Overnight Summary: The S&P 500 closed Thursday lower by -0.21% at 5780.05 from Wednesday higher by 0.71% at 5792.04. The overnight high was hit at 5837.75 at 8:10 p.m. EDT and the low was hit at 5816 at 4:50 a.m. EDT. The overnight range is 21 points. The current price is 5820.75 at 6:50 a.m. EDT lower by -8.25 points.

Executive Summary: Yesterday we asked, “Can markets dodge a bullet this morning as we get the latest CPI data that is expected to come in up 0.1%?” Today we ask the same question on PPI.

Article of Note:

Key Events of Note Today:

- Monthly PPI is due out at 8:30 a.m. EDT.

- University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT.

- Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Earnings Out After The Close

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- NCPL: Form S-1.. Up to 865,264 Shares of Upon Exercise of Certain Common Stock Purchase

Warrants - SNPX: Form S-3.. 11,934,108 Shares of Common Stock

- NCPL: Form S-1.. Up to 865,264 Shares of Upon Exercise of Certain Common Stock Purchase

- Notes Priced:

- CGBD Prices Public Offering of $300 Million 6.750% Unsecured Notes Due 2030

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- LFCR files for 6,795,344 shares of common stock offering by selling shareholders

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- PIPE:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: AEHR +10%, TGI +3.2%, CLOV +2.3% of note.

- Movers Down: HUM -3.8%

News After The Close:

-

- TEVA agrees to pay $425 million to resolve kickback allegations

- Triumph Group (TGI) exploring potential sale amid rising interest in aerospace and defense sector. (Bloomberg)

- Sanofi (SNY) inching higher as CD&R nears €15 bln deal for SNY’s Consumer Health division

- California Department of Public Health confirms fourth human bird flu case in the state

- Humana (HUM) down over -4% after Centers for Medicare and Medicaid Services releases 2025 Medicare Advantage and Part D Star Ratings. (CMS Release)

- CMS increased the rating of Clover’s (CLOV) HMO MA plan to 3.5 Stars. Currently, over 95% of Clover’s Medicare Advantage membership is served through its PPO plans.

- 10Q Delays: None of note.

- NASDAQ Delisting Notice: None of note.

Buybacks or Repurchases:

- SCS discloses in SEC filing that it entered into agreement with an independent third-party broker under which the broker is authorized to repurchase up to 1.5 mln shares of the company’s common stock.

- ATR announces new $500 million share repurchase authorization.

Exchange/Listing/Company Reorg and Personnel News:

- LZB announces retirement of CFO Bob Lucian, effective April 26, 2025; Taylor Luebke will succeed him as CFO beginning Jan 1, 2025

- LECO announces that Christopher Mapes, Executive Chair, will retire from his position as Executive Chair and a member of the Board of Directors on December 31, 2024

- NKE names Tom Peddie as Vice President, General Manager of the North America Geography; succeeds Scott Uzzell, who has decided to depart

- STLA CEO to retire in 2026 and new CFO in. (CNBC)

Dividends Announcements or News:

- Stocks Ex Div Today: GD MRVL AFIPA IEX TOL WPP BKRIY SNX KGFHY SAIC HMY OZK KOF AEO BKU VTMX AAP BKE GNL UVV PMT

- Stocks Ex Div Tomorrow:

- REPX increases quarterly cash dividend 6% to $0.38 a share from $0.36 a share

- MSM increases quarterly cash dividend to $0.85/share from $0.83/share

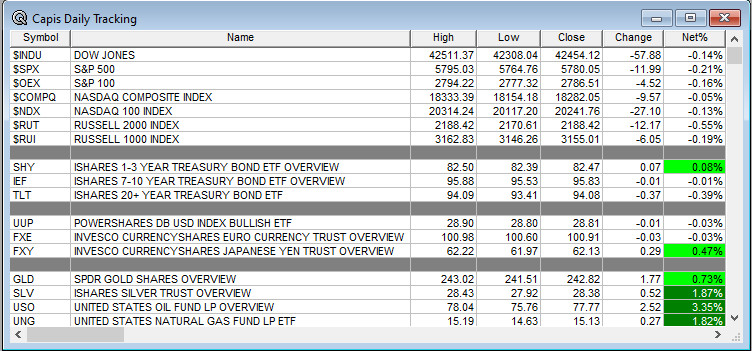

What’s Happening This Morning: Futures S&P 500 -1 NASDAQ 100 -29 Dow Jones -9 Russell 2000 + (at 8:10 a.m. EDT). Asia is lower ex Japan while Europe is higher ex the FTSE. VIX Futures are at 19.10 unchanged from yesterday while Bonds are at 4.10% from 4.082% on the 10-Year. Crude Oil and Brent are lower with Natural Gas higher. Gold, Silver and Copper are higher for a second day. The U.S. Dollar is higher versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $61,168 from $61,001 higher by +17 at 0.03% this morning.

