Overnight Summary: The S&P 500 closed Tuesday lower by -0.05% at 5851.20 from Monday lower by -0.18% at 5853.98. The overnight high was hit at 5893.75 at 3:20 a.m. EDT and the low was hit at 5877.75 at 6:35 a.m. EDT. The overnight range is 16 points. The current price is 5877.75 at 6:35 a.m. EDT lower by -14.75 points lower by -0.25%.

Executive Summary: Earnings are prolific this week.

Article of Note: “The World Bank Somehow Lost Track of at Least $24 billion” by Mark Gongloff (Bloomberg Opinion)

Key Events of Note Today:

- 20 Year Bond Auction at 1:00 p.m. EDT.

- Existing Homes Sales due out at 10:30 a.m. EDT.

Earnings Out After The Close

- Beats: LRN +0.72, WFRD +0.39, MANH +0.29, MTDR +0.23, AGR +0.18, PKG +0.15, ENVA +0.14, VICR +0.13, VMI +0.11, RRC +0.11, STX +0.10, JBT +0.09, EWBC +0.08, TXN +0.06, CSGP +0.06, BKR +0.06, NTB +0.03, RHI +0.02, PFC +.02, HIW +0.02, CNI +0.02, VBTX +0.01, ADC +0.01 of note.

- Flat: None of note.

- Misses: NBR -4.87, PFSI -1.38, TRMK -0.16, ENPH -0.13, RNST -0.07, BDN -0.01, ROIC -0.01 of note.

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- SLN files ordinary share offering, including ordinary shares represented by ADSs

- TELA Proposed Public Offering of Common Stock and Pre-Funded Warrants

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- CYBR files for 2,285,076 ordinary shares offering by selling shareholder

- CAPR files for 2,798,507 shares of common stock offering by selling shareholder

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- HUSA: Form S-3.. $8,000,000.00 Mixed Shelf

- SXTC: Form F-3.. $120,000,000 Mixed Shelf

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: LRN +22.8%, JBT +11.4%,VICR +10.5%, EWBC +3.8%, PKG +3.8%, WFRD +3.6%, TXN +3.5%,ENVA +3.3%, RRC +2.2%, CNI +2.1% of note.

- Movers Down: ANRO -64%, ENPH -9.6%, MCD -6.6%, RHI -5.5%, PRQR -5.5%, SBUX -4.3%, MANH -4.2%, SEDG -4.2%, CSGP -3.8%, LW -3.2%, TSN -2.8%, CYBR -2.5% of note.

News After The Close:

- McDonalds (MCD) notified by CDC of an e.coli breakout in quarter pounders due to bad onions. (CNBC)

- Starbucks (SBUX) pulls 2025 guidance, cuts sales forecast as well and they throw everything in the “kitchen sink”. (CNBC)

- PFE announces that the U.S FDA has approved ABRYSVO for adults aged 18 to 59 at increased risk for RSV, only vaccine approved now.

- LLY Alzheimer’s drug donanemab facing NHS block over cost. (The Telegraph)

- Walt Disney’s (DIS) ESPN notes that Game 5 of WNBA Finals most-viewed in 25 years across all networks

- Barron’s + . (Barron’s)

Buybacks or Repurchases:

- SEIC increased its stock repurchase program by an additional $400 mln, increasing the available authorization under the program to ~$429 mln

- RNST announces $100 mln stock repurchase program

Exchange/Listing/Company Reorg and Personnel News:

- BYON approves a reduction in force affecting approximately 20% of its workforce; to be substantially implemented in 4Q24

- DOUG CEO and Chairman Howard M. Lorber to retire; Michael Liebowitz appointed successor

Dividends Announcements or News:

- Stocks Ex Div Today: LOW CLX AM DNUT AGX LTC

- Stocks Ex Div Tomorrow: ATR REPX LND

- ROL increases quarterly cash dividend 10% to $0.165/share from $0.15/share

- GTY increases quarterly cash dividend 4.4% to $0.47/share from $0.45/share

- SBUX increases quarterly cash dividend to $0.61/share from $0.57/share

- AEP increases quarterly cash dividend to $0.93/share from $0.88/share

- SIRI increases quarterly cash dividend to $0.27/share from $0.266/share

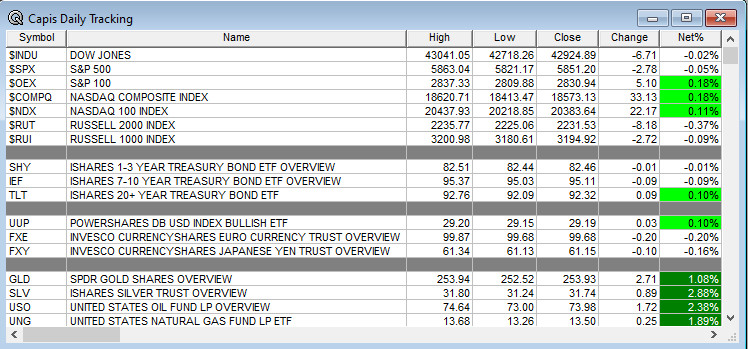

What’s Happening This Morning: Futures S&P 500 -13.50 NASDAQ -62 +108 Dow Jones -209Russell 2000 +0.17 (at 8:25 a.m. EDT). Asia is lower ex Australia while Europe is lower. VIX Futures are at 18.05 from 18.10 while Bonds are at 4.246% from 4.113% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold is higher with Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $66,174 from $68,222 lower by -1286 at -1.95% this morning.

- Daily Positive Sectors: Consumer Defensive, Communication Services and Real Estate of note.

- Daily Negative Sectors: Industrials, Utilities, Healthcare and Consumer Cyclical of note.

- One Month Winners: Utilities, Technology, Materials, Financials and Industrials of note.

- Three Month Winners: Utilities, Real Estate, Financials, Materials, Industrials and Consumer Defensive of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials and Consumer Cyclical of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

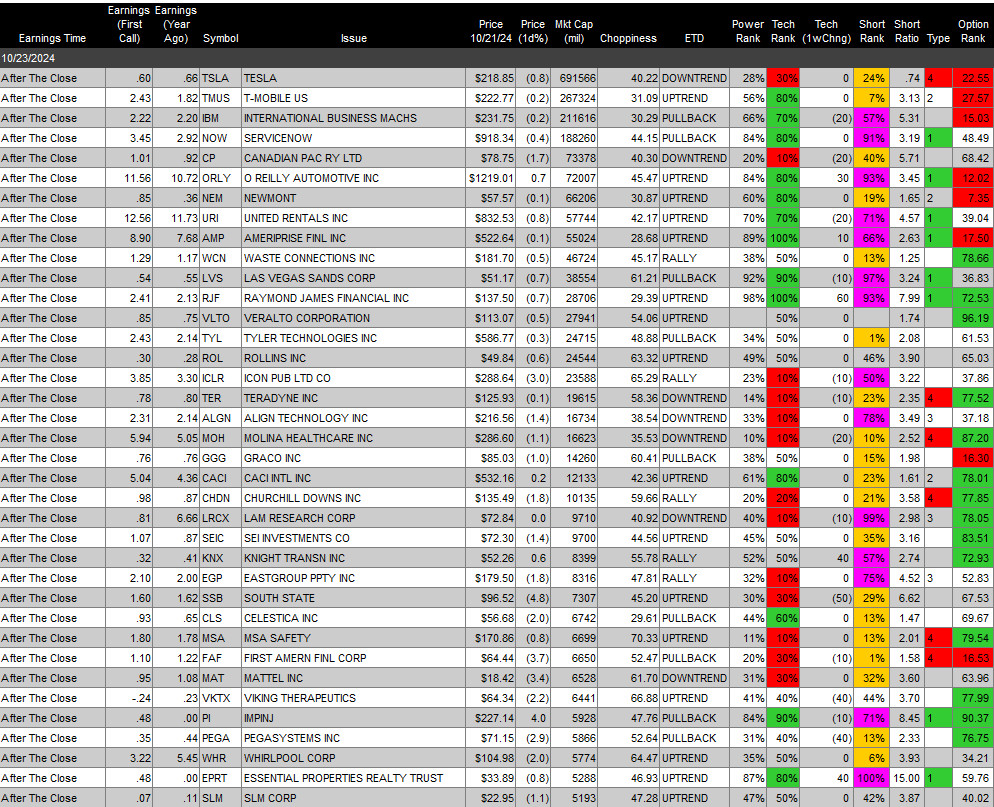

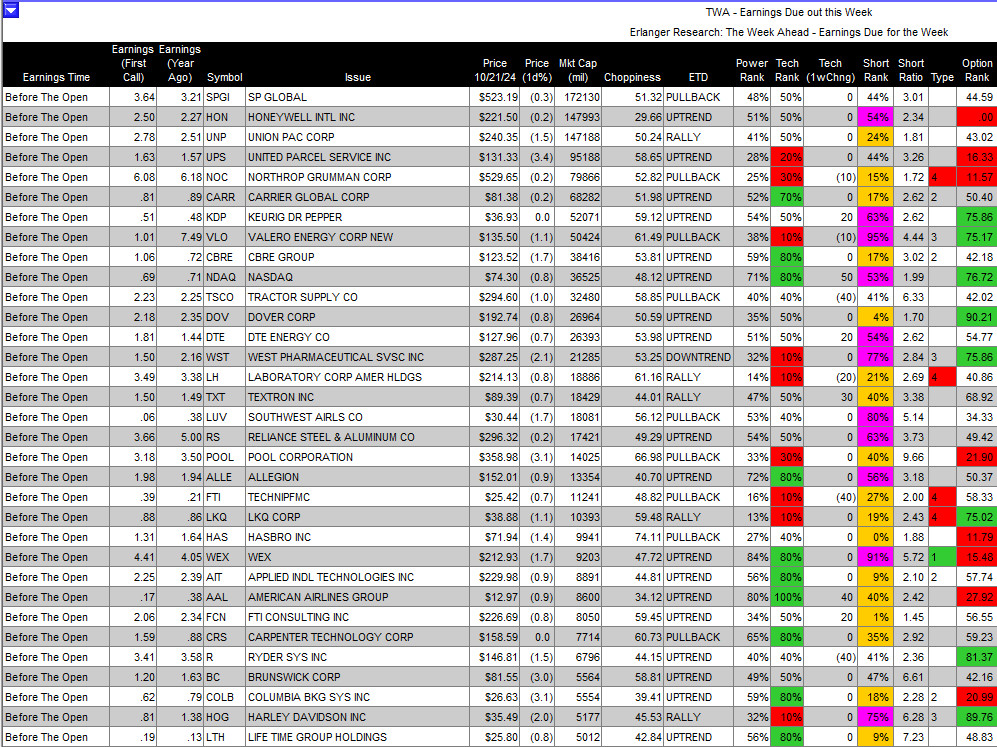

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: LII +0.66, NTRS +0.48, TMHC +0.30, WAB +0.12, ROP +0.09, HLT +0.08, NEE +0.08, BSX +0.04, T +0.03, CME +0.03, KO +0.02, ODFL +0.01 of note.

- Flat: None of note.

- Misses: NEP -1.01, WGO -0.60, WSO -0.51, CSTM -0.31, GD -0.13, SF -0.10 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: LII of note.

- Negative or Mixed Guidance: UNF EDU ROP of note.

Advance/Decline Daily Update: The A/D Line fell yesterday as did the S&P 500.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: LRN +24.4%, VICR +11.2%, ENVA +5.7%, SEIC +5%, JBT +4.6%, VBTX +4.2%, PKG +3.9%, WPP +3.7%, DOUG +3.5%, TXN +3.4%, WFRD +3.4%, WEN +2.7%, QSR +2.6%

- Gap Down: ANRO -60.8%, ENPH -14.5%, VLRS -12.7%, MCD -7.5%, EDU -6.8%, VRT -6%, SEDG -5.3%, STX -5%, SBUX -4.9%, CSGP -4.6%, MMYT -3.6%, CSTM -3.5%, MANH -3.4%, HLT -3.4%, RHI -3%, EWBC -3%, TMHC -2.8%, LW -2.7%, DB -2.4%, HRTG -2.2%, CAPR -2.1%, RVMD -2.1%

Insider Action: None of note that see Insider buying with dumb short selling. None of note that see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: BA MCD ENPH KO. (CNBC)

- 5 Things To Know Before The Market Opens on Tuesday. (CNBC)

- Bloomberg Lead Story: Boeing (BA) CEO says planemaker’s problems will take time to fix. (Bloomberg)

- Markets Wrap: Stocks edge lower as traders track earnings rush. (Bloomberg)

- MBA Mortgage Applications fell -6.7% week over week in the latest release at 7:00 a.m. EDT.

- Frontier Airlines (ULCC) mulling renewed bid for Spirit Airlines (SAVE). (WSJ)

- Arm Holdings (ARM) aiming to cancel Qualcomm (QCOM) chip design license. (Bloomberg)

- Apple (AAPL) CEO Tim Cook promised more China investment. (Bloomberg)

- Novo Nordisk (NVO) asked FDA to ban compounders from making copies of Ozempic. Negative for HIMS (Stat News)

- Coca-Cola (KO) beats estimates despite sluggish sales. (CNBC)

- Bloomberg: Big Take – Danger at Rivian (RIVN) factories. (Podcast)

- NYT Daily: The Gender Election. (Podcast)

- Marketplace: Mexico braces for trade impacts from U.S. election. (Podcast)

- WeaLthion: Are Fed Rate Cuts setting up a crisis. (Podcast)

Economic:

- September Existing Home Sales are due out at 8:30 a.m. EDT and are expected to rise to 3.90 million from 3.86 million.

- Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

Geopolitical:

- Federal Reserve Governor Michelle Bowman speaks at 9:00 a.m. EDT.

- Federal Reserve Richmond President Thomas Barkin speaks at 12:00 p.m. EDT.

- The Federal Reserve Weekly Beige Book is due out at 2:00 p.m. EDT.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

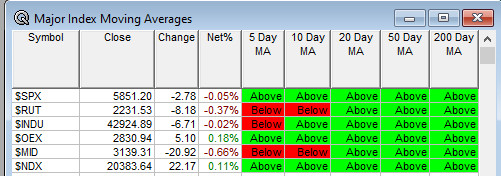

Moving Averages On Major Equity Indexes: Moves from 100% positive to 87%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Leerink Partners Biopharma Private Company Connect

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: BCLI, COEP, JRVR, MNOV, NRSN, PH, REBN, SAR, TECH

- Top Analyst, Investor Meetings: BYCY, CLS, PHVS

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- American Society of Reproductive Medicine’s (ASRM) 2024 Scientific Congress and Expo

- AACR-NCI-EORTC Symposium on Molecular Targets and Cancer Therapeutics

- Gartner IT Symposium/Xpo 2024

- Houlihan Lokey Global Tech Conference

- ICS Cybersecurity Conference

- NBAA Business Aviation Convention & Exhibition

- Parenteral Drug Association Universe of Pre-Filled Syringes and Injection Conference

- QCOM Snapdragon Summit

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: AMLX BYON EBAY TXN

Downgrades: ENPH IPG TIGR