Overnight Summary: The S&P 500 closed Wednesday lower by -0.33% at 5813.67 from Tuesday higher by +0.16% at 5832.92. The overnight high was hit at 5859 at 4:05 p.m. EDT and the low was hit at 5801 at 4:30 a.m. EDT. The overnight range is 58 points. The current price is 5808.25 at 7:45 a.m. EDT lower by -43.75 points lower by -0.75%.

Executive Summary: The Arms Race for AI is underway and both Meta and Microsoft are proof. Expect more spending to hit margins as the revenue model is built out.

Article of Note:

Key Events of Note Today:

- Economic releases of note today include Personal Income, Personal Savings, PCE Core and Chicago PMI along with Weekly Natural Gas Inventories.

Earnings Out After The Close

- Beats: BKNG +6.19, ALL +1.46, META +0.81, AFL +0.47, AMGN +0.47, CLX +0.47, EQIX +0.35, CVNA +0.34, PPC +0.23, AEM +0.12

of note. - Flat: None of note.

- Misses: MGM +0.01, SBUX -0.05, ETSY -0.08, COIN -0.17, MET -0.22 of note.

- IPOs For The Week: ADUR, CASK, CUPR, FBGL, GELS, JUNS, LUD

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ENVX has commenced an underwritten public offering of $100.0 mln of shares of its common stock

- CWH announces commencement of proposed offering of $300 mln of Class A common stock

- BLMZ: FORM F-1 – 41,000,000 Ordinary Shares

- CALC: Proposed Public Offering of Common Stock

- CTRE – Launch of Public Offering of Common Stock – 11,500,000 shares

- CWH: Commencement of Proposed Offering of Class A Common Stock – $300.0 million of its Class

A common stock - EFSH Closing of $11.1 Million Public Offering

- ISPO: Form S-3.. 6,588,478 Shares of Class A Common Stock

- PBM: Form F-1.. 104,921,314 Common Shares

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- MSTR also filed prospectus detailing sales agreement to issue and sell shares of its class A common stock of up to $21.0 billion from time to time through the Agents

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- RENB files a $200 million mixed shelf offering

- PIPE:

- Convertible Offerings & Notes Filed:

- APLD Proposed Private Offering of $300 Million of Convertible Notes

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: CVNA +20.7%, TWLO +11.4%, ETSY +7.2%, BKNG +6.4%, of note.

- Movers Down: ROKU -11.3%, OLED -7.6%, WSC -7.4%, EBAY -7.3%, MSFT -3.7%, META -2.5% of note.

News After The Close:

- Microsoft (MSFT) Azure and other cloud services revenue growth of 33%, up 34% constant currency vs +28-29% CC prior guidance, beats by $0.20, beats on revs

- Meta (META) lowers high end of FY24 total expense guidance range to $96-$98 bln from $96-$99 bln; Raises low end of FY24 capex guidance range to $38-$40 bln from $37-$40 bln, beats by $0.81, reports revs in-line; guides Q4 revs in-line

- Starbucks (SBUX) misses by $0.05, misses on revs

- Carvana (CVNA) beats by $0.34, beats on revs, for Q4, expects sequential increase in yr/yr growth rate in retail units sold

- Elliott aiming to increase economic exposure to 11.3% on Southwest Airlines (LUV). (Bloomberg

- Spirit Airlines (SAVE) to furlough 330 pilots. (Reuters)

- Barron’s: Why Meta’s spending is giving Wall Street jitters. (Barron’s)

Buybacks or Repurchases:

- ETSY approves a new $1b stock repurchase program

Exchange/Listing/Company Reorg and Personnel News:

- CNMD announces that Curt R. Hartman will retire as President and Chief Executive Officer of the Company, effective January 1, 2025 and will be replaced by Patrick Beyer, current Chief Operating Officer of CONMED.

- SNBR president and CEO Shelly Ibach announces retirement, effective no later than the 2025 Annual Meeting of Shareholders; co engages in an independent executive search firm to help identify CEO succesor

- AFL announces the promotion of Virgil R. Miller to president of Aflac Incorporated, effective Jan. 1, 2025

- VLO announces that Joseph Gorder has chosen to retire as Executive Chairman, CEO and President Lane Riggs to assume Chairman position; effective on Dec 31

- MU announces that Robert Switz, its current Board Chair, will retire at the annual shareholders meeting on Jan. 16, 2025 and Micron’s President and CEO, Sanjay Mehrotra, to serve as Board Chair and Lynn Dugle as Lead Independent Director following the annual shareholders meeting

- WTS announces retirement of CFO Shashank Patel on March 15, 2025; co has initiated a comprehensive search to identify a successor

Dividends Announcements or News:

- Stocks Ex Div Today: MS TXN ZTS SAN EPD KMI TRGP NI LNT CAG PAGP PAA AOS NNN AGNC ADC STAG CMC SLG SKT APLE EPR ATMU MTX IBTX GEL NWN VRTS SILA EFC SCHL

- Stocks Ex Div Tomorrow: COST AON NSC OKE O NRG CASY WES AES LW ALLY WBS PNFP ENLC THO HXL KGS

- MPC increases quarterly cash dividend 10% to $0.91/share from $0.825/share

What’s Happening This Morning: Futures S&P 500 -36 NASDAQ -144 Dow Jones -200 Russell 2000 +8 (at 8:25 a.m. EDT). Asia is lower and Europe is lower as well. VIX Futures are at 18.88 from 18.22 yesterday while Bonds are at 4.278% from 4.304% on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold and Silver lower with Copper higher f. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $72.159 from $71,408 higher by +262 at +0.37% this morning.

- Daily Positive Sectors: Communication Services, Real Estate and Financials of note.

- Daily Negative Sectors: Technology, Healthcare and Materials of note.

- One Month Winners: Utilities, Technology, Materials, Financials and Industrials of note.

- Three Month Winners: Utilities, Real Estate, Financials, Materials, Industrials and Consumer Defensive of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials and Consumer Cyclical of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close:

- Friday Before The Open:

Earnings of Note This Morning:

- Beats: LNG+2.06, UBER +0.83, BMY +0.31, CI +0.28, IP +0.18, MA +0.15, MRK +0.09, RBLX +0.02 of note.

- Flat: None of note.

- Misses: H -0.02, PBF -0.09, DFIN -0.28, GVA -0.29 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative or Mixed Guidance: of note.

Advance/Decline Daily Update: The A/D Line has moved above recent lows but struggling still.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: ROOT +75.3%, ATEC +26%, RELY +24.2%, AVDL +22.4%, CVNA +20.5%, AVXL +15.4%, CFLT +14.8%, NXT +14.8%, NVST +13.6%, MCW +13.1%, CRDF +12.5%, SFM +12.4%, TWLO +11.6%, LMND +11.1%, DAWN +10.9%, TDOC +10.4%, RSI +8.6%, ARGX +7.7%, HLF +7.6%, COMP +7%, ETSY +6.8%, AMSC +6.4%, BKNG +5.9%, PAYC +5.7%, CODI +5.6%, RIG +5.3%, SCI +5.1%, TTMI +5%, NSA +4.9%, CTSH +4.9%, GNRC +4.8%, FDP +4.8%, VAL +4.6%, CW +4%, BIO +3.8%, ALL +3.5%, STAA +3.5%, BHC +3.4%, CI +3.4%, BMEA +3.2%, CLX +3.1%, AX +3%, STLA +3%, EQR +2.8%, PCTY +2.7%, WCC +2.6%, DASH +2.4%, COLM +2.3%, MKL +2.2%, MSTR +2.1%, UDR +2.1%, LPLA +2.1%

- Gap Down: AUR -15.5%, ROKU -14.2%, ACHC -13.2%, SNN -12.4%, HOOD -11.2%, IRTC -10.6%, EBAY -10.2%, WSC -10%, OLED -9%, CWH -8.9%, MPWR -8.8%, ALGT -8.7%, ENVX -7.2%, CORT -7.2%, SRI -7%, MGM -6.2%, NOVA -6.1%, AR -6.1%, LI -6%, MET -5.5%, SPXC -5.5%, SNBR -5.4%, LIN -5.4%, HWKN -5%, CRK -4.9%, CACC -4.7%, HRMY -4.4%, APLD -4.1%, CTOS -4%, BUD -4%, MSFT -3.9%, ALTR -3.8%, META -3.7%, RIOT -3.5%, TLSA -3.4%, HUBG -3.1%, MYRG -2.9%, COIN -2.8%, TWI -2.7%, AM -2.7%, PCOR -2.7%, FORM -2.6%, MU -2.3%, AFL -2%, SUM -2%

Insider Action: TBBK FBK see Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: Check back as not out yet. (CNBC)

- 5 Things To Know Before The Market Opens. (CNBC)

- Latest CNN Headlines. (CNN)

- Bloomberg Lead Story: Microsoft Drops on Disappointing Cloud Growth Forecast. (Bloomberg)

- Markets Wrap: Microsoft and Meta drive down NASDAQ futures. (Bloomberg)

- North Korea conducted an ICBM test. (CNN)

- Estee Lauder (EL) pulls 2025 guidance on China and new CEO. (Bloomberg)

- Bristol Myers Squibb (BMY) tops earnings estimates, raises guidance. (CNBC)

- Merck (MRK) tops estimates on Keytruda sales. (CNBC)

- Bloomberg: Big Take – Alexa’s new AI Brain is stuck in the lab. (Podcast)

- Bloomberg: Odd Lots – Is Made in China 2025 still on track. (Podcast)

Economic:

- September Personal Income is due out at 8:30 a.m. EDT and expected to rise to 0.4% from 0.2% with Personal Spending due out at the same time and expected to change the same amount.

- September PCE Core is also out at 8:30 a.m. EDT and is expected to rise by 0.2% from 0.1%.

- Last, October Chicago PMI is due out at 8:30 a.m. EDT and expected to rise to 47.5 from 46.60.

- Weekly Natural Gas Inventories are due out at 4:30 p.m. EDT.

Geopolitical:

- Federal Reserve Speakers move into a blackout period due to FOMC meeting next week.

- President Biden receives the Daily Briefing at 11:30 a.m. EDT.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

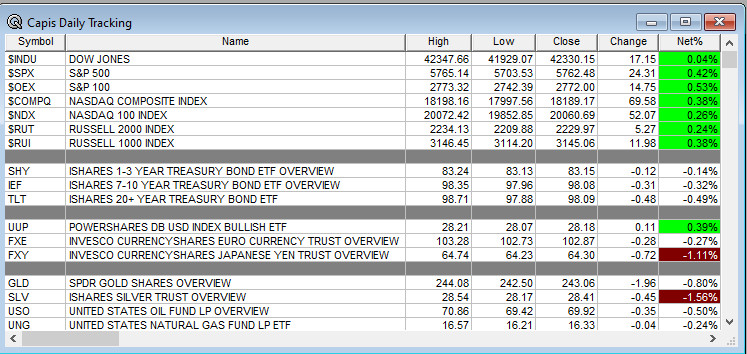

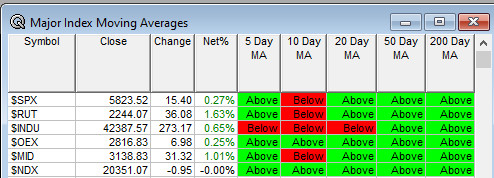

Moving Averages On Major Equity Indexes: Moves from 57% positive to 80%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Cantor’s European TMT Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: FAHN FCEL

- Top Analyst, Investor Meetings: HUMA

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Clinical Trials on Alzheimer’s Disease – Oct 29-Nov 1

- CCCC: Data Presentation for CFT1946

- LXEO: Data Presentation for LX1001

- Company Event: None of note.

- Industry Meetings or Events:

- Clinical Trials on Alzheimer’s Disease (CTAD) Conference

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: OSPN GOOGL EA WING (2) LHX MTH

Downgrades: TEL FIBK ARM