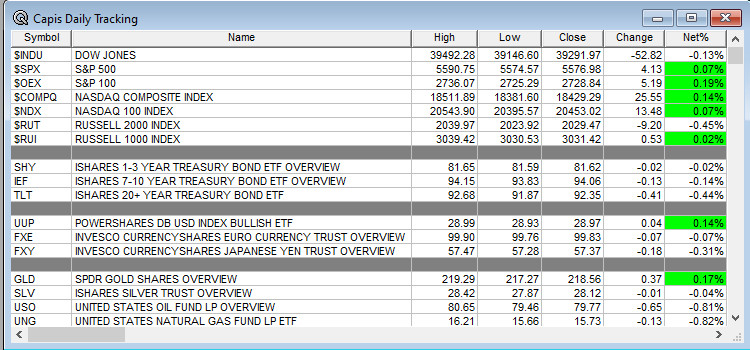

Overnight Summary: The S&P 500 closed Tuesday higher by 0.07% at 5576.98 from Monday higher by 0.10% at 5572.85. The overnight high was hit at 5,640.50 at 6:30 a.m. EDT and the low was hit at 5630.50 at 4:05 p.m. EDT. The overnight range is 10 points. The current price is 5640 at 6:45 a.m. EDT higher by +8.75.

- The latest NYSE and NASDAQ Short Interest are due out after the close.

- 10-Year Treasury Note Auction at 1:00 p.m. EDT.

- Beats: None of note.

- Flat: None of note.

- Misses: KRUS -0.01 of note.

- Yet to Report:

Capital Raises:

- IPOs For The Week: ACTU, AZI, MJID, MSW, ORKT, OSTX, PGHL, QMMM, WOK

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- IDYA announces proposed public offering of up to $200 mln of common stock and pre-funded warrants.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- .

- .

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: AEHR +14.40%, SGH +6.6%, HZO +5.5%, TRIB +4.5%, LOVE +3.9%, ARQT +2.9% , JRVR +2%

- Movers Down: LZ -9.7%, KRUS -3.3%,

News After The Close :

-

- S&P 500 sets 36th record close in 2024.

- PLYA resorts in Caribbean and Mexico did not sustain significant damage from Hurricane Beryl.

- CNS reports preliminary assets under management of $80.7 billion as of June 30, 2024, an increase of $221 million.

- AEHR guides MayQ revs above consensus, provides FY25 outlook.

- LZ reiterates Q2 revenue guidance; lowers FY24 revenue outlook.

- GOOGL dark web monitoring service to be made available for all users instead of just Google One subscribers. (The Verge)

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- UPS appoints Brian Dykes as EVP and CFO; effective immediately.

- CMG announces retirement of CFO Jack Hartung; effective March 31, 2025.

- MSGS names Jamaal Lesane as COO.

- LZ appoints Chairman Jeffrey Stibel as new CEO; effective immediately.

- BWMN COO Michael Bruen promoted to president; VP and division manager Dan Swayze promoted to COO; CFO Bruce Labovitz enters into new four-year contract.

Dividends Announcements or News:

- Stocks Ex Div Today: INTU VZ T GIS DRI GPS LNC ATHM BRC

- Stocks Ex Div Tomorrow: ORCL ACN GE KAI GNL

- CMI increases quarterly cash dividend ~8.3% to $1.82/share from $1.68/share.

What’s Happening This Morning: Futures S&P 500 +11.25, NASDAQ 100 +66.50, Dow Jones +17 Russell 2000 +9.83. Asia is higher ex Australia while Europe is higher this morning. VIX Futures are at 13.01 from 13.10 yesterday while Bonds at 4.277% from 4.299% yesterday on the 10-Year. Crude Oil and Brent are lower with Natural Gas higher. Gold and Silver are higher with Copper lower. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $58,548 from $57,421 higher by 1.36% this morning.

- Daily Positive Sectors: Financials, Healthcare, Utilities and Consumer Cyclicals of note.

- Daily Negative Sectors: Energy, Materials and Industrials of note.

- One Month Winners: Technology, Communication Services, Consumer Cyclical and Energy of note.

- Three Month Winners: Technology, Communication Services, Utilities, Consumer Cyclical and Consumer Defensive of note.

- Six Month Winners: Technology, Communication Services, Financials and Consumer Cyclicals of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Energy, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Communication Services, Financials, Consumer Defensive, Energy and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close: PSMT WDFC AZZ of note.

- Thursday Before The Open: DAL PEP of note.

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: AEHR +15.1%, SGH +6.6%, ILMN +3.9%, HZO +3.8%, BKD +2.8%, ARQT +2.6%, TSM +2.4%, SAVE +2.2%, PLYA +2.1% of note.

- Gap Down: LZ -22%, IDYA -6.4%, KRUS -4.1%, CERT -3.5%, ORLA -2.3%, of note.

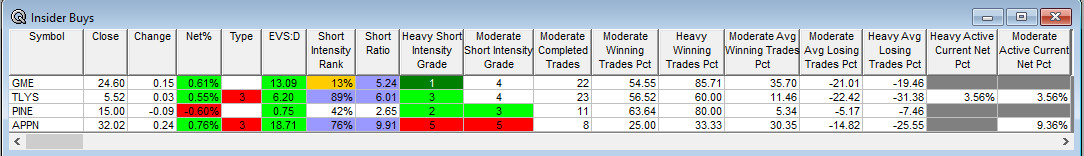

Insider Action: TLYS sees Insider buying with dumb short selling. APPN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens on Wednesday morning. (CNBC)

- What Your Need to Know to Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves Pre-Market: . (CNBC)

- Market Wrap: S&P Futures signal endurance to rate fueled rally. (Bloomberg)

- Bloomberg Lead Story: Powell Flags Rising Risks. (Bloomberg)

- OPEC laggards are still producing above supply limits.

- Bloomberg: The Big Take: The Chinese Chain beating Starbucks. (Podcast)

Economic:

- Weekly Crude Oil Inventories are due out at 10:30 a.m. EDT.

- Weekly MBA Mortgage Applications fell 0.2%.

Geopolitical:

- President Biden receives the President’s Daily Briefing at 10:00 a.m. EDT.

- President Biden meets with AFL-CIO national union leaders at 11:45 a.m. EDT.

- President Biden welcomes NATO Allied Leaders to the NATO Summit at 12:15 p.m. EDT and then meets until 4:00 p.m. EDT.

- President Biden meets with new U.K. Prime Minister Keir Starmer at 5:30 p.m. EDT.

- President Biden hosts NATO Allied Leaders for dinner at 8:00 p.m. EDT.

Federal Reserve Speakers

- Federal Reserve Chairman Powell concludes his testimony before Congress.

- Federal Reserve Governor Michelle Bowman speaks at 2:30 p.m. EDT.

- Federal Reserve Chicago President Austan Goolsbee speaks at 2:30 p.m. EDT.

M&A Activity and News:

- None of note.

Moving Averages On Major Indexes: Moves from 83% to 70% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Bank of America Healthcare Conference

- CJS Securities New Ideas Summer Conference

- Leerink I&I and Metabolism Therapeutics Forum

- Mizhuo Therapeutics Expert Seminar

- Fireside Chat: None of note.

- Top Shareholder Meetings: DNLI, ELDN, IOT, LL, SCS, SKYX, VRNT

- Investor/Analyst Day/Calls: USEG

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- SEMICON West

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: TEVA ILMN DGX BHF A

Downgrades: WMG SPOT RSKD LZ KLG HPP DLAKY