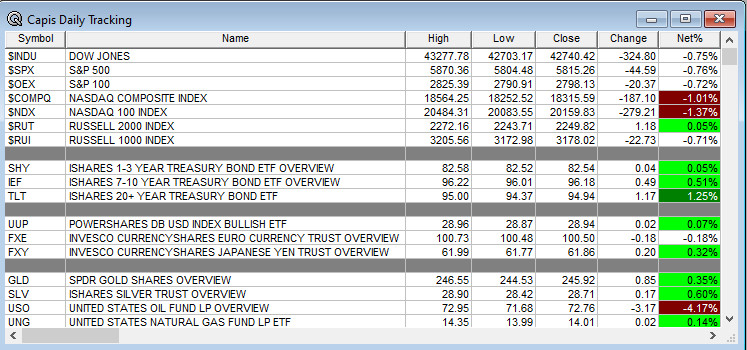

Overnight Summary: The S&P 500 closed Tuesday lower by -0.76% at 5815.26 from Monday higher by 0.77%. The overnight high was hit at 5869 at 12:05 a.m. EDT and the low was hit at 5853.75 at 6:00 p.m. EDT. The overnight range is 16 points. The current price is 5865 at 7:00 a.m. EDT higher by +2.25 points.

Executive Summary: Earnings are coming in strong so far. A positive earnings season will push stocks higher in the fourth quarter.

Article of Note: “Everyone is Under Investigation.” by The Editorial Board. (WSJ) The Justice Department is reviewing the top 40% of the S&P 500 for activities. Really?

Key Events of Note Today:

- Import/Export Data due out at 8:30 a.m. EDT.

- Weekly Crude Oil Inventories due out at 10:30 a.m. EDT.

Earnings Out After The Close

- Beats: UAL +0.16, JBHT +0.10, PNFP +0.09, FULT +0.07, HWC +0.03 of note.

- Flat: None of note.

- Misses: ASML -0.08, IBKR -0.07, PENG -0.03 of note.

- IPOs For The Week: ALEH, CUPR, DMAA, HUHU, LBGJ, LUD, NAMI, PTLE, SAG, SFHG, SNYR, SUNH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- CRKN: Form S-1. .20,000,000 Shares

- GROV: FORM S-3 – Up to 7,760,761 Shares of Class A Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- AEHR: Form S-3.. $100,000,000 Mixed Shelf

- ICCM: FORM F-1 – Mixed Shelf Offering

- MUR – S-3ASR – Mixed Shelf Offering

- PIPE:

- Convertible Offerings & Notes Filed:

- MRX: Form F-1.. U.S.$600,000,000 Senior Notes Due Nine Months or More from Date of Issue

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: NVCR +25.9%, JBHT +6.6%, TCS +4.9%, AMPS +3.5%, AMWL +2.7% and NYCB +2.2% of note.

- Movers Down: PENG -16.3%, SVCO -9.6%, EPAC -7.5%, PLCE -4.2%, IBKR -3.3%, HWC -2% and AEHR -2% of note.

News After The Close:

-

- PFG reports prelim AUM for September 30, 2024 of $740.6 bln

- Moody’s Ratings upgraded MRC to B1 from B2 with a stable outlook

- Copa Holdings (CPA) capacity (ASMs) increased by 9.1%, while system-wide passenger traffic (RPMs) increased by 7.3%, compared to 2023.

- Beyond, Inc. (BYON) and The Container Store Group (TCS) announce strategic partnership to improve customer experience

Buybacks or Repurchases:

- UAL came Out with a $1.5 billion buyback putting in the face of flight attendants who are negotiating with the airline. (CNBC)

Exchange/Listing/Company Reorg and Personnel News:

- EPAC appoints Darren Kozik as CFO, effective Oct 28

- AMWL announces that Mark Hirschhorn will become CFO effective Oct 21, succeeding Robert Shepardson

- ANGI appoints Baily Carson as COO, effective immediately

- New York Community (NYCB) changes name to Flagstar Financial; stock symbol change to “FLG”

- CCCC appoints Paige Mahaney, Ph.D., as Chief Scientific Officer, effective October 28; succeeds Stewart Fisher, Ph.D, who is retiring

Dividends Announcements or News:

- Stocks Ex Div Today: PNC FMX WSO PFLT

- Stocks Ex Div Tomorrow: EOG FUL GHC KWR MGRC CODI DCOM

- LBRT increases quarterly cash dividend 14% to $0.08/share from $0.07/share

What’s Happening This Morning: Futures S&P 500 +4 NASDAQ 100 +21 Dow Jones +28 Russell 2000 +31.08 (at 8:25 a.m. EDT). Asia is lower while Europe is lower ex the FTSE. VIX Futures are at 18.47 from 18.05 yesterday while Bonds are at 4.012% from 4.071% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold, Silver and Copper higher. The U.S. Dollar is lower versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $67,937 from $65,549 higher by 1059 at 1.59% this morning.

- Daily Positive Sectors: Real Estate, Consumer Defensive and Utilities of note.

- Daily Negative Sectors: Energy, Technology and Healthcare of note.

- One Month Winners: Energy, Materials, Communication Services and Technology of note.

- Three Month Winners: Utilities, Real Estate, Industrials, Financials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services and Industrials note.

- Year to Date Winners: Technology, Utilities, Communication Services, Financials, Industrials and Consumer Defensive of note.

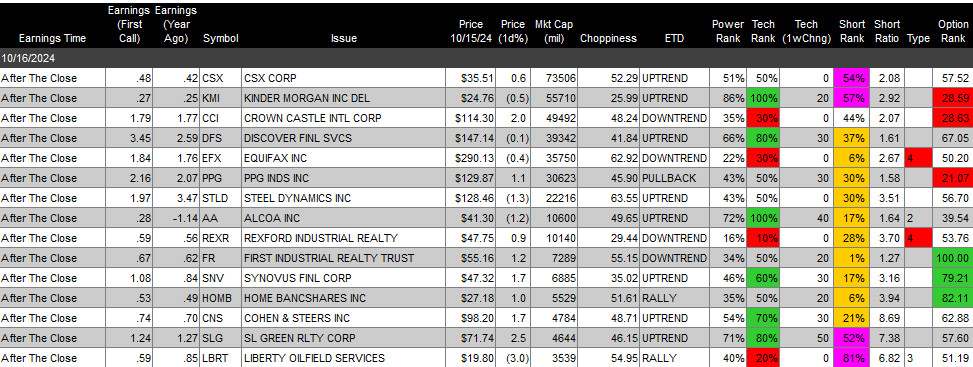

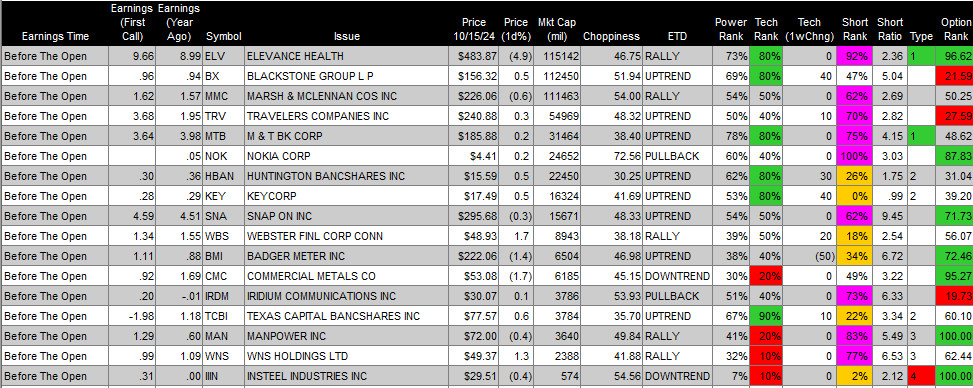

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: MS +0.29, SYF +0.15, PLD +0.06, FHN +0.05, USB +0.04, ABT +0.01 of note.

- Flat: None of note.

- Misses: OFG -0.02 of note.

- Still to Report: None.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Daily Update: The A/D Line sees improvement yesterday despite the S&P 500 selloff.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: TCS +32.1%, NVCR +29.9%, AMPS +11.3%, JBHT +7.1%, ELAN +3.9%, ANGI +3.6%, FHN +2.8%, AMWL +2.4%

- Gap Down: PENG -15.2%, EPAC -6.8%, SVCO -6%, OMC -4.4%, IBKR -4.3%, NBR -4.1%, ASML -4.1%, AEHR -3.3%, INTC -2.1%

Insider Action: None of note see Insider buying with dumb short selling. None of note see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Open on Wednesday. (CNBC)

- Pre-Market Movers: Check back not out yet. (CNBC)

- Bloomberg Lead Story: Trump Defends Tariff Plan While Pushing For More Influence at the Fed. (Bloomberg)

- Markets Wrap: European stocks drop on weak earnings. (Bloomberg)

- China wants review of Intel (INTC) products sold in China. (Reuters)

- Weekly Mortgage Demand drops 17% as rates rise. (CNBC)

- Crude Oil selloff continues as drops another $1. (CNBC)

- Morgan Stanley (MS) beats estimates. (CNBC)

- Bloomberg: Odd Lots – Burgers are telling us something about the business cycle. (Podcast)

- Wealthion: Buffet Hoards Cash, selloff coming? (Podcast)

- NY Times Daily: Montana Senate Race could tip control of the Senate. (Podcast)

Economic:

- Import/Export Prices are due out at 8:30 a.m. EDT and came in last month up 0.8% and -0.7% over the last year.

- Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

Geopolitical:

- President Biden receives the President’s Daily Brief at 4:00 p.m. EDT.

- Press Briefing at 12:00 p.m. EDT with Press Secretary Karine Jean-Piere.

- President Biden heads to the cathedral of St, Matthew the Apostle to deliver the eulogy for Ethel Kennedy, wife of Robert F. Kennedy at 1:00 p.m. EDT.

- President Biden and the First Lady deliver remarks at an Italian American Heritage Month Reception.

Federal Reserve Speakers:

- None of note. Watch our Twitter feed, Bullet86, for any impromptu appearances.

M&A Activity and News:

- VSEC announces acquisition of Kellstrom Aerospace for ~ $200 million, comprised of ~$185 million in cash and ~$15 million of shares of common stock of the Company

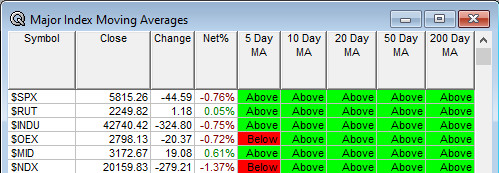

Moving Averages On Major Equity Indexes: Moves from 100% positive to 93%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: AMBC, KOSS, YGMZ

- Top Analyst, Investor Meetings: ANIX, BB, CYTK, DYAI, KFS, LPCN, OKTA, RSG, S, ULTA

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- VSTM: Oct 16-18 Data Presentation on Avutometinib

- AMLX – October 16-19 Data Presentation on AMX0035

- Company Event: None of note.

- Industry Meetings or Events:

- Adobe MAX The Creativity Conference

- ASGCT’s Advancing Gene + Cell Therapies for Cancer Conference

- Diabetes Technology Meeting

- International Conference on Planarization/CMP Technology (ICPT)

- Maxim Group’s Healthcare Virtual Summit

- MedTech Conference

- MicroCap Rodeo Fall Conference

- OCP Global Summit

- Pharma Partnering U.S. Summit

- Public Relations Society of America’s (PRSA) ICON Conference

- Renmark Financial Communications Virtual Non-Deal Roadshow Series

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: UHS NVCR CTVA CSCO

Downgrades: PLL LRLCY CF