Overnight Summary: The S&P 500 closed Thursday lower by -0.02% at 5841.47 from Wednesday higher by 0.47% from 5842.47. The overnight high was hit at 5900.50 at 5:10 a.m. EDT and the low was hit at 5876.25 at 8:30 p.m. EDT. The overnight range is 24 points. The current price is 5896.50 at 7:05 a.m. EDT higher by +9.50 points higher by 0.16%.

Executive Summary: A quiet day into the weekend. Earnings are even more prolific next week.

Article of Note: “A Lesson in Winning From Reagan to Trump” by Kenneth Khachigian (WSJ) Are your better off than for years ago?

Key Events of Note Today:

- Housing Starts and Baker Hughes Rig Count out today.

- A plethora of Fed speakers today.

Earnings Out After The Close

- Beats: NFLX +0.28, ISRG +0.20, CCK +0.18, OZK +0.01, WAFD +0.01 of note.

- Flat: None of note.

- Misses: WDFC -0.11, WAL -0.09, FFIN -0.02, MRTN -0.01, FNB -0.01 of note.

- IPOs For The Week: ALEH, CUPR, DMAA, HUHU, LBGJ, LUD, NAMI, PTLE, SAG, SFHG, SNYR, SUNH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- BPTH: Form S-3.. 17,757,844 Shares of Common Stock

- CAPT: Form F-1.. Up to 4,938,599 Ordinary Shares (for resale)

- CFREX: Form S-3.. 3,156,984 Shares of Common Stock

- TNON: Form S-1.. 2,445,700 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- MDJH: Form F-3.. Up to 28,356,500 Ordinary Shares Offered by the Selling Shareholders

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- BK files a mixed shelf offering.

- PIPE:

- Convertible Offerings & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: AURA +6.9%, ISRG +5.8%, NFLX +4.8%, MCB +2.7%, OCFC +2% of note.

- Movers Down: MGPI -17.2%, WAL -4.7%, BHC -3.2%, WDFC -3%, MRTN -2.8%, MSB -2.4% of note.

News After The Close:

- AURA Multiple Clinical complete responses demonstrated following single low dose administration of Bel-sar in Patients with non-muscle-invasive bladder cancer (NMIBC) in Ongoing Phase 1 Trial

- MGPI issues downside Q3 revenue guidance, lowers FY24 revenue and adjusted basic EPS guidance due to soft alcohol spirits category trends and elevated industry-wide whiskey inventories.

- Stripe mulling acquisition of Bridge, a crypto startup, for $1.0 bln. (Forbes)

- Fluor (FLR) has a new contract with the U.S. Department of Energy that has an estimated ceiling of $45 billion over a 10-year ordering period for environmental management operations at the Hanford Site in Washington state. Fluor will begin to recognize revenues in Q4.

- Centrus Energy’s (LEU), American Centrifuge Operating, won an award from the U.S. Department of Energy aimed at expanding domestic commercial production of High-Assay, Low-Enriched Uranium, which is needed to fuel many next-generation nuclear reactor designs currently under development, worth up to $2 billion over 10 years.

- Bausch Health (BHC) climbing after rejecting bondholders’ debt proposals, exploring sale of Bausch + Lomb (BLCO). (WSJ)

- Intuitive Surgical (ISRG) guides on the call: expects FY24 procedure growth of +16.0-17.0%, up from +15.5-17.0%

- Cencora (COR): AmerisourceBergen Drug Corp awarded $2.03 bln U.S. Defense Logistics Agency contract modification

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

- David Joyner named the new CEO of CVS replacing Karen Lynch. (CNBC)

Dividends Announcements or News:

- Stocks Ex Div Today:PG CL GEHC WSM RPM PNR OC RVTY NVT AYI WDFC AZZ PDCO BUSE OXM CBRL

- Stocks Ex Div Tomorrow: None listed.

- SPFI increases quarterly cash dividend 7% to $0.15/share from $0.14/share

- KNTK announces a 4% increase to quarterly cash dividend to $0.78/share

- LECO approves 5.6% increase in its quarterly dividend to $0.75/share

- HBCP increases quarterly cash dividend 4% to $0.26/share from $0.25/share

- IDA increases quarterly cash dividend to $0.86/share from $0.83/share

What’s Happening This Morning: Futures S&P 500 +13 NASDAQ 100 +108 Dow Jones -34 Russell 2000 +17 (at 8:20 a.m. EDT). Asia is higher ex Australia while Europe is higher ex FTSE. VIX Futures are at 18.20 from 18.45 yesterday while Bonds are at 4.108% from 4.036% on the 10-Year. Crude Oil and Brent are lower with Natural Gas higher as well. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $67,751 from $67,053 higher by +887 at +1.33% this morning.

- Daily Positive Sectors: Technology, Energy, Financials and Materials of note.

- Daily Negative Sectors: Utilities, Real Estate, Communication Services and Healthcare of note.

- One Month Winners: Energy, Materials, Communication Services and Technology of note.

- Three Month Winners: Utilities, Real Estate, Industrials, Financials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Financials and Communication Services of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note

- Monday Before The Open: SASR

Earnings of Note This Morning:

- Beats: AXP +0.20, CMA +0.16, PG +0.03, SLB +0.01 of note.

- Flat: None of note.

- Misses: ALV -0.08, FITB -0.05, RF -0.04 of note.

- Still to Report: SFNC ALLY

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line sees improvement in the last week.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: HEPS +82.3%, AURA +17%, CMTL +8.8%, SUPN +8.2%, ISRG +6.4%, NFLX +5.8%, BLCO +4.9%, GHI +4.1%, LEU +3%, OCFC +2.8%, MCB +2.4%, DCBO +2.2%, RF +2.2%

- Gap Down: MGPI -16%, FNB -5.7%, WAL -5.3%, TNYA -4.2%, BHC -3.1%, MSB -3.1%, VERI -3.1%

Insider Action: None of note see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: PG AXO BFLX CVS (CNBC)

- Bloomberg Lead Story: US Pushes For Cease Fire in Gaza. (Bloomberg)

- Markets Wrap: NASDAQ points to extended gains on Netflix beat. (Bloomberg)

- Intel (INTC) seeks billions for minority stake in Altera. (CNBC)

- Procter & Gamble (PG) profits beat and sales miss. (MarketWatch)

- Schlumberger (SLB) warns oil explorers have slowed spending. (Bloomberg)

- Bloomberg: Big Take – 2024 Election plays out in courts. (Podcast)

- Wealthion: Is China’s $19 trillion crisis a global time bomb. (Podcast)

- Marketplace: Bytes in Review. (Podcast)

Economic:

- September Housing Starts are due out at 8:30 a.m. EDT and is expected to fall to 1,350,000 from 1,356,000.

- Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Geopolitical:

- Federal Reserve Atlanta President Raphael Bostic speaks at 9:30 a.m. EDT and then again at 12:30 p.m. EDT.

- Federal Reserve Minneapolis President Neel Kashkari speaks at 10:00 a.m. EDT.

- Federal Reserve Governor Christopher Waller speaks at 12:10 p.m. EDT.

- Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

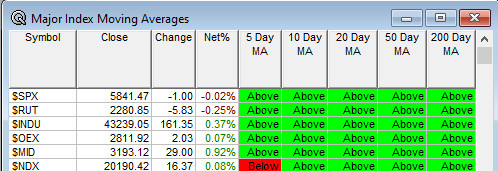

Moving Averages On Major Equity Indexes: Moves from 97% positive to 97%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Raymond James Defense and Government Conference

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: ANIX, CREX, DYAI

- Top Analyst, Investor Meetings:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event: None of note.

- Industry Meetings or Events:

- ASGCT’s Advancing Gene + Cell Therapies for Cancer Conference

- International Conference on Planarization/CMP Technology (ICPT)

- Maxim Group’s Healthcare Virtual Summit

- MedTech Conference

- Parkinson’s Disease Therapeutics Conference

- Urologic Oncology Investor Event

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: SEE OI ILMN HST AVY AMWD AMBP

Downgrades: SR SEDG FTNT