Overnight Summary: The SP 500 closed Wednesday lower by -0.58% at 5022.21 from Tuesday lower by -0.21% at 5051.41. The overnight high was hit at 5,084.25 at 2:25 a.m. while the overnight low was hit at 5056 at 4:05 a.m. EDT. The range overnight is 28 points as of 8:00 a.m. EDT. Currently, the S&P 500 is higher by +9.50 points at 6:10 a.m. EDT.

- Federal Reserve Board of Governors Michelle Bowman 9:05 a.m. EDT

- Federal Reserve New York President John Williams 9:15 a.m. EDT

- April Philadelphia Fed Index is due out at 8:30 a.m. EDT and is expected to fall to 0.00% from 3.20%.

- March Existing Home Sales are due out at 10:00 a.m. EDT and are expected to fall to 4.20 million from 4.38 million.

- March Leading Indicators are due out at 10:00 a.m. EDT and are expected to fall to -0.1% from 0.1%.

- Federal Reserve Atlanta President Raphael Bostic 11:00 a.m. EDT and 5:45 p.m. EDT.

- Beats: SLG +1.02, WTFC +0.48, LVS +0.13, EFX +0.06, OZK +0.05, CSX +0.01 of note.

- Flat: BDN +0.00, CCI +0.00, FNB +0.00, KMI +0.00, REXR +0.00 of note.

- Misses: DFS (1.85), SNV (0.20), AA (0.17), LBRT (0.05), CNS (0.01), FR (0.01) of note.

Capital Raises:

- IPOs Priced or News:

- New SPACs launched/News:

- Secondaries Priced:

- Notes Priced of note:

- TPC – Prices $400 Million of Senior Notes.

- Common Stock filings/Notes:

- ACXP: Filed FORM RW.

- BHVN: Proposed Public Offering of Common Shares $200 million. (JPM Bookmanager)

- LAC: announces proposed public offering of 55 million of its common shares. (Evercore, GS and BMO Bookmanager)

- NRXP: Proposed Underwritten Public Offering of Common Stock. (EF Hutton Bookmanager)

- RNLX: FORM S-3 – 19,986,031 Ordinary Shares.

- ZEO: Filed Form S-1.. 13,800,000 Shares of Class A Common Stock Underlying Warrants (For Issuance) 40,118,434 Shares of Class A Common Stock. (For Resale)

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- ACRV: FORM S-3 – Up to 15,295,000 Shares of Common Stock Offered by the Selling Stockholders.

- Private Placement of Public Entity (PIPE):

- Mixed Shelf Offerings:

- CAN: FORM F-3 – $300,000,000 Mixed Shelf Offering.

IBRX: Filed Form S-3ASR — Mixed Shelf.

- CAN: FORM F-3 – $300,000,000 Mixed Shelf Offering.

- Debt/Credit Filing and Notes:

- SLG – Completes $2.1 Billion of Debt Refinancings.

- Tender Offer:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- TIRX: +150% Extraordinary General Meeting of Shareholders

- TRVN: +32% Patent talk on name

- DUOL: +6% Join S&P Midcap 400

- CSX: +3% Earnings

- OZK: +3% Earnings

- AA: +3% Earnings .

- LAC: -21% Offering

- ICU: -15% Earnings and Business Update

- EFX: -9% Earnings

- BHVN: -4% Offering

- IBRX: -3.5% Mixed Shelf

- LVS: -3% Earnings

- TIRX: +150% Extraordinary General Meeting of Shareholders

- News Items After the Close:

- Stocks making the biggest moves after hours: CSX, EFX, AA, LVS (CNBC)

- Federal Reserve Cleveland President Loretta Mester:

- We Want To Get More Information Before We Can Say Inflation Is On A Sustainable Path To 2% – This Year Inflation Is A Little Higher Than Expected.

- Possible Rate Cut If Labor Markets Worsen.

- Anticipates A Shift To Eased Policy.

