Overnight Summary & Early Morning Trading: The S&P 500 finished Monday higher by 0.79% at 5405.97. Friday higher by 1.81% at 5363.36. Futures are lower this morning by -10 (-0.20%) at 5463 around 7:55 a.m. EDT. The range is now 700 points on the S&P 500 cash for the year, 5400 to 6100. Year to date the S&P 500 is down -8.09%.

Executive Summary: Trading is getting back to normal after several very volatile weeks. With three days left in the week before a holiday on Friday let’s see if stocks can hold this new pattern and calm investor’s nerves.

Article of Note: “Will Policy Chaos Trigger A Flight From The Dollar?” from Bloomberg Editorial Board

Chart of the Day: Not only is Copart (CPRT) a Short Squeeze but it has positive seasonality. Worth some consideration.

Quote of the Day: “It was a reminder that great sporting accomplishments don’t require unbroken greatness. McIlroy didn’t win Sunday by going out and stomping the field. He didn’t play close to his best golf. On CBS, Jim Nantz called it a “masterpiece,” but it was a messy mod-art canvas at best. ” Jason Gay WSJ on McIlroy win.

Key Events of Note Today:

- Import/Export Data and Empire Manufacturing are due out in the morning and API Petroleum after the close.

- 1 Year Bill Auction at 11:30 a.m. EDT.

Notable Earnings Out After The Close

- Beats: PNFP +0.10, APLD +0.02, FBK +0.02 of note.

- Misses: None of note.

- IPOs For The Week: AIRO, CHA, HXHX, OMSE, PHOE

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CNSP: FORM S-1 – Up to 5,223,880 Shares of Common Stock – Up to 5,223,880 Pre-Funded

Warrants to Purchase up to 5,223,880 Shares of Common Stock. - CWD: FORM S-1 – 69,467,779 Shares of Class A Common Stock.

- MRX: FORM F-1 – 8,500,000 Ordinary Shares

- CNSP: FORM S-1 – Up to 5,223,880 Shares of Common Stock – Up to 5,223,880 Pre-Funded

- Notes Priced:

- Notes Files:

- Convertibles Filed:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Private Placements:

- Selling Shareholders of note:

- MRX announces launch of public offering of 8.50 mln common shares by certain shareholders

- Mixed Shelf Offerings:

- IAUX: Form S-3.. $250,000,000 Mixed Shelf

News After The Close:

- NFLX moving higher in after hours trading as streaming company aims to double its revenue by 2030 and achieve a $1 trillion market capitalization.

- Sterling Infrastructure (STRL) to join S&P SmallCap 600. It will replace Patterson Cos (PDCO) in the S&P SmallCap 600 effective prior to the opening of trading on Thursday.

- 10K or Qs Filings/Delays – (Filed), (Delayed) of note.

Exchange/Listing/Company Reorg and Personnel News:

- REXR announces that Chairman Richard Ziman will retire from his role and the Board of Directors following the company’s Annual Meeting of Stockholders on June 3, 2025.

- GLPG announced the departure of its CFO and COO, Thad Huston, effective as of August 1, 2025.

Buybacks

Dividends Announcements or News:

- Stocks Ex Div Today: ABBV ABT FCX WSO MAA AFG PECO ACA TRN BKE CHCO ARR SBR

- Stocks Ex Div Tomorrow: PNC EOG BVN MGRC ALG FINV KWR WGO

Stocks Moving Up & Down Yesterday:

Gap Up: RKLB +5.8%, STRL +5%, ASAN +2.8% of note.

Gap Down: ALGM -12.6%, APLD -11.7%, FBK -4.9%, KMTS -3.5%, PNFP -2.4% of note.

What’s Happening This Morning: (as of 7:45 a.m. EDT) Futures S&P 500 -10, NASDAQ -22, Dow Jones -72, Russell 2000 -6. Europe and Asia are higher. Bonds are at 4.388% from 4.433% yesterday on the 10-Year. Crude Oil and Brent Crude are lower with Natural Gas higher. Gold, Silver and Copper higher. The U.S. Dollar is higher versus the Euro, lower against the Pound and lower against the Yen. Bitcoin is at $85,737 from $84,619 higher by $739 at 0.87%.

- Daily Positive Sectors: All were higher for a second day in a row led by Real Estate, Utilities, Consumer Defensive Energy and Healthcare.

- Daily Negative Sectors: None of note.

- One Month Winners: Consumer Defensive and Utilities of note.

- Three Month Winners: Consumer Defensive, Utilities and Materials of note.

- Six Month Winners: Consumer Defensive and Financials of note.

- Twelve Month Winners: Utilities, Financials, Consumer Defensive, Communication Services, Technology and Real Estate of note.

- Year to Date Winners: Consumer Defensive, Utilities and Materials of note.

Bolded means the Sector is new to the period in which it falls.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close:

- Wednesday Before The Open:

Notable Earnings of Note This Morning:

- Flat: of note

- Beats: JNJ +0.19, PNC +0.13, BAC +0.08, ACI+0.05 of note.

- Misses: of note.

- Still to Report: C ERIC

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D improved with yesterday’s action.

Gap Ups & Down In Early Pre-Market: (+2% or down more than -2%):

- Gap Up: ERIC +6.4%, RKLB +4.4%, STRL +4.3%, NFLX +2.6%, NPCE +2.1% of note.

- Gap Down: APLD -12.1%, ALGM -11.6%, MXCT -6.9%, TLX -6.9%, FBK -6%, CAAP -4.4%, KMTS -3.4%, CMCL -2.4% of note.

Insider Action: FLWS sees Insider Buying with dumb short selling. GTE sees Insider Buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Bloomberg: China Orders Boeing Jet Delivery Halt as Trade War Expands. (Bloomberg)

- Bank of America (BAC) Traders notch record quarter as loan revenue rises. (Bloomberg)

- Department of Commerce launches a 232 investigation into imports of semiconductors and semiconductor manufacturing equipment, which could lead to tariffs on the sector.

- Department of Commerce launches a 232 investigation into imports of pharmaceuticals and pharmaceutical ingredients, which could lead to tariffs on the sector

- LVMH misses on sales. (CNBC).

- Five Things To Know Before The Market Opens. (CNBC)

Bolded Royal Blue means behind a Pay Wall.

Economic & Geopolitical:

- Economic Releases:

- March Import/Export Prices are due out at 8:30 a.m. EDT and last month came in at 0.4% and 0.1%, respectively.

- April Empire Manufacturing is due out at the same time and is expected to improve to -14.80% from -20.00.

- Weekly API Petroleum Report is due out at 4:30 p.m. EDT.

- Federal Reserve Speakers of note today.

- There are 2 Fed speakers today.

- Federal Reserve Richmond President Thomas Barkin at 11:30 a.m. EDT.

- Federal Reserve Governor Lisa Cook speaks at 7:00 p.m. EDT.

- There are 2 Fed speakers today.

- President Trump’s Daily Schedule.

- President Trump has lunch with the Vice President at 12:30 p.m. EDT.

- Press Briefing at 1:00 p.m. EDT.

- President Trump signs Executive Orders at 2:30 p.m. EDT.

- President Trump presents the Commander-in-Chief Trophy to the Naval Academy at 3:30 p.m. EDT. Go Navy Beat Army!!

M&A Activity and News:

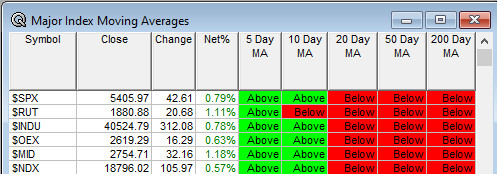

Moving Average Table: Moves from 33% to 37% week over week.

Meeting & Conferences of Note: (Not updated today, back tomorrow)

-

- Sellside Conferences:

- Bank of America’s Automotive Summit

- Morgan Stanley Brazil Education Corporate Access Day

- Raymond James Spring Therapeutics Symposium

- Sellside Conferences:

-

- Shareholder Meetings: BK, CCNE, MCO, STLA, USB, WHR

- Top Analyst, Investor Meetings: IBRX, LENZ, MGA, OCS, ZBAO

- Fireside Chat

- R&D Day: None of note.

- FDA Presentation:

- ASGCT Annual Meeting

- Industry Meetings or Events:

- Canadian Circular Economy Summit

- Cell & Gene Meeting on the Mediterranean

- European Conference on Interventional Oncology

- Healing Lyme Summit

- IP Leadership Executive Summit

- National HPV Conference

- NY Auto Show

Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

-

-

-

- Upgrades: CHD ESI HRL HUBS KKR NBIX VCTR WLK

- Downgrades: APD COTY DOW PGRE

-

-