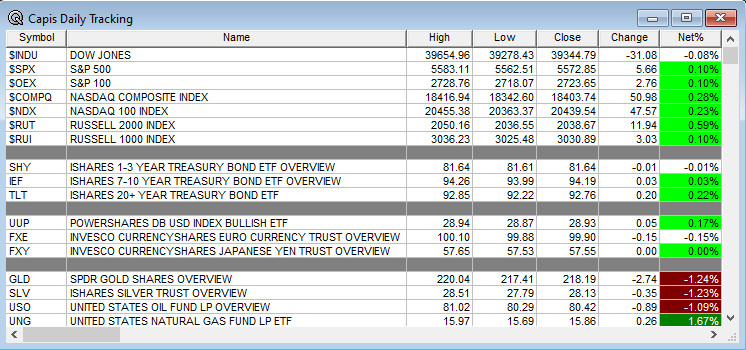

Overnight Summary: The S&P 500 closed Monday higher by 0.10% at 5572.85 from Friday higher by 0.54% at 5567.19. The overnight high was hit at 5,640 at 5:35 a.m. EDT and the low was hit at 5625.25 at 4:05 p.m. EDT. The overnight range is 15 points. The current price is 5638.75 at 7:12 a.m. EDT higher by 13.50.

- 3-Year Note Auction at 1:00 p.m. EDT.

- 52-Week Bill Auction at 11:30 a.m. EDT.

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Yet to Report:

Capital Raises:

- IPOs For The Week: ACTU, AZI, MJID, MSW, ORKT, OSTX, PGHL, QMMM, WOK

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- TNXP files a proposed public offering.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- TEO files a mixed securities shelf offering.

- ENVB files a $200 million mixed securities shelf offering.

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down After The Close:

- Movers Up: KYMR +12.6%, GPAC +9%, NN +8%, RVMD +7.1%, ESE +5.1%, AGO +3%, EBS +2.4%,

- Movers Down: HLIO -3.2%, DRQ-2%

News After The Close :

-

- S&P 500 sets 35th record close in 2024. (Bloomberg)

- Tesla (TSLA) up 9 days in a row. (Yahoo)

- Hedge Funds bet against Gasoline in the middle of the driving season. (Bloomberg)

- NASDAQ reports June volumes and Q2 stats.

- Esco Tech (ESE) to acquire U.S. Navy supplier for $550 million.

- Pentagon to evaluate Boeing’s (BA) improvement plans and DOJ deal before deciding on guilty plea impact.

- IGT signs a 7 year contract with the Colorado Lottery to install new products and solutions.

- Emergent BioSolutions (EBS) and JNJ execute settlement agreement to resolve claims from manufacturing service agreement.

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- HLIO names Sean Bagan as Interim President and CEO in addition to his role as CFO.

Dividends Announcements or News:

- Stocks Ex Div Today: MA CRM DG NYT ERIE

- Stocks Ex Div Tomorrow: INTU VZ T GIS DRI GPS LNC ATHM BRC

What’s Happening This Morning: Futures S&P 500 +12.50, NASDAQ 100 +68, Dow Jones +30 Russell 2000 +4.33. Asia is higher while Europe is lower this morning. VIX Futures are at 13.10 unchanged from yesterday while Bonds at 4.299% from 4.30% yesterday on the 10-Year. Crude Oil and Brent are lower with Natural Gas lower as well. Gold and Silver are higher with Copper lower. The U.S. Dollar is higher versus the Euro, flat versus the Pound and higher against the Yen. Bitcoin is at $57,421 from $57,165 higher by 1.90% this morning.

- Daily Positive Sectors: Technology, Real Estate, Industrials, Healthcare and Utilities of note.

- Daily Negative Sectors: Communication Services, Energy, Financials and Consumer Defensive of note.

- One Month Winners: Technology, Communication Services, Consumer Cyclical and Energy of note.

- Three Month Winners: Technology, Communication Services, Utilities, Consumer Cyclical and Consumer Defensive of note.

- Six Month Winners: Technology, Communication Services, Financials and Consumer Cyclicals of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Energy, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Technology, Communication Services, Financials, Consumer Defensive, Energy and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Tuesday After the Close: SGH of note.

- Wednesday Before The Open: MANU of note.

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: HELE -0.60 of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: KYMR +10.5%, RVMD +6.1%, ESEA +3.4%, ASX +3.1%, AGO +2.1% of note.

- Gap Down: INDV -37%, HELE -17.3%, HLIO -10.7%, BP -4.4%, MESO -2.3% of note.

Insider Action: No names see Insider buying with dumb short selling. TTSH sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens on Tuesday morning. (CNBC)

- Stocks Making the Biggest Moves Pre-Market: . (CNBC)

- Market Wrap: U.S. Stocks set to test another high before Powell. (Bloomberg)

- Bloomberg Lead Story: Trump Returns To Campaign Trail While Biden Fights Off Revolt. (Bloomberg)

- Morning Briefing for Bloomberg Subscribers. (Bloomberg)

- Jain Capital launches fund with $5.3 billion. (Bloomberg)

- BP shares drop on $2 billion impairment announcement. (CNBC)

- Walt Disney (DIS) to introduce new China cruise ship. (Reuters).

- Federal Reserve considers change in capital rules that could save banks billions. (Reuters)

- Bloomberg: The Big Take: At SpaceX Elon Musk’s own brand of Cancel Culture is thriving. (Podcast)

- Bloomberg: Odd Lots: Warren Mosler says U.S. is spending too much. (Bloomberg)

Economic:

- June NFIB Small Business is due out at 6:00 a.m. EDT and last month came in at 90.5.

- API Crude Oil Data is released at 4:30 p.m. EDT.

Geopolitical:

- President Biden receives the President’s Daily Briefing at 10:00 a.m. EDT.

Federal Reserve Speakers

- Federal Reserve Chairman Powell begins testimony today and Wednesday before Congress.

- Federal Reserve Governor Michael Barr speaks at 9:15 a.m. EDT.

- Federal Reserve Governor Michelle Bowman speaks at 1:30 p.m. EDT.

M&A Activity and News:

- .

Moving Averages On Major Indexes: Moves from 73% to 83% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- CIBC Stampede Energy Forum

- Gordon Research Conference Radionuclide Theranostics

- BMO Genetic Medicines Summit

- Leerink I&I and Metabolism Therapeutics Forum

- Mizhuo Therapeutics Expert Seminar

- Raymond James Calgary Stampede Conference

- Stifel Cell Therapy Forum

- TD Cowen Calgary Energy & Power Confernce

- Fireside Chat: None of note.

- Top Shareholder Meetings: AZZ, CHPT, CLMT, FEMY, MULN, SGML

- Investor/Analyst Day/Calls: BNY, EPRX, HCM

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- International Conference on Prenatal Diagnosis and Therapy

- Pharma PR & Communications Summit

- SEMICON West

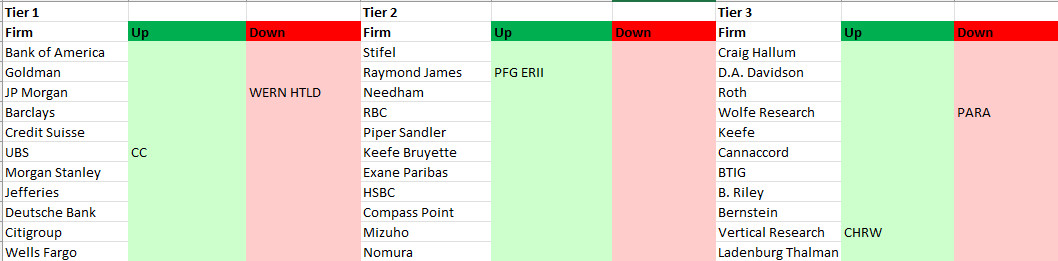

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.