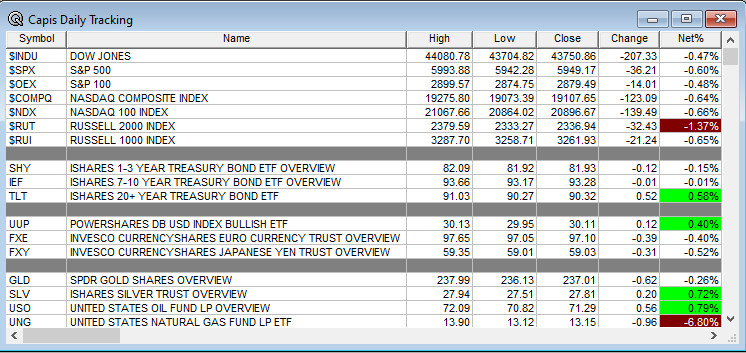

Overnight Summary: The S&P 500 closed Thursday lower by -0.60% at 5949.17 from Wednesday higher by 0.02% at 5985.38. The overnight high was hit at 5976 at 4:05 p.m. EDT and the low was hit at 5930.75 at 3:25 a.m. EDT. The overnight range is 46 points. The current price is 5945 at 6:50 a.m. EDT lower by -33 points which is -0.55%.

Executive Summary: We accidentally published early into our production, 7:15 a.m. EDT. Sorry about that, fat finger. This is the correct version.

Articles of Note:

Key Events of Note Today:

- Several economic indicators are due out this morning which will impact markets.

- President Biden is at the APEC Summit in Lima, Peru and will meet with Chinese President Xi.

Notable Earnings Out After The Close

- Beats: POST +0.32, AMAT +0.13, ESE +0.02, GLOB +0.01 of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- HLNE files Class A common stock offering by selling shareholders

- RCAT also files for 13,550,000 shares of common stock offering by selling shareholders

- Mixed Shelf Offerings:

- HZO files mixed shelf securities offering

- GYRE files $150 mln mixed shelf securities offering

- RCAT files $100 mln mixed shelf securities offering,

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: DESP +16.3%, EVO +12.2%, DPZ +7.3%, CWCO +5.1%, PLTR +3.7%, CDXS +2.9% of note.

- Movers Down: ASTS -14.2%, AMAT -5.6%, GLOB -3.7% of note.

News After The Close:

- Warren Buffet updated his 13-F and bought share in Dominos (DPZ) as a new position.

- Palantir (PLTR) to transfer its Class A common stock to the Nasdaq from the NYSE

- Nvidia (NVDA) bought 7.7 million shares in APLD.

- Discover Financial (DFS) credit card charge-off rate of 2.07% at the end of October; credit card delinquency rate at 1.74%.

- GD among several companies awarded a maximum $33.16 bln U.S. Air Force contract.

- TXT awarded $277 mln U.S. Navy contract modification

- 10-K Delays – ASPI NGNE.

- Barron’s: + Airline stocks could see their best returns in years thanks to Spirit (SAVE) troubles and Trump as president. (Barron’s)

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

-

- SHW Chairman John Morikis to retire; President and CEO Heidi Petz elected Chair; effective as of the close of business on Dec 31.

Dividends Announcements or News:

- Stocks Ex Div Today: LLY SHEL RTX HON SBUX SHW CTAS DUK CEG EMR GSK MMM HLT COR MSCI KR GLW OTIS CCEP SW CHD BAH CSL IP MRO RPRX JBL CF SJM AFG PAG WAL WING WYNN TFX OSK MTDR AGCO MSA WHR

- Stocks Ex Div Monday: CVX AMGN UPS SO APO KLAC PSX LHX ACGL HSY ROK UI GEN CG JEF

What’s Happening This Morning: Futures S&P 500 +6 NASDAQ +2 Dow Jones +103 Russell 2000 +20.53(at 8:20 a.m. EDT). Asia is higher ex China and Europe is lower ex the FTSE. VIX Futures are at 15.63 from 15.35 yesterday morning while Bonds are at 4.437% from 4.41% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower. Gold lower with Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $89,774 from $91,005 yesterday morning higher by +$1,774 by +2.00% this morning.

- Daily Positive Sectors: Energy of note.

- Daily Negative Sectors: Healthcare, Industrials, Consumer Cyclical and Real Estate of note.

- One Month Winners: Communication Services, Financials, Consumer Cyclicals, Industrials and Technology and of note.

- Three Month Winners: Consumer Cyclicals, Technology, Financials, Industrials and Communication Services of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials, and Consumer Cyclical of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Communication Services, Financials and Utilities of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: BRC and TWST

Notable Earnings of Note This Morning:

- Beats: BABA +0.24, of note.

- Misses: SPB -0.07 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line hit a wall Tuesday and rolled over and broke is monthly moving average yesterday.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: RCAT +17.2%, DESP +14%, DPZ +7.7%, CWCO +7.2%, POOL +6.1%, EVO +5.7%, ALMS +5%, PLTR +3.1%, AEG +2.4%, ASPI +2.3%, CHMI +2.2%, ZLAB +2%

- Gap Down: QUBT -29.1%, ASTS -13.3%, ASND -7.5%, ZURA -7.2%, AMAT -7.1%, OKLO -7%, CDXS -6.4%, SEDG -5.1%, NGNE -4.1%, GLOB -4%, HALO -3.8%, DMRC -3.7%, OS -3.5%, ASB -3.4%, LUNR -3.3%, ZG -2.4%, AUPH -2.3%, KGS -2.2%

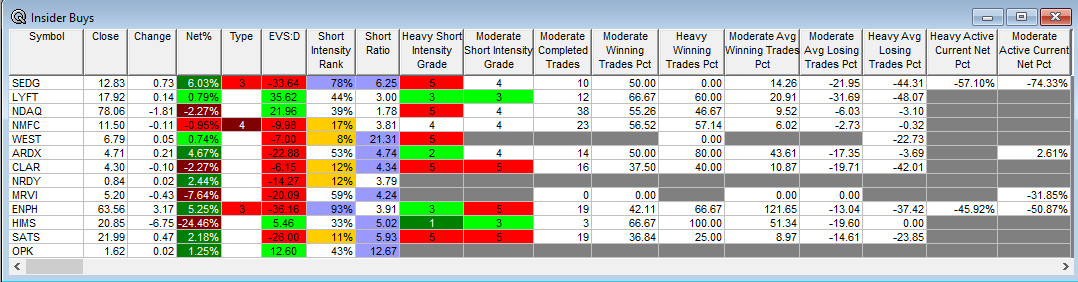

Insider Action: ENPH sees Insider buying with dumb short selling. SEDG sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens. (CNBC)

- Stocks making the biggest move in pre-market BABA, AMAT and ULTA. (CNBC)

- Bloomberg Lead Story: CEOs Brace For Another Four Years of Trump Chaos. (Bloomberg)

- Markets Wrap: US futures fall as post-election rally stalls. (Bloomberg)

- Alibaba (BABA) bets estimates. (CNBC)

- The Big Take: Flood of money chases US banking’s hottest new trade. (Podcast)

Economic:

- October Retail Sales is due out at 8:30 a.m. EDT and is expected to fall to 0.3% from 0.4%.

- Import/Export Prices are due out at the same time and came in last month at -0.4% and -0.7%.

- November NY Fed Manufacturing is due out also at 8:30 a.m. EDT and is expected to improve to 3.3 from -11.90.

- October Industrial Production is due out at 9:15 a.m. EDT and is expected to stay at -0.3%.

- Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Geopolitical:

- Several Federal Reserve speakers today.

- Federal Reserve Governor Adriana Kugler speaks at 7:00 a.m. EDT.

- Federal Reserve Richmond President Tom Barkin speaks at 9:15 a.m. EDT

- Federal Reserve Boston President Susan Collins speaks at 11:55 a.m. EDT.

- President Biden received the Daily Briefing at 4:00 a.m. EDT from Lima, Peru.

- President Biden is in Lima, Peru for the APEC Summit to meet with Chinese President Xi as well as Japanese Prime Minister Shigeru and South Korean President Yeol.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

- .

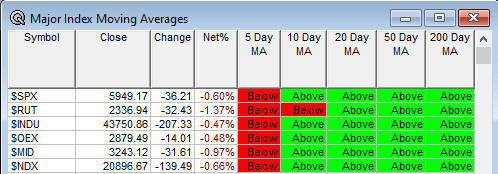

Moving Averages On Major Equity Indexes: Move from 80% to 77%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Needham Growth Conference

- Oppenheimer AI Impact

- Piper East Coast Financial Services Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Analyst, Investor Meetings: AZN, DTIL, IPA, NTLA

- Shareholder Meetings: OPT, SYY, TAL

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: KLIC TWLO AUTL

Downgrades: MAXN EWCZ BLUE APPS