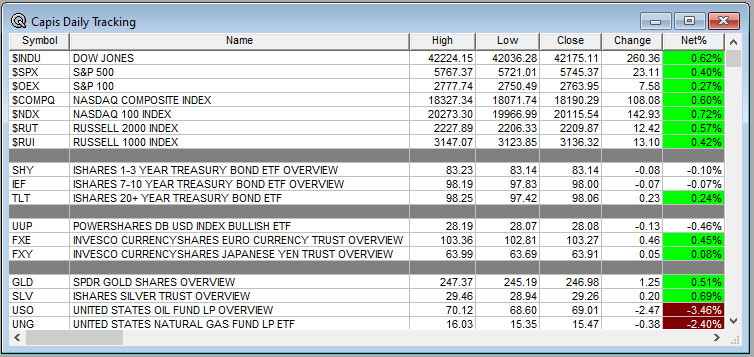

Overnight Summary: The S&P 500 closed Thursday higher by 0.40% at 5745.37. This makes it the 42nd closing new high of the year on the S&P 500. The overnight high was hit at 5812 at 6:20 p.m. EDT and the low was hit at 5790.75 at 3:55 a.m. EDT. The overnight range is 22 points. The current price is 5797.75 at 7:05 a.m. EDT lower by -6.75 points.

Most Important Article Of the Morning: Everyone needs to be up to speed on a potential port strike. Bloomberg Odd Lots: Potentially Massive East Coast Port Strike. (Podcast)

Executive Summary: Well, David Tepper seems to have lost his magic. I guess that magic was lost when he bought the Carolina Panthers who can only lose games. Yesterday, the opening print was the high for the day. Yes, stocks finished higher from Wednesday but off the opening high. Let’s see if stocks can rally off a low PCE Core number this morning and clear 5750 on the S&P 500.

- Several economic releases led by PCE Core.

- Weekly Baker Hughes Rig Count at 1:00 p.m. EDT.

Earnings Out After The Close:

- Beats: COST +0.07, BB +0.03 of note.

- Flat:

- Misses: MTN -0.44 of note.

- IPOs For The Week: BIOA, BKV, FBGL, GRDN, LGCY, NAMI, SAG, SUNH,

WCT, ZENA, ZJK - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- MLNK launches secondary public offering of 6 mln shares by certain funds managed by Thoma Bravo

- MOFG files common stock offering

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- MLNK launches secondary public offering of 6 mln shares by certain funds managed by Thoma Bravo (see above as well)

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- ALGT files mixed shelf securities offering

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Yesterday:

- Movers Up: ESTA +23.8%, TMDX +8.5%, SCHL +6.7%, SM +3.6%, IGT +2%, MOD +2%

- Movers Down:MOFG-6.5%,MLNK-5.3%.

News After The Close :

-

- AIR awarded a five-year indefinite delivery / indefinite quantity contract with an aggregate ceiling value of approximately $1.2 billion by the U.S. Navy’s Naval Air Systems Command to perform engine depot maintenance and repair for its P-8A Poseidon Aircraft fleet

- SEC charges Draft Kings (DKNG) with disclosing nonpublic info via the CEO’s social media accounts. (SEC Release)

- Trump Media & Technology Group Corp (DJT) down mildly following United Atlantic Ventures, backer of the company, disclosing offloading over 7.5 mln shares

- SF reports August operating data; Total client assets and fee-based assets increased 15% and 20%, respectively, from the same period a year ago, due to solid recruiting and market appreciation.

- Coherent (COHR) announces the launch of its 200 mm silicon carbide epitaxial wafers (SiC epi-wafers). Substrate and epi-wafer shipments from the company at 350 micron and 500 micron thickness are now underway.

- Intl Game Technology (IGT) awarded a multi-year retail sports betting agreement with FanDuel, a unit of Flutter Entertainment (FLUT)

- MOS announce July and August sales. (Release)

- ZG introduces climate risk data on for-sale listings. (Release)

- DELL awarded $795 mln U.S. Defense Information Technology Agency contract for Adobe Enterprise (ADBE) software licenses

- LMT awarded $422 mln U.S. Navy contract

- NTSB issues urgent safety recommendations on Boeing (BA) 737 rudder system. (NTSB Release)

- The Ensign Group (ENSG) will replace Southwestern Energy (SWN) in the S&P MidCap 400 and TransMedics Group (TMDX) will replace The Ensign Group in the S&P SmallCap 600 effective prior to the opening of trading on Tuesday, October 1

- Curbline Properties (CURB) will be added to the S&P SmallCap 600 effective prior to the open of trading on Tuesday, October 1, replacing Cross Country Healthcare (CCRN), which will be removed from the S&P SmallCap 600 effective prior to the opening of trading on Wednesday, October 2. CCRN is kicked out of the index.

- 10-Q or 10-K Delays – None of note.

- NASDAQ Delisting Notice – None of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

-

- MTN increased the Company’s authorization for share repurchases by 1.1 million shares to approximately 1.7 million shares.

- OVV receives approval for renewal of normal course issuer bid; to purchase up to 25,920,545 common shares during the 12-month period commencing October 3, 2024

Exchange/Listing/Company Reorg and Personnel News:

-

- None of note.

Dividends Announcements or News:

- Stocks Ex Div Today: DHR MDT BTI KDP FERG NUE VLTO ELS CW RL RRX FLS ESAB VMI XRAY QFIN NHI NOG PRIM CTS REVG MFA

- Stocks Ex Div Monday: SYK DE MDLZ ITW USB MPWR HUM AVB WTW FITB BXP LII ARE ZBH ESS STLD SUI WPC CPT HST REXR NLY BEN LECO DOX EGP TTC ENSC GOLD AGNC FMC FR ADC STAG CDP STWD AXS RHP TRNO DDS BXSL EPRT

- SM increases quarterly cash dividend to $0.20 a share from $0.18 a share

What’s Happening This Morning: Futures S&P 500 +6 NASDAQ 100 +22 Dow Jones +48 Russell 2000 +20. Asia is higher ex China while Europe is higher. VIX Futures are at 17.82 from 17.60 yesterday while Bonds are at 3.777% from 3.766% on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold, Silver and Copper lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and lower against the Yen. Bitcoin is at $65,492 from $64,376 higher by 1.73% this morning.

- Daily Positive Sectors: Materials, Consumer Cyclicals, Technology and Financials of note.

- Daily Negative Sectors: Energy, Real Estate and Utilities of note.

- One Month Winners: Utilities, Real Estate, Financials, Consumer Cyclicals and Industrials of note.

- Three Month Winners: Real Estate, Utilities, Financials, Consumer Defensive, Healthcare and Industrials of note.

- Six Month Winners: Utilities, Real Estate, Technology, Financials, Consumer Defensive and Communication Services of note.

- Twelve Month Winners: Technology, Financials, Communication Services, Industrials, Utilities and Real Estate note.

- Year to Date Winners: Technology, Utilities, Financials, Communication Services, Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note

- Monday Before The Open: CCL of note.

Earnings of Note This Morning:

- Beats: None of note.

- Flat: KMX

- Misses: None of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

Advance/Decline Weekly Update With Both Daily and Weekly Stats: The Daily A/D Line has made a new high while the S&P 500 keeps making new highs. A small divergence.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: ESTA +29.3%, IONQ +8.7%, SCHL +7.7%, TMDX +6.9%, BMY +6.3%, BGNE +3.6%, VINP +3%, SM +2.4%, IGT +2%

- Gap Down: SAVA -8.7%, MOFG -5.4%, TVTX -5.3%, MLNK -4.9%, BB -2.4%, CCU -2.2%

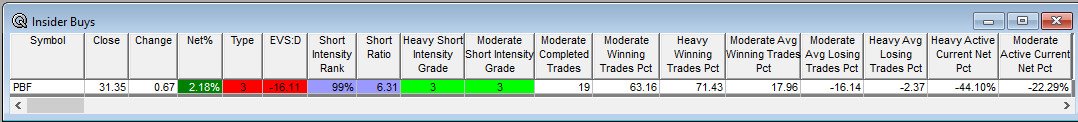

Insider Action: PBF sees Insider buying with dumb short selling. No names see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Pre-Market Movers: BMY COST SMCI. (CNBC)

- Bloomberg Lead Story: Harris Holds Razor Thin Lead Against Trump in Swing States. (Bloomberg)

- Markets Wrap: US Futures pause before PCE Data, Yen climbs. (Bloomberg)

- Hurricane Helene moves to a Tropical Storm now with powerful wind and rain. (CNBC)

- Bloomberg Odd Lots: Potentially Massive East Coast Port Strike. (Podcast)

- Wealthion: Former Fed Offical Dennis Lockhart on the 2008 Crisis. (Podcast)

- NYT Daily: Indictment of Eric Adams. (Podcast)

- Marketplace: Fewer fund for FEMA means slower recoveries from weather nighmares. (Podcast)

Economic:

- August Personal Income is due out at 8:30 a.m. EDT and is expected to rise to 0.4% from 0.3%.

- August PCE Core is due out at the same time and expected to stay at 0.2%.

- The final September University of Michigan Consumer Sentiment is due out at 10:00 a.m. EDT and is expected to remain at 69.

- Weekly Baker Hughes Rig Count is due out at 1:00 p.m. EDT.

Geopolitical:

- President Biden receives the Daily Briefing at 8:15 a.m. EDT.

- President Biden heads to Scranton, PA and arrives at 10:15 a.m. EDT and leaves at 1:00 p.m. EDT and then heads to Rehoboth Beach after that.

Federal Reserve Speakers:

- Federal Reserve Governor Michelle Bowman speaks at 1:15 p.m. EDT.

M&A Activity and News:

- None of note

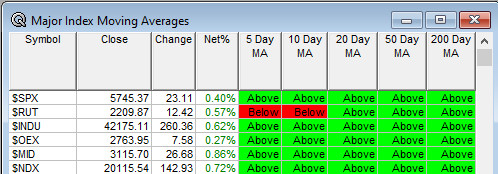

Moving Averages On Major Equity Indexes: Moves from 86% of the moving averages being positive to 93%.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: AEMD, AVAV, SEEL, SGBX, VSTO, XPON

- Investor/Analyst Day/Calls: AQST, REGN

- Update: None of note.

- R&D Day: None of note.

-

- FDA Presentation:

- BGNE: PDUFA Decision on Tislelizumab + chemo

- BMY: PDUFA Decision on OPDIVO

- KRTX PRTC ZLAB: Data Presentation for KarXT

- MRK: PDUFA Decision on KEYTRUDA

- Company Event:

- Industry Meetings or Events:

- Congress for the European Academy of Dermatology & Venereology

- Congress of the ESRS

- HFSA Scientific Meeting

- HCMS Scientific Sessions

- International Myeloma Society Meeting

- MEDITECH LIVE24 Conference

- North American Cystic Fibrosis Conference

- NASS Meeting

- FDA Presentation:

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: VIST CERT BMEA (2 upgrades)

Downgrades: UDMY DG