Overnight Summary: The SP 500 closed Friday lower by -1.46% at 5123.41 from Thursday higher by 0.74% at 5199.06. The overnight high was hit at 5,198.50 at 3:05 a.m. while the overnight low was hit at 5164.50 at 6:05 p.m. EDT. The range overnight is 34 points as of 7:15 a.m. EDT. Currently, the S&P 500 is higher by +23.75 points at 7:20 a.m. EDT.

- Several economic data points are due out including: Retail Sales, NY Fed Empire Manufacturing Index and NAHB Housing Index.

- Market reaction to Iran attack on Israel and whether Israel retaliates.

- Beats: .

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs Priced or News: None of note.

- New SPACs launched/News: None of note.

- Secondaries Priced:

- Notes Priced of note:

- Common Stock filings/Notes:

- ADIL files 2,369,000 shares of common stock

- BNAI files 46,752,838 shares of common stock

- CYN files 52,015,605 shares of common stock

- ZPTA files 13 million shares of common stock

- RVSN files $100 million of stocks and warrants

- TCON files a S-1

- ONVO files a S-1

- Direct Offering: None of note.

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- BALY files 7,911,724 share offering by selling shareholders

- DUOT files 998,337, of common stock by selling shareholders

- Private Placement of Public Entity (PIPE): None of note.

- Mixed Shelf Offerings:

- PHVS files a mixed-shelf offering

- AMPG files a $200 million mixed-shelf offering

- CION files a $350 million mixed-shelf offering

- NRBO files $150 million mixed-shelf offering

- SDOG files $250 million mixed-shelf offering

- Debt/Credit Filing and Notes: None of note.

- Tender Offer: None of note.

- Convertible Offering & Notes Filed: None of note.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close and Over the Weekend:

- News Items After the Close:

- Medical Properties Trust (MPW) to sell 5 Utah hospitals producing $1.1 billion of cash.

- Tesla (TSLA) lowers cost of Full Self Driving capability subscription to $99 from $199.

- Orasure (OSUR) had a cyber attack on March 27th but does appear to impact earnings.

- News Items Over the Weekend:

- Iran bombarded Israel with drones and Israel was able to defend itself with help from the U.S. and Britain. (CNN)

- Netflix’s (NFLX) new film strategy that Dan Lin is promoting. (NYT)

- Bank of England will overhaul its forecasting after inflation surprises. (NYT)

- The Americans crossing the Biden $400,000 level do not think of themselves as rich. (WSJ)

- Barron’s:

- Positive View: NFLX, MSFT, GOOGL, AMZN, GOLD, NEM of note.

- Cautious View: DOW, LYB, WLK, JPM of note.

- Mixed View: None of note.

- Erlanger Type 1 Short Squeezes and Type 4 Long Squeezes reporting earnings this week:

- Exchange/Listing/Company Reorg and Personnel News:

- ZipRecruiter (ZIP) COO Qasim Saifee resigns as of April 30th.

- Matador Resources (MATR) President of Operations Billy Goodwin to retire.

- Customers Bancorp (CUBI) names Philip Watkins to CFO position.

- Buyback Announcements or News: None of note.

- ROAD announces a $40 million repurchase agreement.

- Stock Splits or News:

- Dividends Announcements or News:

- AON increase dividend by 10% to $0.675 from $0.615.

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: None of note.

- Daily Negative Sectors: All led by Consumer Cyclical, Technology and Materials.

- One Month Winners: Energy, Communication Services, Basic Materials and Industrials of note.

- Three Month Winners: Energy, Technology, Communication Services, Industrials and Materials of note.

- Six Month Winners: Technology, Financials, Industrials and Communication Services of note.

- Twelve Month Winners: Technology, Communication Services, Consumer Cyclical and Financial of note.

- Year to Date Winners: Communication Services, Technology, Energy, Industrials and Financials of note.

Upcoming Earnings Of Note:

- Monday After the Close: None of note.

- Tuesday Before the Open:

Earnings of Note This Morning:

- Beats: GS +2.85, MTB +0.01, SCHW +0.01

- Flat: None of note.

- Misses: .

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: LGVN +45%, SNPO +29.7%, PLL +25%, MPW +16%, WIRE +7.7%, NVAX +4.4%, AA +4.3%, OSUR +2.4%, BLKB +2.2% of note.

- Gap Down: KULR -25%, NMRA -25.5%, CYN -13%, BHVN -2.8% of note.

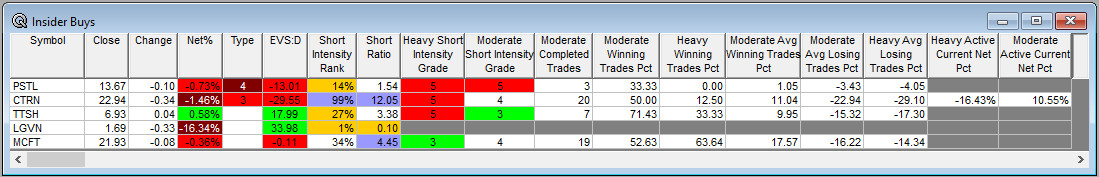

Insider Action: No stock see Insider buying with dumb short selling. CTRN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Iran’s Attack on Israel Sparks Race to Avert A Full Blown War. (Bloomberg)

- Oil steadies, Treasuries dip as Iran stresses ease: Markets Wrap. (Bloomberg)

- Tesla (TSLA) to lay off more than 10% of global workforce. (CNBC)

- Goldman Sachs (GS) tope Q1 estimates fueled by trading and investment banking. (CNBC)

- Bloomberg: Daybreak Podcast: Markets calm after Iran’s attack on Israel. (Podcast)

- Marketplace: 65 -year old computer system at the core of banking industry. (Podcast)

Moving Average Update: Score drops to 34% from 63%.

Geopolitical:

- President’s Public Schedule:

- The president receives The Daily Briefing at 10:00 a.m. EDT.

- The president holds a bilateral meeting with Prime Minister Al-Sudani of the Republic of Iraq at 1:30 p.m. EDT.

- The president holds a bilateral meeting with Prime Minister Fiala of the Czech Republic at 3:00 p.m. EDT.

Economic:

- March Retail Sales are due out at 8:30 a.m. EDT and are expected to fall to 0.4% from 0.6%.

- April NY Fed Empire State Manufacturing is also due out at 8:30 a.m. EDT and is expected to improve to -6.0 from -20.90.

- April NAHB Housing Index is due out at 10:00 a.m. EDT and is expected to remain at 51.

Federal Reserve / Treasury Speakers:

- Federal Reserve Dallas President Lorrie Logan spoke pre-market at 2:30 a.m. EDT.

- Federal Reserve San Francisco President Mary Daly speaks at 8:00 p.m. EDT.

M&A Activity and News:

- Clearlake offers to buy Blackbaud (BLKB) for $80 a share.

- Salesforce (CRM) in advanced talks to buy Informatica (INFA).

Meeting & Conferences of Note:

- Sellside Conferences:

- Canaccord Horizons in Oncology Virtual Conferene

- Top Shareholder Meetings: None of note.

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: SCHW TELO

- Update: None of note.

- R&D Day: None of note.

- Company Event:

- None of note

- Industry Meetings:

- American Academy of Neurology Meeting

- Battery Supply Chain Finance Summit

- HEART Conference

- Quantum Computing Symposium

- ISN World Congress of Nephrology

- Spinal Cord Injury Investor Symposium

- World Orphan Drug Congress USA

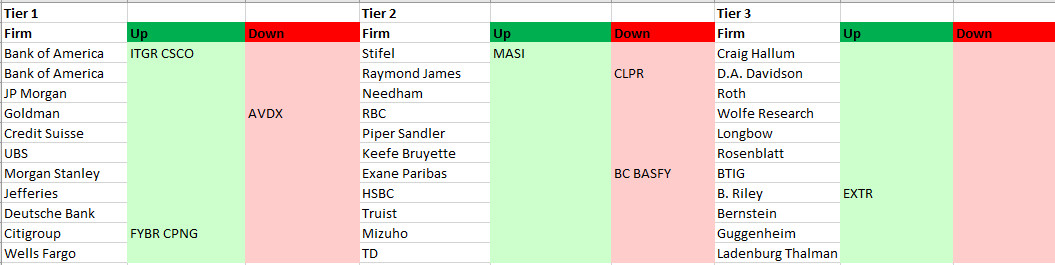

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: