Overnight Summary: The SP 500 closed Thursday lower by -0.22% at 5011.12 from Wednesday lower by -0.58% at 5022.21. The overnight high was hit at 5,039.25 at 7:25 a.m. while the overnight low was hit at 4963.50 at 10:20 a.m. EDT. The range overnight is 72 points as of 8:00 a.m. EDT. Currently, the S&P 500 is lower by -11 points at 6:10 a.m. EDT.

- Federal Reserve Chicago President Austan Goolsbee 10:30 a.m. EDT

- Beats: NFXL +0.77, HTH +0.17, ISRG +-0.08, WAL +0.08, PFS +0.03, FFIN +0.02 of note.

- Flat: MRTN , PPG of note.

- Misses: GBCI -0.03 of note.

Capital Raises:

- IPOs Priced or News:

- New SPACs launched/News:

- Secondaries Priced:

- Notes Priced of note:

- Common Stock filings/Notes:

- ELVN files 1,091,981 shares of common stock.

- GRYP files 5,797,922 shares of common stock.

- MSAI files 16,693,916 shares of common stock.

- TFFP files 147,500 shares of common stock.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- FATE files a 3,636,364 shares of common stock by selling shareholder.

- Private Placement of Public Entity (PIPE):

- Mixed Shelf Offerings:

- XEL files a mixed-shelf offering

- VRPX files a mixed-shelf offering

- Debt/Credit Filing and Notes:

- GD files debt securities.

- Tender Offer:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- MCB +11.8%, KBH +2.9%, ISRG +2.5%

- CGC -6.9%, FYBR -3.8%, JBL -3.2%, FLNX -4.5%, WAL -2.4%,

- News Items After the Close:

- Stocks making the biggest moves after hours: (CNBC)

- Netflix (NFLX) will stop reporting quarterly membership numbers and ARM in Q1 of 2025.

- Glacier Bancorp (GBCI) gets approval to acquire six banks from Heartland Financial (HTLF).

- Western Alliance (WL) issues guidance in slide update sees $4 billion of loan growth, deposit growth of $11 billion, net interest income growth of 5% to 10% and net chargeoffs up 10015 basis points.

- PLCE to delay 10-K.

- Cohen & Steers (CNS) to join S&P 600 replacing KAMN that is being bought by Arcline Investment Mgmt.

- Exchange/Listing/Company Reorg and Personnel News:

- Ocular Therapeutics (OCUL) names Pravin Dugel as President and will serve as Executive Chairman.

- CNI names Remi LaLonde as EVO and Chief Commercial Officer.

- NYCB names Craig Gifford as CFO.

- Jabil (JBL) CEO Kenneth Wilson placed on leave pending investigation related to corporate policies.

- Buyback Announcements or News:

- PPG announces a $2.5 billion buyback.

- KBH to buyback $1.0 billion worth of stock. Ups dividend by 25% to $0.25.

- FC to buy back $50 million of stock.

- Stock Splits or News:

- Dividends Announcements or News:

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Utilities, Communication Services, Financials and Consumer Defensive of note.

- Daily Negative Sectors: Technology, Consumer Cyclicals, Industrials and Healthcare of note.

- One Month Winners: Energy, Communication Services, Basic Materials and Industrials of note.

- Three Month Winners: Energy, Technology, Communication Services, Industrials and Materials of note.

- Six Month Winners: Technology, Financials, Industrials and Communication Services of note.

- Twelve Month Winners: Technology, Communication Services, Consumer Cyclical and Financial of note.

- Year to Date Winners: Communication Services, Technology, Energy, Industrials and Financials of note.

Bond yields rose and stocks mostly slumped Thursday as investors continued to adjust to the idea that interest rates may not come down this year. The S&P 500 lost 0.2%, its fifth straight daily decline. The Nasdaq Composite dropped 0.5%. Both have shed nearly 5% so far in April. The Dow Jones Industrial Average gained less than 0.1%, or 22 points. The blue-chip index’s 5.1% fall this month has wiped out nearly all of its 2024 advance. The yield on benchmark 10-year Treasury notes rose to 4.646%, from 4.584% on Wednesday. (WSJ – Edited by QPI)

Upcoming Earnings Of Note:

- Friday After the Close: None of note.

- Monday Before the Open:

Earnings of Note This Morning:

- Beats: AXP +0.38, PG +0.10, FITB +0.08, HBAN +0.04.

- Flat: None of note.

- Misses: RF -0.08 of note.

- Still to Report: SLB of note.

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative Guidance: of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: PARA +10.8%, MCB +5.7%, CNS +5.4%, LYTS +4.4%, LLAP +3.7%, ISRG +3%, BLX +2.5%, JWN +2.4%, AESI +2.2%, HTH +2%, HTH +2% of note.

- Gap Down: NFLX -6.6%, PLCE -5%, FYBR -3.6%, JBL -3%, GBCI -2.1%, TSLA -2% of note.

Insider Action: No stock see Insider buying with dumb short selling. LOVE sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Iran Says Strike By Israel Involved Drones and Failed (Bloomberg)

- Israel carries out limited strikes against Iran. (CNBC)

- Havens bid unravels as Iran strikes seen contained: Markets Wrap. (Bloomberg)

- China tells Apple (AAPL) to remove messaging apps like WhatsApp, Signal and Telegram. (WSJ)

- Federal Reserve Minneapolis President Neel Kashkari says rate cuts could be delayed until 2025. (Bloomberg)

- House to vote on financial aid to foreign entities on Saturday as well as a voteon Tik Tok. (CNN)

- Procter & Gamble (PG) raises quarterly earnings forecast but sales disappoint. (CNBC)

- Users say that Robinhood (HOOD) went down when futures fell after Israel attack on Iran. (MarketWatch)

- 3M (MMM) may cut its dividend says analyst. (MarketWatch)

- Barron’s is cautious on Apple (AAPL). (Barron’s)

- Bloomberg: Daybreak Podcast: (Podcast)

- Bloomberg: The Big Take: Boeing’s big painful reckoning. (Podcast)

- Marketplace: Tech Bytes: Week In Review. (Podcast)

- NY Times Daily: Supreme Court takes up homelessness. (Podcast)

- Wealthion: FTX Crash Analysis post the fallout. (Podcast)

- Adam Taggart’s Thoughtful Money: Get ready for much larger swings to the downside, Adam Kobeisi. Good example of negative hype to get eyeballs. (Podcast)

Moving Average Update: Score stays at 20% for the 3rd day and you can see why in the chart below.

Geopolitical:

- President’s Public Schedule:

- The President receives the President’s Daily Brief, 9:00 a.m. EDT

- The President delivers remarks at the IBEW Construction and Maintenance Conference, 12:00 p.m. EDT

- The President arrives at the White House, 1:25 p.m. EDT

- Press Briefing by Press Secretary Karine Jean-Pierre, 1:30 p.m. EDT

- The President departs the White House en route to Wilmington, Delaware, 5:10 p.m. EDT

- The President arrives in Wilmington, Delaware, 6:05 p.m. EDT

Economic:

- No releases of note today besides weekly Baker Hughes Rig Count at 1:00 p.m. EDT.

Federal Reserve / Treasury Speakers:

- Federal Reserve Chicago President Austan Goolsbee 10:30 a.m. EDT

M&A Activity and News:

- None of note.

Meeting & Conferences of Note:

- Sellside Conferences:

- None of note.

- Top Shareholder Meetings: AIHS, AMN, CVM, LECO, LTBR, SUPV, OLK.

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: None of note.

- Update: None of note.

- R&D Day: None of note.

- Company Event:

- Industry Meetings:

- CEM Scottsdale Capital Event

- Cholangiocarcinoma Foundation Conference

- Society for Healthcare Epidemiology of America Conference

- Society for Industrial and Organizational Psychology Conference

- Spinal Cord Injury Investor Symposium

- World Congress Experience

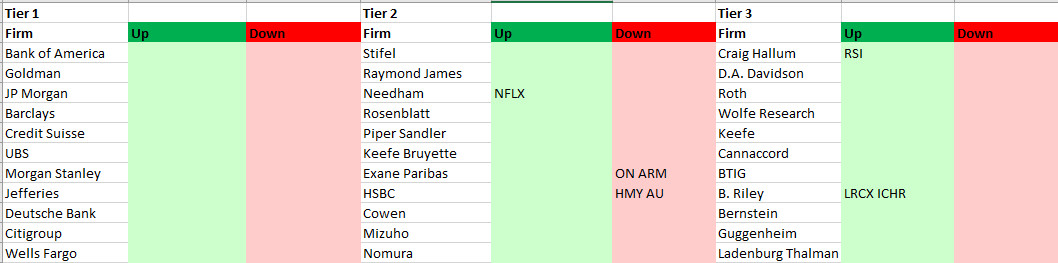

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: