Overnight Summary: The S&P 500 closed Wednesday lower by -0.19% at 5165.31 from Tuesday higher by 1.12% at 5175.27. The overnight high was hit at 5251.25 at 5:45 a.m. EDT while the overnight low was hit at 5231.75 at 4:05 p.m. EST. The range overnight is 20 points as of 7:00 a.m. EST. The 10-day average of the overnight range is at 22.14 from 21.74. The average for May-January average was 20.88 from 20.87 during May-December. Currently, the S&P 500 is higher by +17 points at 6:15 a.m. EDT.

- February PPI is due out at 8:30 a.m. EDT and is expected to remain at 0.3%.

- February Retail Sales is due out at 8:30 a.m. EDT and is expected to rise by 0.7% after falling -0.8% in January.

Earnings Out After The Close:

- Beats: LEN +0.36, PATH +0.06, S +0.02 of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs Priced or News:

- Reddit Sees More Than 20% Sales Growth in 2024 in IPO Roadshow. (Bloomberg)

- New SPACs launched/News:

- Secondaries Priced:

- ICHR: Announces Pricing of $125 Million Public Offering.

- REVG: Announces Pricing of Secondary Offering of Common Stock.

- KNTK: Announce Pricing of Seconday Offering by Selling Shareholders Apache Midstream LLC.

- Notes Priced of note:

- COIN: Announces Pricing of Upsized Offering of $1.1 Billion of 0.25% Convertible Senior Notes Due 2030.

- Common Stock filings/Notes:

- AAOI: Filed Form 424B5.. $25,000,000 Common Stock.

- CDRE: Commences public offering of 3,475,000 shares of its common stock. (BAC Bookmanager)

- PGY: Announces public offering of 6.5 mln Class A ordinary shares. (Citi and Jefferies Bookmanager)

- Direct Offering: None of note.

- Selling Shareholders of note:

- KNTK: Files for 13,079,871 shares of Class A common stock by selling shareholder.

- PAR: Files for 441,598 shares of common stock by selling shareholders.

- REVG: Announces launch of secondary offering of 7,395,191 shares of common stock by American Industrial Partners Capital Fund IV, LP and American Industrial Partners Capital Fund IV. (GS and MS Bookmanager)

- Private Placement of Public Entity (PIPE):

- Mixed Shelf Offerings:

- CRBP: Files $300 million mixed shelf securities offering.

- GOOD: Filed Form S-3.. $1,300,000,000 Mixed Shelf.

- INUV: Filed Form S-3 .. $50,000,000 Mixed Shelf.

- SCPH: Files $200 million mixed shelf securities offering.

- Debt/Credit Filing and Notes:

- Tender Offer: None of note.

- Convertible Offering & Notes Filed:

- GMBL: Announces Secured Note and Amendments to its Convertible Preferred StockSecures Non-Convertible Secured Note of $1.42 Million and a Restructuring of the Existing Preferred Stock.

- MSTR: Announces proposed private offering of $500 million of convertible senior notes due 2013.

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- HEAR: +23% Earnings

- OPTT: +20% Earnings

- HOOD: +7% Monthly operating metrics

- PI: +6% Successful Settlement of Patent Litigation

- SPRB: -74% Topline Results from CAHmelia-203 in Adult Classic CAH and CAHptain-205 in Pediatric Classic CAH

- FSR: -47% BK talk on name

- VRM: -17% Earnings

- PGY: -13% Public Offering of Class A Ordinary Shares

- S: -12% Earnings

- UAA: -5% LEADERSHIP TRANSITION

- News Items After the Close:

- Stocks making the biggest moves after hours: HOOD, S, UA, LEN, FSR, PATH (CNBC)

- Fisker’s (FSR) stock plunges 47% after bankruptcy report. (MarketWatch)

- Walt Disney (DIS) to focus on four divisional leaders in connection with search for an eventual successor to CEO Bob Iger. (Bloomberg)

- JPMORGAN: “.. Ongoing disruptions to the use of the Suez and Panama canals have .. led to a surge in global shipping costs. .. Container rates remain elevated but have started to normalize .. the Baltic Dry Index has risen sharply .. with news about a further reduction in daily transits through the Panama Canal. The region continues to face one of its worst droughts since the 1950s.” (CQ CNBC)

- Anika Therapeutics (ANIK)reducing workforce by approx. 9%.

- Paramount Global (PARA) enters into transfer agreement with Reliance Industries; will sell entire 13.01% equity interest in Viacom 18 Media Private for approximately $517 million.

- ProPetro (PUMP) in 10-K filing: Identified material weakness in internal control over financial reporting.

- BAE Systems (BAESY) awarded $754 million U.S. Army contract modification.

- Exchange/Listing/Company Reorg and Personnel News:

- ARMOUR Residential REIT, Inc. (ARR) Announces Chief Financial Officer Transition

- Empire Petroleum (EP) CFO Stephen L. Faulkner, Jr. to resign.

- NextNav (NN) announces Mariam Sorond as its new CEO.

- Pixie Dust Technologies (PXDT) Announces CFO Transition.

- TE Connectivity (TEL) elect Carol “John” Davidson as the new chairman of the board.

- Under Armour (UAA) appoints Kevin Plank to President and CEO.

- Delayed 10Qs:

- Comtech Telecom (CMTL) provides update on late 10-Q filing.

- Buyback Announcements or News:

- Altria (MO) announces intent to sell a portion of its investment in Anheuser-Busch InBev (BUD) through a global secondary offering; BUD agreed to repurchase $200 mln of ordinary shares directly from Altria.

- Stock Splits or News:

- Dividends Announcements or News:

- Build-A-Bear Workshop (BBW) approves a new quarterly dividend program to evolve its strategic use of capital; declares an initial quarterly cash dividend of $0.20 per share.

- Realty Income (O) increases common stock monthly dividend to $0.2570 per share from $0.2565 per share.

- Travel + Leisure Co (TNL) increases quarterly cash dividend 11% to $0.50 per share from $0.45 per share.

- Shoe Carnival (SCVL) increases quarterly dividend to $0.135 from $0.12 per share.

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: Basic Materials, Energy, Financial, Utilities, Communication Services, Consumer Defensive of note.

- Daily Negative Sectors: Technology, Real Estate, Healthcare of note.

- One Month Winners: Utilities, Basic Materials, Real Estate of note.

- Three Month Winners: Technology, Financial, Healthcare of note.

- Six Month Winners: Technology, Financial, and Industrials of note.

- Twelve Month Winners: Technology, Communication Services, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Healthcare, Financial of note.

The S&P 500 edged lower on Wednesday, weighed down by a drop in tech shares. The benchmark index fell 0.2%, after hitting its 17th record of the year a day earlier. The tech-heavy Nasdaq Composite dropped 0.5%. The Dow Jones Industrial Average rose 0.1% or 38 points. Four of the S&P 500’s 11 sectors finished the day in the red. The declines were led by the information technology sector—the best-performing segment this year and last. Those stocks fell 1.1%. (WSJ – edited by QPI)

![]()

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close: ADBE, ULTA, SMAR, EVCM, PHR, ALLO, ZUMZ, BLNK, BW.

- Friday Before the Open: JBL, ERJ, BKE.

Earnings of Note This Morning:

- Flat: None of note.

- Beats: DKS +0.49, MOMO +0.27, DG +0.10, GIII +0.08 of note

- Misses: WB -0.19, BEKE -0.16 of note

- Still to Report: of note.

Company Earnings Guidance:

- Positive Guidance: TH of note.

- Negative Guidance: DLTR, WOW, WOOF, ANIK of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market:

- Gap Up: HEAR +23.7%, HOOD +12.4%, LAC +12%, MIRM +9%, WB +7.2%, EGY +7%, PATH +6.9%, PI +6.4%, ANIK +6.3%, MSTR +4.3%, GH +3.6%, PSQH +3.3% of note.

- Gap Down: SPRB -73.5%, MOMO -19.2%, PGY -14.2%, S -9.5%, CHRS -7%, UAA -5.6%, KNTK -5.4%, CDRE -5%, REVG -4.6%, BUD -3.9%, NVGS -3.6%, NN -3.3% of note.

Insider Action: No stock sees Insider buying with dumb short selling. No stock sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know To Start Your Day. (Bloomberg)

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- Stocks Making The Biggest Moves. (CNBC)

- Morning Briefing for Bloomberg subscribers. (Bloomberg)

- Bloomberg Lead Story: Biden’s Best Shot Against Trump Lies in Three “Blue Wall” States. (Bloomberg)

- US Futures gain with stocks ahead of inflation data. (Bloomberg)

- EU opens probe into Alibaba (BABA) over illegal content and porn. (CNBC)

- Biden raises concern over Nippon Steel deal for U.S. Steel. (CNBC)

- Bloomberg Daybreak: Tik Tok Ban & Trump’s Cabinet. (Podcast)

- NYT The Daily: It sucks to be 33 and a “peak millennial”. (Podcast)

- Marketplace: What a Tik Tok ban would mean for free speech and privacy. (Podcast)

- Wealthion: Risk of 2024 Recession over 60%, Loreen Gilbert. (Podcast)

- Adam Taggart Thoughtful Money: Higher rates will bring pain to credit markets. (Podcast)

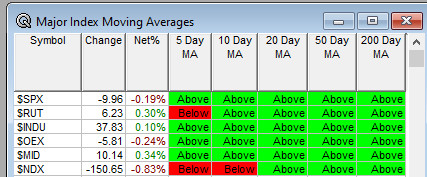

Moving Averages Update: 90% from 93%, stays strong.

Geopolitical:

- President’s Public Schedule:

- Where’s Waldo today? The President leaves Milwaukee and heads to Saginaw, Michigan for a campaign event at 2:00 p.m. EDT.

- President arrives back at the White House at 6:45 p.m. EDT.

Economic:

- Jobless Claims 8:30 a.m. EDT

- February PPI is due out at 8:30 a.m. EDT and is expected to remain at 0.3%.

- February Retail Sales is due out at 8:30 a.m. EDT and is expected to rise by 0.7% after falling -0.8% in January.

- Business Inventories 10:00 a.m. EDT

- EIA natural Gas Report 10:30 a.m. EDT

- 10-Yr TIPS Announcement 11:00 a.m. EDT

Federal Reserve / Treasury Speakers: None of note. Fed speakers in blackout period due to next week’s FOMC meeting.

M&A Activity and News:

- Turtle Beach (HEAR) announces definitive agreement to acquire PDP for $118 million.

- AstraZeneca (AZN) to buy Amolyt for $1.05 billion.

Meeting & Conferences of Note:

- Sellside Conferences:

-

- Previously posted and ongoing conferences:

- Bank of America Consumer & Retail Conference

- Barclays Global Healthcare Conference

- BTG – Latam Opportunity Conference

- Citi India Conference

- Citigroup TMT Conference

- Deutsche Bank Media Internet & Telecom Conference

- Guggenheim 5th Annual Healthy Altitudes Summit

- Jefferies Biotech on the Bay Summit

- J.P. Morgan Industrials Conference

- Leerink Global Biopharma Conference

- Oppenheimer Healthcare MedTech & Services Conference

- Previously posted and ongoing conferences:

-

- Top Shareholder Meetings:

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: AZTA, DRS, GILD, BOX, EGHT.

- R&D Day: None of note.

- Company Event: None of note.

- Industry Meetings:

-

- Previously posted and ongoing conferences:

- Acute Kidney Injury and Continuous Renal Replacement Therapy Conf

- HIMSS Global Health Conference and Exhibition

- iAccess Alpha Best Ideas Spring Virtual Conference

- International Battery Seminar & Exhibit

- International Conference on Advances in Critical Care Nephrology (AKI & CRRT 2024)

- NYSE Materials Day

- Partner Marketing Visionaries Summit

- Society of Neuroimmune Pharmacology Conference

- Society of Toxicology conference

- Previously posted and ongoing conferences:

-

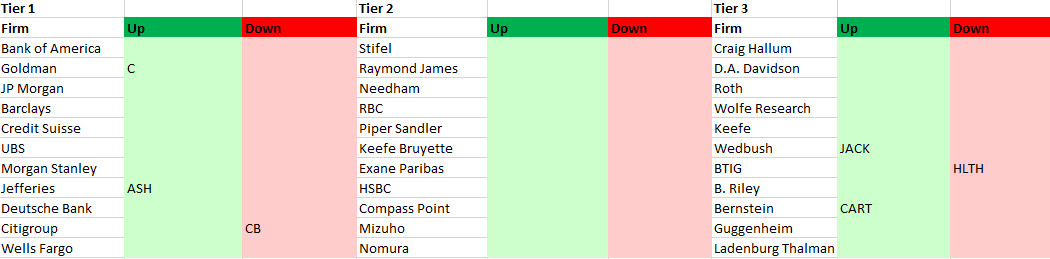

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: