Overnight Summary: The S&P 500 closed Wednesday lower by -0.92% at 5787.42 from Tuesday lower by -0.05% at 5851.20. The overnight high was hit at 5866.75 at 4:20 a.m. EDT and the low was hit at 5834.50 at 4:00 p.m. EDT. The overnight range is 32 points. The current price is 5865 at 6:35 a.m. EDT higher by +27.25 points higher by +0.47%.

Executive Summary: After three days of selling and a break of 5800 on the S&P 500, stocks are bouncing this morning. There was overnight strength as the S&P 500 hit its low right at 4:00 p.m. EDT and never looked back.

Article of Note: “Bond Markets Fear the “Know Unknown” of a GOP Sweep” by John Authers (Bloomberg Opinion)

Key Events of Note Today:

- 5-Year TIPS Auction at 1:00 p.m. EDT.

- Several weekly economic indicators and New Home Sales.

Earnings Out After The Close

- Beats: CACI +0.89, RJF +0.54, GBX +0.52, GL +0.38, PLXS +0.30, NOW +0.27, FAF +0.24, WHR +0.23, MAT +0.19, TMUS +0.18, SEIC +0.12, TER +0.12, TSLA +0.12, CLS +0.11, AMP +0.09, CASH +0.09, IBM +0.08, PI +0.08, MOH +.07, LRCX +0.05, ALGN +0.04, MC +0.03, WU +0.02, CHDN +0.01, CLB +0.01, WH +0.01 of note.

- Flat: None of note.

- Misses: SPR -2.42, URI -0.76, ICLR -0.50, SLM -0.30, KALU -0.14, ORLY -0.12, CYH -0.11, LVS -0.09, OII -0.07, NEM -0.05, GGG -0.05, MXL -0.04, CP -0.02, ROL -0.01, PTEN -0.01, CHX -0.01 of note.

- IPOs For The Week: ADUR, ALEH, CUPR, FBGL, GELS, HUHU, INGM, LBGJ, NTCL, PRB, ROLR, SAG, SNYR

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- BNED: FORM S-3 – 19,276,512 Shares of Common Stock

- BOW: Pricing of Secondary Offering of Common Stock 4,000,000 shares @$29

- EONR: Form S-1.. Up to 1,847,963 Shares of Class A Common Stock

- NLSP: FORM F-3 – Up to 2,747,437 Common Shares

- OKUR: Form S-1.. 2,938,005 Shares of Class A Common Stock

- SOBR: Form S-1.. Up to 31,036,386 Shares of Common Stock(Including up to 29,011,695 Shares of

Common Stock Issuable Upon Exercise of Warrants) - STSS: Form S-3.. 259,092 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- BKD files for 54,968,244 shares of common stock offering by selling shareholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- BKU files a mixed-shelf offering.

- CDU files a $100 million mixed-shelf offering.

- PIPE: COYA Closing of $10.0 Million Private Placement

- Convertible Offerings & Notes Filed: WULF Proposed Private Offering of $350 Million of Convertible Notes

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: TSLA+11.6%,AMTB +11.5%, MOH +11%, LC +9.9%, SDRL +9.7% MXL +8.9%, FAF +8.3%, GBX +8.1%, SLP +7.4%, CLS +7.1%, GL +6.9%, PEGA +6.5%, EGBN +5.5%, QS +5.2%, RBBN +5%, CACI +4.9%, LRCX +4.8%, VKTX +4.7%, TER +4.6%, MAT +4.3%, RIG +3.9%, WHR +3.8%, SHEN +3.6%, AMSF +3.5%, GRAL +3.4%, PTEN +3.2%, LVS +2.4%, MORN +2.4%, TMUS +2.4%, VIST +2.2%, CHX +2.2%, DFH +2.1%, OKUR +2% of note.

- Movers Down: MC -22.3%, ODV -21%, ICLR -16.7%, CYH -9.9%, BNED -9.1% SLM -6.1%, PI -5%, NEM -4.8%, WULF -4.5%, CLB -3.9%, WFG -3.9%, ROL -3.5%, TXT -3.2% URI -3.1%, GGG -3%, ORLY -2.9%, IBM -2.6%, CVBF -2.3%, AMP -2.1% of note.

News After The Close:

- Hedge Fund Manager David Einhorn says Peloton (PTON) is undervalued. (CNBC)

- Colorado officials say McDonald’s (MCD) E. coli outbreak could have affected all stores in the state. (Fox)

- ESI may put itself up for sale. (Bloomberg)

- Transocean (RIG) up +2% on merger discussion with rival Seadrill (SDRL). (Bloomberg)

- Boeing’s (BA) Millennium Space Systems, awarded an other transaction agreement with the U.S. Space Force Space Systems Command to deliver an additional plane of six Missile Track Custody, or MTC

- NOC awarded $1.80 bln U.S. Air Force contract modification

- Gulfstream Aerospace, unit of General Dynamics (GD), awarded $991 mln ceiling U.S. Air Force contract

- Barron’s + . (Barron’s)

Buybacks or Repurchases:

- WULF announces that its Board of Directors approved a share repurchase program authorizing the Company to repurchase up to $200 mln of the Company’s outstanding shares of common stock through December 31, 2025

- FTI authorizes additional share repurchases of up to $1 bln

Exchange/Listing/Company Reorg and Personnel News:

- HFWA announces that Nicholas Bley will become the COO of Heritage Bank, effective Oct 28

- MORN announces that CFO, Jason Dubinsky will step down as CFO at the end of the year to pursue other interest; co has initiated a succession process

Dividends Announcements or News:

- Stocks Ex Div Today: ATR REPX LND

- Stocks Ex Div Tomorrow: CARR FAST J UNM COKE CWSI SM SIG CNXC LKFN KALU

- AMSF declares special dividend of $3.00/share payable on December 13, 2024, to shareholders of record as of December 6

- WCN increases quarterly cash dividend 10.5% to $0.315/share from $0.285/share

- ZWS increases quarterly cash dividend 12.5% to $ 0.09/share from $0.08/share

- SHEN increases annual dividend 11% to $0.10/share from $0.09/share

- AWI increases quarterly cash dividend 10% to $0.308/share from $0.28/share

- STBA increases quarterly cash dividend ~3% to $0.34/share from $0.33/share

- PNW increases quarterly cash dividend to $0.895/share from $0.88/share

- BRO increases quarterly cash dividend 15% to $0.15/share from $0.013/share

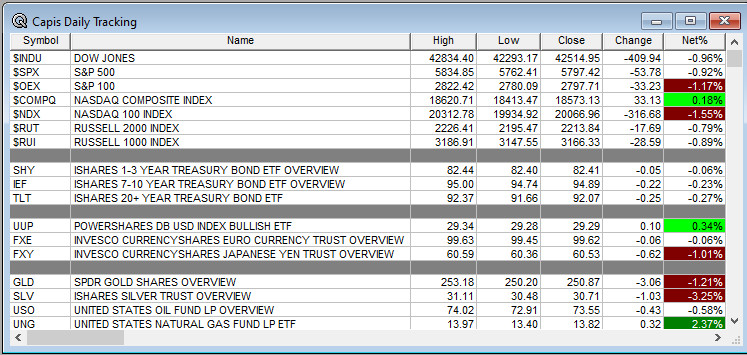

What’s Happening This Morning: Futures S&P 500 -13.50 NASDAQ -62 +108 Dow Jones -209Russell 2000 +0.17 (at 8:25 a.m. EDT). Asia is lower ex Japan while Europe is higher. VIX Futures are at 18,27 from 18.05 while Bonds are at 4.192% from 4.246% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $67,225 from $66,174 higher by +979 at +1.45% this morning.

- Daily Positive Sectors: Utilities and Real Estate of note.

- Daily Negative Sectors: Consumer Cyclical, Technology, Communication Services and Materials of note.

- One Month Winners: Utilities, Technology, Materials, Financials and Industrials of note.

- Three Month Winners: Utilities, Real Estate, Financials, Materials, Industrials and Consumer Defensive of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials and Consumer Cyclical of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

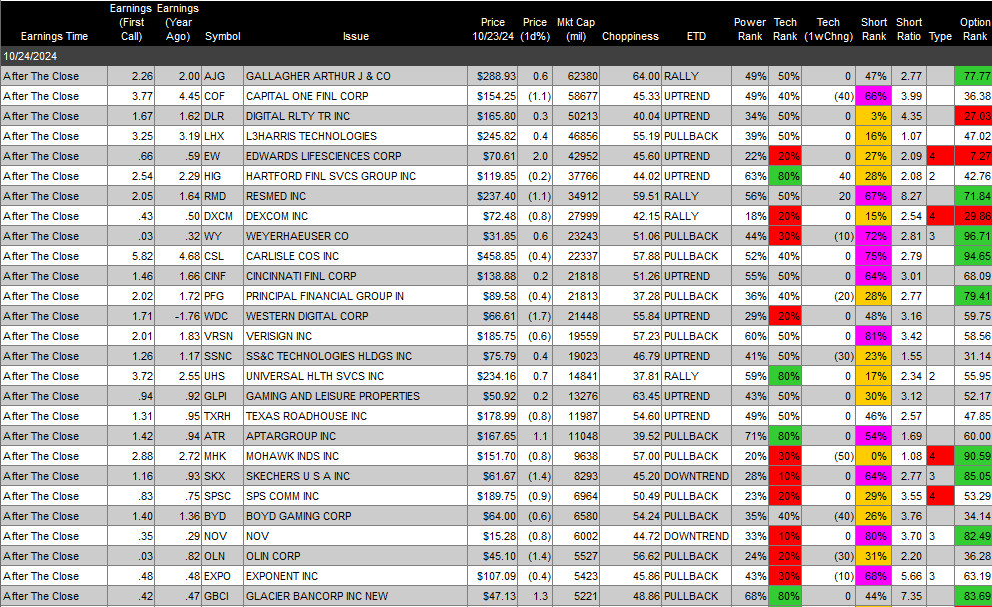

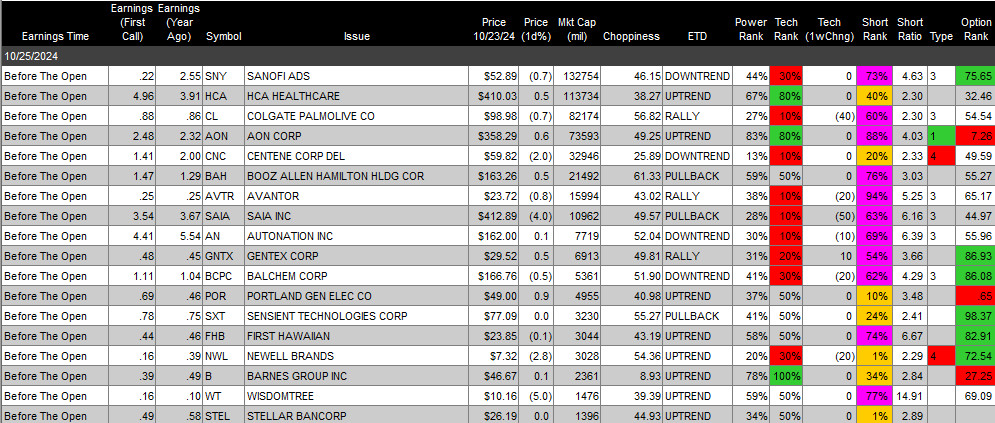

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

- Friday Before The Open:

Earnings of Note This Morning:

- Beats: BYON+1.73, NOC +0.92, SAH +0.72, HAS +0.44, LEA +0.35, FSV+0.21, VLO +0.16, AAL +0.14, UPS +0.13, HOG +0.10, LUV +0.09, NDAQ +0.05, DOW +0.01 of note.

- Flat: None of note.

- Misses: DAR -0.26, FCN -0.21, TXT -0.09, MSM -0.04, UNP-0.03 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: WST SPGI CBRE LTH of note.

- Negative or Mixed Guidance: LEA UPS DOV CARR RS BC WNC WEX LKQ of note.

Advance/Decline Daily Update: The A/D Line fell again yesterday as did the S&P 500.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: MNOV +21.4%, QS +12.9%, SDRL +12.2%, MOH +12.2%, AMTB +11.7%, TSLA +11.4%, CLS +8.9%, FAF +8.4%, MXL +7.6%, WST +6.9%, LRCX +6.5%, PEGA +6.1%, LC +6.1%, TXT +5.6%, UPS +5.4%, TER +5.3%, MAT +5.2%, VKTX +5.1%, SHEN +5%, EGBN +5%, CACI +4.9%, EQNR +4.8%, PTEN +4.5%, SBSI +4.3%, GBX +4.1%, GL +4%, BCS +3.8%, RIG +3.6%, AMSF +3.5%, WHR +3.5%, SLP +3%, CLMT +3%, UL +2.7%, ALLE +2.7%, TMUS +2.5%, FTI +2.4%, DFH +2.2%, OKUR +2%

- Gap Down: MC -22.3%, ODV -19%, ICLR -16.4%, CYH -8.8%, NEM -6%, CARR -5.5%, WH -5%, IBM -4.9%, SLM -4.6%, PI -4.4%, BNED -4.2%, ROL -3.5%, URI -3.5%, EPRT -2.8%, BA -2.6%, ASGN -2.5%, HON -2.4%, CVBF -2.3%, ORLY -2.1%, RBBN -2%

Insider Action: None of note that see Insider buying with dumb short selling. None of note that see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: Check back as not out yet. (CNBC)

- Latest CNN Headlines. (CNN)

- 5 Things To Know Before The Market Opens on Thursday. (CNBC)

- Bloomberg Lead Story: See Big Take. (Bloomberg)

- Markets Wrap: Stocks climb on earnings, Treasuries rally as well. (Bloomberg)

- Boeing (BA) machinists reject new labor contract, strike continues.

- Tesla (TSLA) jumps on profit beat and Musk calls for 20% vehicle production growth in 2025. (CNBC)

- SK Hynix, Nvidia supplier, records a record quarterly profit. (CNBC)

- Southwest Airlines (LUV) strikes deal with activist Elliott Associates as Southwest adds six new board members from Elliott.

- Bloomberg: Big Take – Two Weeks Out and Trump/Harris are Locked in Dead Heat. (Podcast)

- Bloomberg: Odd Lots – Why Mortgage Rates went up after Rate Cut. (Podcast)

- NYT Daily: 12 Days to Election. (Podcast)

- Marketplace: Apple answers question on repairing iPhones. (Podcast)

- Wealthion: Larry McDonald looks at inflation and energy pending crisis. (Podcast)

Economic:

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- September New Home Sales are due out at 10:00 a.m. EDT and expected to fall to 713,000 from 716,000.

- Weekly Natural Gas Inventories are due out at 10:30 a.m. EDT.

Geopolitical:

- Federal Reserve Cleveland President Beth Hammack speaks at 8:45 a.m. EDT.

- Former Federal Reserve Kevin Warsh interviewed on CNBC this morning, calls for Fed to do “more thinking and less talking”. Bravo!!!

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

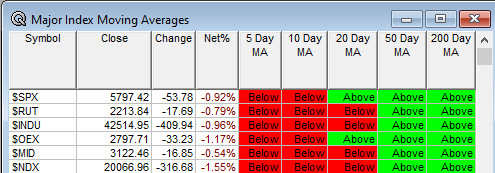

Moving Averages On Major Equity Indexes: Moves from 87% positive to 46%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Goldman Sachs Emerging Market Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: COEP, CXDO, NRSN

- Top Analyst, Investor Meetings: AREC, BRFH, BYON, ERAS, GRRR, NTLA, PRSO, RCUS, ZLAB

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- AACR-NCI-EORTC Symposium on Molecular Targets and Cancer Therapeutics

- Game Industry Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: RF (2) TIGR

Downgrades: MCRB