- CSX first-quarter profit declines but beats expectations. (MarketWatch)

- Equifax (EFX) stock falls as company says it’s feeling effect of weaker mortgage demand. (MarketWatch)

- Alcoa’s (AA) first-quarter loss widens on lower prices, higher costs. (MarketWatch)

- Airline executives predict a record summer and even more demand for first class. (CNBC)

- Abbott Labs (ABT) awarded $117 million U.S. Defense Logistics Agency contract.

- Exchange/Listing/Company Reorg and Personnel News:

- Index Changes:

- Duolingo (DUOL) to join S&P MidCap 400

- Cable One (CABO) to join S&P SmallCap 600

- AdaptHealth (AHCO) names Suzanne Foster as CEO.

- Intrepid Potash (IPI) grants Executive Chairman and CEO Bob Jornayvaz a temporary medical leave of absence, effective immediately; appoints CFO Matt Preston as acting CEO.

- Toshiba is considering cutting its domestic workforce by 5,000, equivalent to about 7% of the total in Japan. (NIKKEI)

- Index Changes:

- Buyback Announcements or News:

- Stock Splits or News:

- Dividends Announcements or News:

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Utilities, Basic Materials, Consumer Defensive of note.

- Daily Negative Sectors: Technology, Real Estate, Industrials, Consumer Cyclical of note.

- One Month Winners: Energy, Communication Services, Basic Materials and Industrials of note.

- Three Month Winners: Energy, Technology, Communication Services, Industrials and Materials of note.

- Six Month Winners: Technology, Financials, Industrials and Communication Services of note.

- Twelve Month Winners: Technology, Communication Services, Consumer Cyclical and Financial of note.

- Year to Date Winners: Communication Services, Technology, Energy, Industrials and Financials of note.

Stocks fell Wednesday, deepening an April selloff, after investors largely abandoned their expectations of imminent interest-rate cuts or even by June. The S&P 500 fell 0.6%, marking a fourth straight session of declines. The Nasdaq Composite shed 1.1%. The Dow Jones Industrial Average dipped 0.1%, or 46 points. The S&P 500’s losing streak is its longest since the first week of 2024. And for the third consecutive session, the index rose in early trading before closing lower, the longest streak of such reversals since 2022. Stocks rallied sharply to start the year, due in part to widespread expectations that the Federal Reserve would move to lower interest rates at some point in 2024. The S&P 500 had its best first quarter since 2019. (WSJ – Edited by QPI)

Upcoming Earnings Of Note:

- Thursday After the Close:

- Friday Before the Open:

Earnings of Note This Morning:

- Beats: DHI +0.45, CMA +0.20, ALK +0.13, APOG +0.13%, ELV +0.12, SNA +0.11, MMC +0.09, GPC +0.05, BX +0.01, IRDM +0.01.

- Flat: None of note.

- Misses: TCBI -0.12, KEY -0.02, of note.

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: KMI of note.

- Negative Guidance: KNX, EFX, REXR of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: DUOL +6.1%, EOLS +5%, ADTN +4.7%, OZK +3.9%, IPI +3.3%, AHCO +3.1%, CABO +2.9%, DHI +2.9%, TWKS +2.7%, KMI +2.3%, LBRT +2.2%, AA +2.1%, NOK +2.1% of note.

- Gap Down: CAN -27.9%, LAC -20.5%, EFX -9.1%, PHAR -8%, SNV -7.7%, BHVN -4.7%, MCRI -3.3%, FNB -3.1%, LVS -2.7%, TFIN -2.2%, CAAP -2%of note.

Insider Action: RXO see Insider buying with dumb short selling. BRT sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Mester Says Fed Can Hold Rates Steady, Not In a Hurry To Cut. (Bloomberg)

- Stocks climb with earnings in focus, dollar dips: Markets Wrap. (Bloomberg)

- Bank of England to cut rates in May says Morgan Stanley. (CNBC)

- TSMC beat Q1 revenue and profit expectations on strong AI chip demand. (CNBC)

- Alaska Airlines (ALK) beats estimates despite ground of Boeing (BA) Max planes. (CNBC)

- Bloomberg: Daybreak Podcast: (Podcast)

- Bloomberg: The Big Take: A Cocoa shortage rocks the chocolate world. (Podcast)

- Marketplace: How science could change the Gin industry. (Podcast)

- NY Times Daily: The opening days of Trump’s first criminal trial. (Podcast)

- Wealthion: Fed losing battle with inflation. (Podcast)

- Adam Taggart’s Thoughtful Money: Stocks have broken their trendline, will they recover? (Podcast)

Moving Average Update: Score again remains at 20%.

Geopolitical:

- President’s Public Schedule:

- The President departs the White House en route to Joint Base Andrews, 10:15 a.m. EDT

- The President departs Joint Base Andrews en route to Philadelphia, Pennsylvania, 10:35 a.m. EDT

- The President arrives in Philadelphia, Pennsylvania, 11:20 a.m. EDT

- The President participates in a campaign event, 12:45 p.m. EDT

- The President participates in a campaign event, 1:45 p.m. EDT

- The President departs Philadelphia, Pennsylvania en route to Joint Base Andrews, 3:50 p.m. EDT

- The President departs Joint Base Andrews en route to the White House, 4:45 p.m. EDT

- The President arrives at the White House, 4:55 p.m. EDT

Economic:

- Jobless Claims 8:30 a.m. EDT

- April Philadelphia Fed Index is due out at 8:30 a.m. EDT and is expected to fall to 0.00% from 3.20%.

- March Existing Home Sales are due out at 10:00 a.m. EDT and are expected to fall to 4.20 million from 4.38 million.

- March Leading Indicators are due out at 10:00 a.m. EDT and are expected to fall to -0.1% from 0.1%.

- EIA Natural Gas Report 10:30 a.m. EDT

Federal Reserve / Treasury Speakers:

- Federal Reserve Board of Governors Michelle Bowman 9:05 a.m. EDT

- Federal Reserve New York President John Williams 9:15 a.m. EDT

- Federal Reserve Atlanta President Raphael Bostic 11:00 a.m. EDT

- Federal Reserve Atlanta President Raphael Bostic 5:45 p.m. EDT

M&A Activity and News:

- None of note.

Meeting & Conferences of Note:

- Sellside Conferences:

- None of note.

- Top Shareholder Meetings: AMRN, CARR, CF, FSD, FAM, HUM, IBKR, KBH, MFD, OC, PK, PPG, REKR, SLAB, WH, WISH, XFIN

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ADAP, BNTC, PEV, TENX

- Update: None of note.

- R&D Day: None of note.

- Company Event:

- Industry Meetings:

- American Academy of Neurology Meeting

- Life Science Innovation Northwest Conference

- Spinal Cord Injury Investor Symposium

- World Congress Experience

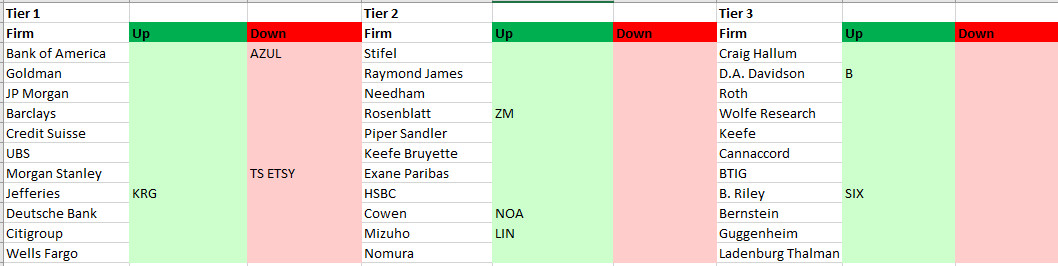

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: