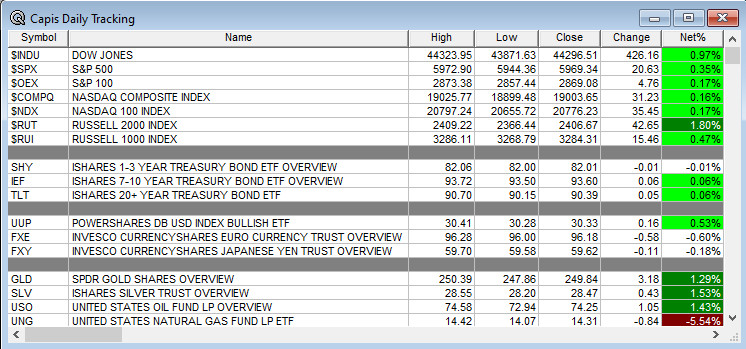

Overnight Summary: The S&P 500 closed Friday higher by 0.35% at 5969.34 from Thursday higher by 0.53% at 5948.71. The overnight high was hit at 6019.25 at 6:30 a.m. EDT and the low was hit at 6005.50 at 6:00 p.m. EDT. The overnight range is 32 points. The current price is 6017.25 at 6:50 a.m. The S&P 500 is higher by +30.75 higher by +0.51% this morning.

Executive Summary: A shortened trading week that typically moves higher into Thanksgiving and Black Friday. Enjoy along with your Turkey and stuffing!

Articles That Matter: Scott Bessent: What Trump’s Treasury pick could mean for global markets. (CNBC)

Key Events of Note Today:

- No economic releases of note.

- 2-Year Bond Auction at 1:00 p.m. EDT.

Daily Chart Request: A new section of the morning note as of today. Want to see an Erlanger Chart? Simply email us at [email protected].

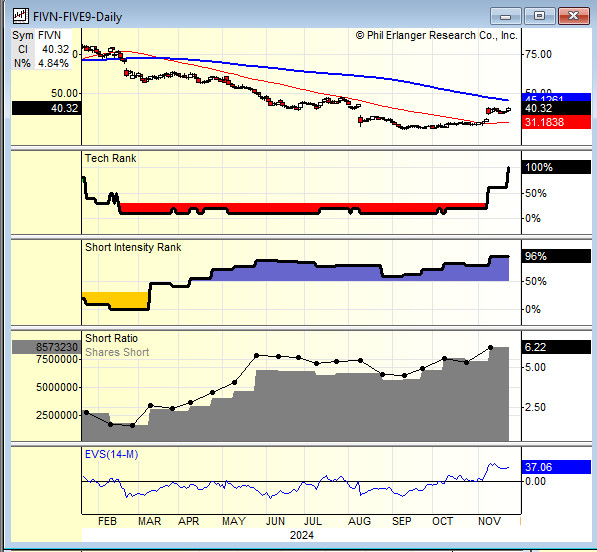

Next up is Five9, Inc. (FIVN). The stock has improved technically to a rank of 100%. Short Intensity has risen to 96% with the Short Ratio at 6.22. Last, Erlanger Volume Swing (EVS) has risen to 37.06. This morning the stock is at $40.032. What to Do: We would buy here as it improves. If long, then we would stay with the position. To Short or Not To Short: We do not short into the start of a Short Squeeze, stay away from being short.

Notable Earnings Out After The Close

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CDIO – Form S-1. Up to 1,235,939 Shares of Common Stock

- CPK – $100 Million At-The-Market Equity Offering Program

- MBIO: Form S-3.. 34,767,934 Shares of Common Stock underlying certain Common Warrants and

Placement Agent Warrants - NOTE: FORM S-3 – Up to 10,532,463 Shares of Class A Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- IMNM files for 1,805,502 share common stock offering by selling shareholder.

- NN files for 620,106 share common stock offering by selling shareholder.

- Mixed Shelf Offerings:

- LRHC: Form S-3.. $50,000,000 Mixed Shelf

- SELF: Form S-3.. $100,000,000 Mixed Shelf

- SSKN: Form S-3.. $25,000,000 Mixed Shelf

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Last Week:

- Movers Up: OMER (10.86 +60.81%), EBS (9.49 +22.91%), MDGL (347.37 +20.37%), MATW (30.65 +28.46%), BE (26.09 +23.39%), UXIN (6.13 +35.67%), AAOI (37.72 +40.75%), ESTC (108.03 +25.15%), SOI (23.37 +24.71%) of note.

- Movers Down: KURA (10.85 -31.88%), ERII (15.91 -15.15%), JBLU (6.1 -13.6%), TGT (125.37 -17.59%), PDD (99.9 -12.37%), PLAY (34.13 -10.21%), GDS (18.19 -17.17%), AMSWA (9.66 -13.02%) of note.

News After The Close:,

- Organogenesis (ORGO) announces plans to expand its manufacturing capacity with new long-term lease for biomanufacturing facility in Rhode Island.

- Community Health (CYH) enters definitive agreement to sell ShorePoint Health System in Florida for $265 mln.

- LMT awarded a $870 mln US Navy contract.

- RTX awarded a $439 mln modification to a previously awarded US Navy contract.

- BA awarded a $129 mln US Air Force contract for the F-15 Japan Super Interceptor program.

- Index Changes: Texas Pacific Land (TPL) goes into the S&P 500 replacing MRO. Mueller Industries (MLI) goes into the S&P 400 replacing TPL. Atlas Energy Solutions (AEIS) will replace MLI in the S&P 600 as of next Tuesday, November 26th.

- 10-K “Delays – None of note.

Buybacks or Repurchases:

- ORLY approves a resolution to increase share buyback authorization by $2 bln.

Exchange/Listing/Company Reorg and Personnel News:

- NODK announces the appointment of Seth Daggett as President and Chief Executive Officer, effective December 1, 2024.

Dividends Announcements or News:

- Stocks Ex Div Today: TSCO CDW ATO TER PAYC PAC RHI MKSI RDN AEIS GLNG GFF PATK PHIN MRX CRI DAC IRS NVGS BLMN CBL

- Stocks Ex Div Tomorrow: JNJ SPGI XYL LH YUMC WLK EQH VOYA IGT AVA SPB PSEC MNR CRAI

What’s Happening This Morning: Futures S&P 500 -1.21, NASDAQ -16, Dow Jones +40 and Russell 2000 +9.88. Europe is higher. Asia is higher as well. Bonds are at 4.359% from 4.39% for the 10-Year. VIX Futures are at 16.75 from 16.10. Crude Oil and Brent are lower with Natural Gas higher. Gold and Silver are lower with Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $98,140 from $98,772 Friday morning higher by +$1357 with Futures up +1.39% this morning.

- Daily Positive Sectors: Industrials, Consumer Defensive, Consumer Cyclicals and Financials of note.

- Daily Negative Sectors: Communication Services and Utilities of note.

- One Month Winners: Financials, Consumer Cyclicals, Energy, Industrials and Communication Services and of note.

- Three Month Winners: Consumer Cyclicals, Financials, Industrials, Utilities, Technology and Communication Services of note.

- Six Month Winners: Financials, Real Estate, Utilities, Consumer Cyclical and Technology of note.

- Twelve Month Winners: Financials, Technology, Industrials, Utilities and Communication Services note.

- Year to Date Winners: Technology, Financials, Utilities, Communication Services and Industrials of note.

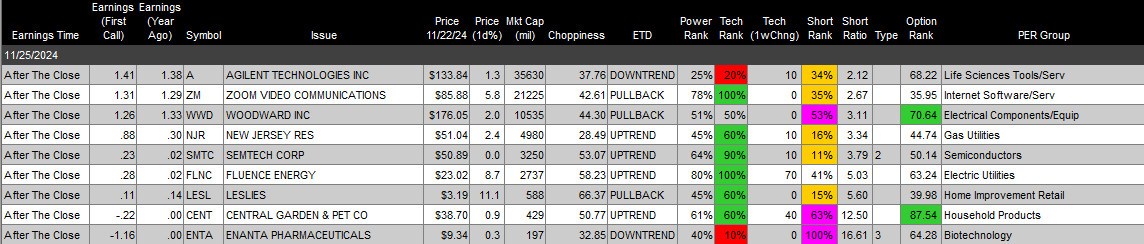

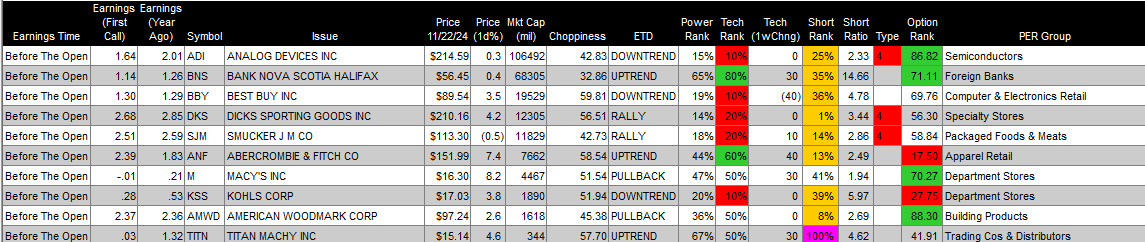

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close:

- Tuesday Before The Open:

Notable Earnings of Note This Morning:

- Beats: BBWI +0.02 of note.

- Misses: PDD -0.99 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: of note.

Advance/Decline Daily Update: The A/D Line hit a wall last Tuesday and rolled over having broken its monthly moving average but has now improved.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: NVX +18.7%, EVTL +10.4%, QSI +7.7%, ORGO +5.2%, EQT +4.8%, UXIN +3%, NNDM +2.8%

- Gap Down: BTU -7%, CYH -1.9%, CPK -1.7%, BBIO -1.7%

Insider Action: No names see Insider buying with dumb short selling. BNTC, KNS, ONEW see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Lead Story on Bloomberg: Dollar and U.S. Yields Fall on Bets That Bessent Will Dilute Trump Plans. (Bloomberg)

- 5 Things To Know Before The Market Opens. (CNBC)

- Stocks Making The Biggest Moves: Check back not out yet. (CNBC)

- Market Wrap: Stocks and Bonds rise as market cheer on Bessent nomination. (Bloomberg)

- G-7 to boost pressure on China over Russian support. (Bloomberg)

- Macy’s (M) delays earnings on employee hid of expenses. (Bloomberg)

- Wicked brings in $114 million while Gladiator hits $55.5 million. (CNBC)

- Thanksgiving dinner is more affordable this year. (CNBC)

- Bloomberg: Odd Lots – Inside the brutal world of creditor-on-creditor violence. (Podcast)

- Bloomberg: The Big Take – Amazon’s (AMZN) moonshot plan to rival Nvidia (NVDA) on AI Chips. (Podcast)

Economic:

- None of note today.

Geopolitical:

- No Federal Reserve speakers of note today.

- President Biden received the Daily Briefing at 10:00 a.m. EDT.

- President Biden will do the annual pardon of a Thanksgiving Day Turkey at 11:00 a.m. EDT on the South Lawn of The White House.

- President Biden and the First Lady head to Staten Island to deliver remarks and help serve food at 6:15 p.m. EDT.

- Watch our Twitter feed, Bullet86, for an impromptu appearances.

M&A Activity and News:

- None of note.

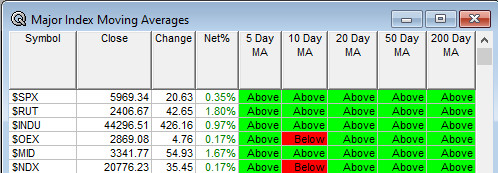

Moving Averages On Major Equity Indexes: Moves from 77% to 94%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Bank of America Securities Asia Internet & AI Conference

- BTIG Digital Health Forum

- Goldman Sachs Energy Clean Tech & Utilities Conference

- Goldman Sachs European Artificial Intelligence Enablers Symposium

- Macquarie Global Energy Transition & Commodities Conference

- Needham Consumer Tech / Ecommerce Virtual Conference

- Needham Growth Conference

- TD Securities Technology Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Analyst, Investor Meetings: BAK, PAR, VINP, VTMX

- Shareholder Meetings: AOUT, EDU, PMD, SEEL, VSTO

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: San Antonio Breast Cancer Symposium

- Company Event: None of note.

- Industry Meetings or Events:

- British Society for Immunology (BSI) Immune Therapies Summit

- Furey Research Partners Hidden Gems Conference

- LA Auto Show

- National Bank of Canada London CEO Mining Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: WRB USB SNCR SBH PG

Downgrades: NIO HCA DESP CYH