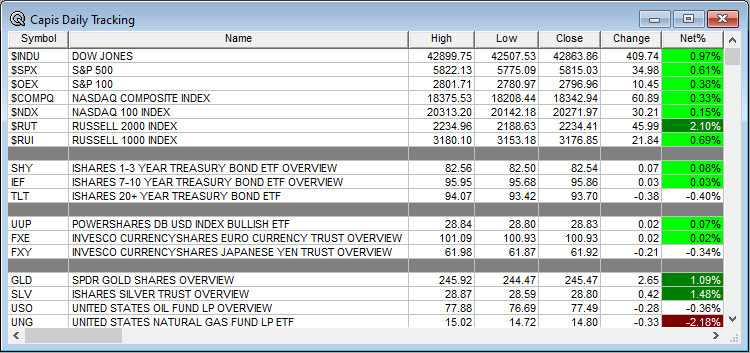

Overnight Summary: The S&P 500 closed Friday higher by 0.61% at 5815.03 from Thursday lower by -0.21% at 5780.05. The overnight high was hit at 5874.50 at 6:15 a.m. EDT and the low was hit at 5850 at 10:05 p.m. EDT. The overnight range is 24 points. The current price is 5871.75 at 6:50 a.m. EDT higher by +12 points.

Executive Summary: .

Article of Note:

Key Events of Note Today:

- There is no economic data as the government is closed for Columbus Day.

- The bond market is closed as well.

Earnings Out After The Close

- Beats: NRIX +0.02 of note.

- Flat: None of note.

- Misses: None of note.

- IPOs For The Week: ALEH, CUPR, DMAA, HUHU, LBGJ, LUD, NAMI, PTLE, SAG, SFHG, SNYR, SUNH, WYHG

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- ICCT: Form S-1.. Up to 27,425,287 Shares of Common Stock

- YYAI: FORM S-1 – 2,200,000 Shares of Common Stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares: None of note.

- Selling Shareholders of note:

- EVRG files for 2,269,447 shares of common stock offering by selling shareholder

- SOC files for 7.5 mln share common stock offering by selling shareholders

- LDI for 241,800,107 share common stock offering by selling shareholders

- Debt/Credit Filing and Notes: None of note.

- Mixed Shelf Offerings:

- CCEC files $500 mln mixed shelf securities offering

- PIPE:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Last Week:

- Movers Up: IART (19.39 +14.07%), BHVN (53.24 +11.78%), TGI (15.01 +19.22%), NCLH (23.35 +14.49%), CUK (18.71 +14.4%), HELE (71.36 +13.67%), CCL (20.41 +13.24%), INSG (19.53 +18.51%), CLS (62.96 +16.96%), AAOI (17.67 +15.04%), UIS (6.39 +13.41%), HIMX (6.33 +11.75%), GGAL (49.77 +14.44%), TRUP (48.91 +14.16%), ALTM (5.55 +80.19%) of note.

- Movers Down: CYRX (6.85 -13.24%), EBF (20.43 -15.96%), UXIN (5.46 -25.71%), SNBR (14.47 -20.71%), TSLA (218.19 -12.75%), JKS (23.97 -19.95%), DQ (20.4 -16.67%), CSIQ (13.95 -11.96%) of note

News After The Close:

-

- Discover (DFS) sees credit card total delinquency rate at 1.70% as of September 30

- Boeing (BA) issues downside Q3 revenue guidance; making important strategic decisions to restore the company. Also, to reduce the size of its total workforce by roughly 10%; expects 777x first delivery in 2026

- 10Q Delays: None of note.

- NASDAQ Delisting Notice: None of note.

Buybacks or Repurchases:

Exchange/Listing/Company Reorg and Personnel News:

Dividends Announcements or News:

- Stocks Ex Div Today: None of note.

- Stocks Ex Div Tomorrow: ABBV ABT FCX EME MAA HRL AFG PECO ACA TRN ALG CHCO BFS ARR

What’s Happening This Morning: Futures S&P 500 +6.97 NASDAQ 100 +53.28 Dow Jones -85 Russell 2000 +8.29 (at 8:20 a.m. EDT). Asia is higher while Europe is lower ex the DAX. VIX Futures are at 18.75 from 19.10 from Friday while Bonds are at 4.096% from 4.10% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $64,825 from $61,168 higher by +2172 at 3.47% this morning.

- Daily Positive Sectors: Financials, Industrials, Real Estate, Healthcare and Utilities of note.

- Daily Negative Sectors: None of note.

- One Month Winners: Energy,

Consumer Cyclicals, Materials, Communication Services and Technology of note. - Three Month Winners: Utilities, Real Estate, Industrials, Financials and Consumer Defensive of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials and Consumer Defensive of note.

- Twelve Month Winners: Technology, Financials, Utilities, Communication Services, Industrials and

Real Estatenote. - Year to Date Winners: Technology, Utilities, Communication Services, Financials, Industrials and Consumer Defensive of note.

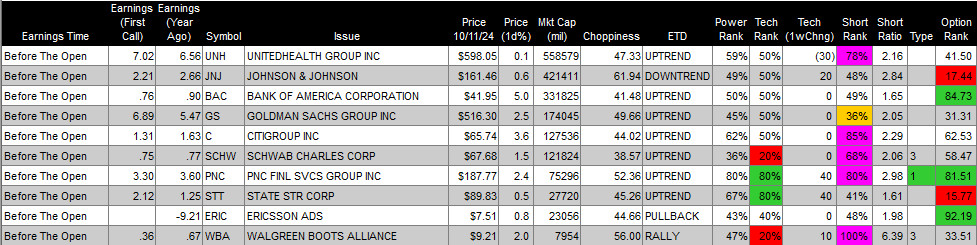

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close: None of note

- Tuesday Before The Open:

Earnings of Note This Morning:

- Beats: BLK +1.01, JPM +0.38, WFC +0.14, BK +0.09 and FAST +0.01 of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

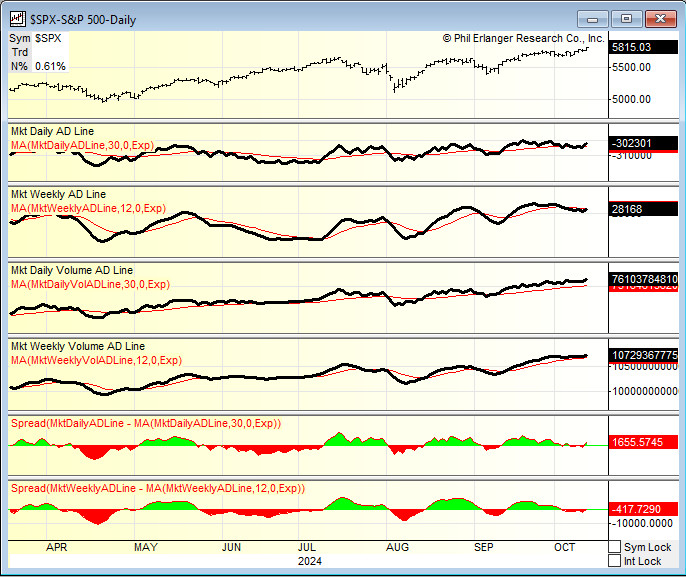

Advance/Decline Daily Update: The A/D Line Weekly Daily and Weekly A/D Lines see improvement.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: LBPH +46.2%, RILY +11.8%, RDW +7.6%, VRA +6.9%, SIRI +5.5%, NRIX +4.1%, BLCO +3.5%, BNTC +2.7%, NTRA +2.5%, CG +2.2%

- Gap Down: UVE -3.2%, BA -2.1%

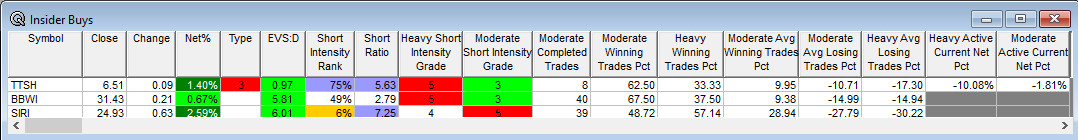

Insider Action: None of note see Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens. (CNBC)

- Pre-Market Movers: BA, SIRI, CAT. (CNBC)

- Bloomberg Lead Story: Chinese Stocks Climb As Traders See Hope in Beijing’s Promises. (Bloomberg)

- Markets Wrap: Stocks drift with earnings set to test bull market. (Bloomberg)

- OPEC cuts 2024 global oil demand growth forecast to 1.93 million BPD (PREV. FORECAST 2.03 MILLION BPD)

- ECB set for third rate cut of the year this week. (CNBC)

- Bloomberg: The Big Take –Catastrophe Bonds leave nations vulnerable. (Podcast)

- Bloomberg: Odd Lots – How Big Tech is disrupting credit markets. (PodCast)

- Wealthion: Weekly Recap. (Podcast)

- Marketplace: TikTok creators do not want a ban. (Podcast)

Economic:

- None of note today.

- The US Bond Market is closed today for Columbus Day.

- Of note this week NY Fed Empire Manufacturing Index, Import/Export Prices, Retail Sales, Philadelphia Fed Index, Industrial Production, NAHB Housing Market Index and Housing Starts.

Geopolitical:

- President Biden receives the President’s Daily Brief at 9:00 a.m. EDT.

- A quiet day ahead as the government is closed for Columbus Day.

Federal Reserve Speakers:

- Federal Reserve Minneapolis President Neel Kashkari will speak at 9:00 a.m. EDT and then again at 5:00 p.m. EDT.

- Federal Reserve Governor Christopher Waller will speak at 3:00 p.m. EDT.

M&A Activity and News:

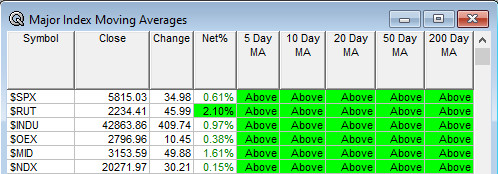

Moving Averages On Major Equity Indexes: Move to 100% positive from 83%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

-

- Fireside Chat: None of note.

- Top Shareholder Meetings: BOF, CSBR, KOPN

- Top Analyst, Investor Meetings: ADBE, BTU, MBRX

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- MBRX: Host Virtual Acute Myeloid Leukemia KOL

Event

- MBRX: Host Virtual Acute Myeloid Leukemia KOL

- Company Event: None of note.

- Industry Meetings or Events:

- Adobe MAX The Creativity Conference

- Paris Motor Show 2024

- Scandium Symposium

- United European Gastroenterology (UEG) Week Congress

- Virtual Acute Myeloid Leukemia KOLEvent

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: IBTA DEA ATR

Downgrades: VFC TGI GOOS CAT AZO