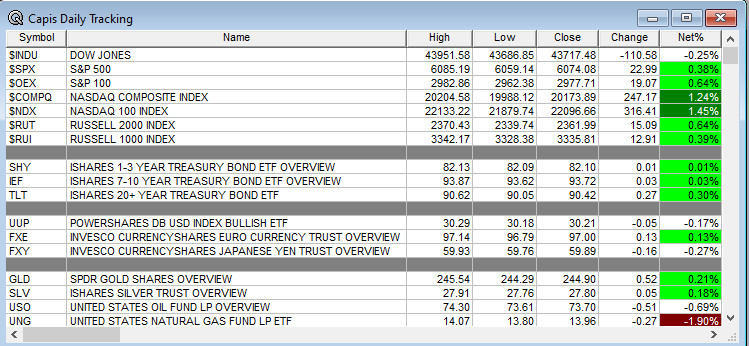

Overnight Summary & Early Morning Trading: The S&P 500 closed Monday higher by 0.38% at 6074.08 from Friday slightly lower at 6051.09. The overnight high was hit at 6152.75 at 11:25 p.m. EDT and the low was hit at 6132.50 at 3:45 a.m. EDT. The overnight range is 20 points. The current price is lower at 6:45 a.m by -0.26% down -16.00.

Key Events of Note Today:

-

- Key economic releases include Retail Sales, Industrial Production and NFIB Housing Market.

- 20-Year Bond Auction at 1:00 p.m. EDT.

Notable Earnings Out After The Close

- Beats: MITK +0.18 of note.

- Flat: None of note.

- Misses: CMP -0.82 of note.

- IPOs For The Week: ALEH, FTRK, HIT, MIMI, MTRS, NTCL, PHH, YSXT

- New IPOs/SPACs launched/News: None of note.

- IPOs Filed/Priced: None of note.

- Secondaries Filed or Priced:

- EVGO to offer for sale in an underwritten public secondary offering 23,000,000 shares of Class A common stock.

- Notes Priced: None of note.

- Direct Offering: None of note.

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- Mixed Shelf Offerings:

- PIPE:

- AFRM to offer $750 million aggregate principal amount of Convertible Senior Notes due 2029 in a private offering.

- Convertible Offerings & Notes Filed:

- WBA to offer and sell debt securities offering in one or more series.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Last Week:

- Movers Up: MITK +18.2%, RICK +8.4%, AMTM +3.6%, of note.

- Movers Down: EVGO -17.7%, MAMA -17%, RCAT -10.8%, CMP -6.3%, MRUS -5%, CMTL -3% of note.

News After The Close:

-

- 10-K Delays – CMTL ESOA of note.

- RMAX national housing report for November 2024. (Press Release)

- FDA issues to Johnson & Johnson (JNJ) Complete Response Letter for the BLA for a fixed combination of amivantamab and recombinant human hyaluronidase for subcutaneous administration. (FDA Release)

- Merck (MRK) provides update on KeyVibe and KEYFORM clinical development programs evaluating investigational Vibostolimab and Favezelimab fixed-dose combinations with Pembrolizumab. (Press Release)

- BDX resolves previously disclosed SEC investigation.

- New Jersey Division of Gaming Enforcement reports $119 mln in sports betting revenue for November, a 24.1% increase yr/yr.

- NUE guides Q4 EPS below consensus.

Buybacks

- CENT authorizes increase of $100.0 mln in stock repurchase plan.

- EBAY authorizes an incremental $3.0 billion under its current stock repurchase program in addition to the remaining amounts previously authorized.

Exchange/Listing/Company Reorg and Personnel News:

- Performant Healthcare (PHMT) announces it will change its ticker to PHLT effective as of market open on Wednesday, Dec 18.

- GDRX appoints Wendy Barnes as President and CEO, effective January 1, 2025.

- HURN appoints Hugh E. Sawyer as independent, non-executive Chairman of the Board, effective January 1, 2025; to succeed John McCartney.

- Bruce Cozadd to retire as CEO of JAZZ, but remain as Chair of the Board; reaffirms FY24 revenue guidance.

- CEO Brian Evens has given notice of his retirement from GEO.

- CEO Melinda Whittington of LZB has been elected to serve additionally as Chair of the Board, effective Dec 11.

- R appoints John Diez as COO, effective Jan 1; Cristina Gallo-Aquino promoted to succeed John Diez as CFO.

Dividends Announcements or News:

- Stocks Ex Div Today: AIG, DTE, EMN, EXR, HES, ICE, IRM, LDOS, MRK, META, PARA, PLD, REG, DIS, WRB

- Stocks Ex Div Monday: CRM TEF HBAN ES LAMR SUZ CPT BRFS ASO TR RNST UPBD CSGS

- SFBS increases quarterly cash dividend 12% to $0.335/share from $0.30/share.

- Blue Owl Capital Corporation III (ODBE) announces a special cash dividend of $0.52/share payable in cash on or before January 31, 2025 to shareholders of record as of December 31.

- GECC declares special cash distribution of $0.05 per common share; raises quarterly dividend by 5.7% to $0.37/share.

- PNR increases quarterly cash dividend by 9% to $0.25/share from prior amount of $0.23/share.

- WM increases quarterly dividend from $0.75/sh to $0.825/sh; co also has temporarily suspended share repurchases.

What’s Happening This Morning: (as of 8:00 a.m. EDT) Futures S&P 500 -29, NASDAQ -78, Dow Jones -228 and Russell 2000 . Europe is lower with Asia is lower ex Australia. Bonds are at 4.43% from 4.369% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold, Silver and Copper lower. The U.S. Dollar is higher versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $107,103 from $103,513 higher by $931 up +0.89%.

- Daily Positive Sectors: Consumer Cyclical, Communication Services, Technology and Financials were higher yesterday.

- Daily Negative Sectors: Energy, Materials, Healthcare and Utilities of note.

- One Month Winners: Consumer Cyclicals, Financials, Industrials, Energy and Utilities of note.

- Three Month Winners: Consumer Cyclicals, Financials, Communication Services, Industrials, Utilities, Consumer Defensive and Technology of note.

- Six Month Winners: Financials, Real Estate, Utilities, Consumer Cyclical and Technology of note.

- Twelve Month Winners: Financials, Technology, Industrials, Utilities and Communication Services note.

- Year to Date Winners: Technology, Financials, Utilities, Communication Services and Industrials of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close: of note.

- Wednesday Before The Open: None of note with no time set for CALM NEOG on Tuesday.

Notable Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: none of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: CMP of note.

Advance/Decline Daily Update: SPX A/D is mixed after last week’s action.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

- Gap Up:

- Gap Down:

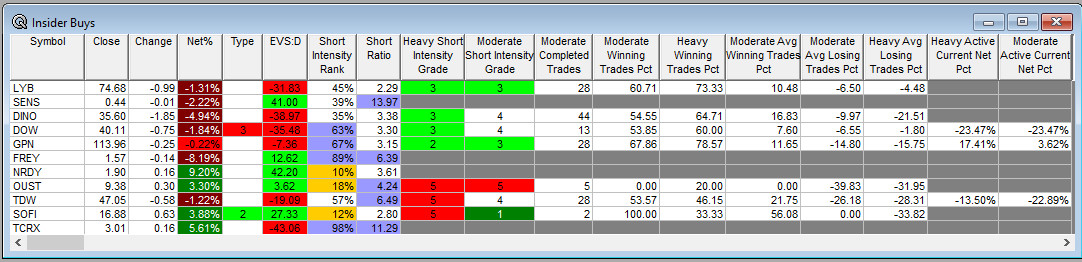

Insider Action: GPN GPN see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Lead Story on Bloomberg: Canadian PM Trudeau Teeters After Finance Minister Resigns. (Bloomberg)

- Market Wrap: Stocks retreat as traders await the Fed. (Bloomberg)

- 5 Things To Know Before The Market Opens. (CNBC)

- Stocks Making The Biggest Moves Pre-Market: Check back later for update. (CNBC)

- Ukraine killed a senior Russian General in bombing. (WSJ)

- Lawmakers still negotiating government funding details ahead of Friday’s deadline amid disagreements over farm aid. (Washington Post)

- President-elect Trump met with TikTok CEO Shou Zi Chew. (CNBC)

- Nvidia (NVDA) falls deeper into correction territory while Broadcom rallies. (CNBC)

- NY Judge denies President-elect Trump’s bid to throw out New York conviction for falsifying business documents. (NYT)

Economic:

- November Retail Sales is due out at 8:30 a.m. EDT and expected to rise to 0.5% from 0.4%.

- November Industrial Production is due out at 9:15 a.m. EDT and expected to rise to 0.3% from 0.30%.

- December NFIB Housing Market is due out at 10:00 a.m. EDT and is expected to rise to 47 from 46.

Geopolitical: (Watch our Twitter feed, Bullet86, for any impromptu appearances)

- President Biden will receive the Daily Briefing at 2:00 p.m. EDT.

- President Biden heads to Delaware at 9:10 p.m. EDT.

M&A Activity and News: None of note.

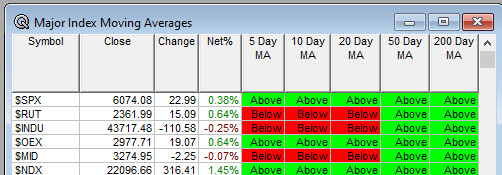

Moving Averages On Major Equity Indexes: Moves back to 70% from 57%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Citi India Financials Tour

- Goldman Sachs Energy Clean Tech & Utilities Conference

- KeyBanc Capital Markets Telecom Infrastructure Tour

- Needham Growth Conference

- Truist Energy Event

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Analyst, Investor Meetings: A, AFMD, AJG, HPAI, IR, LOVE, NVX, PDSB, PFE, RNXT

- Shareholder Meetings: AIM, AZPN, MBOT, PSHG, SANW, UNFI, USAS, WGO

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- AFMD: Data Presentation for AFM24

- Company Event: None of note.

- Industry Meetings or Events:

- Axios Artificial Intelligence (AI) Summit

- NYC Summit Investor Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

-

- Upgrades: VTS BHLB

- Downgrades: INNV ESS CSIQ CPT COMM BFB