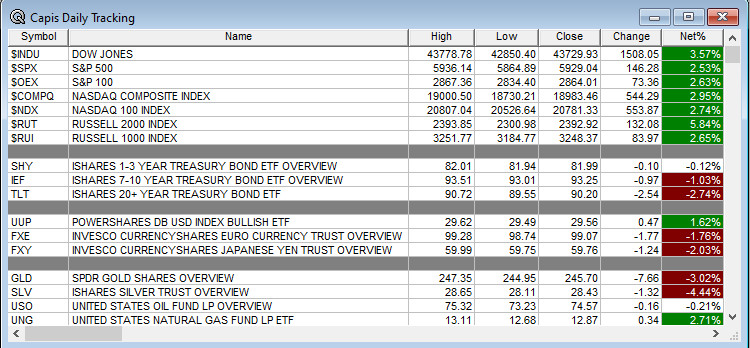

Overnight Summary: The S&P 500 closed Wednesday higher by 2.53% at 5929.04 from Tuesday higher by 1.23% at 5782.76. The overnight high was hit at 5973 at 3:25 a.m. EDT and the low was hit at 5951 at 7:50 p.m. EDT. The overnight range is 22 points. The current price is 5968.50 at 6:55 a.m. EDT higher by +10.25 points higher by +0.17%.

Executive Summary: Today the Federal Open Market Committee (FOMC) concludes its two-day meeting and Chairman Powell will host the Press Conference at 2:30 p.m. EDT. The question is are they going to cut rates again? If yes, then by how much?

The consensus is they cut by 25 basis points. At the last meeting, the FOMC cut the discount rate by 50 basis points (-0.50%) so the short end of interest rates fell but the long end is now higher by 85 basis points (0.85%). They law of unintended consequences. They cut again the long rate goes up even more. That house you wanted is going to cost you more than it did two months ago. Ditto the new car. In fact, the real outcome of the Fed cutting is that they are actually tightening.

Article of Note:“Investors Bid Bye Bye To Bidenomics”. by The WSJ Editorial Board (WSJ)

Key Events of Note Today:

- Economic releases of note today include Weekly Natural Gas Inventories and Jobless Claims along with Consumer Credit at 3:00 p.m. EDT.

- At 11:30 a.m. EDT, the Treasury holds a 4-Week Bill Auction.

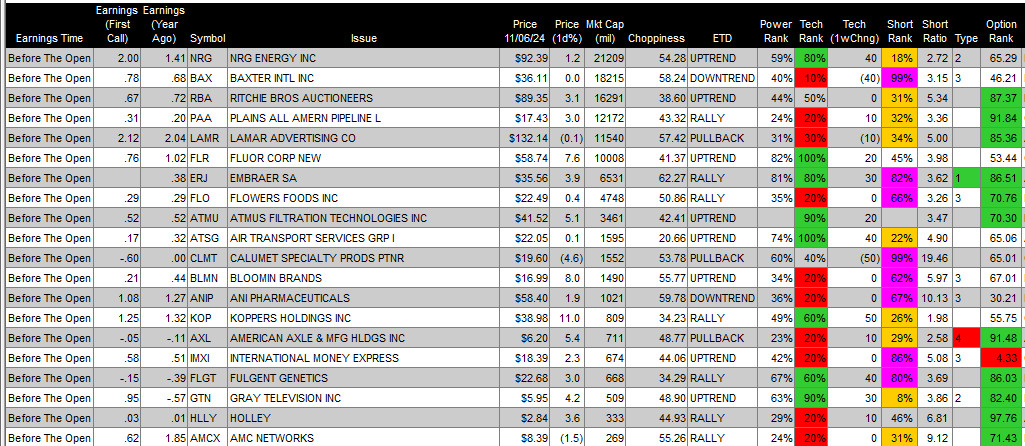

Earnings Out After The Close

- Beats: RNR +2.21, JAZZ +1.11, ANSS +0.80, SRPT +0.68, GILD +0.51, APP +0.37, SBGI +0.36, ELF +0.34, VSAT +0.31, ATO +0.27, HUBS +0.27, MKSI +0.27, VAC +0.23, MCK +0.19, FICO +0.18, PLYA +0.17, RLGD +0.15, DUOL +0.14, COHR +0.13, QCOM +0.13, LYFT +0.10 of note. (greater than +0.10)

- Flat: None of note.

