Overnight Summary: The S&P 500 closed Monday higher by 0.42% at 5762.48 from Friday lower by -0.13% at 5738.17. The overnight high was hit at 5822.50 at 9:55 p.m. EDT and the low was hit at 5800.75 at 3:15 a.m. EDT. The overnight range is 23 points. The current price is 5813.75 at 6:55 a.m. EDT lower by -0.50 points.

Most Important Article Of the Morning: See Podcast From Wealthion on China Stimulus and Fed Cuts.

Executive Summary: Stocks started out yesterday on a weak note with futures lower in the morning and then fell even more when Federal Reserve Chairman Powell spoke at 1:00 p.m. EDT when he stated that he thought two rate cuts of 25 basis points were likely. Then stocks rallied into the close by almost a percent from 2:00 p.m. into the close. The U.S. Port strike is now a reality and will impact ports from the East Coast to the Gulf Coast. Over a month will pretty much guarantee a recession.

- 52 Week Bill Auction at 11:30 a.m. EDT.

- Several economic releases out today: ISM Manufacturing Index, JOLTS and Construction Spending.

Earnings Out After The Close:

- Beats: None of note.

- Flat:

- Misses: None of note.

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Cerebras, an AI chipmaker, files for U.S. IPO. (Reuters)

- Secondaries Filed or Priced:

- PNTG announces public offering of 3.50 mln shares of common stock

- BHVN announces proposed public offering of $250 mln of its common shares

- AKR announces public offering of 4.5 mln shares of common stock

- AGMH: Form F-1.. Class A Ordinary Shares Offering

- PNTG Public Offering of Common Stock – 3,500,000 shares of common stock

- ZBAO: Form F-1.. Up to 3,282,563 Class A Ordinary Shares

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- PMTS files secondary stock offering of 1,000,000 shares of common stock by majority stockholder

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- CASH files mixed shelf securities offering

- SPFI files $150 mln mixed shelf securities offering

- PRQR files mixed shelf securities offering

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: TRAK +4.4%

- Movers Down: IGMS -19.8%, RPTX -8.4%, PMTS -6%, PNTG -3.4%

News After The Close :

-

- TD to pay over $20 mln to resolve fraud trading tactics. (Reuters)

- RMD unveils 2030 strategy to drive growth; projects high-single-digit revenue growth over the next five years

- ULH acquires Parsec, a rail terminal operator for a purchase price was $193.6 million

- PEB notes several resorts impacted but repair costs net of insurance payments not expected to be material

- ES completes the sale of its 50% interest in the 132-megawatt South Fork Wind project and the 704-megawatt Revolution Wind project to Global Infrastructure Partners, nets $745 million.

- PCG cuts power for over 9,000 customers in northern California over wildfire risks. (Reuters)

- SEC concludes investigation of Clover (CLOV) which began in 2021; not intend to recommend enforcement action by SEC.

- BGC updates Q3 outlook: expects to be around high end of revenue and adjusted EPS guidance ranges

- PEP looking to buy Siete Foods for over $1.0 bln. (WSJ)

- PRQR files $300 mln mixed shelf securities offering

- BA awarded $6.9 bln U.S. Air Force contract for Small Diameter Bombs Increment One, also awarded $1.68 bln U.S. Air Force contract modification.

- BA also awarded $600 mln U.S. Air Force contract for Joint Direct Attack Munition and Laser Joint Direct Attack Munition testing and integration

- LMT awarded $2.11 bln U.S. Navy contract modification, also awarded $1.17 bln U.S. Navy contract.

- RTX awarded $1.31 bln U.S. Navy contract

- 10-Q or 10-K Delays – None of note.

- NASDAQ Delisting Notice – None of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

Exchange/Listing/Company Reorg and Personnel News:

-

- IGMS appoints new CEO, Mary Beth Harler, and announces strategic pivot and pipeline transformation to accelerate development of T cell engaging IgM antibodies

- ZS announces appointment of Adam Geller as Chief Product Officer, who previously launched multiple product lines for Palo Alto Networks (PANW)

- KB Home (KBH) CFO Jeff J. Kaminski to retire in early 2025; company is following succession planning process to identify next CFO

-

Charles Schwab & Co (SCHW) CEO to retire at end of year, Rick Wurster to replace him. (CNBC)

Dividends Announcements or News:

- Stocks Ex Div Today: APD O PWR A VTR CAH STT RJF CUBE EHC FRT INGR CHH PEGA RITM TNET FULT UPBD ANDE TWO WWW

- Stocks Ex Div Tomorrow: CSCO CMCSA RSG ITUB BBDO BBD ERIC

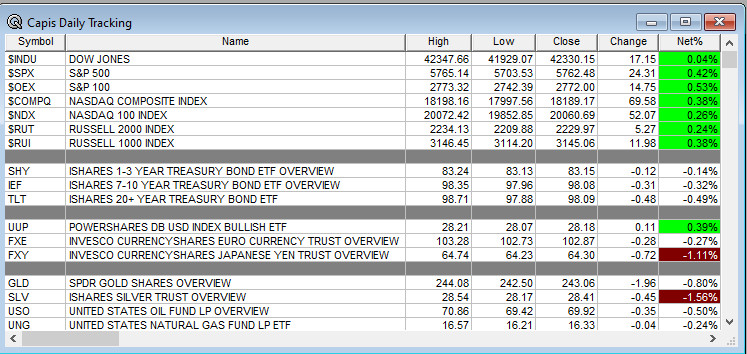

What’s Happening This Morning: Futures S&P 500 -3 NASDAQ 100 +12 Dow Jones -102 Russell 2000 +9.63 (at 7:50 a.m. EDT). Asia is lower ex Japan while Europe is higher ex France. VIX Futures are at 18.05 from 18.42 yesterday while Bonds are at 3.743% from 3.771% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold, Silver and Copper higher. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $63,806 from $63,566 higher by 0.52% this morning.

- Daily Positive Sectors: Communication Services, Real Estate and Healthcare of note.

- Daily Negative Sectors: Materials and Consumer Cyclicals of note.

- One Month Winners: Consumer Cyclicals, Utilities, Materials and Industrials of note.

- Three Month Winners: Utilities, Real Estate, Financials, Materials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Financials, Materials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Communication Services, Industrials, Utilities and Real Estate note.

- Year to Date Winners: Technology, Utilities, Financials, Communication Services, Consumer Defensive and Industrials of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close:

- Wednesday Before The Open:

Earnings of Note This Morning:

- Beats: MKC +0.19, UNFI +0.09 and AYI +0.03 of note.

- Flat: PAYX

- Misses: None of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Weekly Update With Both Daily and Weekly Stats: The Daily A/D Line is working back to a new high while the S&P 500 keeps making new highs. A small divergence currently exists.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: SITC +54.5%, AMRX +7%, DJT +6.9%, ZK +6.7%, NIO +4.6%, LI +3.7%, MKC +3.6%, XPEV +3.2%, ULH +2.8%, TRAK +2.4%, IAG +2.3%, BGC +2.3%

- Gap Down: IGMS -24.4%, PMTS -12%, RPTX -10.2%, PRQR -6.6%, STTK -4.9%, BA -2.7%, PNTG -2%, BHVN -2%

Insider Action: No names see Insider buying with dumb short selling. CTLP TTSH see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens. (CNBC)

- What You Need to Know To Start Your Day. (Bloomberg)

- Pre-Market Movers: . (CNBC)

- Port Strike on at midnight as mentioned last week. (Bloomberg)

- Bloomberg Lead Story: Israel Enters Lebanon. (Bloomberg)

- Markets Wrap: Bond rally gains speed as ECB meets inflation goals. (Bloomberg)

- VP Debate Tonight. (Bloomberg)

- BA may sell up to $10 billion of stock in the next month. (Bloomberg)

- CVS considers a breakup. (Bloomberg)

- Bloomberg Big Take: Forecasting America under Harris or Trump. (Podcast)

- Wealthion: China Stimulus and Fed Cuts, Enough?. (Podcast)

- NYT Daily: Helene’s 600 Miles of Destruction. (Podcast)

- Marketplace: AI and Social Media lack regulation. (Podcast)

Economic:

- September ISM Manufacturing Index is due out at 10:00 a.m. EDT and expected to rise to 47.70% from 47.20%.

- At the same time, the August JOLTS data is due out and came in at 7.673 million.

- Last, August Construction Spending is due out at 10:00 a.m. EDT and is expected to rise to 0.1% from -0.3%.

- Weekly API Crude Oil Inventories are due out at 4:30 p.m. EDT.

Geopolitical:

- President Biden receives the Daily Briefing at 10:00 a.m. EDT.

- President Biden receives a briefing on Hurricane Helene and the federal response.

- President Biden holds a call with Jewish Rabbis ahead of the Jewish High Holidays at 1:15 p.m. EDT.

- Press Briefing is held at 1:30 p.m. EDT with Press Secretary Karine Jean-Pierre.

Federal Reserve Speakers:

- Federal Reserve Atlanta President Raphael Bostic speaks at 11:00 a.m. EDT and then again at 6:15 p.m. EDT.

- Federal Reserve Governor Lisa Cook speaks at 11:10 a.m. EDT.

- Federal Reserve Richmond President Thomas Barkin speaks at 6:15 p.m. EDT.

M&A Activity and News:

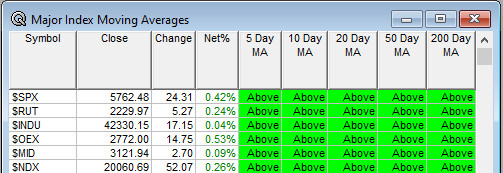

Moving Averages On Major Equity Indexes: 100% of the moving averages are positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Chardan Genetic Medicines Conference

- Goldman Sachs Cell Therapy Day

- Mizuho REIT Conference

- Piper Sandler Technology Private Equity Forum

- UBS Ophthalmology Day

- Wolfe Utilities Midstream and Clean Energy Conference

- Fireside Chat: None of note.

- Top Shareholder Meetings: ASST, BORR

- Investor/Analyst Day/Calls: AIOT, AMPY, APO, BNTX, BNZI, HRMY, SEMR, WINT

- Update: None of note.

- R&D Day: None of note.

- Sellside Conferences:

-

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- AI Day

- American Society for Radiation Oncology

- American Society for Bone and Mineral Research

- Barrigel Educational Symposium

- Extracorporeal Life Support Organization Conference

- Heart Failure Society of America Medical Conference

- International Conference on Silicon Carbide and Related Materials (ICSCRM 2024)

- International Congress of Parkinson’s Disease and Movement Disorders

- Live Burn and Education Seminar

- Society of Plastics Engineers TPO Global Auto

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: STLD AA F DDOG CLX BUD BIO BDX

Downgrades: PPRUY MGY IGMS FIBK AR