Overnight Summary: The S&P 500 closed Wednesday higher by 0.47% from 5842.47 from Tuesday lower by -0.76% at 5815.26. The overnight high was hit at 5914.25 at 6:55 a.m. EDT and the low was hit at 5871.25 at 10:40 p.m. EDT. The overnight range is 43 points. The current price is 5912.50 at 7:00 a.m. EDT higher by +25.50 points higher by 0.43%.

Executive Summary: Earnings are coming in strong so far. A positive earnings season will push stocks higher in the fourth quarter.

Article of Note: “NASA’s $100 Billion Moon Mission Is Going Nowhere”. by Michal R. Bloomberg (Bloomberg Opinion)

Breaking News: ECB cut rates for the third time.

Key Events of Note Today:

- There are lots of economic releases today led by Retail Sales, Industrial Production, NAHB Housing Index, Weekly Jobless Claims and Natural Gas Inventories.

Earnings Out After The Close

- Beats: AA +0.32, DFS +0.21, SNV +0.15, STLD +0.08, CCI +0.05, CNS +0.03, FR +0.02, EFX +0.01, REXR +0.01, SLG +0.01 of note.

- Flat: None of note.

- Misses: LBRT -0.13, HOMB -0.03, CSX -0.03, PPG -0.02, KMI -0,02 of note.

- IPOs For The Week: ALEH, CUPR, DMAA, HUHU, LBGJ, LUD, NAMI, PTLE, SAG, SFHG, SNYR, SUNH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CAPR announces proposed public offering of common stock

- REAX files for $100 mln common shares offering by the company

- BNZI: Form S-1.. Up to 877,372 Shares of Class A Common Stock

- MDAI: Form S-3.. Up to $50,000,000 of Common Stock

- OCX: Form S-3.. 3,461,138 Shares of Common Stock

- VCNX: FORM S-3 – 1,601,238 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- LCID announces public offering of 262,446,931 common stocks and corresponding investment by an affiliate of PIF

- REAX also files 45,000,000 common shares offering by the selling shareholders

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- LCID files mixed shelf securities offering

- CTO files $500 mln mixed shelf securities offering

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: GEVO +45.8%, CLMT +18.6%, AA +8.8%, SNV +3.1% and STLD +2.8% of note.

- Movers Down: LCID -11.6%, CMTL -11.1% PAL -9.3%, CAPR -9.1%, CERS -5.6%, EFX -4.6%, CSX -4.3%, SLG -2.9%, KMI -2.6% , CNS -2.3% and HCSG -2.2% of note.

News After The Close:

- New clinical evidence links Ceribell (CBLL) point-of-Care EEG to shorter hospital stays and better functional outcomes compared to conventional EEG.

- Glaukos (GKOS) announces positive topline outcomes in Phase 3 confirmatory trial for Epioxa, achieving primary efficacy endpoint and demonstrating favorable tolerability and safety.

- HCI Group (HCI) provides hurricane season update.

- GLDD awarded a $115 mln US Army contract for beach nourishment.

- CMTL to delay 10-K filing

Buybacks or Repurchases:

- MTX authorizes a new $200 million share repurchase program

Exchange/Listing/Company Reorg and Personnel News:

- AAPL Chief People Officer departing following under two-year tenure. (Bloomberg)

Dividends Announcements or News:

- Stocks Ex Div Today: EOG FUL GHC KWR MGRC CODI DCOM

- Stocks Ex Div Tomorrow: PG CL GEHC WSM RPM PNR OC RVTY NVT AYI WDFC AZZ PDCO BUSE OXM CBRL

- PAG increases quarterly cash dividend 11% to $1.19/share from $1.07/share

- PB increases quarterly cash dividend 3.57% to $0.58/share from $0.56/share

- MTX increases quarterly cash dividend 10% to $0.11/share from $0.10/share

What’s Happening This Morning: Futures S&P 500 +27 NASDAQ 100 +175 Dow Jones +48 Russell 2000 +5.12 (at 8:25 a.m. EDT). Asia is lower ex Australia while Europe is higher. VIX Futures are at 18.45 from 18.47 yesterday while Bonds are at 4.036% from 4.012% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well. Gold higher with Silver and Copper lower. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $67,053 from $67,937 lower by -779 at -1.15% this morning.

- Daily Positive Sectors: Utilities, Financials, Real Estate and Industrials of note.

- Daily Negative Sectors: Communication Services and Consumer Defensive of note.

- One Month Winners: Energy, Materials, Communication Services and Technology of note.

- Three Month Winners: Utilities, Real Estate, Industrials, Financials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials and Communication Services of note.

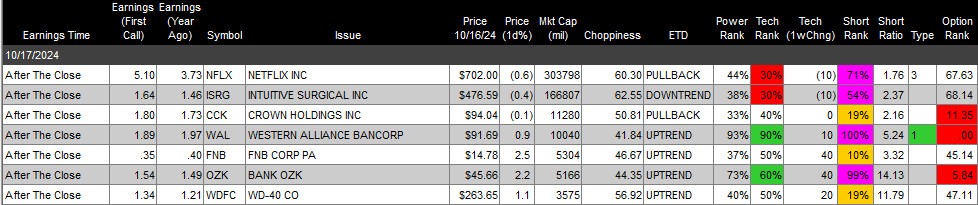

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

- Friday Before The Open:

Earnings of Note This Morning:

- Beats: TRV +1.58, TCBI +0.58, TFC +0.40, FHN +0.05, MTB +0.38, TSM +0.15, WWNS +0.14, SNA +0.11, BX +0.11, CBSH +0.07, HBAN +0.03, KEY +0.02, MMC +0.01 and IRDM +0.01 of note.

- Flat: None of note.

- Misses: ELV -1.29, IIIN -0.07, CMC -0.01 of note.

- Still to Report: None.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line sees improvement again yesterday confirming the move higher.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: GEVO +38.7%, CLMT +20.5%, TSM +8.1%, LXRX +6.8%, AA +4.9%, CBLL +4%, USAP +3.8%, SNV +3.4%, STLD +3.1%, RKLB +3%, HOOD +2.8%, MTX +2.7%, MTB +2.5%

- Gap Down: LCID -15.5%, ELV -13.5%, CAPR -12%, PAL -11%, IIIN -10.4%, CERS -8.9%, CMTL -8.8%, TFIN -6.1%, NOK -5.8%, CSX -5%, WNS -3.5%, REAX -3.3%, EFX -3.1%, CNS -2.3%, HCSG -2.2%

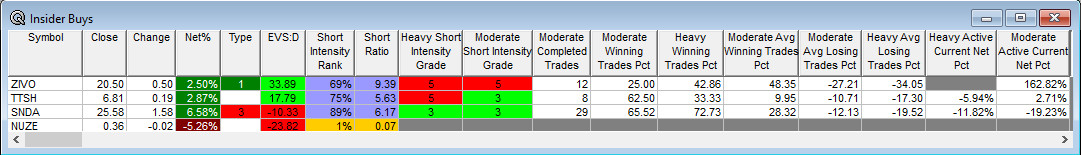

Insider Action: SNDA sees Insider buying with dumb short selling. ZIVO TTSH see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Open on Thursday. (CNBC)

- Pre-Market Movers: Check back not out yet. (CNBC)

- Bloomberg Lead Story: ECB Cuts Rates Says Disflationary Process Well On Track. (Bloomberg)

- Markets Wrap: Tech Rally Back on Track After TSMC Lifts Guidance. (Bloomberg)

- US Military bombs Houthi rebel’s payload with bunker buster bombs. (USA Today)

- Student Loan Forgiveness. (CNBC)

- Bloomberg: Big Take – Key moments from Trump interview on Bloomberg. (Podcast)

- Wealthion: US Economy a balancing act. (Podcast)

- NY Times Daily: 19 Day To Go: Early Voting is on. (Podcast)

Economic:

- September Retail Sales is due out at 8:30 a.m. EDT and expected to climb to 0.2% from 0.1% in August.

- October Philadelphia Fed Index is due out at 8:30 a.m. EDT and last month came in at 1.70% and is expected to come in up 4.0% this month.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- September Industrial Production is due out at 9:15 a.m. EDT and is expected to drop to -0.1% from 0.8%.

- October NAHB Housing Index is due out at 10:00 a.m. EDT and is expected to rise to 43 from 41.

- Weekly Natural Gas Inventories due out at 10:30 a.m. EDT.

Geopolitical:

- Federal Reserve Speakers:

- Federal Reserve Chicago President Austan Goolsbee speaks at 11:00 a.m. EDT.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

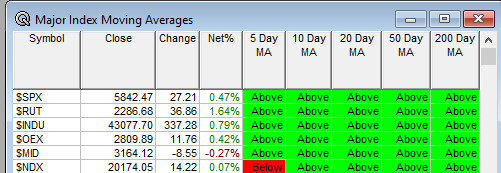

Moving Averages On Major Equity Indexes: Moves from 93% positive to 97%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Raymond James Defense and Government Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: ANIX, DYAI, GCTK, LENZ, MDT, MRNS, OPT

- Top Analyst, Investor Meetings: AMLX, AURA, MDU, NTRB, SUPN, VSTM

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- AMGN: PDUFA Date for LUMAKRAS

- AURA: Data Presentation for Belzupacap Sarotalocan

- SUPN: Data Presentation for SPN-820/821

- Company Event: None of note.

- Industry Meetings or Events:

- ASGCT’s Advancing Gene + Cell Therapies for Cancer Conference

- International Conference on Planarization/CMP Technology (ICPT)

- Maxim Group’s Healthcare Virtual Summit

- MedTech Conference

- Parkinson’s Disease Therapeutics Conference

- Urologic Oncology Investor Event

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: SEE OI ILMN HST AVY AMWD AMBP

Downgrades: SR SEDG FTNT