of $500 Million Fixed-to-Fixed Reset Rate Junior Subordinated Notes in Public Offering

- TPR: Prices Senior Unsecured Notes Offering

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- AEYE announces launch of secondary offering of common stock by selling stockholders.

- FFWM files for 70,258,815 share common stock offering by selling shareholders.

- CPOP: Form F-3.. 10,000,000 Class A Ordinary Shares Offered by Selling Shareholders

- Mixed Shelf Offerings:

- SYBT files mixed securities shelf offering.

- AXTI files $35 million mixed securities shelf offering.

- SMTC CPOP: Form F-3.. 10,000,000 Class A Ordinary Shares Offered by Selling Shareholders

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: VRNT +19.4%, FIVE +12%, CHPT +10.2%, CXM +6%, IDT +5.6%, ASO +3.6%, OOMA +2% of note.

- Movers Down: NCNO -13.4%, S -13.4%, AEYE -12.4%, AEO -12.3%, PVH -6.5%, AVAV -6.4%, GEF -6.3%, SNPS -6.3%, MYO -6.4%, SMTC -3.2%, of note.

News After The Close:

- COST reports adjusted comps of +4.9% for November.

- ANF announces new multi-year, franchise partnership with Myntra Jabong India Private, Ltd., expanding reach of brands into India.

- CBOE reports Trading Volume for November 2024. (Press Release)

- PAC reports in November 2024 a passenger traffic increase of 1.8% compared to 2023.

- GOOGL ticking lower on report that key leaders behind NotebookLM are leaving to create their own startup. (Tech Crunch)

- ATEK enters into a definitive business combination agreement with Ace Green Recycling.

- RTX awarded $1.31 bln U.S. Navy contract modification.

- OPEC + likely prolonging oil cuts for Q1. (Reuters)

- 10-K “Delays – of note.

Buybacks or Repurchases:

- ASO announces new $700 million share repurchase program.

Exchange/Listing/Company Reorg and Personnel News:

- FIVE names Winnie Park as CEO.

- CSV announces appointment of John Enwright as Senior Vice President, Chief Financial Officer and Treasurer, effective January 2, 2025.

- OGE appoints Charles Walworth as CFO, effective Dec 4.

Dividends Announcements or News:

- Stocks Ex Div Today: QCOM BLK ELV SRE NXPI KIM MOS HRB JXN ONB SLM DNB LANC HWC AMBP SBLK LZB AAT ARIS LB RYI

- Stocks Ex Div Tomorrow: BAC PEP BKNG TT WM AJG GM NDAQ KMB AME NTRS GPC TPR GLPI CHRW TAP CHDN ORI KNX MLI BPOP

- COFS increases quarterly cash dividend to $0.28/share from $0.27/share.

- WSR increases quarterly cash dividend 9% to $0.045/share from $0.0413/share.

- DIS declares a cash dividend of $1.00 per share; will be paid in two installments of $0.50 per share.

- BEN increases quarterly cash dividend to $0.32/share from $0.31/share.

- BANX declares a $0.20/sh special cash distribution and a regular distribution of $0.45/share.

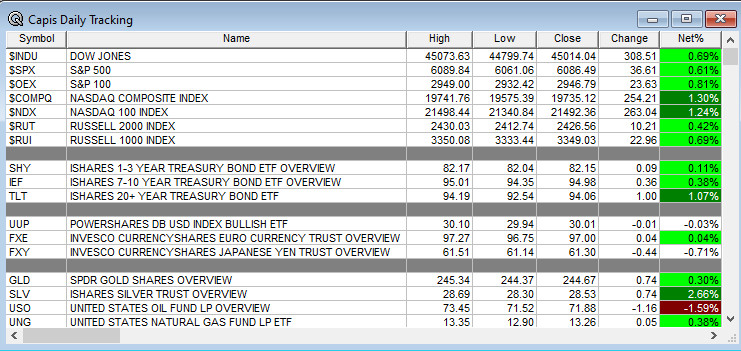

What’s Happening This Morning: Futures S&P 500 -3.50, NASDAQ -15, Dow Jones -35 and Russell 2000 -1.26. Europe is higher ex the FTSE. Asia is higher ex Australia. Bonds are at 4.211% from 4.261% on the 10-Year. Crude Oil is higher and Brent is lower with Natural Gas higher. Gold, Silver and Copper are lower for a third day in a row. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $103,157 from $95,905 yesterday morning higher by $4316 with futures +4.36% this morning.

- Daily Positive Sectors: Technology, Consumer Cyclical, Communication Services, Industrials of note.

- Daily Negative Sectors: Energy, Materials, Real Estate, Financials of note.

- One Month Winners: Consumer Cyclicals, Financials, Industrials, Energy and Utilities of note.

- Three Month Winners: Consumer Cyclicals, Financials, Communication Services, Industrials, Utilities, Consumer Defensive and Technology of note.

- Six Month Winners: Financials, Real Estate, Utilities, Consumer Cyclical and Technology of note.

- Twelve Month WinnerMOmONTs: Financials, Technology, Industrials, Utilities and Communication Services note.

- Year to Date Winners: Technology, Financials, Utilities, Communication Services and Industrials of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

Thursday After the Close:

Friday Before The Open: GCO

Notable Earnings of Note This Morning:

- Beats: SAIC +0.45, +0.14, CM +0.02 of note.

- Flat: HRL

- Misses: BMO -0.49, GMS -0.17, CAL -0.13, SIG -0.07, DG -0.05, PDCO -0.02 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: of note.

Advance/Decline Daily Update: The A/D Line has been improving for the last two weeks and now has stalled.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: VRNT +21.6%, FIVE +14.1%, NNOX +10.8%, CHPT +9%, IDT +6.1%, MRUS +5.2%, CXM +4.7%, CM +3.7%, LUV +3.5%, WSR +3%, JANX +2.5%, ASO +2.3%, CSV +2.1%, FUFU +2%, FOUR +2%.

- Gap Down: NCNO -17.9%, S -15.1%, AEO -15%, CAL -10.5%, AEYE -9.4%, PVH -8.2%, MESO -7.9%, AVAV -7.6%, SNPS -7.6%, MYO -6.7%, NKTX -4.8%, CSIQ -4.4%, SMTC -3.8%, OOMA -3.8%, AS -3.5%, GEF -2.2%, CRVS -2.1.,

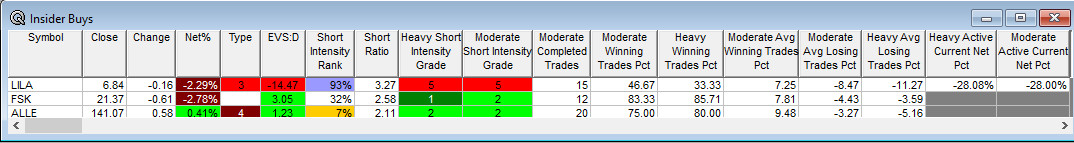

Insider Action: LILA sees Insider buying with dumb short selling. No names see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Lead Story on Bloomberg: Bitcoin Clears $100,000 on SEC Pick. (Bloomberg)

- 5 Things To Know Before The Market Opens. (CNBC)

- Stocks Making The Biggest Moves: Check back. (CNBC)

- Market Wrap: US Futures pause after record (Bloomberg)

- Weekly Mortgage Applications were out yesterday and rose 2.8%.

- Bitcoin above $100,000 and Crypto stocks on fire. (CNBC)

- OPEC+ meets to discuss latest quotas and will delay oil production increases. (CNBC)

- Bloomberg: The Big Take – The quiet rise of highly regulated home insurance. (Podcast)

Economic:

- October Factory Orders is due out at 10:00 a.m. EDT and came in last month at -0.5% with no estimate for this month.

- Weekly Crude Oil Inventory update is out at 10:30 a.m. EDT.

Geopolitical:

- Federal Reserve Richmond President Thomas Barkin speaks at 11:30 a.m. EDT.

- President Biden receives the Daily Brief at 10:00 a.m. EDT.

- President Biden lights the National Christmas Tree at 6:00 p.m.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

- None of note.

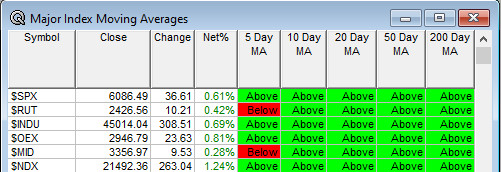

Moving Averages On Major Equity Indexes: Moves from 90% to 93%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Bank of America Clean Energy Symposium

- Barclays Eat Sleep Play Shop Conference

- Citi Global Healthcare Conference

- Evercore ISI HealthConX Conference

- Goldman Sachs Industrials and Materials Conference

- Goldman Sachs Energy Clean Tech & Utilities Conference

- Jefferies Renewables & Clean Energy Conference

- Morgan Stanley Global Consumer & Retail Conference

- Needham Growth Conference

- Piper Sandler Healthcare Conference

- Roth Annual Sustainability Private Capital Event

- Sidoti & Co. Small Cap Conference

- UBS Global Technology & AI Conference

- UBS Industrials and Transportation Conference

- Wolfe Research Small and Mid-Cap Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Analyst, Investor Meetings: CGON, CSGP, NVX, PRCH, SHLS, TARA, TSCO

- Shareholder Meetings: CCEC, CGON, HOLX, HYPR, RDI, SKLZ, TARA, THCP, VIPS

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- CGON: Data Presentation for Cretostimogene

- Company Event: None of note.

- Industry Meetings or Events:

- AMZN re:Invent Conference

- Nasdaq London Investor Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: DEO

Downgrades: ROP PFG OTIS NAUT MRVI F CNX AMAT