- Misses: QTWO -0.56, KGS -0.45, CTVA -0.19, BKH -0.14, FNF -0.09 of note. (lower than -0.09)

- IPOs For The Week: ADUR, ALEH, CASK, CGTL, HIT, JUNS, LEC, MSW, PHH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- AIEV: Form S-1.. Up to 17,616,408 Shares of Common Stock

- IXHL: Form S-3.. 61,389,758 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- ALKT launches proposed secondary offering of 7.5 mln common stocks by entities affiliated with General Atlantic, Ventures Fund III, George Kaiser and Brian Smith

- Mixed Shelf Offerings:

- KMT files mixed shelf securities offering

- IVR files $650 mln mixed shelf securities offering

- QCOM files mixed shelf securities offering

- CNTX files $250 mln mixed shelf securities offering

- ABUS files $300 mln mixed shelf securities offering

- ALGS filed a $400 million mixed shelf securities offering

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: APP +28.4%, LYFT +21.5%, BROS +16.8%, FRSH +15.4%, ZG +14.3%, GH +13.4%, QCOM +6% of note.

- Movers Down: APPS -41%, CDLX -29.9%, SEDG -21.1%, MELI -9.2%, DUOL -5.9% of note.

News After The Close:

- SolarEdge Technologies (SEDG) announces that the Board of Directors has elected Avery More as Chairman of the Board of Directors, replacing Nadav Zafrir, who will remain on the Board.

- IonQ (IONQ) to acquire Qubitekk, furthering leadership in Quantum Networking, no terms.

- Costco (COST) sees October sales rise +6.5%.

- Vice President Kamala Harris officially concedes the election to President-elect Donald Trump

- Qualcomm (QCOM) pops on revenue and earnings beat. (CNBC)

- 10-K Delays –

- Barron’s: Fed is primed for another rate cut. (Barron’s)

Buybacks or Repurchases:

- PTC has authorized the repurchase of up to $2 bln worth of PTC common stock through September 30, 2027

- RNR increases share repurchase authorization to $750 million

- QCOM authorizes a new $15.0 bln stock repurchase plan

- TS approves a $700 mln follow-on share buyback program

- APP increases its share repurchase authorization by an incremental $2.0 bln; increases total aggregate remaining plan to $2.3 bln

Exchange/Listing/Company Reorg and Personnel News:

- MHK announces the planned retirement of Chris Wellborn, President and Chief Operating Officer and the promotion of Paul De Cock to succeed Mr. Wellborn effective February 1, 2025.

- John McLaren is returning to Sun Communities (SUI) as President to oversee the restructuring and the execution of these initiatives. CEO Gary Shiffman has informed the Board of his intention to retire in 2025, following over 40 years of dedicated service to the Company and its stakeholders. He will remain on the board.

- RNR names Loretta Mester to the Board of Directors replacing Brian Gray who is retiring from the Board.

- VYX announces the appointment of Darren Wilson as President, International

- SEM approved declaration of a special stock distribution to spin-off Concentra (CON); will be made on November 25, record date November 18

- KIND announced Georg Petschnigg as Chief Design Officer (recently led the successful redesign at The New York Times)

Dividends Announcements or News:

- Stocks Ex Div Today: SCCO BRO EQT WFRD NEP AROC VSEC GBX

- Stocks Ex Div Tomorrow: AAPL WFC HSBC PFE UL SCHW COP BH BP ET TFC GWW AEP AMX MPLX LNG HWM EXC OWL JBHT MAS TECH LAD X SUN SSB JHG MGY SON LAZ MAIN MWA TEX,

- UVE announces a special cash dividend $0.13/share

- ATO increases quarterly cash dividend to $0.87/share from $0.805/share

What’s Happening This Morning: Futures S&P 500 +16 NASDAQ +87 Dow Jones +70 Russell 2000 + (at 8:25 a.m. EDT). Asia is lower ex Australia and Europe is higher. VIX Futures are at 16.05 from 16.20 yesterday while Bonds are at 4.428% from 4.47% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $74,800 from $74,433 lower by +$1164 down -1.56% this morning.

- Daily Positive Sectors: Financials, Industrials,Communication Services and Consumer Cyclicals of note.

- Daily Negative Sectors: Real Estate, Consumer Defensive, Utilities and Healthcare of note.

- One Month Winners: Financials, Communication Services, Technology and Consumer Cyclicals of note.

- Three Month Winners: Consumer Cyclicals, Technology, Financials, Communication Services of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials and Communication Services of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

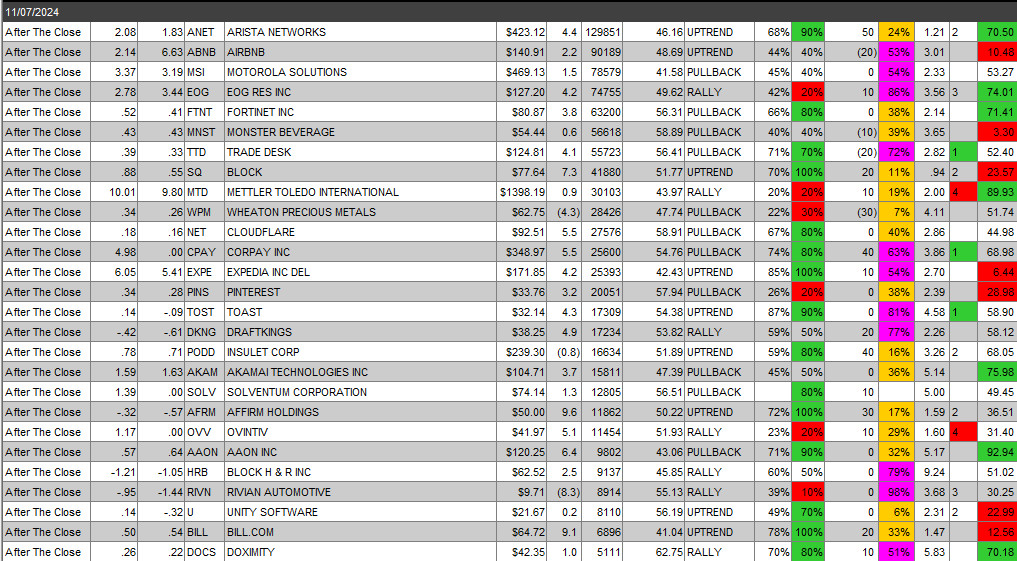

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

- Friday Before The Open:

Earnings of Note This Morning:

- Beats: MRNA +1.97, TDG +0.57, ACIW+0.35, UA +0.20, WBD +0.16, SAVA +0.15, TAP +0.13, RL +0.12, GOLF +0.10, MT +0.10, MUR +0.10 of note. (greater than +0.10)

- Flat: None of note.

- Misses: COMM -0.35, HSY -0.22, TPR -0.11, EQX -0.10, DUK -0.07, IRWD -0.05, HAIN -0.03, HAL -0.02, BRY -0.01 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: LGND UAA SRAD of note.

- Negative or Mixed Guidance: APD ROK TGNA XRAY NABL of note.

Advance/Decline Daily Update: The A/D Line continues its rebound.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: APP +28%, LYFT +22.2%, EBS +20.7%, BROS +18.1%, GH +17%, FRSH +16%, ZG +13.8%, OPFI +13.7%, WAY +11.7%, ELF +10.9%, CDMO +10.7%, LFST +10.7%, CPRX +9.7%, ECG +9.6%, MKSI +9.4%, ASPN +9%, CEVA +9%, EPAM +8.5%, ACMR +8.2%, MEOH +8.1%, QCOM +7.6%, ZIP +7.3%, MCK +6.8%, BBSI +6.6%, CXW +6.5%, LZ +6.1%, ALNT +6%, CERT +5.9%, UPWK +5.9%, COHR +5.6%, RAMP +5.6%, HUBS +5.4%, RPD +5.3%, VTLE +5.2%, CDRE +5%, CWAN +4.6%, RCUS +4.6%, MT +4.4%, MODV +4.3%, HIMX +4.2%, ENLC +3.8%, LTM +3.8%, FSM +3.8%, NVGS +3.6%, CLDX +3.5%, HCAT +3.4%, CRH +3.2%, JAZZ +3%, TTWO +2.7%, KMT +2.5%, FBIN +2.5%, CDE +2.5%, ODD +2.4%, AMED +2.3%, ARDT +2.3%, RLJ +2.2%, PRI +2.1%, DCO +2.1%, ET +2%, WK +2%.

- GapDown: APPS -41.4%, CDLX -31.1%, WOLF -25.2%, SEDG -19.5%, MTCH -14.6%, CRSR -14.5%, KVYO -12.9%, CTVA -10.6%, ECPG -9.7%, HL -8.5%, MELI -8.1%, CLOV -8%, KRUS -7.2%, DUOL -7.2%, ARM -6.5%, COTY -6.5%, SUI -6.1%, SPCE -5.9%, IONQ -5.8%, CYTK -5.8%, BMBL -5.6%, ASH -5.6%, PTC -5.6%, CNTX -5.4%, BIRD -5.3%, TNDM -5.1%, JXN -5%, BYND -5%, VAC -5%, IPAR -5%, PRVA -5%, ACLS -4.5%, JANX -4.5%, OSUR -4.5%, KAR -4.5%, APD -4.5%, RXO -4.5%, RXRX -4.2%, NMIH -4.2%, GEO -4.2%, AMC -4.1%, JOBY -4.1%, ALKT -3.9%, TRIP -3.8%, DV -3.8%, PR -3.6%, BTG -3.5%, GDRX -3.4%, OSCR -3.4%, TS -3.3%, KW -3.1%, IIPR -3%, LB -2.5%, ORA -2.5%, WES -2.4%, SBGI -2.4%, RDN -2.3%, ALB -2.1%, CCRN -2%, LOPE -2%.

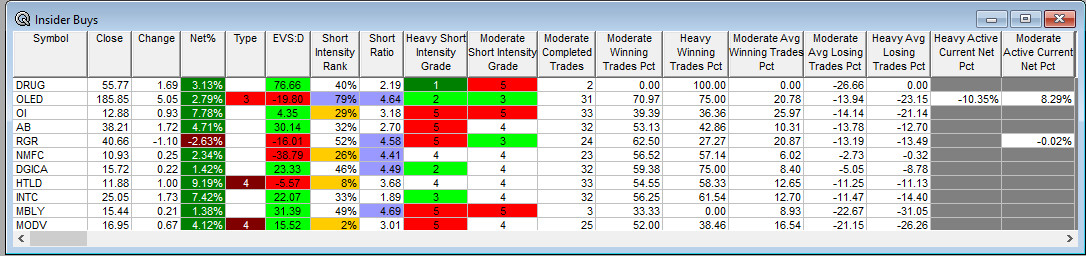

Insider Action: OLED sees Insider buying with dumb short selling. No names sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: Yet to report. (CNBC)

- 5 Things To Know Before The Market Opens. (CNBC)

- Bloomberg Lead Story: Harris Concedes Election To Trump. (Bloomberg)

- Markets Wrap: Stocks hold election gains as Dollar eases. (Bloomberg)

- Moderna (MRNA) posts surprise profit. (CNBC)

- China urges U.S. cooperation. (CNBC)

- Bloomberg: Big Take – Jerome Powell is back in Trump’s World and about to feel the heat. (Podcast)

- Bloomberg: Odd Lots – Trump, The Fed and Bonds. (Podcast)

- Marketplace: Students make AI a habit. (Podcast)

- NY Times The Daily: Donald Trump’s America. (Podcast)

Economic:

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- Weekly Natural Gas Inventories due out at 10:30 a.m. EDT.

Geopolitical:

- Federal Reserve Speakers are in a blackout period that ends after the FOMC meeting.

- The latest Federal Reserve Open Market Committee (FOMC) is due out at 2:00 p.m. EDT and presser at 2:30 p.m. EDT.

- President Biden receives the Daily Briefing at 1:30 p.m. EDT

- At the same time, there is a Press Briefing with Karine Jean-Pierre.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

- Avid Bioservices (CDMO) to be acquired for $12.50/share in cash by GHO Capital Partners and Ampersand Capital Partners in $1.1 billion transaction

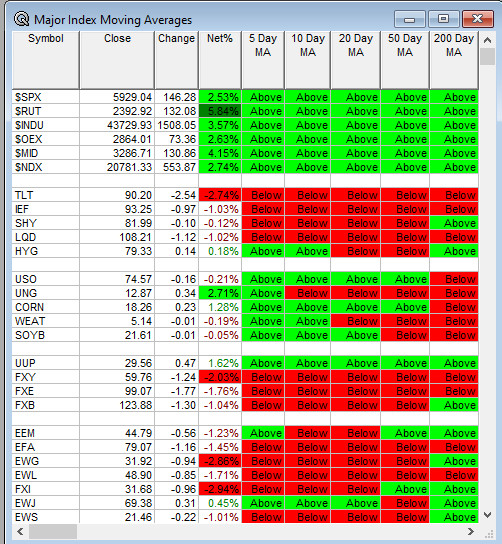

Moving Averages On Major Equity Indexes: Moves from 84% positive to 100%. Other asset classes continue to struggle.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Goldman Sachs APAC Healthcare Corporate Day

- BAC Mexico Year Ahead Conference

- Hovde Group Financial Services Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: AKTX, COTY, KNOP, LFVN, RLYB, SSYS, UUU, ZBH

- Top Analyst, Investor Meetings: BIVI, CLDI, CSX, INMB, NXPI, VEEV

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- Annual Society for Immunotherapy of Cancer Meeting

- BancAnalysts Association of Boston Conference

- Houlihan Lokey Alternative Asset Valuation Symposium

- Inaugural Sport United Conference

- Truist Securities BioPharma Symposium

- UAE BioTech Symposium

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: AVDX IFF SNDR

Downgrades: LMND COTY SEDG PLTR JPM ENPH