Overnight Summary: The S&P 500 closed Friday higher by 0.40% from Thursday lower by -0.02% at 5841.47. The overnight high was hit at 5915.50 at 7:20 p.m. EDT and the low was hit at 5887 at 6:55 a.m. EDT. The overnight range is 29 points. The current price is 5887.50 at 7:05 a.m. EDT lower by -17.25 points lower by -0.29%.

Executive Summary: Earnings are prolific this week.

Article of Note: “Trump Tariffs Appeal To Voters. Don’t Be Fooled.” by William Dudley Former NY Fed President (Bloomberg)

Key Events of Note Today:

- 3& 6 Month Bill Auction at 11:30 a.m. EDT

- Leading Economic Indicators out at 10:00 a.m. EDT.

Earnings Out After The Close

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- PENN files for 468,932 shares of common stock offering

- GXAI: Form S-3.. Up to 2,607,723 Shares of Common Stock

- ISPC: Form S-1.. UP TO 1,216,545 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- EUDA files $100 mln mixed shelf securities offering

- PROP files $150 mln mixed shelf securities offering

- RUM files $300 mln mixed shelf securities offering

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: SAVE +37.2%, HUM +5.5% of note.

- Movers Down:JBLU -6.9%, CI -5.3%, PROP -3% of note.

News After The Close:

- Dana (DAN) Inc looking into selling its Off-Highway business; possibly valued at a few billion dollars. (Bloomberg)

- Spirit Airlines (SAVE) expects to end 2024 with over $1.0 billion of liquidity. (SEC Filing)

- Cigna Group (CI) dropping after resuming merger discussions with Humana (HUM) following a breakdown in talks last year

- Boeing (BA) and its union have re-engaged in discussions to solve the strike. Vote on Wednesday.

- Barron’s + on BRBR, COST SHW and positive on all stocks.

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

- PSA announces that Chris Sambar joins the Company as COO

Dividends Announcements or News:

- Stocks Ex Div Today: CAT CVS BK BSBR GGG USAC CMRE AC

- Stocks Ex Div Tomorrow: DELL NOK APA CRS APOG GOOD GLAD

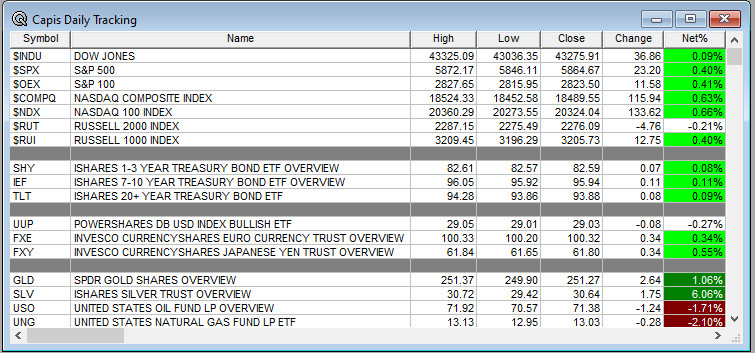

What’s Happening This Morning: Futures S&P 500 -20 NASDAQ -115 +108 Dow Jones -94 Russell 2000 -3.85 (at 8:20 a.m. EDT). Asia is lower ex Australia while Europe is lower .VIX Futures are at 18.10 from 18.20 Friday while Bonds are at 41.134% from 4.108% on the 10-Year. Crude Oil and Brent are higher with Natural Gas higher as well. Gold, Silver and Copper higher. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $68,222 from $67,751 lower by -280 at -0.41% this morning.

- Daily Positive Sectors: Materials, Real Estate, Communication Services, Consumer Cyclical and Utilities of note.

- Daily Negative Sectors: Energy of note.

- One Month Winners: Utilities, Technology,

Energy, Materials, Financials and IndustrialsCommunication Servicesof note. - Three Month Winners: Utilities, Real Estate, Financials, Materials, Industrials and Consumer Defensive of note.

- Six Month Winners: Technology, Utilities, Real Estate, Financials and Consumer Cyclical

Consumer Defensiveof note. - Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials, Industrials and Communication Services of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

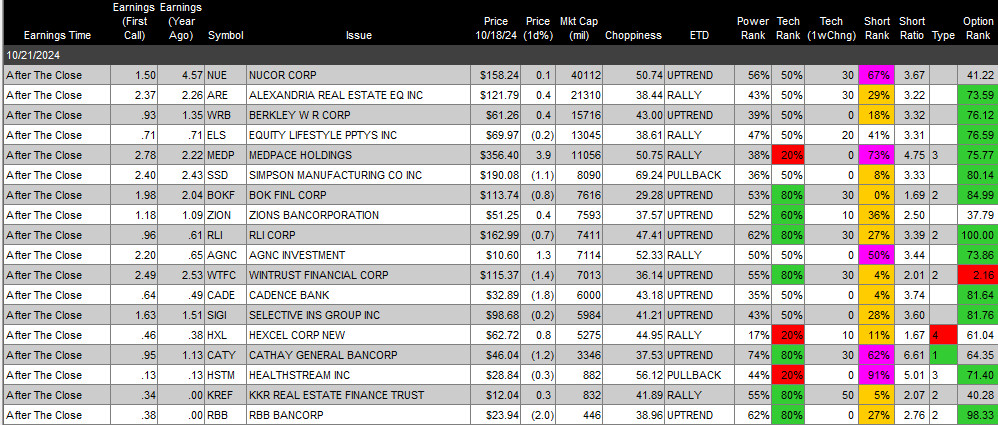

- Monday After the Close:

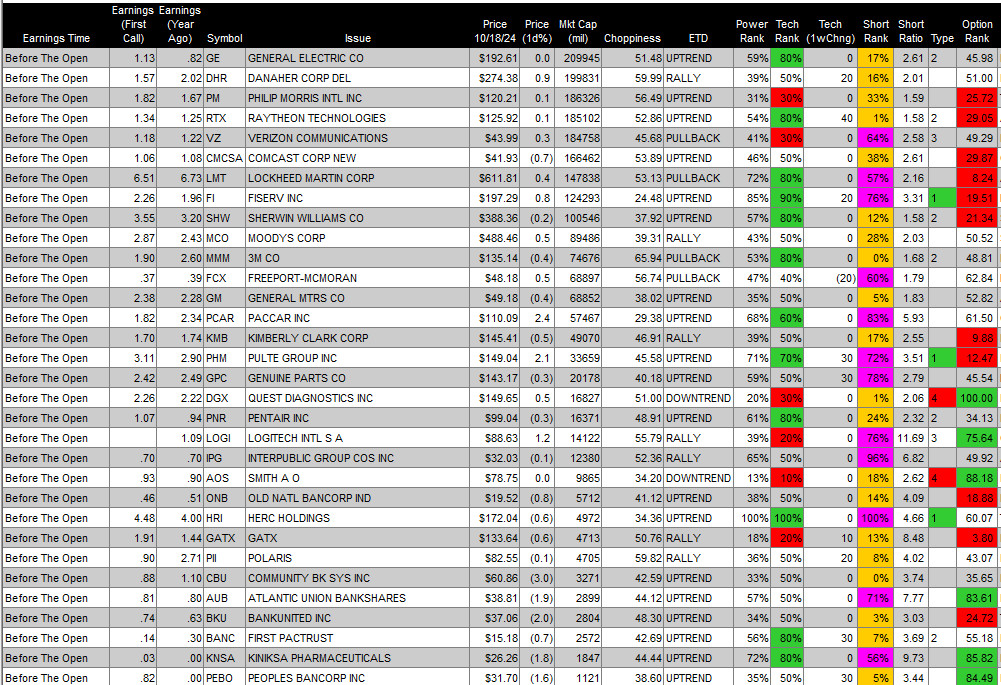

- Tuesday Before The Open:

Earnings of Note This Morning:

- Beats: AUB +0.02 of note.

- Flat: None of note.

- Misses: SASR -0.06 of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

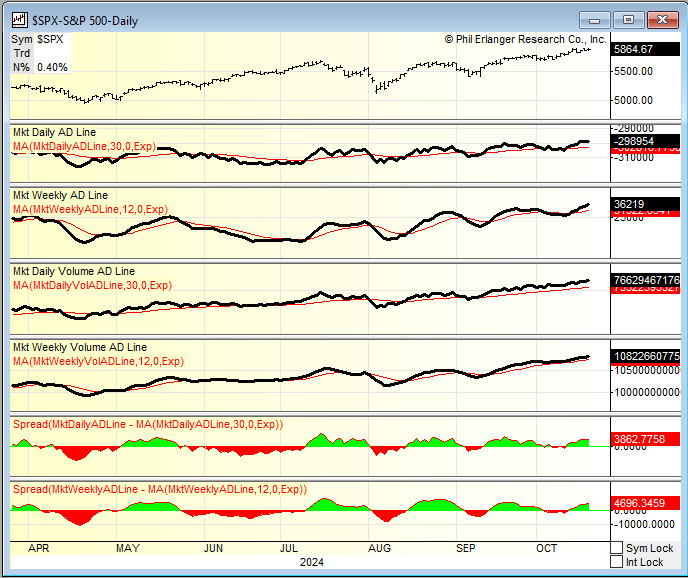

Advance/Decline Daily Update: The A/D Line sees improvement in the last week.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up:SAVE +39.5%, TVGN +10.2%, HUM +4.4%, BA +3.7%, SIRI +3.4%, SASR +3%, CBUS +2.8%

- Gap Down: JBLU -7%, CI -3.6%, PROP -2.6%

Insider Action: None of note that see Insider buying with dumb short selling. None of note that see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: BA KVUE HUM. (CNBC)

- Bloomberg Lead Story: Goldman Sachs The Decade Big Move In The S&P 500 is Over. (Bloomberg)

- Markets Wrap: US Futures Lower as Earnings Take Focus. (Bloomberg)

- Potential Cigna (CI) buyout of Humana (HUM) is a “when” not “if”. (MarketWatch)

- What Harris-Trump Election means for markets. (Bloomberg)

- Bloomberg: Big Take – Hedge Funds pile up huge bets against a green future. (Podcast)

- Bloomberg: Odd Lots – Why Mortgage Rates Went Up After Big Rate Cut By Fed. (Podcast)

- Wealthion: Market Recap: Market Shock Ahead? (Podcast)

- Marketplace: How Big Tech Is Courting Big Oil. (Podcast)

Economic:

- September Leading Indicators are due out at 10:00 a.m. EDT and are expected to remain weak at -0.3% from -0.2%.

Geopolitical:

- Federal Reserve Dallas President Lorrie Logan speaks at 8:55 a.m. EDT.

- Federal Reserve Minneapolis President Neel Kashkari speaks at 1:00 p.m. EDT.

- Federal Reserve Kansas City President Jeffrey Schmid speaks at 5:05 p.m. EDT.

- Federal Reserve San Francisco Mary Daly speaks at 6:40 p.m. EDT.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

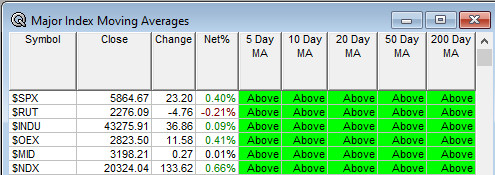

Moving Averages On Major Equity Indexes: Moves from 97% positive to 100%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: AEHR, COEP, NRSN, QBTS, VTSI

- Top Analyst, Investor Meetings: JEF, PATH, VNRX, VTSI

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- American Society of Reproductive Medicine’s (ASRM) 2024 Scientific Congress and Expo

- Annual AI Collaboration and Customer Experience Event

- Congress of the European Association of Nuclear Medicine

- Gartner IT Symposium/Xpo 2024

- ICS Cybersecurity Conference

- International Association of Chiefs of Police Conference

- Montagna Symposium

- QCOM Snapdragon Summit

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades:

Downgrades: