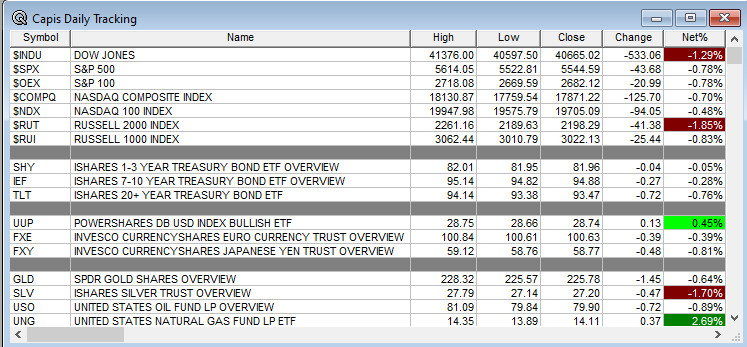

Overnight Summary: The S&P 500 closed Thursday lower by -0.78% at 5544.59 from Wednesday lower by -1.39% at 5588.27. The overnight high was hit at 5,607.25 at 2:05 a.m. EDT and the low was hit at 5568.50 at 3:40 a.m. EDT. The overnight range is 39 points. The current price is 5594.25 at 7:12 a.m. EDT lower by -0.25 points.

- A couple Fed speakers today as John Williams and Raphael Bostic both speak.

- Beats: ISRG +0.24, RGP +0.22, NFLX +0.14, BANF +0.09, WAL +0.04, AIR +0.02, AMK +0.02, GBCI +0.02, PPG +0.02, FFIN +0.01 of note.

- Flat: OZK and KMI of note.

- Misses: SIGI -2.59, MRTN -0.01 of note.

- Yet to Report:

Capital Raises:

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- IDAI: Form S-3.. Up to 4,597,701 Shares of Class A Common Stock

- SCLX: Form S-3.. Up to 3,500,000 Shares of Common Stock

- PLUG – Proposed Public Offering of Common Stock $200,000,000 of its common stock

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- SCLX files for 3,500,000 shares of common stock by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- DTST: Form S-3 .. $50,000,000 Mixed Shelf

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: HE +39.3%, RGP +10.6%, ABL +10.50%, SGRY +8.9%, ISRG +6.50%, TXT +2.5%

- Movers Down: SCHL -11.1%, SIGI -7.3%, OCFC -5.3%, CRSR -4.8%, GBCI -3.7%, PPG -2.9%

News After The Close :

-

-

- Netflix (NFLX) beat estimates as ad supported memberships climb. (CNBC)

- Corsair Gaming (CRSR) guides Q2 revenue well below consensus; says the market for high-end self-built gaming PCs continues to be softer than expected.

- Abacus Life (ABL) guides Q2 revenue above two analysts’ estimates.

- Smartsheet (SMAR) ticking higher after fielding buyout interest. (Reuters)

- Surgery Partners (SGRY) up +9% after private equity backer explores potential sale. (Bloomberg)

- TXT awarded $312 U.S. Navy contract modification

- Hawaiian Electric (HE) surges by over +30% after being among firms looking at a $4.0 bln Maui fire deal. (Bloomberg)

-

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

Exchange/Listing/Company Reorg and Personnel News:

- MRAM CFO Anuj Aggarwal to depart, effective July 26; appoints Matthew Tenorio as Interim CFO; reiterates Q2 guidance

Dividends Announcements or News:

- Stocks Ex Div Today: PG CL GEHC WSM PNR SM WDFC PDCO CMRE CBRL

- Stocks Ex Div Tomorrow: CAT CVS BK GGG APA BMA PAC USAC SVC RDUS

What’s Happening This Morning: Futures S&P 500 +2.25, NASDAQ 100 +9.75, Dow Jones -79, Russell 2000 +2.61. Asia and Europe are lower this morning. VIX Futures are at 15.55 from 14.65 yesterday while Bonds at 4.21% from 4.184% on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $64,067 from $64,653 higher by +0.81% this morning.

- Daily Positive Sectors: Energy of note.

- Daily Negative Sectors: Healthcare, Materials, Consumer Cyclical, Financials and Real Estate of note.

- One Month Winners: Technology, Communication Services, Real Estate, Consumer Cyclical and Financials of note.

- Three Month Winners: Technology, Utilities, Communication Services, Real Estate, Healthcare, Financials and Consumer Defensive of note.

- Six Month Winners: Technology, Communication Services, Financials and Industrials of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Healthcare, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Communication Services, Financials, Utilities and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Friday After the Close: None of note.

- Monday Before The Open: VZ, IQV and BOH

Earnings of Note This Morning:

- Beats: TRV+0.50, CMA +0.30, AXP +0.23, RF +0.03, HBAN +0.02, SLB +0.02 of note.

- Flat: None of note.

- Misses: EEFT -0.91, ALV -0.33, FITB -0.04 of note.

- Still to Report: BMI HAL of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart: Yesterday’s drop did not really hurt the A/D lines progress.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: HE +37.3%, CAAS +11.1%, SGRY +7.9%, ABL +5.3%, ISRG +4.5%, HHH +2.9%, TXT +2.6%, HBAN +2.6%, EBR +2.4%, SLB +2.1%, WAL +2% of note.

- Gap Down: OCFC -16.2%, SCHL -14.8%, CRWD -13.4%, PLUG -9.9%, SIGI -7.2%, CRSR -7.2%, ALV -5.8%, CMA -4.7%, PPG -2.8%, CASI -2.3%, SMAR -2.1%, FITB -2.1% of note.

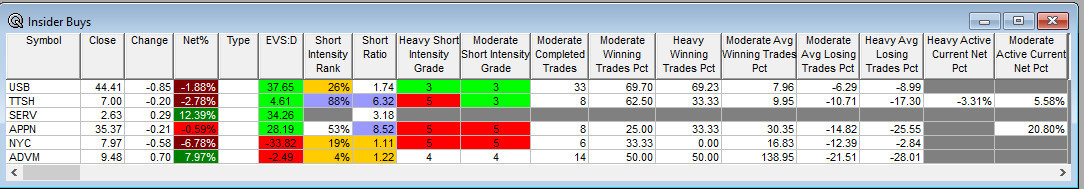

Insider Action: No stocks see Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- Bloomberg Lead Story: Microsoft says underlying cause of outage fixed, some 365 Apps still down. (Bloomberg)

- Markets Wrap: Stocks struggle as tech outage hits overnight. (Bloomberg)

- Major Global IT Outage this morning as both Crowdstrike (CRWD) and Microsoft (MSFT) having separate issues. (CNBC)

- Barron’s – Ford (F) is making a comeback. (Barron’s)

- Presidential Nominee Former President Donald J. Trump speech reviewed. (CNBC)

- Major Democratic donors push Biden to drop out of the presidential race. (CNBC)

- Bloomberg: The Big Take: Silicon Valley shift to the right. (Podcast)

Economic:

- Weekly Baker Hughes Rig Count is out at 1:00 p.m. EDT.

Geopolitical:

- President Biden is in lockdown in Delaware with a mild case of Covid. All events are canceled again today.

Federal Reserve Speakers

- Federal Reserve New York President John Williams speaks at 10:40 a.m. EDT.

- Federal Reserve Atlanta President Raphael Bostic speaks at 1:00 p.m. EDT.

M&A Activity and News:

- Darden (DRI) to buy Chuy’s Holding (CHUY) for $37.50 a share in an all cash transaction.

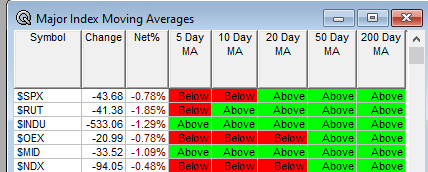

Moving Averages On Major Indexes: Moves from 77% to 70% of the moving averages being positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: CEE, CELZ, CRON, GRND. INMB

- Investor/Analyst Day/Calls: PHAT

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings or Events:

- American Society of Retina Specialists (ASRS) Annual Meeting

- Society of Cardiovascular Computed Tomography

- International Cough Symposium

- NACUFS National Showcase

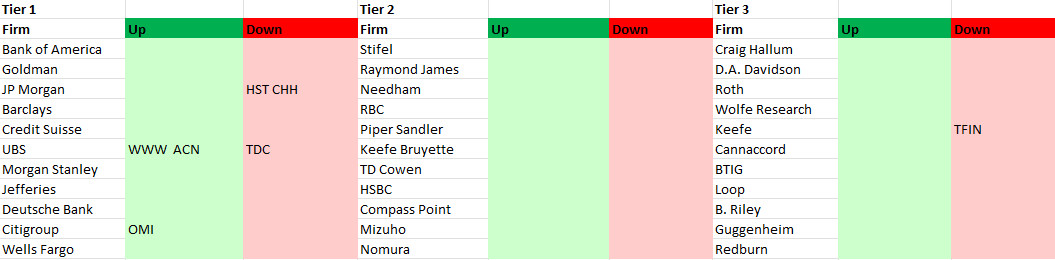

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.