- Daily Positive Sectors: Energy, Materials and Technology of note.

- Daily Negative Sectors: Real Estate, Industrials and Consumer Defensive of note.

- One Month Winners: Consumer Cyclicals, Materials, Communication Services and Technology of note.

- Three Month Winners: Utilities, Real Estate, Financials, Industrials, and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, mmmTechnology, Consumer Defensive and Financials of note.

- Twelve Month Winners: Technology, Utilities, Financials, Communication Services, Industrials and Real Estate note.

- Year to Date Winners: Technology, Utilities, Communication Services, Financials, Industrials and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note

- Monday Before The Open: None of note

Earnings of Note This Morning:

- Beats: BLK +1.01, JPM +0.38, WFC +0.14, BK +0.09 and FAST +0.01 of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line saw weakness yesterday as a new was made for October.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: AEHR +13.7%, CLOV +5.1%, BLK +2.4%, TGI +2.3%, LFCR +2.3%

- Gap Down: TSLA -5.7%, HUM -3.9%, STLA -3.6%, AORT -2.8%

Insider Action: None of note see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens. (CNBC)

- What You Need to Know To Start Your Day. (Bloomberg)

- Pre-Market Movers: WFC JPM STLA. (CNBC)

- Bloomberg Lead Story: Milton’s Surprise Was the Wind. (Bloomberg)

- Markets Wrap: Stocks slip as rates, earnings uncertainty grips. (Bloomberg)

- Chinese investors expect more stimulus this weekend. How much? $283 billion!! (Bloomberg)

- Blackrock (BLK) hits $11.5 trillion of assets as the private market grows. (Bloomberg)

- Tesla (TSLA) lower as Cyber Taxi fails to impress. Really?? (CNBC)

- JP Morgan (JPM) knocks it out of the park on earnings and revenues. (CNBC)

- Bloomberg: The Big Take – Why Election Night could take a week. (Podcast)

- Wealthion: Crypto and Bitcoin reviewed with Anthony Scaramucci. (Podcast)

- NY Times Daily: Trump Presidency 2.0 driven by revenge. (Podcast)

- Marketplace: Bytes: Week in Review. (Podcast)

Economic:

- September PPI is due out at 8:30 a.m. EDT and is expected to fall to 0.1% from 0.2%.

- October University of Michigan Consumer Sentiment (Preliminary) is expected to stay at 70.10.

- Weekly Baker Hughes Rig Count out at 1:00 p.m. EDT.

Geopolitical:

- President Biden receives the President’s Daily Brief at 2:30 p.m. EDT.

- President Biden receives a briefing on efforts to respond to recent hurricanes at 12:30 p.m. EDT and then speaks about it at 1:00 p.m. EDT.

Federal Reserve Speakers:

- Federal Reserve Chicago President Austan Goolsbee will speak at 9:45 a.m. EDT.

- Federal Reserve Dallas President Lorrie Logan will speak at 10:45 a.m. EDT.

- Federal Reserve Governor Lisa Cook will speak at 1:10 p.m. EDT.

M&A Activity and News:

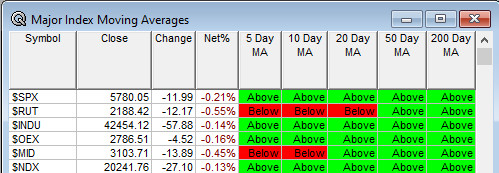

Moving Averages On Major Equity Indexes: Move to 83% positive from 77%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: CLOE, OCX, TCON

- Top Analyst, Investor Meetings: ADTX, FURY

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- Annual Congress of the World Muscle Society

- Inaugural PublicSquare Business Summit

- International Congress of the Society for Melanoma Research

- RSI EXPO & Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: KMI UNFI

Downgrades: