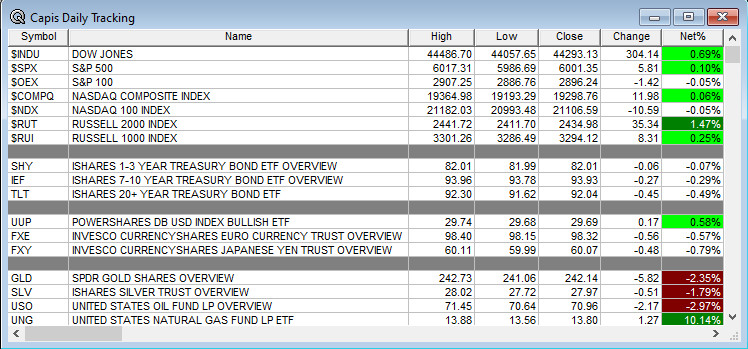

Overnight Summary: The S&P 500 closed Monday higher by 0.10% at 6001.35 from Friday higher by 0.38% at 5995.54. The overnight high was hit at 6032.50at 8:45 p.m. EDT and the low was hit at 6012.25 at 5:45 a.m. EDT. The overnight range is 20 points. The current price is 6023.50 at 7:05 a.m. EDT lower by -8.25 points which is -0.14%.

Executive Summary: Markets are quiet into CPI and PPI the next two days. Sellside conferences are on the rise with 10 new conferences today which let’s us know earnings have hit their peak.

Articles of Note:“Trump’s Mass Deportation Promise” could get ugly sooner than later. (WSJ)

Key Events of Note Today:

- Treasury 3 & 6 month Auctions at 11:30 a.m. EDT.

- NFIB Small Business Index and Treasury Budget update are out today along with API Crude data after the close.

Notable Earnings Out After The Close

- Beats: AGO +1.08, NVRO +0.40, LYV +0.05, GRAB +0.02, AROC +0.01 of note.

- Flat: None of note.

- Misses: IAC -2.65, JRVR -0.89, TALO -0.07, ZETA -0.03, LAZR -0.01 of note.

- IPOs For The Week: AGH, JUNS, LHAI, MSW, NAMI, PRB, ZSPC

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- KRUS commences an underwritten public offering of shares of its Class A common stock

- CWAN launches secondary public offering of an aggregate of 25,000,000 shares of Class A common stock

- NXGL $2,000,000 Registered Direct Offering

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- Mixed Shelf Offerings:

- PIPE: UPST Proposed Private Offering of $425,000,000 of Convertible Senior Notes Due 2030

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: NVRO +20.1%, LYV +5.9%, ORGO +5.4%, YALA +4.5%, LAZR +3.9%, AROC +3.8%, IAC +2.5%, HOOD +2.3% of note.

- Movers Down: NGNE -35%, ANGI -13.7%, CWAN -4.3%, KRUS -2.5%, IVZ -2.4% of note.

News After The Close:

- Franklin Resources (BEN) reports preliminary month-end assets under management of $1.63 trillion at October 31, 2024, compared to $1.68 trillion last month.

- Invesco (IVZ) reports preliminary month-end assets under management of $1,772.0 billion, a decrease of 1.3% versus previous month-end.

- Cohen & Steers (CNS) reports preliminary assets under management of $89.7 billion as of October 31, 2024, a decrease of $2.0 billion from assets under management of $91.8 billion last month.

- Victory Capital (VCTR) reports total assets under management of $172.3 bln as of October 31, 2024, down 2.2% from last month.

- Endeavor Group (EDR) agreed to sell OpenBet and IMG ARENA to OB Global Holdings for about $450 mln in a management buyout backed by Ariel Emanuel with participation from executives of OpenBet.

- HOOD reports October 2024 operating data; Assets Under Custody up 5% from September.

- 10-K Delays –

- Barron’s: + Shopify (SHOP) beats on third quarter revenues. (Barron’s)

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- None of note.

Dividends Announcements or News:

- Stocks Ex Div Today: V IBM DHI PPG AWK ROL MT RYAN RGA WTRG OMF HR MAC OGN CWT HTLF KMT WMK CNXN NMM TNK WLFC AGRO DK

- Stocks Ex Div Tomorrow: EQIX WELL PCAR URI KVUE WAB ED ETR WST CMS AER POOL HOMB SEM MSM ST PBF HTGC CAKE

What’s Happening This Morning: Futures S&P 500 -2.60 NASDAQ -10 Dow Jones -18 Russell 2000 -4.08 (at 8:20 a.m. EDT). Asia is lower and Europe is lower. VIX Futures are at 15,85 from 15.56 yesterday while Bonds are at 4.365% from 4.306% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower. Gold, Silver and Copper lower for a third session in a row. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $86,349 from $81,600 lower by -753 by -0.99% this morning.

- Daily Positive Sectors: Consumer Cyclical, Financials, Industrials, Communication Services and Energy of note.

- Daily Negative Sectors: Materials, Technology and Real Estate of note.

- One Month Winners: Communication Services, Financials, Consumer Cyclicals, Industrials and Technology and of note.

- Three Month Winners: Consumer Cyclicals, Technology, Financials, Industrials and Communication Services of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials, and Consumer Cyclical of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Communication Services, Financials and Utilities of note.

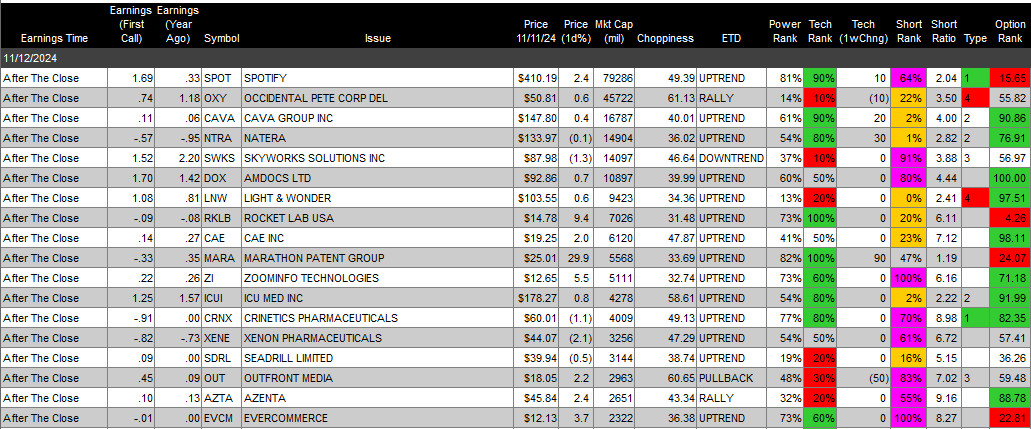

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close:

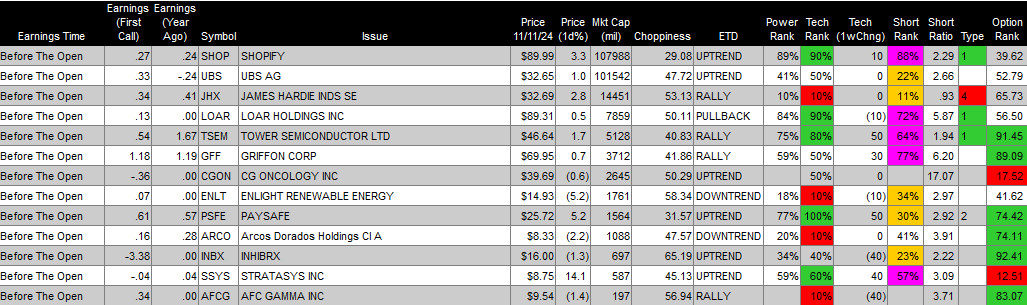

- Wednesday Before The Open:

Notable Earnings of Note This Morning:

- Beats: PGY +0.63, SLVM +0.26, TSN +0.20, TGI +0.18, HD +0.13, RGEN +0.09, NVAX +0.07, DAVA +0.04, AZN +0.04, of note. (greater than +0.05)

- Flat: None of note.

- Misses: THS -0.89, IHS -0.69, SE -0.22, HTZ -0.22, TME -0.20, IGT -0.18, SATS -0.13, ONON-0.04, SHO -0.01 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: HD RGEN CAMT IGT SHLS of note.

- Negative or Mixed Guidance: NVAX THS of note.

Advance/Decline Daily Update: The A/D Line continues its rebound on its weekly review.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: NVRO +16%, LAZR +14.7%, TGI +13.3%, ORGO +12.3%, GRAB +10.7%, CAMT +9.8%, SE +7.1%, LYV +6.6%, ZGN +5.6%, AROC +5.6%, YALA +5.3%, KRUS +4.9%, HUYA +4.6%, AGO +4%, ONON +3.9%, EGY +3.4%, HD +2.4%, EAF +2.4%, TH +2.4%, DOMO +2.1%

- GapDown: NGNE -34.6%, ANGI -10.3%, SWTX -9.2%, JRVR -7.1%, TME -6.5%, ZETA -6.3%, CWAN -3.4%, NPWR -3.1%, FWRG -2.9%, TER -2.5%, SGMT -2.2%, AZN -2.1%, HOOD -2%, BGNE -2%, NUVL -2%

Insider Action: No names see Insider buying with dumb short selling. No names see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: SHOP HD LYV. (CNBC)

- 5 Things To Know Before The Market Opens. (CNBC)

- Bloomberg Lead Story: The Fight For Leader of the Senate, Rick Scott of Florida pushing hard. (Bloomberg)

- Markets Wrap: US Futures edge lower as markets await Trump cabinet picks and CPI tomorrow. (Bloomberg)

- China’s biggest shopping event of the year exceeds low expectations. (CNBC)

- Trump expected to announce that Sen. Marco Rubio (R-FL) as the next Secretary of State. (CNBC)

- Bitcoin nears $90,000. (Bloomberg)

- Tyson (TSN) sees turnaround in 2025 as Chicken prices rise. (Bloomberg)

- Home Depot (HD) sales are improving but the consumer is still cautious. (CNBC)

- The Big Take: Inside Trump’s Day One Economic Agenda. (Podcast)

- Marketplace: Free speech in the online age. (Podcast)

- Wealthion: Inside strategies that hedge funds use. (Podcast)

Economic:

- October NFIB Small Business Optimism is due out at 6:00 a.m. EDT and came in last month at 91.50.

- The October Treasury Budget is due out at 3:00 p.m. EDT and came in last month at $64.00 billion.

- Weekly API Crude Oil Inventories are due out at 4:30 p.m. EDT.

Geopolitical:

- A deluge of Federal Reserve speakers today.

- Federal Reserve Governor Waller speaks at 10:00 a.m. EDT.

- Federal Reserve Richmond President Barkin speaks at 10:15 a.m. EDT and 5:30 p.m. EDT.

- Federal Reserve Minneapolis President Kashkari speaks at 2:00 p.m. EDT

- Federal Reserve Philadelphia President Harker speaks at 5:00 p.m. EDT.

- President Biden receives the Daily Briefing at 10:00 a.m. EDT

- The president and vice president have lunch at 12:15 p.m. EDT.

- President Biden meets with the President of Indonesia at 2:00 p.m. EDT.

- Press Briefing at 4:00 p.m. EDT by Press Secretary Karine Jean-Pierre.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

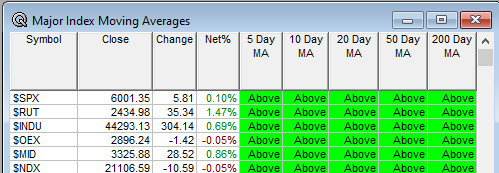

Moving Averages On Major Equity Indexes: Remains at 100%. Other asset classes continue to struggle.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Baird Global Industrial Conference

- Bank of America Global Energy Conference

- Citizens JMP Financial Services Conference

- Evercore ISI Insurance Conference

- Goldman Sachs Carbonomics Conference

- Guggenheim Healthcare Innovation Conf

- JMP Securities Financial Services Conference

- Morgan Stanley Global Chemicals Agriculture and Packaging Conference

- Needham Growth Conference

- Northcoast Research Management Forum

- Truist Securities Virtual Internet Growth Summit

- UBS Global Healthcare Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: COEP, EQC, IRRX, NGNE, SLXN, SMSI

- Top Analyst, Investor Meetings: BNZI, DAY, EVTL, GTLS, OCGN, RNA, VLN

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: OCGN: Data Presentation for OCU400 OCU410

- Company Event: None of note.

- Industry Meetings or Events:

- American Conference on Pharmacometrics

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: VRE SABK S CNI CHRW AVBH

Downgrades: SUI SNDR KNX CXM ALNY